Accept Nothing Less Than Full Victory

When it comes to important dates in history, some days are more equal than others. And today, June 6, is one of those days.

That’s because today marks the 74th anniversary of D-Day, a seminal event in the history of human conflict and the struggle against collectivist tyranny.

It was June 6, 1944. On that day, more than 160,000 Allied troops landed along a 50-mile stretch of the heavily fortified coastline in Normandy, France. They did so, of course, to fight Nazi Germany, and to try to put an end to the existence of one of the ugliest, most philosophically repugnant regimes the world has ever seen.

In his comments about the D-Day invasion, Gen. Dwight D. Eisenhower called the operation a crusade in which, “we will accept nothing less than full victory.” (If you want to experience “goose bumps,” I highly recommend listening to Gen. Eisenhower’s D-Day message for yourself. I assure you it’s two minutes well spent).

In doing so, the United States and the Allied troops sent more than 5,000 ships and 13,000 aircraft in to support the invasion. Close to my heart are the over 13,000 paratroopers from the U.S. Army’s 82nd Airborne and 101st Airborne Divisions.

I say “close to my heart” because today I feel a sense of pride, having also been a member of the elite U.S. Army paratrooper forces, and for also having gone through essentially the same training my fellow paratroopers went through some three-quarters of a century ago.

American soldiers leave a landing craft tank to storm Omaha Beach on D-Day, 1944.

Now, in conducting the D-Day operation, the Allied troops suffered more than 9,000 killed or wounded. Yet it was their bravery and ultimate sacrifice that allowed some 100,000 soldiers essentially to gain a foothold in Continental Europe, literally by the end of that gruesome June day, 74 years ago.

Of course, the battle for Europe had just begun on June 6, 1944, and there was much more death and destruction that followed for both sides. Yet through it all, the United States carried with it the principle that we would accept nothing less than full victory.

That principle, and the relentless mindset it reveals, is really the only way to approach one’s own life.

Think about it: we are born, and from that moment on we are engaged in a battle for survival. As humans, we have no choice but to use our most salient feature to facilitate that existence, i.e. the faculty of reason. That’s why Aristotle called man the “rational animal.”

Our reason allows us to solve problems, and to provide for our basic needs such as food, clothing and shelter. Our reason also allows us to form societies, to write laws that protect individual rights and to understand what’s required to produce the goods and services necessary for that survival.

It is this rational realization that’s led us to what we have today — a capitalist economy fueled by the financial markets, and one that allows us to participate in the ownership of great companies (i.e. via the equity markets) and to lend our own capital to help fund other companies (i.e. the bond markets).

The way I see it, we have no choice but to exercise our minds, and to use our rational faculties to sustain our lives. Now, any particular individual certainly can abdicate this responsibility, but that doesn’t change the fact that his or her survival will still depend on another person’s reason applied to the challenge of survival.

And it is in this effort that we should accept nothing less than full victory for ourselves, for our families and for our society. And it is this mindset that, for me, is the takeaway to ponder on this day, June 6, D-Day.

If you want to find out more about how I apply the “accept nothing less than full victory” mindset in my newsletter advisory services, then I invite you to check out my Successful Investing, Intelligence Report and Fast Money Alert advisory services today, D-Day.

Fast Money Summit and FreedomFest Agenda Now Posted Online!

Today, I am very happy to announce that the tentative agenda for the “Fast Money Summit” and FreedomFest are now posted!

Go to https://www.freedomfest.com/agenda-3/ and check out over 200 speakers, panels, debates and exhibitors. It represents thousands of hours of work. See why FreedomFest is the #1 conference in the world.

The dates, July 11-14, are only five weeks away. Our room block at Paris and Bally’s will end in two weeks! We have over 1,500 people coming.

The Fast Money Summit Will Take Place in the Vendome A Room at the Paris Resort

Register now at www.freedomfest.com, or call toll-free: 1-855-850-3733, ext. 202. Be sure to use the code EAGLE100 to get $100 off the registration fee. See you on 7/11 in Las Vegas.

