Why the Rich Get Richer—and How You Can Too

A few years ago, building wealth in America was all about getting a good education, a good job and diligently saving money through your 401(k) and investing in real estate. That formula worked through the 1990s and through most of the 2000s.

Then in 2008, the housing market crashed, the banking and financial system nearly imploded and the value of stock portfolios, including most retirement accounts, got slapped upside the head by a vicious bear. If you’re like most investors, you probably were counting on a consistent rise in your stock holdings to get you to the next level of wealth — and maybe into the echelons of the so-called rich.

A big part of that plan also was likely the increased value of your home and/or other real estate holdings. Well, we all know what happened to real estate prices when the bubble burst, and that put many investors in a seemingly inescapable hole.

We also know that many investors threw their hands up in frustration and sold their equity holdings at the very bottom of the market in late-2008 and early 2009. To make matters worse, many have still stayed out of stocks since 2009, thereby missing out on the longest and most-powerful bull run in market history.

Yet the meltdown in both the real estate and equity markets in 2007-2008, along with the pessimism about the future of the economy and the markets, were reflected in a 2012 poll commissioned by the Washington publication The Hill that revealed nearly half, or 47%, of likely voters surveyed now believe it is impossible for them to become wealthy in the course of their lifetime.

Even more disturbing to an advocate of smart investing like me is the survey’s finding that fewer than two-in-five likely voters that year, or 37%, thought they can ever become rich.

These findings certainly highlight the lack of confidence many Americans feel about their economic future. However, the way I see it, you don’t have to buy into the pessimism.

Getting rich and achieving success is possible, but to get rich and stay rich, you need to emulate the investing behavior of the rich.

And what do the rich do to get and stay rich? The answer is actually quite simple — they invest in stocks.

According to a June 2012 article at CNBC.com, “Why the Rich Recovered and the Rest Didn’t,” the reason why the wealthy have managed to recover from the ravages of the worst economic downturn since the Great Depression is because they have a greater proportion of their wealth in stocks, and less of their overall net worth in their homes.

The article points out that according to the then-latest data from the Federal Reserve, the wealth of the middle class declined by more than a third between 2007 and 2010, but the wealth of the top 10% actually grew by 2%.

Yes, this is a case of the rich getting richer, but how did they get that way?

According to Fed data from 2009, the top 1% of income earners had just 10% of their overall wealth attributed to real estate. This group had much more of its wealth, or 38%, in financial investments, including 9% of their wealth in stocks.

By comparison, the Fed data showed that both middle class and upper-middle class, i.e., those in the 50% to 90% range, counted more than half of their wealth in their homes. This group only had one third of their wealth in financial investments, and perhaps most revealing, they only had 1.6% of their wealth in stocks.

The conclusion you may draw here is that the reason why the rich have more money to invest in stocks is simply because they have more money. Yet looking at things through this simplified lens obscures the deeper image to be gleaned from the data.

The real insight here is that if you want to be rich, and if you want to stay rich, you simply must invest in stocks.

Now, there are many ways to invest in stocks, and there are myriad services and people out there to help you do just that. Yet even before you start investing with the help of any person or advisory service, the first step is realizing that to get rich, stay rich, or get even richer, you need to invest in stocks.

No other asset class can give you the kind of upside appreciation, liquidity and flexibility that stocks offer — and no other asset class can help you get where you want to be.

So, let me repeat: if you want to be rich, do as the rich do — and get invested in stocks.

If you want to know how my subscribers get invested in stocks according to a proven plan that’s been delivering for investors for more than four decades, I invite you to check out Successful Investing, right now.

**************************************************************

ETF Talk: Seeking Market Exposure in Foreign Currencies

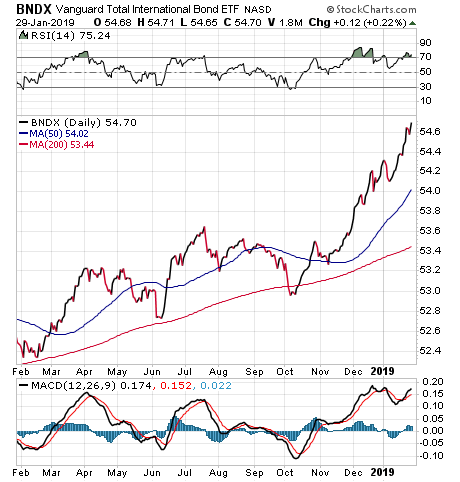

Investors seeking exposure to foreign currencies may be interested in learning about the Vanguard Total International Bond ETF (BNDX).

This exchange-traded fund (ETF) offers broad exposure to investment-grade bonds that are denominated in foreign currencies and hedged against currency fluctuations for U.S. investors. Conservative investors may appreciate that a majority of the fund’s investments are in sovereign bonds with AA ratings or better.

BNDX limits the impact of non-U.S. currency fluctuations on performance through the use of non-deliverable forward contracts. Transparency remains a concern for investors because Vanguard only publishes holdings on a monthly basis. However, the fund still offers a low cost and is the largest, most liquid fund in its segment. A newer fund entrant, iShares Core International Aggregate Bond ETF (IAGG), tracks a very similar index.

The Vanguard fund’s top sectors include government, corporate bond, agency/quasi-agency, covered bond and supranational. Its five top holdings are in agency bond (0.65%), France 1.0% 25-MAY-2027 (0.6%), Japan (0.55%), France 0.0% 25-MAY-2021 (0.51%) and Italy (0.48%).

Courtesy of Stockcharts.com

Recently, shares of the Vanguard Total International Bond ETF crossed above its 200-day moving average, changing hands as high as $54.62 per share.

Net assets are over $110 billion. The fund has 5,434 bonds, a daily volume of $71.75 million and an average spread of 0.02%. The expense ratio is low at 0.11%, which means that it is relatively inexpensive to hold in comparison to other exchange-traded funds.

Investors who are looking to add international diversity to their portfolio should consider this fund. The exchange-traded fund (ETF) employs hedging strategies to protect against uncertainty in exchange rates. It provides a convenient way to get broad exposure to non-U.S. dollar denominated investment-grade bonds and is passively managed, using index sampling.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Try to Be More Kind

We live, then we die.

That’s a reality we all must grapple with each minute. And the fact that life is finite has implications for everything we do. And no matter what your beliefs are about the existence of an afterlife, there is no doubt that life on earth as we experience it is going to come to an end for us all.

This admittedly morbid, yet eminently liberating, realization is at the spine of nearly all of our decisions, even though many times we fail to realize it. Think about the actions you take each day.

You wake after a night of sleep, because your body requires sleep. You consume food because your body requires energy. Then for most of us, we engage in some form of productive activity that nets us financial compensation so that we can attain the capital required to fund our existence.

If we’re lucky, we have family and friends who we love that we can share our lives with, and that allows us both to provide and to receive mutual support.

The requirements of a finite life also have a profound effect on your decisions about what to do with your money, how to spend that money, how to invest it and how to plan for a time when you may not be able to, or may no longer want to, work. Then there’s your family, and the work involved in making the right decisions to provide for them when you’re no longer here to do so.

Now, much of my newsletter advisory services are aimed at the nuts and bolts of how to put your money to work in the financial markets so that you can maximize this critical aspect of your life. Yet as you likely know, in The Deep Woods I like to peel back the layers of the onion skin so that we can access the principles at the root of the issue.

And when you think about it, what is at the essence of our quest to make sure we are financially secure enough to take care of ourselves and the ones we love?

To me, the answer is simple: It’s a desire to be kind.

Indeed, the desire to be kind, i.e. the quality of being caring, attentive, considerate and otherwise thoughtful of others, is something that we all should strive to be motivated by. I know for me, the action I take out of kindness not only feels good, but it’s always in my rational self-interest to do so.

Acting kind doesn’t mean self-sacrifice. Rather, it means acting and interacting with others so that both parties receive maximum benefit from the interaction.

Extended out to the political realm, the desire for kindness is why I am a passionate advocate for laissez-faire capitalism. You see, capitalism is the only social system where men are free to interact with each other based on the principle of exchanged values.

For example, this morning I went to my local Starbucks and paid $4.95 for a latte. I wanted the latte more than I wanted the $4.95, and Starbucks wanted the $4.95 more than they wanted the latte. I didn’t exercise physical force to extort the latte from my barista, and she didn’t wrestle me into the store from the street to confiscate my money.

Instead, we engaged in a mutually kind exchange of values that also was mutually beneficial. This kindness is the essence of capitalism, and it’s the opposite of the radical left’s idea that capitalism exploits the proletariat.

In my view, a prescription for increasing societal happiness is to increase kindness. Not only in terms of our daily human interactions, but also in the wider sense of people interacting with each other via the kindest of all principles — the principle of free exchange.

Finally, I’ll leave you with a powerful quote from philosopher and neuroscientist Sam Harris regarding kindness. As Sam writes: “Consider it: every person you have ever met, every person will suffer the loss of his friends and family. All are going to lose everything they love in this world. Why would one want to be anything but kind to them in the meantime?”

If you want to make yourself and the world a better place, try to be more kind.

*********************************************************************

Escaping Anxiety

“Today I escaped from anxiety. Or no, I discarded it, because it was within me, in my own perceptions — not outside.”

–Marcus Aurelius

Life is replete with worry, angst and anxiety. Yet when we realize that these feelings are all, in essence, just thoughts in our heads, we can manage them to our advantage. And, if need be, we can abandon our most destructive perceptions.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods