What’s the Deal with Banks?

When you wake up to news of banks failing, stocks tumbling and the Federal Deposit Insurance Corporation (FDIC) swooping in to “save” the 16th largest bank in the country, you have to ask yourself: What is the deal with banks?

Simply put, the deal here is that last Friday, venture-focused Silicon Valley Bank (SVB) failed, marking the largest bank failuFVFVre in the U.S. since Washington Mutual during the financial crisis. Then, on Sunday, Signature Bank of New York (SBNY) also failed, and was taken over by the FDIC. Like the also-failed Silvergate Capital (SI) and SVB, Signature Bank had a lot of crypto exposure. In sum, three large banks failed in less than a week!

In response, the Federal Reserve and the Treasury Department aggressively stepped in and announced that all depositors at SVB and SBNY, including FDIC insured and non-insured, will be made whole and have access to their deposits.

Then, in a flashback to the financial crisis, the Fed also created a new lending facility, the Bank Term Funding Program (BTFP). This new institution will provide one-year loans to banks, accept Treasuries and agency mortgage-backed securities (Fannie/Freddie MBSs) as collateral and the lending facility will value the bonds at par (not current market values).

But did this situation just appear out of nowhere? Of course not, no effects happen with prior causes.

The underlying reason for the bank dislocations is in very large part due to the Fed’s monetary policies over the past couple of years. You see, after keeping the cheap-money fire hose on full blast for years, this past year, we reaped what we sowed and got inflation.

Now, the Fed is determined to reverse the easy-money policies of the past to try to tame inflation, and that’s resulted in a contracting money supply and the price of money (interest rates) going up very fast. We also now are suffering the pernicious effects of a negative yield curve, where short-term interest rates are higher than long-term rates. And while bond yields have gyrated wildly of late, sharply compressing that negative yield curve, the result of that prior huge inversion has been horrible for banks, and as a result, bank fundamentals are very negative.

Of course, the SVB, SBNY and SI situations all have issues specific to their situations. Those respective specific problems resulted in old-fashioned “bank runs” in the space, meaning more people went to get their money out of the bank than the bank could handle — and that’s always an extremely scary situation.

Now, the fear is “contagion,” i.e., that other banks will suffer the same fate as SVB, SBNY and SI. And seemingly right on cue, this morning, we woke to similar issues with Credit Suisse (CS), one of Europe’s most storied financial institutions.

So, what’s the bottom line here for markets? Well, this could be a silver lining in one sense, and that is we are very likely to see the Fed get much more “dovish” from here when it comes to future interest rate hikes.

We know that, because the introduction of contagion risk has significantly altered the market’s outlook on what the Fed is going to do. Prior to the failure of Silvergate, Silicon Valley Bank and Signature Bank, fed fund futures were pricing in a greater-than-50% chance of a 50-basis-point rate hike next week at the March 22 Federal Open Market Committee (FOMC) meeting, and a terminal fed funds rate (level where rates finally peak) of 5.625%.

Now, in just three trading days, Fed fund futures are pricing in a 25-basis-points hike next week (and the possibility of no rate hike), and a terminal fed funds rate of 4.625% – 4.875% (meaning next week’s hike could be the last of this cycle).

That change helped stocks rally big on Tuesday despite the bank failures, but of course, that Credit Suisse news overnight soured yesterday’s bullish mood.

Unfortunately, there’s likely to be more negative bank news before this whole tragicomedy is over, and that means we are likely in for more equity and bond market drama in the days and weeks to come.

So, hold on tight, as there is one thing you can bank on here, and that is this rollercoaster ride ain’t over yet.

***************************************************************

ETF Talk: Cloud Computing Is a Growing Industry to Tap

Cloud computing.

It has become the “It Girl” of the internet age, and despite its huge growth over the past several years, cloud computing remains a still-growing industry that is becoming increasingly important within the technology center. The technology allows individuals and businesses to store files on a remote database that is accessible via the Internet, offering both an alternative method of storage and a method of backing up data.

Cloud computing has gained my attention because it has proven quite popular, and quite profitable. Numerous companies have found success delving into the billion-dollar industry. With the technology becoming more widely used, many investors may want to benefit from the growth of this industry as well.

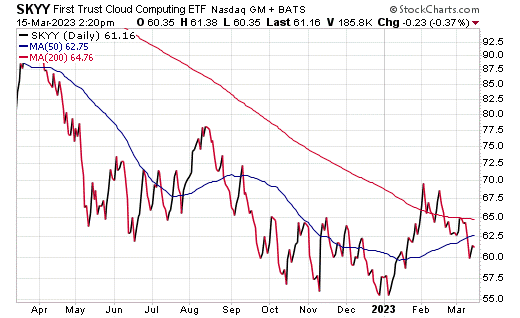

First Trust Cloud Computing ETF (SKYY) is one such way to gain exposure to the cloud computing market. SKYY tracks an index of companies that are specifically involved in the cloud computing industry. This fund is managed by First Trust, and was the first mover to offer exposure to cloud computing stocks in the exchange-traded fund (ETF) space.

Prior to June 24, 2019, SKYY tracked the ISE Cloud Computing Index, but now uses its own index to track stocks. This index takes all stocks that fall into at least one of its three groups: Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and Software as a Service (SaaS).

It then applies additional size, liquidity and tradability screens, and assigns scores of 3, 2 and 1, respectively, to these groups. A stock’s weight in the index is its score divided by the sum of all scores, which is then modified so that no single security exceeds a 4.5% weight in the portfolio. Firm size (market cap) has no direct bearing in weighting.

This fund invests more than 80% of its total assets into the technology sector, with around 98% of its investments in U.S. companies. Top holdings include Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), MongoDB, Inc. (MDB), Oracle Corporation (ORCL), Arista Networks, Inc. (ANET) and International Business Machines Corporation (IBM).

SKYY’s expense ratio is currently at 0.60%. However, its returns have not been favorable as of late. As of March 14, SKYY’s total returns are at -7.00% for the last month and -0.03% for the past three months, though it has seen a return of 3.96% year to date (YTD). With the technology sector’s continued growth, this fund does have a chance of rebounding in the coming months.

While this fund provides investors with an entry point into the growing market of cloud sharing technologies, it’s important to consider your individual financial situation and goals carefully. Investors are always encouraged to do their due diligence before adding any stock or ETF to their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Kindness of Capitalism

We live, and then we die.

That’s a reality we all must grapple with each minute. The fact that life is finite has implications for everything we do. And no matter what your beliefs are about the existence of an afterlife, there is no doubt that life on earth, as we experience it, is going to come to an end for us all.

This admittedly morbid, yet eminently liberating, realization is at the spine of nearly all our decisions, even though many times we fail to realize it. Think about the actions you take each day.

You wake up after a night of sleep because your body requires sleep. You consume food because your body requires energy. Then, for most of us, we engage in some form of productive activity that nets us financial compensation so that we can attain the capital required to fund our existence.

If we’re lucky, we have family and friends whom we love that we can share our lives with, and that allow us to both provide and receive mutual support.

The requirements of a finite life also have a profound effect on your decisions about what to do with your money, how to spend that money, how to invest it and how to plan for a time when you may not be able to, or may no longer want to, work. Then, there’s your family, and the work involved in making the right decisions to provide for them when you’re no longer here to do so.

For a special audio essay version of this article, click here.

Now, much of my newsletter advisory services are aimed at the nuts and bolts of how to put your money to work in the financial markets so that you can maximize this critical aspect of your life. Yet, as you likely know, in The Deep Woods, I like to peel back the layers of the onion skin so that we can access the principles at the root of the issue.

And when you think about it, what is at the essence of our quest to make sure we are financially secure enough to take care of ourselves and the ones we love?

To me, the answer is simple: It’s a desire to be kind.

Indeed, the desire to be kind, i.e., the quality of being caring, attentive, considerate and otherwise thoughtful of others, is something that we all should strive to be motivated by. I know for me, the actions I take out of kindness not only feel good, but they’re always in my rational self-interest to do so.

Acts of kindness don’t mean self-sacrifice. Rather, it means acting and interacting with others so that both parties receive maximum benefit from the interaction.

Extended out to the political realm, the desire for kindness is why I am a passionate advocate for laissez-faire capitalism. You see, capitalism is the only social system where people are free to interact with each other based on the principle of exchanged values.

For example, this morning, I went to my local Starbucks and paid $4.95 for a latte. I wanted the latte more than I wanted the $4.95, and Starbucks wanted the $4.95 more than it wanted the latte. I didn’t exercise physical force to extort the latte from my barista, and she didn’t wrestle me into the store from the street to confiscate my money.

Instead, we engaged in a mutually kind exchange of values that also was mutually beneficial. This kindness is the essence of capitalism, and it’s the opposite of the Marxist idea that capitalism exploits the proletariat.

In my view, the prescription for increasing societal happiness is to increase kindness. Not only in terms of our daily human interactions, but also in the wider sense of people interacting with each other via the kindest of all principles — the principle of free exchange.

Finally, I’ll leave you with a powerful quote from philosopher and neuroscientist Sam Harris regarding kindness.

As Sam writes: “Consider it: every person you have ever met, every person will suffer the loss of his friends and family. All are going to lose everything they love in this world. Why would one want to be anything but kind to them in the meantime?”

If you want to make yourself and the world a better place, try to be more kind.

*****************************************************************

J. Paul Said It Best

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”

— J. Paul Getty

The richest men in history often have a way of putting into perspective what the rest of us have trouble conceiving. The reason why is because the more money we have, the more our perceptions of the world change. Think about that in your own life.

Indeed, as much as we might try to deny it, the wealthier we become, the more our world view changes. Those changes can be both good and bad, depending on one’s perspective. However, just like a man can’t step into the same river twice, neither can he look at the world the same as his net-worth increases.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

P.S. Join me for a MoneyShow virtual event where I’ll be on a panel moderated by Roger Michalski and will be joined by my colleagues Bryan Perry and Mark Skousen. In addition, the entire event focuses on investing for income — real estate, Master Limited Partnerships, dividend-paying stocks, bonds and more. To sign up for this free event taking place March 21-23, click here now.

In the name of the best within us,

Jim Woods