**************************************************************

ETF Talk: Finding a Fund with High-Quality U.S. Holdings

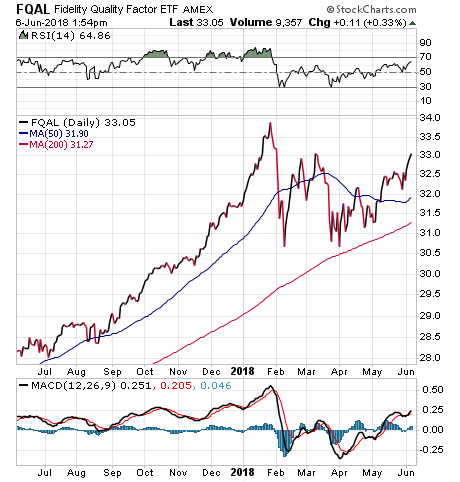

The Fidelity Quality Factor ETF (FQAL) tracks an index of large- and mid-cap U.S. companies with a higher quality profile than the broader market.

FQAL evaluates the top 1,000 stocks (by market cap) on balance sheet measures of quality, scoring them based upon these key factors: free cash flow margin, cash flow stability and return on invested capital. The fund invests at least 80% of its total assets (currently $65.7 million) in these quality holdings.

With FQAL’s strategy, sectors are cap-weighted to provide more market-like exposure. Analysts at Zacks Research give the fund an overall “B” rating for its exposure coverage, volatility and cost. Investors looking to invest in FQAL should do their due diligence to gauge whether it is a good fit for their portfolios.

FQAL’s one-year return is 16.29%, compared with the market’s return of 11.99%. Year to date, FQAL’s return of 4.03% also has beaten the market’s return of 3.70%. The fund has a distribution yield of 1.69% and an expense ratio of 0.29%.

Currently, FQAL is trading around $33, which is within the upper half of its 52-week price range. The chart below shows FQAL’s performance over the last year.

Chart courtesy of Stockcharts.com

FQAL’s top five holdings are Apple (APPL), 4.36%; Microsoft (MSFT), 3.57%; Alphabet (GOOGL), 3.15%; Facebook (FB), 2.31%; and Johnson & Johnson (JNJ), 1.88%. Among the fund’s sectors, its assets are 21% invested in technology, 20% in financials, 14% in consumer services, 12% in health care and 11% in industrials.

For investors who are seeking a fund with high-quality holdings, the Fidelity Quality Factor ETF (FQAL) could be worth checking out closely.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

Thanks Italy, We’re Going to the Bank

I confess that I love the bold red wines from Italy’s Piedmont region. On more than one occasion, my overindulgence in these full-bodied, fermented grapes has left me drunk with pleasure.

Interestingly, I had that same feeling last week when watching the overblown market reaction to the political uncertainty in the country — uncertainty that caused U.S. stocks to tumble and global and U.S. bond yields to plummet.

Yet my sense of being drunk with pleasure last Monday (May 28) was free from any fermentation. Instead, I was drunk with the knowledge that I had just bought into a market sector on the cheap, and one that had been unfairly sold off on what I suspect will prove to be soon-forgotten news.

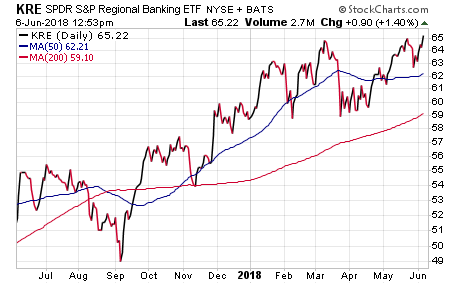

That sector is banks/financial stocks, and specifically U.S. regional banks found in the SPDR S&P Regional Banking ETF (KRE). This exchange-traded fund (ETF) holds the best U.S. regional bank stocks, with top names in the fund such as SVB Financial Group (SIVB), Texas Capital Bancshares, Inc. (TCBI) and Cullen/Frost Bankers, Inc. (CFR) among its biggest allocations.

On Tuesday, May 29, shares tumbled 2.4% from last Friday’s closing price as the yield on the 10-year Treasury note sank 13 basis points to 2.80%.

Yet the following day, KRE rebounded nicely, nearly recovering all its prior-session losses.

For me, and for readers of my Intelligence Report advisory service, the dip last week in KRE meant we bought into the fund at a discount. (KRE is just one of the new recommendations in the service. For a full list of our latest buy recommendations, I invite you to check out the Intelligence Report, today.)

So, why did U.S. regional banks and financial stocks get hit hard Monday by, of all things, internecine Italian politics? To understand that, we need to take a quick dive into the details of domestic Italian politics to see what happened — and why it matters to financial markets.

Over the weekend of May 26-27, efforts to form a functioning government in Italy collapsed. As you likely know, that proved to be the catalyst for the worst day in U.S. markets in over a month. The failure to form a government stems from what happened in March during the last Italian general election.

Here we saw two “anti-establishment” parties, 5-Star Movement and the League, receive the highest number of votes. That caused some general concern in markets that if the two parties were to collaborate and form a functioning government, they might ultimately introduce what the markets really don’t want, and that’s a “Brexit”-style referendum calling for Italy to leave the European Union (EU).

Over the past few weeks, the League and 5-Star Movement (along with other smaller parties) have come close to reaching an agreement on forming a functioning government. This has raised fears over what’s cleverly being called an “Italeave” from the EU.

Adding fuel to the fear of an Italeave was the recent nomination of an anti-EU economist as the country’s finance minister. That same weekend, the President of the Republic vetoed the finance minister’s appointment on the grounds that the Italian Constitution states Italy is in the EU. The decision sent the negotiations to form a government into a nosedive, and that prompted fears that the Italian Parliament would hold a vote of “no confidence.” Fortunately, that did not happen, and for now, Italian political fears have largely subsided.

This does, however, matter to markets because if anti-establishment parties like the League and 5-Star Movement gain more power from another general election, the potential for an ultimate referendum on EU membership will grow. And because Italy is the third-largest economy in the EU, an Italeave would roil the entire eurozone, and the entire global economy.

As for markets, the real impact of this Italeave fear can be seen in bonds. Italian bond yields rose sharply on the political developments last week. And in a flight to safety, German bund yields fell, as did U.S. Treasury bond yields (remember, bond prices and bond yields are inversely correlated, meaning if bond prices go up, bond yields go down).

For banks and financial stocks, including those in KRE, falling bond yields would compress margins in the short term, and unwind some of the rally banks have enjoyed this year due to the expectation of continued higher interest rates, i.e. rising bond yields.

Yet what is important to understand here, and why I think the Italian-themed selling in bank stocks will prove evanescent, is because nothing having to do with Italy has altered the fact that the medium- and long-term trend in U.S. Treasury yields is higher. This trend is being driven by 1) Rising inflation and 2) Fed rate hikes.

My oft-quoted colleague, Tom Essaye of the Sevens Report, gave me some insight on this situation, saying, “If the EU begins to ease up on interest rate hikes in order to offset the Italian uncertainty, then that could constrain the Fed regarding the eventual number of rate hikes here at home. But that isn’t a negative for the U.S. stock market. If anything, it’d allow inflation to run.”

The bottom line here is that the drivers pushing bank stocks higher are a continuation of the “reflation trade” that I’ve been telling readers about for much of the past six months. That reflation trade includes rising inflation, rising bond yields and an increase in economic growth, bank lending and an increase in bank bottom lines.

So far, nothing having to do with the Italian elections threatens that paradigm (and this is even more true given the calm in this situation since my original writing of this last Wednesday). As such, when the sector sees selling like it did last week, well, we’re going to take advantage of the opportunity and continue going to the bank.

*********************************************************************

A Decisive Moment

“World War II was a decisive time in our history and June 6, 1944, marked the decisive moment of the war.”

— Lane Evans

The late U.S. congressman was spot on with his assessment of what this day in history meant for the war, for the United States and for the free world. Let us never forget what happened on this June day on the beaches of Normandy, 74 years ago.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.