Invest in Your ‘First Wealth’

“The first wealth is health.”

That’s a profound proclamation by essayist and poet Ralph Waldo Emerson, a man who was brimming with all kinds of excellent wisdom. Here, Emerson reminds us that even if we’ve managed to achieve a good measure of monetary wealth, that wealth cannot, and should not, replace the first goal of actual physical health.

As you likely know, in my newsletter advisory services, I am primarily concerned with delivering the tactics and strategies for improving your monetary wealth. But this is The Deep Woods, a publication that casts a wider net on issues germane to our lives, and there is perhaps no more important issue to contend with — especially as we begin to feel our age — than the issue of our health and wellness.

Now, I’ve long been a fitness fanatic, and my weapon of choice to help maintain and achieve physical health is a specific type of exercise protocol known as High Intensity Training, or H.I.T. This type of training is both brief and brutal, but it’s also wildly effective in stimulating muscular growth and positive physiological adaptations. Yet, having a great workout regimen in place is only part of the equation.

The other part of the health and wellness equation is making sure nutritional needs are being met, and by that, I mean making sure our bodies are getting what they need on a cellular level in order to thrive.

Fortunately, thanks to progress in scientific testing and nutritional analysis, we have sophisticated tools available to us at a relatively moderate cost (about $800) that can tell us all about our cellular health, and that can help us shore up any glaring deficiencies in our nutrient profiles.

I recently underwent a battery of these tests provided by a company called SpectraCell Laboratories, and the results were quite revealing.

The first test is known as a Telomere Test. A telomere is a region of repetitive DNA sequences at the end of a chromosome. Telomeres basically function to protect the ends of chromosomes from becoming frayed or tangled.

Each time a cell divides, the telomeres become slightly shorter. Eventually, they become so short that the cell can no longer divide successfully, and the cell dies. So, the theory here is that the longer your telomeres are, the “younger” your cells are, and hence the younger you are.

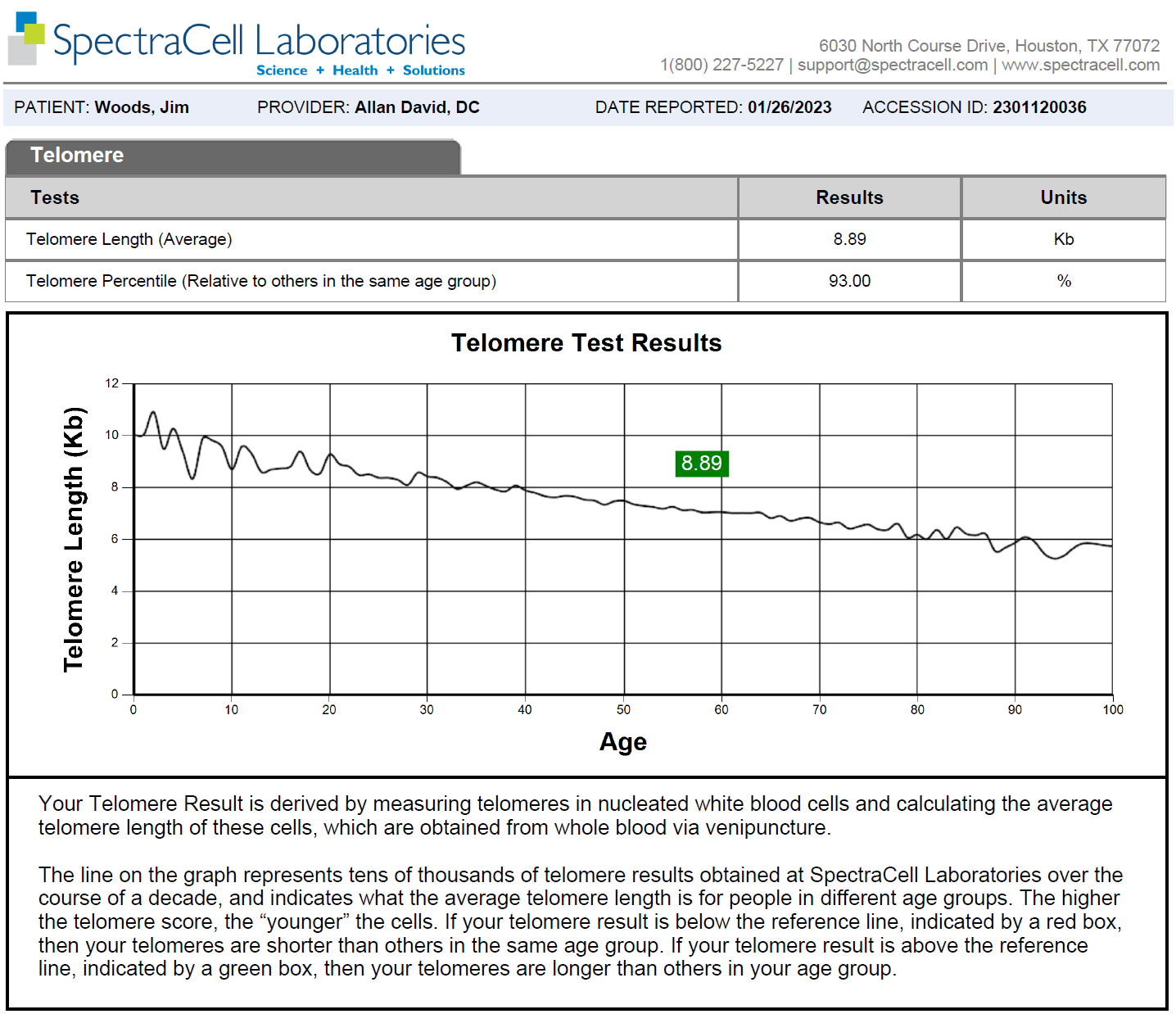

The graphic here is my actual Telomere Test results, which measures the length of my telomeres and then plots that metric against the average length of telomeres in the SpectraCell database that’s been collected over the past decade.

Here you can see my telomere length came in at 8.89. Now, at age 58, my telomeres are extremely long. In fact, they are in the top 93% for my age group. Another way of seeing this data is that my telomere length is at the average telomere length of people in their early 20s!

So, the good news is now I know why I look and feel so young. I jest, of course, but the real good news is that barring some tragedy, there’s a good chance I will be writing The Deep Woods for many more years to come — telomeres permitting, of course.

The next set of tests were more detailed, regarding my specific lipid profiles, vascular inflammation markers, metabolic syndrome traits and immune function scores.

On these important fronts, I am happy to report my scores were solidly in the “No Functional Deficiencies” group. There was, however, some specific areas of deficiency with respect to macronutrients. For example, I was borderline deficient in alpha lipoic acid, folate and manganese. Knowing about these deficiencies allowed me to address them by beginning an enhanced supplementation protocol that included higher levels of each of these nutrients that I now take in addition to my usual intake of multivitamins, amino acids and minerals.

This is an example of a what I call, “investing in your first wealth,” because for a little bit of time and a little bit of expense, I have a much greater knowledge of my cellular health. And as a result of that knowledge, I am now taking the proper action steps to maximize my physical health.

If you are concerned with your “first wealth,” then I highly recommend you check out the SpectraCell Laboratories cellular diagnostic tests. The way I did it is by going through one of SpectraCell’s providers, a man who also happens to be a good friend, Dr. David Allan.

Listeners to my podcast, Way of the Renaissance Man, might recall my Season Three episode with Dr. Allan. Here we shared thoughts on how to eliminate muscle, nerve and joint pain caused by repetitive use injuries, and how to build good physical habits that can prevent these injuries from recurring. Now, Dr. Allan and SpectraCell have helped me look within the cellular level, literally into “The Deep Woods,” to help enhance my physical well-being.

If you want to do the same for yourself and get a deeper look into your telomeres and your cellular profiles, then I highly recommend you contact Dr. David Allan for a consultation.

Finally, I want to say that I have no monetary relationship with Dr. Allan or SpectraCell. I am just a fan of the insights they provide, as these insights have helped me enhance my “first wealth.”

If you want to do the same, then there is no better place to start.

***************************************************************

ETF Talk: Expanding Exposure to High-Quality Tech

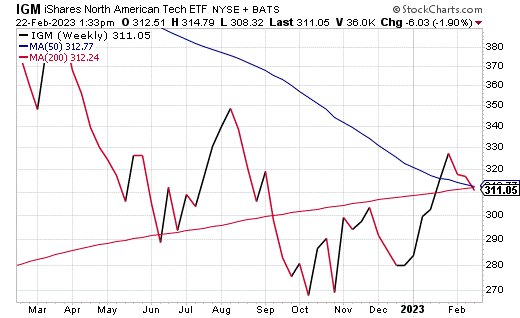

The iShares Expanded Tech Sector ETF (NYSE Arca: IGM) tracks a market-cap-weighted index of U.S. and Canadian technology companies.

IGM offers a broad coverage of the North American technology sector. Aside from conventional technology stocks, the fund also includes tech-related stocks from other sectors — specifically internet retail companies.

While IGM is a North American fund, nearly all its assets are allocated to the United States. Seeking to provide a diversified exposure to the tech industry, its market-cap-weighted index caps each security’s weight at 8.5%. The index is reconstituted semi-annually and rebalanced quarterly.

Prior to Dec. 24, 2018, the fund was tracking the S&P North American Technology Index. The change in index was due to a new Communications Services sector developed at the end of 2018.

Source: www.stockcharts.com

The fund generally will invest at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics substantially identical to the component securities of its index. A significant portion of the underlying index is represented by securities of companies in the technology industry or sector. It is non-diversified.

Top holdings in IGM include Apple, Inc. (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Amazon.com (NASDAQ: AMZN), Meta Platforms (NASDAQ: META) and Alphabet (NASDAQ: GOOGL), to name just a few of the mega-cap, tech-related stalwarts in this fund.

IGM has $2.5 billion in net assets and a 0.05% average spread. Its expense ratio is 0.40%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds. IGM share price currently trades around $311, giving it a 0.47% distribution yield.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Bracing for a ‘No Landing’

Here’s something you’re not likely to hear from a commercial airline pilot the next time you fly: “Ladies and gentlemen, this is your captain speaking, please make sure your seat backs and tray tables are in their full upright position and that your seat belt is correctly fastened, as we prepare for a no landing.”

This term, “no landing,” has been introduced of late in market terms, because it’s a great way to help us understand what the potential outcome in the market might be, and how the Federal Reserve might react to the data.

Now, since the beginning of the year, market watchers like me have been trying to determine if the Fed’s monetary policy engineering will ground the economic airplane via a “soft landing” (a slowing of the economy enough to quell inflation while avoiding recession, the most positive outcome for equity bulls), or a “hard landing” (an abrupt slowing of the economy that pushes it into recession, which is the most negative outcome for the markets).

Yet, what if the immediate answer is neither a soft landing nor a hard landing, but rather, a “no landing”?

What I mean by this is, what if the economic data is such that the economy stays up in the air (to use the plane metaphor) and doesn’t even come in for a landing? Now, this possibility was brought to my attention via my “secret market insider,” the man whose research provides the backbone data in my Eagle Eye Opener daily brief.

This theory was given more credence after the January jobs report came in ridiculously high, with some 517,000 new non-farm payrolls created in the month, along with the unemployment rate falling to 3.4%, which is a remarkable 53-year low (yes, you read that correctly).

Here, the no-landing scenario means that economic growth stays strong, and inflation once again starts to creep higher. What this would look like is data rebounding, and specifically job adds stay strong, service measures of the economy stay in expansion territory and manufacturing and housing bounce back in the coming months.

The question then becomes: What would a no landing mean for markets?

The most important development for markets would be that the very real possibility of numerous additional Fed rate hikes would come back on the table. That would then bring us back to a 2022 situation, where markets begin to price in an ever-higher terminal fed funds rate, which should weigh on stocks and bonds.

Additionally, a no landing ultimately just delays, but does not actually avoid, the hard vs. soft landing debate. The reason why is the Fed will keep raising rates until it feels confident growth is slowing and that it won’t put upward pressure on inflation.

That means a no landing would not be a sustainable positive, because it just ultimately delays that point where we get to peak hawkishness and where the market can reasonably expect the Fed to pivot to a more supportive stance for the economy.

Now, if you are somewhat confused by the reemergence of this no landing possibility, well, you are not alone. This market has become more confusing for investors thanks to the posture from the surprisingly not-hawkish recent Fed decision and press conference by Fed Chairman Powell, and that aforementioned hotter-than-expected jobs data, as well as other hot economic data.

As you likely know if you’re a reader of my newsletters, what the market hates more than anything is uncertainty. And given the possible no-landing scenario, the definitive answer regarding soft landing or hard landing is as uncertain as it’s been during this cycle.

To help us gain some certainty on this “soft landing, hard landing, no landing” question, I will provide a few thoughts on what each of the scenarios mean for stocks. So, as the data come to us in the weeks and months ahead, you won’t be blindsided by whatever that data tell us.

Hard Landing: For this scenario to play out, the unemployment rate will have to rise sharply, economic growth will have to fall faster than inflation and the market will start to price in a terminal fed funds rate under 4.875%, as that will mean the Fed has overshot the target and crashed the economy into the ground. This would be very negative for markets, and it could possibly send the S&P 500 down to support as low as 3,300.

Soft Landing: For this to occur, which is what the Fed and the markets want, the unemployment rate will need to start rising, preferably somewhere between 4% and 5%.

Economic growth needs to cool, but only slightly, and inflation needs to cool down even faster than growth. The metric to watch here is the Consumer Price Index (CPI), as it needs to fall to 5% in the first half of the year. Terminal fed funds will be in the Goldilocks zone of 4.87-5.125%. A soft landing likely means a rally in the S&P 500 into the mid-to-upper 4,000s.

No Landing: This is definitely the most curious of cases, and it will be characterized with a continuation of the extremely low unemployment rate that stays below 4%, economic growth data that stays strong and inflation that, at best, levels off. In this scenario, terminal fed funds consensus would spike above 5.125%. This would also put pressure on the S&P 500, keeping it locked in a range between 3,500 and 4,000, essentially “trapping” traders in a holding pattern, waiting for the economy to land — soft of hard.

One thing to note here is that the key to whatever scenario plays out will be the economic growth data. If the data remain strong, then the peak fed funds rate will be higher than 5.125%, and that will become a headwind on stocks.

If the data rolls over from here, then the peak fed funds rate will likely stay at or even below 5.125% (soft landing), and that will not put an additional headwind on stocks. Bottom line, the Fed has told us that it will follow the data, and so it behooves us to follow that data as well — and that’s exactly what we’re doing in my newsletter advisory services.

*****************************************************************

Adopt the Patience of Nature

“Adopt the pace of nature: her secret is patience.”

–Ralph Waldo Emerson

Getting healthy, losing weight, growing your money, learning a new skill… just about any long-term goal you pursue requires time, effort and patience. Remember the classic Motown tune, “You Can’t Hurry Love”? Well, just like you can’t hurry love, you can’t hurry results. So, if you want to make changes, approach them as Emerson recommends, and adopt the patience of nature.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods