Learning to Match the Beat of the ‘New World Man’ Market

On Monday, the Dow Jones Industrial Average tumbled 1,175 points, its biggest one-day point decline in history. And though the session saw “only” a 4.60% drop, putting it far down the list of biggest one-day percentage declines, the rapid descent was enough to fill even the most intrepid investor with a sense of dread.

Monday’s Dow decline was compounded by the fact that on Friday, the Dow plunged 666 points, or a 2.54% drop. Yet what was even scarier for strident bulls, cautious bulls and really anyone who owns stocks, is what happened on Tuesday morning.

That day, markets opened with a serious plunge that turned the fear dial all the way up, so much so that in the first hour of trade I suspected we could be at the precipice of a full-blown correction… and possibly even knocking at the door of a bear market.

But then, things changed.

After gyrating wildly throughout Tuesday trade, the Industrial Average closed 567 points higher, or 2.33%. That move included an incredibly wild 1,167.5-point swing during the session.

When asked about what I thought of this hyper volatility by a colleague, my first thought was that we’re living in a “new world” where computer algorithm trading, a.k.a. “algos,” are ginning up the rapid rise and fall of markets.

You see, by having automated buy and sell orders in place at certain floor and ceiling levels, trading volumes — and share price swings — get exacerbated in a way that an “old world” market rarely witnessed. And, when I say, “old world,” I’m talking about just a few years ago.

Yet the prominence of algos on the trading scene have ushered in a new era, and that era isn’t going away. In fact, it’s likely only to get more prominent.

So, what’s the “New World Man” investor to do here?

Interestingly, the answer to that question lies in the wisdom of a progressive rock masterpiece of the same title, “New World Man,” by the Canadian trio Rush.

Check the lyrics here from the 1982 release off the band’s “Signals” album.

He’s not concerned with yesterday

He knows constant change is here today

He’s noble enough to know what’s right

But weak enough not to choose it

He’s wise enough to win the world

But fool enough to lose it

He’s a New World Man…

Let’s unpack those lyrics as they apply to markets, and as they apply to us — i.e., the virtual “New World Man” investor.

First, we cannot change what happened yesterday. Markets are going to do what they do, and there’s nothing we can do to alter that. Yes, we can learn from it, but what we must realize is that constant change is here today. That means we always must prepare for what could happen, what is most likely to happen… and what is not likely to happen.

In markets, what is likely to happen is a correction nearly every year. I say that because a look at the historical record tells us that on average, the market has seen a decline of at least 10% from its most-recent highs (but not a decline of more than 20%), every year since 1900. That makes corrections about as common as your birthday.

And just like you have a birthday every year, the chances are you are going to see a correction in markets on a nearly annual basis.

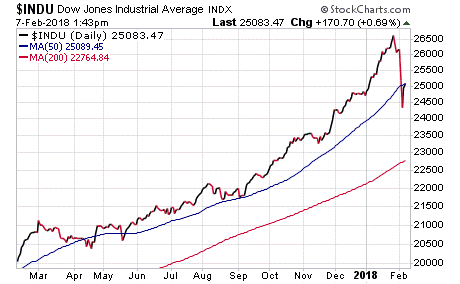

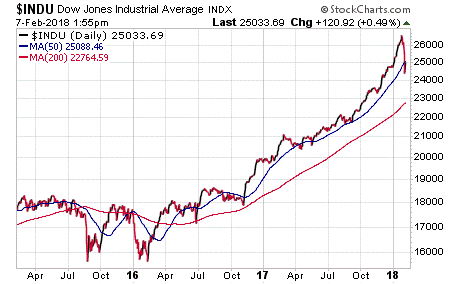

Of course, last year we didn’t have a correction. In fact, the last real pullback we had was in the first quarter of 2016.

One glance at the three-year chart (see above) of the Dow will show you what’s happened since that correction.

If this current market volatility becomes a full-fledged correction (the Dow briefly descended into correction territory Tuesday before roaring back), then it will be just part of the normal, constant change that’s here today in markets.

Now, back to the lyrics, a New World Man investor is one who knows what’s right — but is often weak enough not to choose it.

I wonder how many long-term investors got spooked to the point of selling all their stocks and going to cash on Tuesday as the market plunged?

If you made that move, then you let your weakness get the better of you. I say that, even though selling and going to cash to sidestep a bear market is warranted sometimes. But before you make a material adjustment to your investment strategy, you better be noble enough to know what’s right… and to act on that nobility.

In my Successful Investing advisory service, we’ve been helping investors navigate both the old and new world markets with a proven plan to get investors in the market when its trending higher, and out of the market when it’s trending lower. So far, the past week’s wobble hasn’t gotten us near a confirmed downtrend.

Could that confirmed downtrend happen soon? Yes. However, it hasn’t yet.

That is why we must do, as the song suggests, and be “wise enough to win the world,” and not be “fool enough to lose it.”

Yes, it’s a New World Man investing landscape, and as such you must adjust your mindset to it. That means you must be noble enough to know what’s right, and strong enough to choose it.

If you want to succeed, then learn to match the beat of the New World Man market.

***********************************************************

ETF Talk: Understanding the Bitcoin Investment Trust

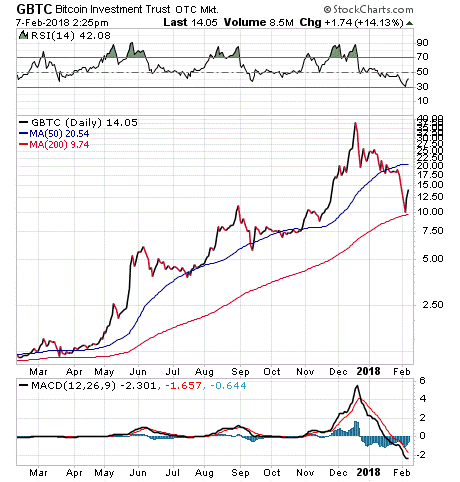

The Bitcoin Investment Trust (GBTC) is the only publicly available choice for investors to trade bitcoin in the stock market.

GBTC is a publicly traded exchange-traded fund (ETF) that holds bitcoin as its sole asset. Following its inception in September 2013, GBTC remained relatively quiet until May 2015, when it greatly improved liquidity for its investors by having shares of the trust trade on the U.S. OTC Market.

GBTC is run by Grayscale, a digital currency group company. In the words of Grayscale’s Director of Business Development Michael Sonnenshein, GBTC employs “no leverage, no trading, no cash, no other assets at all other than bitcoin.” As of this writing, each share of GBTC represents ownership of approximately 0.092 bitcoin.

One disadvantage to the fund is that it charges an annual expense fee of 2%. The fund’s popularity and a lack of competition also have driven its price far above the value of the bitcoin it holds. This translates into a hefty premium of around 50% for investors to hold GBTC shares, as opposed to owning bitcoin directly. However, GBTC has several notable advantages over bitcoin:

- A familiar investment vehicle with a familiar structure. Directly trading the still relatively new concept of cryptocurrency can be intimidating to investors. GBTC provides investors with the more familiar structure of an ETF.

- Ease of trading. Since it is a publicly quoted fund, investors can purchase shares of GBTC through their existing brokerage accounts to eliminate the hassle of creating and managing additional cryptocurrency trading accounts.

- The premium could work in investors’ favor. As mentioned above, GBTC trades at a premium to the value of bitcoin it holds because of speculation on bitcoin prices. This could benefit investors if the value of bitcoin starts to gain momentum, causing that premium to increase. In short, a slight increase in the value of bitcoin could translate to a bigger movement in the price of GBTC.

- Eligibility for tax advantages. Shares of GBTC can be held in certain IRA, Roth IRA and other investor accounts to give investors the possibility of reducing their taxes.

- Added Security. With its explosive growth in value, the theft of bitcoins has not been uncommon around the world as of late. GBTC stores its bitcoins in vaults that are protected with sophisticated encryption.

Over the last 12 months, GBTC has returned 730.58%. However, as regulations against bitcoin sales have started to mount, the value of bitcoin and GBTC have fallen considerably over the last month to plunge by roughly 61% as of Feb. 5.

Other than GBTC, Grayscale runs two similar funds that derive their value from Ethereum and Zcash, which are other types of cryptocurrencies. But for investors who are seeking a convenient way to trade bitcoin, I encourage you to consider Bitcoin Investment Trust (GBTC).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

The Very Wise Abe Lincoln

“I do the very best I know how — the very best I can; and I mean to keep doing so until the end. If the end brings me out all right, what’s said against me won’t amount to anything. If the end brings me out wrong, 10 angels swearing I was right would make no difference.”

— Abraham Lincoln

This week’s wisdom is brought to us by reader Steve H., who sent me this great Abraham Lincoln quote. Steve also told me that he attempts to live up to this ideal each day, and to that spirit, I raise my glass and toast in his honor. You see, in life — and particularly during times of tumult — the only thing you can do is the best you know how, and the best you can.

The ensuing outcome of your actions usually isn’t up to you, but that outcome is the only objectively true thing that matters. That’s why Lincoln knew that what his detractors and his supporters thought didn’t really matter in the end. Reality is the only arbiter of our decisions, but outcomes are never guaranteed. All we can do is our best, the best way we know how. Or as Shakespeare wrote, “This above all: To thine own self be true.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.