Bracing for a ‘No Landing’

Bracing for a ‘No Landing’

Here’s something you’re not likely to hear from a commercial airline pilot the next time you fly: “Ladies and gentlemen, this is your captain speaking, please make sure your seat backs and tray tables are in their full upright position and that your seat belt is correctly fastened, as we prepare for a no landing.”

This term, “no landing,” has been introduced of late in market terms, because it’s a great way to help us understand what the potential outcome in the market might be, and how the Federal Reserve might react to the data.

Now, since the beginning of the year, market watchers like me have been trying to determine if the Fed’s monetary policy engineering will ground the economic airplane via a “soft landing” (a slowing of the economy enough to quell inflation while avoiding recession, the most positive outcome for equity bulls), or a “hard landing” (an abrupt slowing of the economy that pushes it into recession, which is the most negative outcome for the markets).

Yet what if the immediate answer is neither a soft landing nor a hard landing, but rather, a “no landing”?

What I mean by this is, what if the economic data is such that the economy stays up in the air (to use the plane metaphor) and doesn’t even come in for a landing? Now, this possibility was brought to my attention via my “secret market insider,” the man whose research provides the backbone data in my Eagle Eye Opener daily brief.

This theory was given more credence after the January jobs report came in ridiculously high, with some 517,000 new non-farm payrolls created in the month, along with the unemployment rate falling to 3.4%, which is a remarkable 53-year low (yes, you read that correctly).

Here, the no-landing scenario means that economic growth stays strong, and inflation once again starts to creep higher. What this would look like is data rebounding, and specifically job adds stay strong, service measures of the economy stay in expansion territory and manufacturing and housing bounce back in the coming months.

The question then becomes: What would a no landing mean for markets?

The most important development for markets would be that the very real possibility of numerous additional Fed rate hikes would come back on the table. That would then bring us back to a 2022 situation, where markets begin to price in an ever-higher terminal fed funds rate, which should weigh on stocks and bonds.

Additionally, a no landing ultimately just delays, but does not actually avoid, the hard vs. soft landing debate. The reason why is the Fed will keep raising rates until it feels confident growth is slowing and that it won’t put upward pressure on inflation.

That means a no landing would not be a sustainable positive, because it just ultimately delays that point where we get to peak hawkishness and where the market can reasonably expect the Fed to pivot to a more supportive stance for the economy.

Now, if you are somewhat confused by the reemergence of this no landing possibility, well, you are not alone. This market has become more confusing for investors thanks to the posture from the surprisingly not-hawkish recent Fed decision and press conference by Fed Chairman Powell, and that aforementioned hotter-than-expected jobs data, as well as other hot economic data.

As you likely know if you’re a reader of my newsletters, what the market hates more than anything is uncertainty. And given the possible no-landing scenario, the definitive answer regarding soft landing or hard landing is as uncertain as it’s been during this cycle.

To help us gain some certainty on this “soft landing, hard landing, no landing” question, I will provide a few thoughts on what each of the scenarios mean for stocks. So, as the data come to us in the weeks and months ahead, you won’t be blindsided by whatever that data tell us.

Hard Landing: For this scenario to play out, the unemployment rate will have to rise sharply, economic growth will have to fall faster than inflation and the market will start to price in a terminal fed funds rate under 4.875%, as that will mean the Fed has overshot the target and crashed the economy into the ground. This would be very negative for markets, and it could possibly send the S&P 500 down to support as low as 3,300.

Soft Landing: For this to occur, which is what the Fed and the markets want, the unemployment rate will need to start rising, preferably somewhere between 4% and 5%.

Economic growth needs to cool, but only slightly, and inflation needs to cool down even faster than growth. The metric to watch here is the Consumer Price Index (CPI), as it needs to fall to 5% in the first half of the year. Terminal fed funds will be in the Goldilocks zone of 4.87-5.125%. A soft landing likely means a rally in the S&P 500 into the mid-to-upper 4,000s.

No Landing: This is definitely the most curious of cases, and it will be characterized with a continuation of the extremely low unemployment rate that stays below 4%, economic growth data that stays strong and inflation that, at best, levels off. In this scenario, terminal fed funds consensus would spike above 5.125%. This would also put pressure on the S&P 500, keeping it locked in a range between 3,500 and 4,000, essentially “trapping” traders in a holding pattern, waiting for the economy to land — soft of hard.

One thing to note here is that the key to whatever scenario plays out will be the economic growth data. If the data remain strong, then the peak fed funds rate will be higher than 5.125%, and that will become a headwind on stocks.

If the data rolls over from here, then the peak fed funds rate will likely stay at or even below 5.125% (soft landing), and that will not put an additional headwind on stocks. Bottom line, the Fed has told us that it will follow the data, and so it behooves us to follow that data as well — and that’s exactly what we’re doing in my newsletter advisory services.

***************************************************************

ETF Talk: This Fund Offers a Middle Ground for Growth

While large-cap stocks are often seen as more consistent and safer, and small-cap stocks have the best potential for growth if an investor chooses the right one, a middle ground can allow investors to use both of these elements in their portfolio at once.

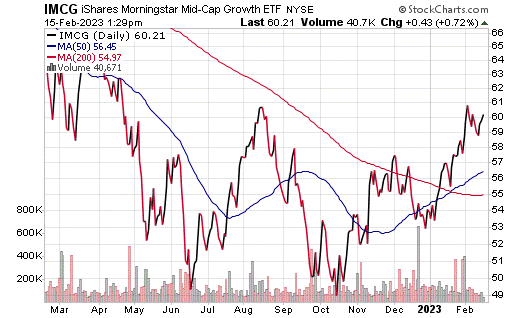

The iShares Morningstar Mid-Cap Growth ETF (IMCG) is one investment that plays into such a strategy. This fund focuses on domestic mid-cap stocks whose earnings are expected to grow at an above-average rate relative to the market.

Growth stocks typically focus on returns over dividends and possess the power to propel top- and bottom-line revenues. This fund holds $1.4 billion in assets and has strong liquidity characteristics.

IMCG holds upwards of 300 stocks in total. Its 0.83% yield is not surprising given its strategy, but easily wipes out the low 0.06% expense ratio and leaves investors with some cash.

During the last 12 months, the fund’s performance is approximately in line with the S&P, posting a loss of 6.6%. However, it has been trending upward for most of the current year.

Chart courtesy of www.StockCharts.com

Top holdings include MSCI Inc. (MSCI), 1.10%; Block Inc. (SQ), 1.01%; Arthur J. Gallagher & Co. (AJG), 1.01%; IDEXX Laboratories (IDXX), 1.01%; and Ross Stories Inc. (ROST), 1.00%. As these figures demonstrate, the distribution of fund holdings is relatively even, as no one or handful of companies compose an outsized proportion of IMCG’s holdings. The top ten holdings make up only 9.64% of assets.

The fund’s greatest sector weighting lies in technology at 24%, followed by industrials, 19%, and health care, 12%. Traditionally stable sectors such as utilities and energy are the least prevalent, which makes sense given the fund’s tilt towards growth stocks.

For investors looking to tap into mid-cap growth stocks, judging by its impressive assets under management, iShares Morningstar Mid-Cap Growth ETF (IMCG) is a popular option.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Good Night, Sweet Prince

“Now cracks a noble heart. Good night, sweet prince, and flights of angels sing thee to thy rest.”

–Shakespeare, “Hamlet”

“Good night, sweet prince.”

These were the last words I spoke to my majestic chow chow, Hemingway, as he was sent into his final sleep. One week ago, I was forced to let him go as his body had shut down due to a cancerous tumor.

To say that my heart still hurts would be a grotesque understatement; however, I have attempted to summon the courage to put on my bravest face, as I know that sadness, loss and pain are just part of the human condition. And if we want to be fully developed humans, we must be able to embrace the pain of that condition.

Easier said than done, I know, and if you have experienced the loss of a devoted pet, you know how I feel. You were also likely just reminded of that loss as a result of my admission, and for that, I apologize. Of course, if you were also reminded of the love and joy they brought to your life, then I shall also proudly claim credit.

So it is with life. The dueling forces of pain and joy seem locked in an epic battle for our souls. And while I want more joy than pain in my final ledger, I am not afraid of experiencing the pain.

You see, it is through the embrace of the contents of consciousness — be those contents happy or sad, ebullient or heartbreaking, exalted or disparaged, joyful or painful — that we discover who we are, what we are and what it means to be human. Moreover, the more aggressively we embrace the contents of consciousness, the fuller, more integrated and more complete we can be.

Now, in honor of my sweet prince, today I present you with a recollection of one of my fondest memories of him, a memory I wrote about in May 2021 in an article titled, “Get Yourself A Chow Chow.”

I think you’ll find it an enjoyable read, and I think you’ll see that the lesson here is that everyone needs to build a good team around them that “has their back.”

So, good night, sweet prince. May you continue to always have my back.

Get Yourself A Chow Chow

We all know the cliché that a dog is “man’s best friend.”

Well, let me tell you something, man needs best friends. In fact, as social animals, building a network of close friends and trusted associates is imperative to a life well-lived. Of course, finding those you can trust and that “have your back” isn’t always the easiest of propositions.

Yet when it comes to canines, generally speaking, if you treat a dog well, he/she will treat you even better. Like humans, dogs are social “pack” animals, and they are hardwired by nature to help protect their pack. That means they are hardwired by nature to be your friend and ally, and to have your back.

I saw this trait play out firsthand this past week, as my canine, a chow chow named “Hemingway,” put the smack down on a most unwanted intruder.

You see, I live on a small horse ranch in Southern California. In addition to horses, there is a barn, and around the barn, there are many feral cats and kittens. Yes, I feed them all, and so I am not surprised they keep coming around. But I like cats, so I choose to make sure they have plenty of food. Yet while I choose to feed and welcome the cats, I definitely do not welcome the coyotes that come around to try and make a meal of the felines.

A few days ago, Hemingway was barking rather aggressively, wanting me to let him outside. It was about 3 a.m., which is an unusual time for him to want to go outside. Still, I obliged his request, and as soon as I opened the back door, Hemingway sprinted outside and ran full speed toward the barn.

I had a flashlight handy, and as I shined the beam in the direction he ran off, I saw that Hemingway had cornered a full-grown coyote. Both sets of fangs were out, and I was about to witness some canine combat.

The next moment Hemingway bolted toward the coyote and knocked him against the side of the barn with a body blow reminiscent of a tackle from the great Baltimore Ravens linebacker Ray Lewis. After bouncing hard off the side of the barn, the coyote sprinted away from my property and into the cover of the early morning darkness.

I have seen no signs of its return since.

Your editor with Hemingway and my good friend/veterinarian extraordinaire Dr. Aiden Ables.

This incident reminded me of the importance of putting people, or in this case a chow chow, on your “team” that can help you get through difficult, even combative situations. And while my chow was just being a chow, i.e., an aggressive and strong breed known for its powerful build and protective nature, he nevertheless lived up to his nature by kicking that coyote’s butt.

Because you see, in life, sometimes we need to kick a coyote’s butt.

Sometimes we have problems that require tough, no-B.S. action that must be taken to achieve a result. Many times, these are business problems, and at other times legal problems. Sometimes those problems are medical, relationship-oriented or family-oriented. And sometimes those problems are about investing.

That’s why it’s imperative that you build your own personal network of tough chow chows who have your back when the coyotes come calling.

So, make sure you have good friends, real friends, that can help pull you through the tough times. And in turn, be a good friend to them when they require some assistance. Because guess what: we all require some assistance at some point in our lives.

You also should make sure you have a cadre of professionals on your team who you trust to get you through the tough times.

For example, have a great lawyer on your team. I can tell you that I have never regretted spending money on a good lawyer, and you won’t either. Also have a good certified public accountant (CPA) or tax person on your team. Pay extra for them, because I guarantee you it will save you money in the long run.

Next, cultivate a personal relationship with your physician. A physician who knows you personally is likely to give you a little extra attention, attention that is required as we get older and as our medical needs accelerate.

And, of course, if you are having trouble with your finances, and especially if you are having issues getting the results you want from your investments, well, that’s what my newsletter advisory services are all about.

Finally, if you are in need of a protective dog that will fight off intruders, but will sleep lovingly at your side each night, while also looking like a real-life teddy bear, then do yourself a favor and get yourself a chow chow.

It might be the best investment you’ll ever make.

*****************************************************************

A Little Black Spot

There’s a little black spot on the sun today

That’s my soul up there

It’s the same old thing as yesterday

That’s my soul up there

–The Police, “King of Pain”

Over the past several weeks, I feel like a little black spot has been tattooed on my soul by the recent events in my life. And while that little black spot continues to shrink in emotional prominence, I never want it to go away. You see, the little black spots on one’s soul are there to tell us that life is a package deal, complete with exaltation and sorrow at the extremes. And since I am a man of extremes, I embrace this reality. And if you want to really feel your life in every moment, I recommend you do the same.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

P.S. I will be holding a subscribers-only teleconference on Feb. 23 at 2 p.m. EST entitled “Piloting the Economic Plane – Enjoy the Ride or Jump Out?” The event is free to attend, but you have to register here. Don’t miss out!