A Message from the Fed Whisperer

Treasury yields are on the march higher. Indeed, the move to multi-decade highs in the 10-year Treasury Note yield has been the primary (but not only) reason stocks have declined over the past several weeks. Now, one of the reasons yields have risen is because investors have been “pushing out” the date of expected rate cuts, as investors begin to accept the Fed may keep rates “higher for longer.” That idea was furthered over the weekend in an article by “Fed Whisperer” Nick Timiraos of the Wall Street Journal, and that article was responsible for the rise in yields on Monday.

In Tuesday’s issue of my daily market briefing, Eagle Eye Opener (which you simply must subscribe to, if you want to know what real professionals are watching each trading day), we explained that there’s usually always one Fed Whisperer at the Wall Street Journal, and currently it’s Timiraos. Prior to Timiraos, the Fed Whisperer was Jon Hilsenrath.

The fact that these Fed reporters have deep insight into what the Fed may do is not a coincidence, because the Fed does not like to surprise markets anymore, so the more it can telegraph its decisions and communications, theoretically, the smoother the digestion of that news by stock and bond markets. Point being, whether official or unofficial, the Fed tends to “tip off” the current WSJ Fed reporter to any policy shifts or changes so that it can be disseminated in the markets and not surprise investors.

It’s for that reason that an article from Timiraos this weekend caught the market’s collective attention. The focus of the article was on an economic statistic called “r-star” or sometimes “r*”, but if we read between the lines of the econ speak, the message was clear: The chances the Fed hikes again and/or keeps rates higher for longer may be higher than the market currently appreciates, and if that’s true, it’ll add another headwind for stocks because it’ll damage one of the three pillars of the rally (i.e., the assumption the Fed is done or almost done).

What did Timiraos say? Essentially, Timiraos said that there’s a growing feeling among Fed members that the neutral real interest rate is higher than currently thought. The neutral real interest rate, which is r*, is the level of real interest rates (so nominal fed funds minus expectations for inflation over the next year) that is neither a tailwind nor a headwind on economic growth (so it’s neutral).

Why does this matter? In eras of high inflation, such as now, the Fed wants to get real interest rates into “restrictive” territory, so that economic growth and inflation both slow. But what is “restrictive?” Well, restrictive depends on where Fed officials think the neutral real rate is. Consider that for the last several years, Fed consensus has been that the neutral real rate was 0.5% (so, fed funds 0.5% above one-year inflation expectations). With longer-run annual inflation expectations still around 2-3% and fed funds at 5.375%, right now, real rates are clearly above neutral (2.5-3.5%, depending on how you calculate forward inflation). If the neutral real rate is still 0.5%, then that means real rates are 2-3% above neutral and are putting a serious headwind on growth.

But what if the neutral rate isn’t 0.5% anymore? What if it’s 1.5% or 2.0%?

If that’s the case, then real interest rates aren’t as restrictive as we thought they were, and as a result, rate hikes won’t slow the economy nor blunt inflation as much as the Fed would expect. The net result isn’t so much that the Fed will keep raising rates, but instead that the Fed will keep rates higher for longer, because they aren’t as much of a headwind on growth as was previously expected. That’s why the neutral rate matters and why yields rose after the Timiraos article.

What Comes Next? This debate about the level of r* (or the neutral real interest rate) has been ongoing for months, and there are camps in the Fed that think it’s higher than 0.5% and camps in the Fed that think it is still 0.5%. The reason this article caught everyone’s attention is because Timiraos wrote it a few days before Federal Reserve Chairman Jerome Powell speaks at the Jackson Hole Summitt on Friday, and there’s some concern that this article could be softening up the market for Powell to deliver a hawkish message that drives home the higher-for-longer message to markets. If that’s the case, expect more volatility in stocks and bonds.

Bottom line, higher for longer is a risk to this rally, because it’s not the height of rates that matters as much as how long they stay high, so we’ll continue to monitor the debate over r* in the coming weeks. But in the more immediate term, if we see Powell hint at higher for longer on Friday, we will need to brace for more equity market volatility, with defensive sectors (utilities, healthcare, staples) likely relatively outperforming (as they have since this pullback started).

***************************************************************

ETF Talk: Emergin’ Into This Emerging Markets Fund

It seems that no matter which financial media source you consult, all the news regarding emerging markets center around issues in the Chinese economy.

There is, of course, good reasons for this. ABC News reported that an important real estate developer in China — Country Garden — failed to meet a scheduled debt payment, causing a cascading effect on global markets. Everywhere one looked, one saw the same question: How shaky is the Chinese economy, where real estate is a primary driver of the economic boom there — albeit one built on a great deal of debt?

After all, such a problem in the Chinese real estate market is not new. In 2021, financial problems and an eventual default by Evergrande caused a slide in global markets that was only arrested when Chinese officials said the crisis was contained and credit markets would continue as normal. This new default in the Chinese real estate sector has proved that there are problems in the Chinese economy — problems that will likely remain present into the near future.

Other emerging markets, according to the Globe and Mail, are doing much better than China. For instance, when we look at the MSCI Emerging Markets Index (which includes China), we see a rise of 11.4% by the end of July. When China is removed from the index, and we look at the MSCI EM Ex-China Index, we see a rise of 14.6% over the same time.

As a result, some emerging-market investors are turning away from China and toward Taiwan and South Korea — two countries that are also benefitting from the artificial intelligence (AI) wave that is sweeping the American tech sector. Still others have turned to Europe, especially Greece, largely due to the recent electoral victory of a pro-business government.

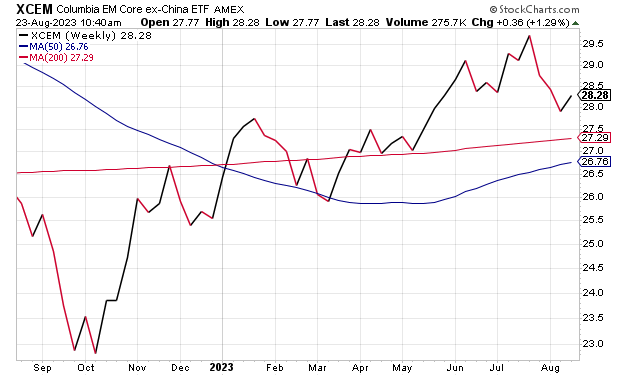

For investors who want to enter the world of emerging markets but who want to steer clear of the Chinese economy for the time being, the Columbia EM Core ex-China ETF (NYSEARCA: XCEM) might appeal to them. This fund tracks an index of emerging market companies that are not in either mainland China or Hong Kong. The portfolio is built through a market-cap-weighting strategy that selects the largest 700 companies by market capitalization.

Top holdings in this portfolio include Taiwan Semiconductor Manufacturing Co. Ltd (NYSE: TSM), Samsung Electronics Co. Ltd. (KRX: 005930), ICICI Bank LTD ADR (NYSE: IBN), HDFC Bank LTD ADR (NYSE: HDB), International Holdings Co. PJSC (1308.HK), Infosys LTD ADR (NYSE: INFY) and Al Rajhi Banking and Investment Company (TADAWUL: 1120).

This fund is down 3.84% over the past month, up 1.85% over the past three months and up 9.63% year to date. The fund has $334.8 million in assets under management, and it has an expense ratio of 0.16%.

Source: stockcharts.com

While this fund does provide an access point to the world of emerging markets, such an ETF may not be suitable for all investors. Investors should always do their due diligence before adding any stock, ETF or fund to their portfolio to make sure it is the best choice for their investing strategy.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Come On Get Higher for Longer

There’s a fantastic song by the great Matt Nathanson that I’ve always loved called, “Come On Get Higher.” Here’s an acoustic version of the song from a 2013 appearance at Amoeba Records in San Francisco, where coincidentally, your editor happened to be that day. Now, I bring up this song title today because it reminds me of what the market is facing right now, and that is the headwind that is “higher-for-longer” interest rates.

As we wrote last week in the Eagle Eye Opener, the recent stall in the stock market rally has coincided with a quiet, but important, evolution in the outlook for Federal Reserve monetary policy, as investors have started to focus on what’s “next” from the Fed, namely rate cuts. And over the past two weeks, rate cut expectations have been solidly pushed out, and that’s contributing to the upward pressure on yields and a growing headwind on stocks.

Now, we understand that it might seem somewhat premature for the market to be focused on when the Fed cuts rates, considering we may get another rate hike before year-end. But that’s just testament to the reality that the market is always looking for what’s “next,” and with the Fed done (or almost done) with rate hikes, what’s “next” is rate cuts.

Broadly speaking, investors had previously anticipated a rate cut as early as March 2024. But over the past month, that’s been pushed out to May and that has contributed to the rise in the 10-year yield and the headwind on stocks, because the longer it takes for the Fed to cut rates, the greater the chances of a hard economic landing, and the reason is clear: The longer rates stay high, the more pressure on the economy, and the greater likelihood that an economic contraction occurs.

Going forward, it’s not so much about how high rates go (barring a major surprise of two or more rate hikes), but instead how long they stay high.

That’s also why 2024 year-end fed funds estimates have become important. Right now, markets expect year-end 2024 fed funds to end at 4.33%. That reflects 100 basis points of rate cuts in 2024 (starting in early 2024). Here’s the problem: That is fewer cuts than the market expected a month ago.

One month ago, the market was pricing in a year-end fed funds of around 4.10%, or another 25 basis points of cuts next year. Now, that number has drifted higher thanks to solid economic growth and a lack of a big decline in inflation. So, why does this matter to you?

It matters, because if the market pushes out the timing of the first rate hike (June or beyond) or increases the expectations for year-end 2024 fed funds (meaning there will be fewer cuts next year) then that will act as a hawkish headwind on stocks and boost Treasury yields further (10-year Treasury yield above 5%?) and that, in turn, will increase hard landing chances and weigh on stocks.

Because of this reality, and until the market dynamic changes and this is no longer necessary, our Eagle Eye Opener will include commentary on the data so you know 1) At what point markets expect the first rate cut, and 2) Year-end 2024 fed funds expectations.

That way, we can see whether the market expectation is becoming more hawkish (negative for stocks and bonds), because if the market begins to price in a higher-for-longer interest rate environment, that will be a new and substantial headwind on stocks — and that would require getting more defensive in portfolio allocations.

*****************************************************************

On Seeing the Beauty

“Anyone who keeps the ability to see beauty never grows old.”

— Franz Kafka

What does the world look like? Well, it depends on your eyes. If you train your perception on the sublime, that’s what you’re going to see. This is especially true as we advance in age, because the path to the end is, unfortunately, filled with sadness, loss of friends, health issues and the realization of life’s finality. Yet, if we can keep our ability to see the beauty of the world, as Kafka says, we will never grow old.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

P.S. Come join me and many of my Eagle colleagues on an incredible cruise. If you book before Sept. 29, you’ll receive a spend-as-you-wish $250 shipboard credit! In addition, this is all-inclusive — meals, drinks and even the excursions are included in your one-time price! We set sail on Dec. 4 for 16 days embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

In the name of the best within us,

Jim Woods