A May Jobs Whiff, So Now What?

A May Jobs Whiff, So Now What?

It doesn’t get much uglier than the May jobs report, especially if you were like most on Wall Street and were hoping to see some 160,000 net new jobs created during the prior month.

Well, the economy only generated 38,000 new non-farm payroll jobs… and that, my friend, is a big whiff in my book.

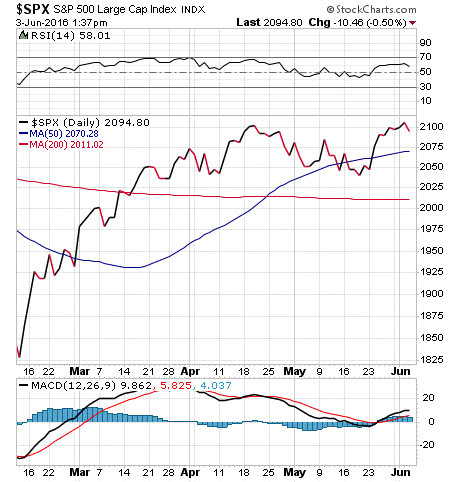

Reaction from the market to the downbeat jobs print (the worst monthly jobs showing since September 2010) was telling. Stocks trended markedly lower to open the session. Though the S&P 500 Index was down about 0.50% midway through Friday’s trading, the real reaction to the jobs report was seen in bonds and gold.

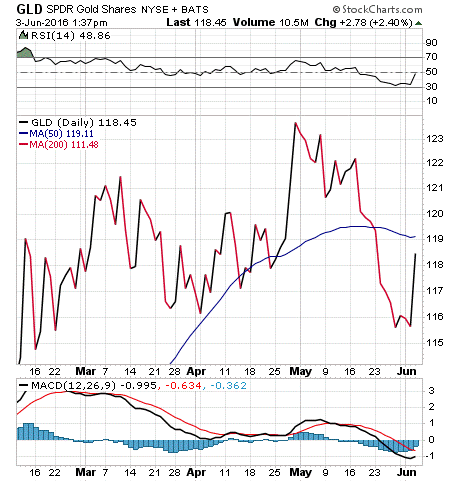

Why the reaction in bonds and gold? Well, because the lackluster May employment report now pretty much takes a June Fed rate hike off of the table. It also may have seriously diminished the chances of a July rate hike.

In fact, we might not see any rate hike this year, as election uncertainty is going to really ramp up after the respective Democratic and Republican conventions this summer.

If there isn’t going to be a rate hike, you would expect the dollar to fall, gold prices to rise and bond prices to rise — and that is precisely what happened today.

The charts below of the iShares 20+ Year Treasury Bond (TLT) and the SPDR Gold Trust (GLD) clearly show the bullish reaction to the likelihood of no new rate hikes this summer.

What does this mean for investors?

Well, it means that equities are going to likely trudge along throughout the summer, with the S&P 500 stuck in what has now been about an 18-month trading range.

It also means that we could see renewed investor appetite for gold, and a continuation of the safe-haven buying in the safest of all asset classes, long-term U.S. Treasury bonds.

Right now, subscribers to my Successful ETF Investing newsletter are benefiting from the boost in both bonds and gold, and we continue to take advantage of the equity market segments moving higher due to sector-specific favorable conditions.

If you’d like to join in on the ride, I invite you to check out Successful ETF Investing today.

ETF Talk: Introducing a Quiet Gold Fund

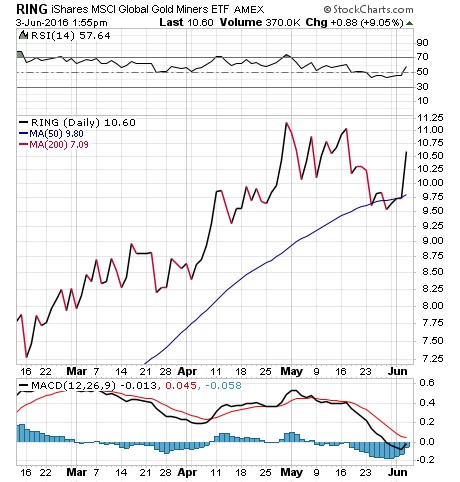

Today’s ETF Talk features the iShares MSCI Global Gold Miners Fund (RING), a solid, serviceable gold mining fund that offers investors all the advantages and disadvantages that they might expect of a precious metals fund. RING is part of the same family of exchange-traded funds (ETFs) as iShares MSCI Global Silver Miners ETF (SLVP), a silver fund that was featured in my previous ETF Talk.

Structurally, the two funds are very similar. Both invest in diversified precious metals portfolios all over the world. RING’s portfolio consists of close to 40 different positions from many countries, including top holdings in Canada, South Africa and Australia.

Year to date, RING has achieved a gain of 77.92%. This is a strong gain compared to the general market, considering S&P 500’s year-to-date gain is only 2.51%, but comparable to the performance of other gold funds in the same period. The fund pays a 0.50% dividend yield and its expense ratio is 0.39%.

View the current price, volume, performance and top 10 holdings of RING at ETFU.com.

RING’s top 10 holdings are Barrick Gold Corp. (ABX), 15.01%; Newmont Mining Corp. (NEM), 12.97%; Goldcorp Inc. (G), 10.14%; Newcrest Mining Ltd. (NCM), 7.44%; Agnico-Eagle Mines Limited (AEM), 4.75%; AngloGold Ashanti Ltd. (ANG), 4.68%; RandGold Resources Ltd. (RRS), 4.27%, Kinross Gold Corp (K), 4.18%, Yamana Gold Inc. (YRI), 3.99%; and Gold Fields Ltd. (GFI), 3.03%.

RING differs from some funds in that the companies it invests in do not always have their performances closely linked to the underlying price of gold.

If you are bullish on gold and wish to invest into a relatively stable fund without immense risk, I encourage you to take a closer look at iShares MSCI Global Gold Miners Fund (RING) on your own.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

Josey Wales Mad

“Now remember, when things look bad and it looks like you’re not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. ‘Cause if you lose your head and you give up then you neither live nor win. That’s just the way it is.”

— “The Outlaw Josey Wales”

The 1976 Clint Eastwood classic has a lot of great memorable lines, but here the main character Josey Wales reminds us that if you’re in a jam, or you’re facing extreme adversity, the only way to get through it is to get after it. I like this movie, I like this quote and I love the advice. So, the next time you’re in a tough spot, get mad-dog mean and choose to prevail… because that’s just the way it is.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about how the markets are preparing to reach new highs. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian