Smoking an Unstoppable Freedom Wave in 2018

It is a new year, and that means a new crop of federal, state and local laws go into effect. Some of those laws are the restrictive sort that prohibit specific behaviors or that levy fines for a given offense. Others are laws of permission, i.e., the removal of previous restrictions on human actions now deemed permissible by the legal system.

In my home state of California, one of the most prominent new state laws of permission is the legalization of what’s known as “adult marijuana use.”

On New Year’s Day, I woke up to news reports in the greater Los Angeles area featuring excited citizens eager to exercise their newfound freedom to legally purchase up to an ounce of marijuana and/or related cannabis products.

Now, as you might expect, there were huge lines outside the now-legal dispensaries that were literally wrapped around the buildings.

As you likely know, legal recreational use of marijuana has been gaining a foothold throughout the country. Moreover, medical use of marijuana and cannabis-related products also has become legally permissible throughout much of the country.

California’s legalization of adult marijuana use makes it the eighth state to do so. Later this year, both Massachusetts and Maine are expected to make the legal leap into adult usage. Currently, there are 29 states, plus the District of Columbia, that have laws that at a minimum legalize cannabis for medical purposes.

I view this legalization trend as an extremely positive development, and you don’t have to be a marijuana smoker or a cannabis user to think so.

I am not a cannabis user but, in my view, the legalization of a product that people have used for thousands of years, both as a medicinal aid and a tool to alter mental states, is part of a trend I call the “unstoppable freedom wave.”

This is a trend that animates the American spirit, and that no matter how oppressed and/or self-modulated,it cannot be suppressed for too long.

This freedom always breaks into the clear, sometimes despite itself. It’s a freedom for individuals to think about what they want, say what they want, wear what they want, live how they want, marry who they want… and ingest the substances they want, without the heavy hand of government interference.

This unstoppable freedom wave broke out after the disaster of prohibition (where teetotalers persuaded the government to restrict Americans from choosing to drink alcohol). The marijuana issue is no different, save for marijuana actually being a far less destructive drug than alcohol, both physically and socially.

According to recent surveys conducted by Gallup, more Americans favor legalizing marijuana than at any other point since Gallup began asking Americans about their views in 1969. Back then, only 12% of Americans favored legalizing cannabis. Today, 64% of the country is in favor of it. This is proof that most Americans want the freedom to put marijuana in the public market.

Now, from an investment standpoint, we can leverage this unstoppable freedom wave by investing in the best companies in the medical and legal marijuana industry. There are many ways to do this, and I am in the process of researching many of these companies for potential allocation in my Successful Investing and Intelligence Report investment newsletters.

In fact, just this week in my Fast Money Alert service, my partner, Dr. Mark Skousen, and I recommended a stock benefitting from the boom in medical and legal marijuana use.

Given the freedom wave that’s embraced legal cannabis use, there’s a whole lot of growth to go in the future. But just how big is the cannabis industry?

According to a report from ArcView Market Research, the total economic output from legal cannabis will grow 150% from $16 billion in 2017 to $40 billion by 2021. Moreover, ArcView thinks that U.S. consumer spending on legal cannabis in 2021 of $20.8 billion will generate $39.6 billion in overall economic impact, 414,000 jobs and more than $4 billion in tax receipts.

That’s a lot of cannabis cash, and a lot of profits for investors who embrace this unstoppable freedom wave.

Stay tuned.

P.S. Want the latest exchange-traded fund (ETF) and stock recommendations backed up by a 40-plus-year plan that’s helped investors maximize gains and protect against pernicious downturns in the market? Then I invite you to check out Successful Investing today!

***********************************************************

ETF Talk: This Fund Gives Exposure to Large-Cap Growth Companies

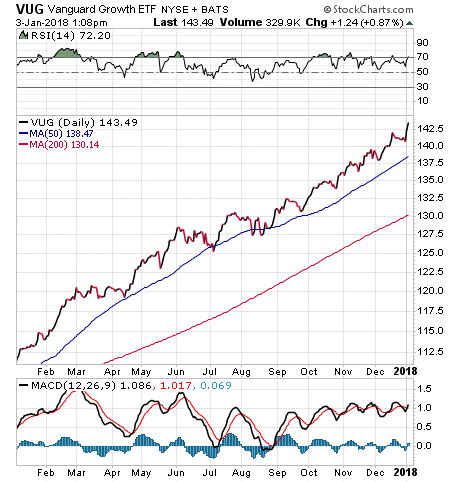

The Vanguard Growth ETF (VUG) aims to select mid- and large-cap U.S. companies that exhibit strong growth characteristics.

“Growth stocks” usually refers to companies that are likely to experience higher future revenues and earnings at a faster rate than the industry average. As a result, growth stocks tend to outperform during a market uptrend.

This fact was clearly illustrated in 2017, as the information technology (IT) sector returned an impressive 35.51% to top the gains of all other major sectors, including consumer discretionary (19.92%) and real estate (9.07%). The overall S&P 500 index returned around 19% for 2017.

VUG employs a passive, buy-and-hold approach. It has $31.51 billion in assets under management and an average daily trading volume of $88.63 million. This makes it a very liquid fund. The exchange-traded fund’s (ETF) operating efficiency is reflected in its low expense ratio of just 0.06%. Low expense ratios are a hallmark of many Vanguard funds.

The fund pays a quarterly distribution and has a distribution yield of 1.22%. Its most recent payout of $0.475 on December 27, 2017, was an increase of 15.6% over the previous distribution.

The chart below clearly shows that VUG went nowhere but up in 2017, with its share price increasing nearly every month. The fund touched an all-time high of $142.50 in December and returned about 29% for 2017. Zacks Investment rated VUG as one of the top growth funds of 2017 and has given it a “strong buy” rating.

While VUG is very focused on its goal of investing in large-cap growth companies, the fund spreads its holdings over a basket of 300-plus stocks, with none accounting for more than 7.2% of the fund’s total assets. Roughly 27% of the fund is invested in technology, 20% in consumer services and 12-13% in health care, financials and industrials.

VUG’s top five holdings are: Apple (AAPL), 7.20%; Amazon.com (AMZN), 4.34%; Facebook (FB), 3.80%; Alphabet Inc. A (GOOGL), 2.79%; and Alphabet Inc. C (GOOG), 2.73%.

If you are seeking a straightforward way to get into some of the biggest and best growth stocks, consider looking into Vanguard Growth ETF (VUG).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Wisdom from a Blackstone

“The public good is in nothing more essentially interested, than in the protection of every individual’s private rights.”

— William Blackstone, Commentaries on the Laws of England

In 2018, I am hoping we continue to see an increase in freedom, both personal and economic, and even greater protection of individual rights. And, if you want to create your own vision of economic freedom, then you need to make good decisions with your money — and that’s what we’re here to help you with.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In case you missed it, I encourage you to read my e-letter article from last week, which featured my best articles of 2017.