When What’s Expected Isn’t What’s Wanted

It’s Fed day.

What that means is that all market eyes, including my own, were eagerly anticipating the decision on interest rates by the Federal Reserve at the conclusion of the latest Federal Open Market Committee (FOMC) meeting. The markets also were eagerly anticipating the comments by Fed Chairman Jerome Powell in his post-FOMC-statement press conference.

So, what happened?

Well, the Fed basically did what analysts expected. It cut the benchmark interest rate cut by 25 basis points, lowering the key overnight lending rate to a range of 1.75%-2.00%.

Interestingly, three policymakers dissented on the decision, with St. Louis Fed President James Bullard preferring a more aggressive 50-basis-point cut. Boston Fed President Eric Rosengren and Kansas City Fed President Ester George both opposed a rate cut, as both have stuck to their “hawkish” guns. The other seven voting members of the FOMC opted for today’s rate cut.

Now, going into this Fed meeting, markets were hoping for more than what was generally expected. I find that interesting, and generally a prescription for disappointment.

As we all know from other walks of life, what we expect to happen isn’t always what we want to happen. Most of us expect life to be a struggle, yet most of us want to get a few lucky breaks along the way. And if we don’t get those breaks, we can sometimes be very disappointed.

The smart money on Wall Street wanted a 50-basis-point interest rate cut and a clear signal from Powell that there would be more interest rate cuts before the end of the year. Well, that didn’t happen, and so the market expressed its disappointment with a post-FOMC selloff.

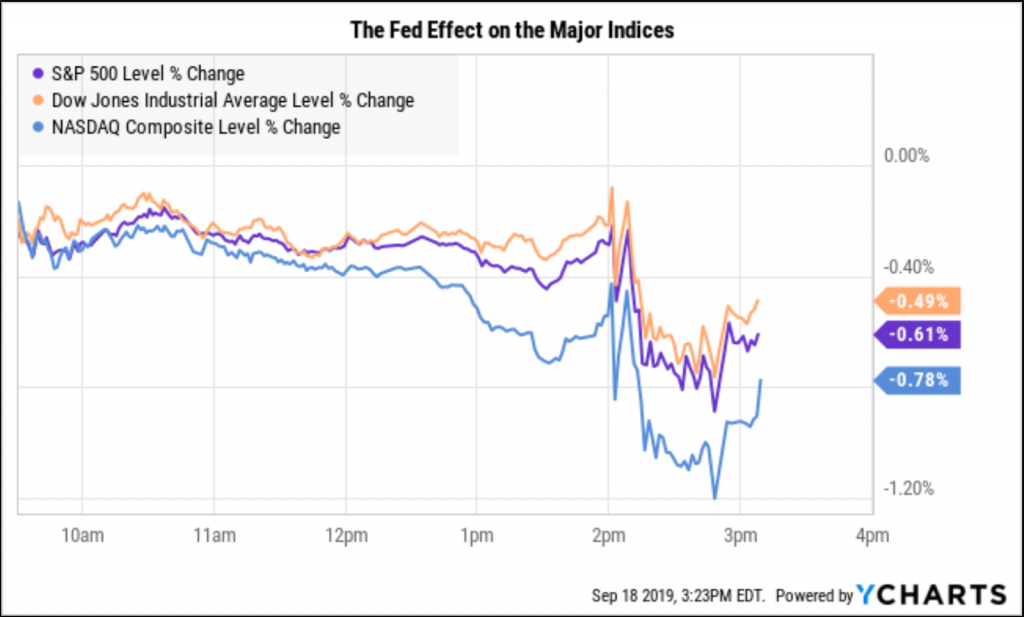

The one-day chart here of the major domestic indices, pulled just after the Powell press conference ended, shows the Fed effect on stocks. As you can see, the selling started right at the 2 p.m. announcement and continued from there. Encouragingly for the bulls, the majors did manage to move back off session lows, as Powell’s press conference did offer some encouragement for buyers.

The bottom line here is that markets are disappointed by the Fed, but the reason why is because the markets always want the Fed to be more “dovish” than it is. The markets always want lower rates, as that is generally a very good thing for the bulls.

So, while the markets didn’t get what they wanted, they did get what was expected — a Fed that reduced the cost of capital commensurate with what it sees as an economy that is generally strong, but that has seen some mixed economic signals of late. Those mixed signals include consumer spending that remains robust, but manufacturing activity that has weakened.

Finally, I would encourage my fellow traders on Wall Street to remember the following lyrics from a Rolling Stones classic:

You can’t always get what you want

But if you try sometimes

You just might find

You get what you need.

Keeping this notion in our heads might just keep us all from ever getting too disappointed — both on Wall Street and on Main Street.

**************************************************************

ETF Talk: Gain Inverse Exposure to U.S. Small-Cap Companies

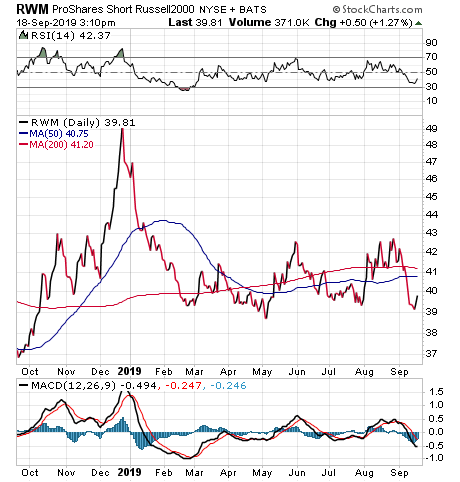

The ProShares Short Russell 2000 (RWM) exchange-traded fund (ETF) provides inverse exposure to a market-cap-weighted index of U.S. small-cap companies.

RWM offers a bet against the Russell 2000’s index of 2,000 small-cap firms that attract enough daily liquidity to make it a viable trading tool. The non-diversified fund uses both ETF and index swaps to achieve its inverse exposure.

As with most leveraged and inverse products, RWM is designed to provide its -1x exposure for the short term. Anyone holding it for longer periods will have their returns affected by the effects of compounding, which cause returns to drift away from the expected inverse exposure to the 2,000 small-cap stocks that comprise the Russell 2000 Index.

The fund is sufficiently popular to allow investors to use it for short-term tactical trading, with heavy daily trading activity and narrow spreads. Its fees are comparatively high for an ETF, though in line with other funds found in the inverse equity segment.

The ETF currently has more than $307 billion in assets under management and an average spread of 0.02%. It currently sits at just under $40 a share and has a 1.34% yield. With an expense ratio of 0.95%, it is more costly to hold relative to some other exchange-traded funds.

Chart Courtesy of Stockcharts.com

The ProShares Short Russell 2000 has an MSCI ESG Fund Rating of A, based on a score of 6.70 out of 10. The MSCI ESG Fund Rating measures the resiliency of portfolios to long-term risks and opportunities arising from environmental, social and governance factors. Highly rated funds consist of companies that tend to show strong and/or improving management of financially relevant issues.

While RWM facilitates the opportunity to profit at a time when the Russell 2000 Index is at risk for producing negative returns, inverse ETFs may not be appropriate for all portfolios.

As always, interested investors should exercise due diligence to decide whether the fund fits their individual investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*******************************************************************

The Fascinating Path of a Righteous Warrior

Want to hear a true story of international banking intrigue during the Vietnam war?

Well, then I’ve got just the thing for you, courtesy of the latest installment of the Way of the Renaissance Man podcast.

In this episode, I speak with precious metals expert Michael Checkan, president of Asset Strategies International.

Michael is a hard-money warrior and someone who has been in the precious metals business for more than half a century. During this conversation, you’ll learn all about the work Michael did for Vietnamese refugees to help them start new lives in the United States.

(Photo Credit: Unlock Your Wealth TV)

You’ll also find out how Michael assisted these refugees in converting their golden “Taels” into U.S. dollars — dollars that allowed them to make America their new home.

Plus, find out Michael’s current views on the latest run higher in gold prices, the tailwinds propelling gold’s price and why it makes sense for every Renaissance Man to consider owning some physical gold in his portfolio.

I loved this conversation with Michael Checkan, and I know you will too.

To listen to this episode of the podcast, simply click here right now.

For more about Michael and his firm, please visit Asset Strategies International.

**********************************************************************

In case you missed it… (originally published Sept. 11, 2019)

The Scars of History Must Never Heal

“It was not a street anymore but a world, a time and space of falling ash and near night.”

That’s how novelist Don DeLillo described lower Manhattan on September 11, 2001, in his masterpiece “Falling Man.” That novel was published six years after the attack, but the memories and the scarring on our national soul were still fresh and exposed.

Eighteen years later to the day, those scars haven’t faded. They will never fade.

Etched on my own black box recorder were the memories I had circa 1999, when I checked in at the World Trade Center lobby to report to work for my first day at Morgan Stanley. The firm’s training program for new brokers took place in those twin towers, and in the weeks that followed, I spent many an afternoon high atop the Manhattan skyline, learning the trade inside the iconic monument erected to celebrate capitalism, Western achievement and the wealth of nations.

Their boldness, their glaring simplicity, their twin-brother-like stance and their defiance of the rest of the New York City skyline were all part of the reason the World Trade Center was targeted for destruction by forces whose primary directive is the death of the infidel.

On that day, when the blue skies were pierced by the stiletto insertion of commercial jets into the towers, I watched the events unravel from some 2,500 miles west. A condo nestled at the foot of the Hollywood Hills hardly seemed congruent to the billowing smoke oozing out of the structural siblings.

The only connection in my mind was… my mind.

A mind having been there just a couple of years earlier, wondering what it would be like to actually be there in that moment.

Wondering if I would have been incinerated along with the roughly 2,600 other souls that were extinguished that day.

Wondering if I would have acted heroically, the way so many did.

Wondering if I would have succumbed to the cowardice that so often accompanies paralytic fear.

I would like to think I could have been a hero. I need to think I would have been a hero.

Fortunately, I didn’t have to find out.

Instead, from afar, from the safety of Hollywood, I watched. All day, all night, I watched. Compelled by the horror and compelled by the enormity. Thinking to myself, “Will this be the world from here on?”

Would the world be plunged into war? At that moment, I wanted war. I wanted vengeance. I wanted to pound those responsible, and the philosophy that animated these acts, into a pulp.

I still want to do so.

I want to stoke the burn of that day. I want to remember the collapse of icons.

I want to keep calling out the life-hating, celebratory death cult of ideas that is radical Islam, and I want to rejoice in its defeat.

The scars of history must never be allowed to heal. No salve of time should be permitted to mask the day America was altered forever.

*********************************************************************

Barris’ Dark Wisdom

“I came up with a new game-show idea recently. It’s called ‘The Old Game.’ You got three old guys with loaded guns onstage. They look back at their lives, see who they were, what they accomplished, how close they came to realizing their dreams. The winner is the one who doesn’t blow his brains out. He gets a refrigerator.”

— Chuck Barris, “Confessions of a Dangerous Mind”

Those of us who grew up in the 1970s will remember iconic TV game shows such as “The Gong Show,” “The Dating Game” and “The Newlywed Game.” These shows were the brainchild of producer Chuck Barris, who also wrote the unbelievably interesting autobiography, “Confessions of a Dangerous Mind.” The book also was made into a very good film that I recommend directed by George Clooney.

Now, as dark as this week’s quote by Chuck Barris may be, it does make a critically important point about life. You see, if we look back on our lives and see what we’ve accomplished, will we be winners? Will we be proud? Will we get that refrigerator? Or, will we be tempted to squeeze the trigger? The choices you make determine your existence. Make the right choices and you win.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.