A Full-Throttle Fortnight in Focus

We are just over a fortnight into 2018, and already the major averages are in a full-throttle bull run.

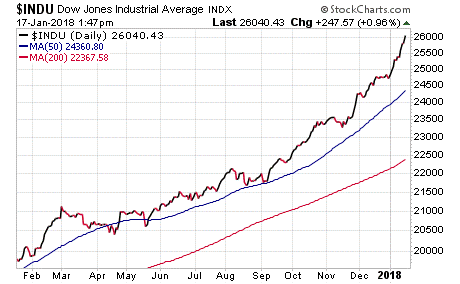

In fact, as of midday Wednesday, the Dow Jones Industrial Average ($INDU) was up 250 points, or about 1%, and well above the psychologically significant 26,000 milestone.

The one-year chart below of the Dow Jones Industrial Average shows just how potent the gains have been, particularly over the past several months.

In fact, the Dow is up 12.4% over the past three months, a stellar gain that has thus far proved all the bearish naysayers dead wrong.

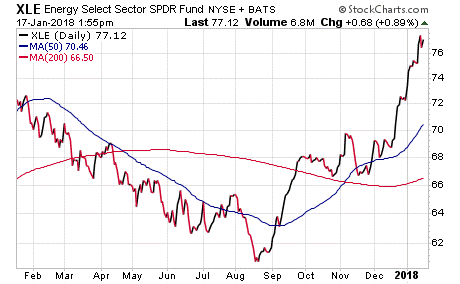

Interestingly, this full-throttle market move has brought along many previously beaten-down market segments. For example, the Energy Select Sector SPDR (XLE) is up just 3% over the past 52 weeks. Yet over the past three months, XLE has outpaced the Dow with a 13.6% surge.

Conversely, many of the market’s best performers over the past year have taken somewhat of a breather of late, although they’re still performing well on an absolute basis.

Take the Technology Select Sector SPDR (XLK). Over the past 52 weeks, XLK is up a whopping 36%. Yet during the past three months, the technology index is “only” up 10.6%.

I guess that’s what this market has come to of late — a lament over a double-digit-percentage gain since mid-October.

I jest here, of course, but the more serious condition to be aware of is that because of the ongoing bull market, one which has really been in full effect for nearly two years, we must not become complacent against a potential downturn.

And even though this market has been on an incredible run for about two years now, that doesn’t mean a correction isn’t around the corner. In fact, the much-overdue nature of the next inevitable pullback means it will probably be a bit more painful than normal corrections.

Just look at the two-year chart below of the S&P 500 Index ($SPX). Here we see just how strong this market has been since breaking above its respective 50- and 200-day moving averages in March 2016.

So, should we act now to lock in gains and pare down our holdings?

I say, “no.” In fact, I say there’s no rational reason not to be fully invested here. The only exception to that notion would be if you need to raise cash for a specific life event (home purchase, college tuition, medical expense, etc.).

The way I see it, the fact that a pullback is long overdue does not constitute sufficient grounds to exit this market. Now, that situation might change. For example, Q1 earnings may stall (so far, they haven’t), economic growth numbers might disappoint and/or the Fed could raise rates too high, too fast and cause an inversion of the yield curve.

Circumstances such as these would give me pause about remaining fully invested. But until then, the wise choice is to ride this full-throttle bull until it runs out of fuel.

***********************************************************

ETF Talk: Introducing an Income Fund for the Long-Term Investor

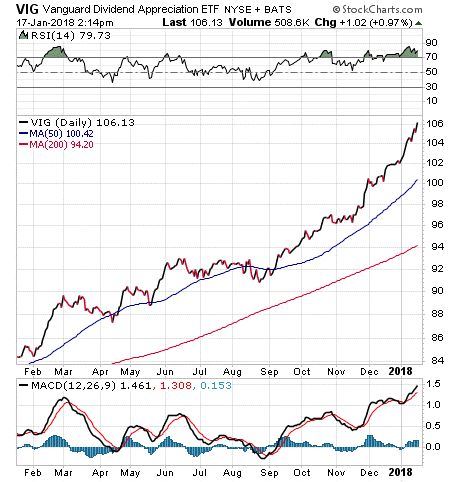

The Vanguard Dividend Appreciation ETF (VIG) seeks to hold shares in companies that feature rising dividend yields.

Specifically, VIG is designed to track the performance of companies that have increased their annual dividends for 10 or more consecutive years. This fact distinguishes VIG from many other dividend funds, such as the Vanguard High Dividend Yield ETF (VYM), which typically focuses on stocks that have the highest current yield.

In fact, VIG will exclude companies from its portfolio if it seems there is little potential for increasing dividends, even if the current yield is high. As a rule, VIG avoids real estate investment trusts (REITs), which do not benefit from favorable tax rates on qualified dividends.

A steady stream of income in the form of dividends has helped VIG avoid some market weakness from time to time. For example, during the 2008 financial crisis, the fund decreased by around 30%, while the S&P 500 fell 37%.

VIG is one of the most popular exchange-traded funds (ETFs) in the U.S. market, with $34 billion in net assets and an average daily trading volume of $63.91 million. The fund is fully invested and employs a passively managed, full-replication strategy that focuses on large equities, with the philosophy that income-producing equities will outperform other types of equities over the long term.

VIG has a dividend yield of 1.83% and a low expense ratio of 0.08%, making the fund a cheap one to hold. Year to date, the fund has risen 3.02%. Over the past 12 months, VIG jumped an impressive 24.77%.

The fund’s top five holdings are Microsoft Corp. (MSFT), 4.73%; Johnson & Johnson (JNJ), 4.05%; PepsiCo Inc. (PEP), 3.84%; 3M Co (MMM), 3.57%; and Medtronic PLC (MDT), 2.82%.

VIG is 30.07% invested in industrials and 15.68% in health care. Other areas of focus are consumer defensive, technology and financial services.

For investors who are in search of long-term income with potential dividend appreciation, the Vanguard Dividend Appreciation ETF (VIG) may be worth a look.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

The Animating Force for More of What’s Good

A new year often brings about the rise of hope. The hope of more freedom, more prosperity, more stock market gains… and a better world for humanity.

Of course, very often we don’t get all of what we hope for. Yet it’s our eternal optimism and desire to strive for more of what’s good and what’s truly meaningful in life that animates the free world.

That striving for more also is largely the force that animates investor sentiment. It also is one of the key animating forces in my Intelligence Report, Successful Investing and Fast Money Alert advisory services.

Just think about how we are entering 2018. We have the tailwind of tax reform at our backs, a tailwind that the markets have pined for since Donald Trump won the presidency.

We also have solid economic growth in both the United States and throughout much of the world. It is the global economic growth story (including the growth here at home) that is providing the fundamental backbone of higher equity prices.

Then we have the earnings picture, which is expected to continue driving equity prices into new, record-high territory.

According to CFRA Research, the consensus estimate for Q4 is for a 10.6% increase in S&P 500 profits. That would represent the third quarter in the past four quarters with earnings per share (EPS) gains of more than 10%.

Yet CFRA doesn’t stop there. The research firm also estimates that in Q1 through Q3, S&P 500 profit growth also will top 10%. That’s another very strong springboard by which stocks can keep heading higher. Add to the equation a relatively benign geopolitical environment (despite the bellicose North Korean bluster), and you have a good setup for stocks.

In fact, just last week we got one of the most bullish calls on 2018 from securities firm UBS. Analysts at the bank raised their S&P 500 earnings per share forecast for the year to $157, which represents a robust 18% year-over-year gain.

Moreover, UBS predicted that kind of earnings growth could lead to the S&P 500 at 3,150 by year’s end. That’s about 15% higher from current levels. And while the UBS call is one of the most bullish on Wall Street, it’s certainly well within the realm of possibility given current conditions, and given the relative lack of major headwinds on the horizon.

Another reason for the presence of hope and optimism here is the Dow, which lithely breached 25,000 in the first week. And as of midday Wednesday, the Dow now has breached 26,000.

Though these Dow milestones are largely psychological, and mainly serve as good headlines for the financial media, there is real significance in the fact that the move shows people want to buy stocks, and want to participate in what is undeniably one of the greatest wealth-building tools ever devised by humankind.

In 2018, we’ll also be eager participants in this wealth-building device, and we’ll do so via the best stocks, exchange-traded funds (ETFs), mutual funds and options the market has to offer.

And of course, we’ll do so via the animating force for more of what’s good.

P.S. Want the latest exchange-traded fund and stock recommendations backed up by a 40-plus-year plan that has helped investors maximize gains and protect against pernicious downturns in the market? Then I invite you to check out Successful Investing today!

*********************************************************************

What Motivates You?

“Something that motivates me? Existence.”

— Jim Woods

A friend of mine recently asked me to name something that motivates me. My response: “Existence.” You see, the fact that I’m alive, and the fact that I possess the consciousness to know that I am alive, is all the motivation I need to act every day to maximize my happiness. Whenever I feel down or whenever I lack motivation to take the proper action, I remember how fortunate I am to be alive in 21st-century America. If you think about it, what more motivation does anyone need to live life all the way?

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.