Why ‘Average Inflation’ Matters to You

- Why ‘Average Inflation’ Matters to You

- A Must-See FREE Webinar Replay

- ETF Talk: Fund Offers Exposure to Financial Technology

- It’s Capitalism’s Fault

- Owl City Wisdom

***********************************************************

Why ‘Average Inflation’ Matters to You

Today is Fed day, and as expected, Federal Reserve Chairman Jerome Powell and the Federal Open Market Committee (FOMC) left interest rates unchanged. The Fed did, however, mention something that could be of key importance going forward.

In the Fed’s FOMC statement, officials noted how inflation, after excluding the volatile food and energy categories, was running below the central bank’s 2% target. In his presser following the release of the statement, Chairman Powell did say that the recent softening in inflation was likely to be “transient.”

Yet Powell went on to qualify that if this outlook proved wrong — and the recent weakness in price pressures was persistent — that would be “something we would be concerned about.”

The bottom line here is that the Fed is standing pat for now, and there will be no immediate “precautionary” rate cut as many pundits had speculated. As Powell put it, “We don’t see a strong case for moving [rates] in either direction.”

Yet aside from just a simple rate cut, there is another move the Fed could make that has potentially big implications for equities, bonds and your money. This move is all about what’s known as “Average Inflation,” and this subject is something that my friend, macro-analyst extraordinaire and contributor to my Intelligence Report advisory service Tom Essaye has written brilliantly about.

Tom is the founder and editor of the Sevens Report, a daily market update and analysis that I highly recommend to all my readers.

Today, I am pleased to present you with a special guest editorial by Tom Essaye on this subject. I think you’ll find it as thought-provoking as I did. — J.W.

Why Average Inflation Matters to You

By Tom Essaye, Editor, Sevens Report

One of the key catalysts that could continue driving markets higher from here is the Fed, and particularly a more-dovish-than-expected Fed. This outcome is, in some ways, more likely than most appreciate.

Now, I’m not talking about the Fed cutting rates. Unless economic data or inflation nosedive from here (and both are unlikely, especially with what’s happening to oil and the positive impact that will have on inflation), the Fed is “on hold” for the remainder of 2019.

However, in June, the Fed could turn more dovish in a different way — one that could have profound implications on the returns of commodities, stocks and bonds over the coming decades — because it’s happened before.

The specific dovish event I’m referring to is the Fed potentially changing its inflation target from a 2% ceiling to a 2% average.

Here’s why that’s important.

The Core PCE Price Index has been under 2% annually for 10 straight years. And last year, as the Core PCE Price Index approached the Fed’s 2% inflation target, the Fed hiked rates four times to stop the ascent. That, in turn, choked off growth in the short term, nearly inverted the yield curve and contributed to a correction in stocks.

But, if the inflation target is set to an average, that likely wouldn’t have happened. Why? Because if it’s an average, then inflation needs to spend time above 2%, which means the Fed will initiate interest rate hikes less frequently as inflation rises. And since inflation has been under 2% for years, it’s conceivable that the Fed could allow inflation to rise above 2% for years to come. Practically speaking, that means a more dovish Fed than we’ve seen in decades.

Here’s what I mean.

In the 1970s and 1980s, the Core PCE Price Index was consistently well above 2%. In fact, the Core PCE Price Index rose above 2.5% year over year in the late 1960s and didn’t drop below that level until the mid-1990s — that’s nearly 30 years of higher inflation!

But in the mid-1990s, the Fed informally adopted a 2%-ish inflation target, and they’ve been very good at hitting that target ever since. In fact, since the mid-1990s, the Core PCE Price Index hasn’t risen above 2.5% year over year. However, with a new “average” inflation target, that likely will change. Here’s why that matters to you.

It means that over the longer term, we could be investing in an era of higher inflation — something no one in the markets has seen since the mid-1990s. And, it’d be a major reversal from the asset allocation strategy that has worked so well for the last 25 years.

When inflation is low (1995-Present) that’s good for 1) Bonds, 2) Stocks (mostly) 3) Consumers (via low interest rates) and it’s bad for 1) Commodities and 2) Hard Assets. But, when inflation is high, the biggest loser is bonds — so this move could represent a material change in different asset class performances going forward.

When inflation is higher (2020?) that’s good for 1) Commodities, 2) Hard Assets (Real Estate and “Stuff”), 3) Stocks (but it increases their volatility) and it’s bad for 1) Bonds and 2) Cash.

Bottom line, there are increasing signs the Fed is willing to let inflation run higher than at any time in the past 30 years. That potential change could be longer-term positive for hard assets and stocks and longer-term negative for bonds and fixed income. This could be an important development, given the impending retirement of millions of baby boomers who are about to start relying on fixed income.

What’s Next?

The Fed’s “framework” conference in early June (June 4-5) will be where they discuss an “average” inflation target. I don’t expect any bombshell announcements at this point, but by the end of that conference, we should know 1) Whether the shift to an “average” inflation target is going to happen and 2) The process by which it does happen (it’s going to be a long one as the Fed does nothing quickly unless all hell is breaking loose).

Interestingly, I did not miss the irony of writing this piece about low inflation, because if you’re like me, real inflation (health care costs, tuition costs, property costs, car costs, etc.) is moving well above 2% per year! So, if I were invited to this conference, which of course I will not be, I would urge the Fed not to consider changing its inflation target, but to think about the way it defines inflation instead.

I’d be happy to show them a pie chart of my monthly expenses as a reference point, because the inflation rate of the things I need to pay for (those mentioned above) said bye, bye to 2% a long time ago.

So, I shudder to think what will happen if the Fed decides to let inflation run going forward. Yet, I learned early in this business we must trade the market we’ve got… not the one we wished we had. — T.E.

Thanks again to Tom for that outstanding analysis. I know I will be keeping a keen eye on the average inflation issue. I will be writing more about that in this publication, and in my newsletters… so stay tuned!

**********************************************

A Must-See FREE Webinar Replay

One week ago, I was the featured guest on the quarterly webinar “ON THE MOVE.” This webinar series was hosted by my friend and precious metals expert Rich Checkan of Asset Strategies International (ASI), and market analyst extraordinaire Chris Blasi.

During this webinar, the three of us had an in-depth discussion of the current socialism vs. capitalism debate, and the implications of that debate for our country and for our money. We also discussed the current market milieu, including earnings season, the future of equities, the U.S. dollar, the future of gold prices and many other important topics. If you want to watch a replay of this event, simply click here.

Also, if you’ve been thinking about owning gold and precious metals, Rich is the man to guide you. In fact, he’s my “go-to precious metals expert.” So, if you are looking to invest in physical gold or other precious metals, I highly recommend a discussion with Rich.

He and his team at Asset Strategies International can be reached at infoasi@assetstrategies.com, or via phone at 1-800-831-0007. To sign up for ASI’s free newsletter, which I also strongly recommend, click here.

**********************************************

Join Me at the MoneyShow in Las Vegas, May 13-15

I invite you to join me for the MoneyShow in Las Vegas, May 13-15, when I will be a featured speaker to share my latest views about the market and the best investments to make now. The event will be based at the Bally’s/Paris Resorts and feature more than 200 presentations. Other featured speakers include Steve Forbes, Dr. Mark Skousen and Hilary Kramer. Click here to register free as my guest or call 1-800-970-4355 and be sure to use my priority code of 047465.

**************************************************************

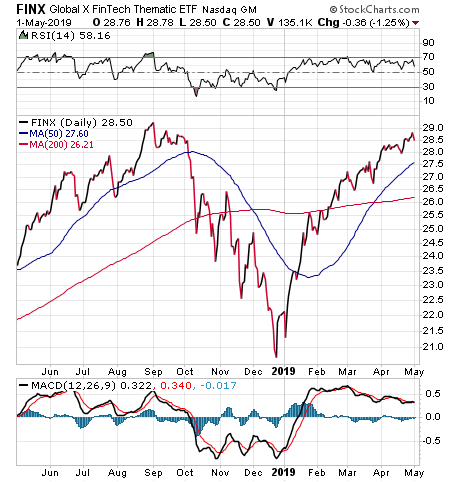

ETF Talk: Fund Offers Exposure to Financial Technology

Financial technology, as some might say, is too important to be left to the financiers.

Indeed, it is hard to find a sector of the economy that hasn’t been touched by financial technology innovations, including the insurance, fundraising and third-party lending sectors. The Global X FinTech ETF (NASDAQ: FINX) offers prospective investors access to this dynamic sector of the economy.

Specifically, FINX focuses on providing investment results that generally correspond to the price and yield performance, before fees and expenses, of the Indxx Global FinTech Thematic Index. This approach is particularly salient because FINX can transcend sector, industry and geographical classifications. For example, FINX has holdings that are in North America (73%), Europe (17%) and the Asia-Pacific region (10%).

Some of this exchange-traded fund’s (ETF) largest positions include PayPal Holdings Inc. (NASDAQ: PYPL), SS&C Technologies Holding (NASDAQ: SSNC), Intuit Inc. (NASDAQ: INTU), Fiserv Inc. (NASDAQ: FISV), Temenos Group AG-Reg (OTCMKTS: TMSNY), Square Inc. (NYSE: SQ), Fidelity National Info SE (NYSE: FIS) and First Data Corp — Class A (NYSE: FDC).

While these companies are mainly in the technology arena (78%), this ETF has holdings in companies that are in the financial (11%), health care (3%) and other (8%) sectors, too.

The fund currently has $361 million in net assets and an average spread of 0.23%. It also has an expense ratio of 0.68%, meaning that it is more expensive to hold in comparison to other exchange-traded funds.

In terms of FINX’s MSCI ESG Fund Quality Score of 4.79, it ranks in the 17th percentile within its peer group and in the 28th percentile within the global universe of all funds in the MSCI ESG Fund Metrics coverage.

Chart Courtesy of StockCharts.com

This fund’s performance has been quite solid in the long term. While it only has been up 3.65% over the past month, it rose 14.94% over the past three months and remains up 29.88% year to date. In short, while FINX does have several advantages over some of its peer funds and provides an investor with a way to pursue profits from some truly cutting-edge technology, this ETF’s risks and costs are not zero.

Thus, interested investors should always do their due diligence and decide whether the fund is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

In case you missed it…

It’s Capitalism’s Fault

What’s to blame for today’s economic ills? Ask that question of both the left and right, rich and poor, and you’re liable to get a similar answer.

That answer is: It’s capitalism’s fault.

On the left, you have the extreme Marxist-types who argue that capitalism shows the final stages of a decayed society. Yet now there also is a phalanx of mainstream 2020 Democratic presidential candidates who all are racing to blame the nation’s income inequality, racism, culture clash, crime, opioid addiction, climate change and every other possible unsavory aspect of human life on capitalism.

On the right, you also have critics of capitalism, including our current president. Indeed, it was President Donald Trump’s critique of free trade, free markets and his willingness to take on a protectionist posture complete with threats of tariffs and other punitive measures on foreign competition and on companies here at home that helped get him elected in the blue-collar swing states.

Now, you might expect that individuals at the lower end of the economic spectrum may be hostile to capitalism because it hasn’t benefited them as much as the so-called rich. Yet these days the loudest cries of, “It’s capitalism’s fault” can be heard by some of the wealthiest, most-successful capitalists among us.

The latest sonorous screed against capitalism comes from Ray Dalio, who has gotten a lot of press of late with his series of LinkedIn posts on “Why and How Capitalism Needs to Be Reformed.”

Dalio, who is the founder of hedge-fund manager Bridgewater Associates, was recently profiled on “60 Minutes.” Now, given that Mr. Dalio is worth an estimated $18 billion and is one of the best investors in the world, I had hoped I would find out more about his keys to success. Yet what I found out more about is why the system that allowed him, and millions of other Americans throughout history to become so successful, i.e. capitalism, is now cause for a “national emergency.”

According to Dalio, the American dream is lost because it’s not adequately “redistributing opportunity,” and that this “wealth gap” as he puts it, is a huge problem. “I think that if I was the president of the United States… what I would do is recognize that this is a national emergency.”

So, what is Dalio’s key prescription for fixing this wealth gap?

Sadly, his fix includes a bromidic mix of tired ideas, including: “Bipartisan and skilled shapers of policy working together to redesign the system so it works better,” and “Redistribution of resources that will improve both the well-beings and the productivities of the vast majority of people.” Of course, Dalio also advocates every authoritarian’s favorite solution to any problem, increased taxation on wealth and government redistribution of that wealth.

But Dalio isn’t the only member of the rich elite that’s recently criticized capitalism. Jamie Dimon, CEO of JPMorgan Chase & Co. and one of the best bankers in the world, also has piled on with his own critique in his latest annual letter to shareholders. Although Mr. Dimon doesn’t get as philosophical as Mr. Dalio in his assessment, he does think that corporate America has ignored and avoided some of society’s biggest problems.

Now, regular readers of this column likely will have figured out that I disagree with both the left and much of the right on this issue. I also disagree with Mr. Dalio and Mr. Dimon.

It’s not that I don’t recognize that some people have much, much more wealth than others. That’s just a fact. Yet it’s not capitalism’s fault that wealth is concentrated.

Wealth concentration is simply a matter of the reality that some people are more productive economically than others, and some people operate in areas that generate more capital than others. Hence you find much greater compensation and wealth creation. Is this unfair? Well, yes, it is.

Yet what is even more unfair, what is dangerously unfair, is to try and strip success from those who have achieved via government fiat (i.e. taxation and redistribution) in the name of “equality.”

I think that if we want to fix the income gap, increase the pie for everyone and make America a more prosperous place, what we need to do is stop blaming capitalism and start extolling capitalism.

And, the greatest way to do that is to recognize that capitalism could use some reform, but that reform is a move toward more liberty and less government involvement in the economy — not greater central planning and less freedom.

*********************************************************************

Owl City Wisdom

Birds-eye view, awake the stars ’cause they’re all around you

Wide eyes will always brighten the blue

Chase your dreams, and remember me, sweet bravery

’Cause after all those wings will take you up so high

So bid the forest floor goodbye as you race the wind and

Take to the sky…

— Owl City, “Take To The Sky”

The pop/rock band Owl City lives up to the folklore of a wise old owl in its lyrics here to “Take To The Sky.” The song reminds us that opportunities and the good things in life are always around us, if our eyes are wide enough to see them. It also reminds us that our values are worth fighting for, and that we must arm ourselves with the bravery required to spread our wings and take to the sky in search of achievement.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods