We All Scream for Ice Cream: A Joe Biden Update

- We All Scream for Ice Cream: A Joe Biden Update

- ETF Talk: New Fund Tracks Innovations in Fintech

- Something is Rotten in Chi Town

- Aristotle the Capitalist

*********************************************************************

We All Scream for Ice Cream: A Joe Biden Update

Things don’t look too good for Joe Biden at the moment. The former vice president and longtime U.S. senator from Delaware hasn’t even officially launched his 2020 presidential bid. Yet “Uncle Joe” is already facing a slew of allegations that his “tactile politics,” as the New York Times described it, could short circuit his candidacy before it ever begins.

Now, in fairness to Mr. Biden, he hasn’t been accused of any crime or sexual harassment by any of the women speaking out on how his personal style made them feel “weird and uncomfortable.” Yet in a Democratic primary race that looks to be a sprint toward the most-ludicrous “woke” policies on economics, race, gender and social justice issues, the former vice president’s “old school” approach of pressing the flesh isn’t likely to win him the nomination.

That’s just fine by me, because a Biden presidency wouldn’t be good for the country. I base that opinion not only on my disagreements with him on policy, but also on my personal interaction with the man.

In August 2008, I wrote a humor-laced reflection on the nearly five hours I spent sitting next to then-Sen. Biden on a flight from Washington, D.C. to Los Angeles. And given the recent headlines regarding Mr. Biden, I thought I would republish that piece for you today in The Deep Woods.

So, please enjoy my reflections on the former vice president in the following article titled, “We All Scream for Ice Scream: A Joe Biden Tale.”

*********************************************************************

You can tell a lot about a man by the way he eats.

Some men like to sit down to a meal, take their time and savor each and every morsel of food and drink. People like this tend to be thoughtful, meticulous, confident and in many cases, hedonistic. How do I know this? Well, I’ve been known to spend more time than most getting through a multi-course, wine-paired meal.

Still, other men like to dig right into their prize, attacking the meal with fervor and a literal hunger for life that reveals their carpe-diem approach to the world. This type of person tends to be decisive, purposeful, driven and a born leader. My favorite example of this type of eater is my good friend and fellow investment guru Doug Fabian.

But what do you say about a man who eats his meal in reverse order?

That thought has plagued me ever since I sat next to Sen. Joe Biden on a flight from Washington, D.C. to my hometown of Los Angeles, California. Sen. Biden was on his way to L.A. for an appearance on HBO’s “Real Time with Bill Maher,” while I was returning home from my annual pilgrimage to the nation’s capital for a meeting with friends, publishers and people from some of my favorite think tanks.

After exchanging pleasantries with the senior senator from Delaware, Biden wasted no time in digging right into his criticisms of the war in Iraq, and what he perceived to be the folly of the Bush administration. I expected nothing less from the senator, as he’s known for his outspoken critiques and his shoot-from-the-hip commentary.

What I didn’t expect was a lesson in how to eat a meal backwards.

Now, since I had the benefit of first-class seating accommodations during this journey, the flight attendants were very conscientious when it came to serving what was a surprisingly tasty meal. The first course was a salad with Italian dressing, which was followed by a main course of a plump, well-seasoned chicken breast and a side of rice. The best part of the meal for me was the dessert, which was a generous scoop of gourmet chocolate ice cream.

I ate my meal with my usual casualness, and in the aforementioned order. Sen. Biden, however, took a different path. Biden accepted the salad, but he put it aside and saved it for later. When the main course came, he politely rejected it. But when the ice cream came, Biden’s fervent personality really came out. He emphatically asked for a serving, although he had not yet eaten any food.

Biden ate his ice cream while we discussed Kevin Phillips’ book “American Theocracy,” the then-latest critique of the Bush administration’s religious overtones. After eating the ice cream, Biden pulled out a hefty ham sandwich from his briefcase and consumed it in a deliberate and determined fashion. Once the sandwich disappeared, the senator turned to the only remaining bit of food left on his tray table, the salad.

As I watched this reverse-order meal consumption, a thought occurred to me: Is this why the federal government is so screwed up? Is Sen. Biden’s backwards approach to a meal indicative of what’s wrong with Washington? Does this backwards eating pattern explain why the government does everything less efficiently and less effectively than the private sector?

Given my theories on discerning knowledge of a person based on how they eat, what was I to make of Sen. Biden’s meal habits? The only logical conclusion is that Biden looks at the world — shall we say — differently from the rest of us. And while there is nothing wrong with a little different perspective on things, I don’t think I want someone a heartbeat away from the presidency who eats his ice cream first.

The next thing you know is that person will advocate raising taxes to stimulate the economy, negotiating with our ideological enemies as a means of portraying strength and railing against judges who think interpreting the Constitution is the only proper function of the courts.

Wait a second… that’s what Biden wants?

I knew there was a reason why he ate the ice cream first.

*********************************************************************

Join Me at the MoneyShow in Las Vegas, May 13-15

I invite you to join me for the MoneyShow in Las Vegas, May 13-15, where I will be a featured speaker to share my latest views about the market and the best investments to make now. The event will be based at the Bally’s/Paris Resorts and feature more than 200 presentations. Other featured speakers include Steve Forbes, Dr. Mark Skousen and Hilary Kramer. Click here to register free as my guest or call 1-800-970-4355 and be sure to use my priority code of 047465.

*********************************************************************

ETF Talk: New Fund Tracks Innovations in FinTech

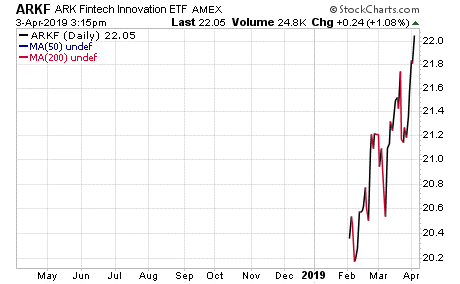

The Ark Fintech Innovation ETF (ARKF) is an actively managed exchange-traded fund (ETF) that seeks long-term growth of capital by following the theme of Innovation in Financial Technology.

The fund invests at least 80 percent of its assets in domestic and foreign equity securities of companies that are engaged in the fund’s investment theme of Innovation in Financial Technology. That growing category also is known as FinTech innovation.

“A company is deemed to be engaged in the theme of FinTech innovation if (i) it derives a significant portion of its revenue or market value from the theme of FinTech innovation, or (ii) it has stated its primary business to be in products and services focused on the theme of FinTech innovation,” according to Ark.

In other words, FinTech innovation features new technologies that change the way traditional financial services or products function. Examples of FinTech innovations include Transaction Innovations, Blockchain Technology, Risk Transformation, Frictionless Funding Platforms, Customer Facing Platforms, and New Intermediaries.

The top five sectors for ARKF include Technology, Financial Services, Consumer Cyclical, Real Estate and Industrials. The fund’s top holdings are in Square Inc. (NYSE:SQ), LendingTree Inc. (NASDAQ:TREE), Tencent Holding (OTCMKTS:TCEHY), Apple (NASDAQ:AAPL) and Amazon (NASDAQ: AMZN).

Chart courtesy of StockCharts.com

The fund has $56.99 million assets under management and an average spread of 0.13 percent. It has an expense ratio of 0.75 percent, meaning it is relatively expensive to hold in comparison to other exchange-traded funds.

ARKF is fairly new and only became available as an investment on February 4, 2019. It since then has seen a few slight downturns, but mostly has been on an upward climb. The fund is currently up 6.9 percent. However, as always, conduct your own due diligence to decide whether or not this ETF is suitable for your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Something is Rotten in Chi Town

The plot twists and turns in the Jussie Smollett case would be enough to impress the Bard himself. And after reading about the stunning decision by the Cook County State’s Attorney’s Office to drop all charges against the “Empire” actor, who was accused of staging a hate crime, I was reminded of this Shakespeare line from “Hamlet”:

“Something is rotten in the state of Denmark.”

The reference in the play essentially means that there is a repugnant stench in the air atop the political hierarchy and, so too, it seems, something is rotten these days in Chi Town.

I say this, because the reaction to the prosecutor’s decision to drop all 16 felony charges against Smollett was nothing short of stunning — and that was the reaction of Chicago Mayor Rahm Emmanuel and Police Superintendent Eddie Johnson.

The two civic leaders sharply criticized the State’s Attorney’s Office, as well as Smollett, with Emmanuel firmly denouncing the decisions, calling it “a whitewash of justice.” Emmanuel went even further with his criticism, saying, “You cannot have, because of a person’s position, one set of rules apply to them and one set of rules apply to everybody else.”

What Emmanuel is saying, in effect, is that something is rotten in his city — and I couldn’t agree more.

For his part, Smollett announced at a recent press conference, “I’ve been truthful and consistent on every single level since Day One.” The actor and singer went on to say, “This has been an incredibly difficult time, honestly one of the worst of my entire life, but I am a man of faith and I’m a man that has knowledge of my history, and I would not bring my family, our lives or the movement through a fire like this.”

So, what’s so rotten about this case, and why is it raising suspicion that political strings have been pulled at the highest levels to get Smollett off?

The answer, perhaps, lies in Chicago politics, traditionally a cesspool of rot and corruption. According to some excellent reporting by the Chicago Sun-Times, influence over this case may have come from a one-time aide to former First Lady Michelle Obama.

Here’s how the Chicago Sun-Times frames it:

“Just days after Jussie Smollett told Chicago police he had fought off a pair of attackers who targeted him in an apparent hate crime, Cook County State’s Attorney Kim Foxx tried to persuade Police Supt. Eddie Johnson to turn the investigation over to the FBI.

“Foxx’s call to Johnson came after an influential supporter of the ‘Empire’ actor reached out to Foxx personally: Tina Tchen, a Chicago attorney and former chief of staff for former First Lady Michelle Obama, according to emails and text messages provided by Foxx to the Chicago Sun-Times in response to a public records request.”

The Sun-Times goes on to report that Foxx recused herself from the case after having conversations with a member of Jussie Smollett’s family, presumably about the case.

Foxx’s role in this tragicomedy prompted Chicago’s Fraternal Order of Police (FOP) to lash out at her. The group now is calling for a federal investigation into Foxx’s “interference” in the case.

Martin Preib, the FOP’s second vice president, told the Sun-Times, “The conduct of her office from the very beginning of this case was highly, highly suspicious.” Mr. Preib might as well have quoted “Hamlet,” too.

As regular readers of The Deep Woods likely recall, I shared my views on the Smollett case in the Feb. 27 issue, “The Folly of Forgetting Phenomenal Fortune.” In it, I wrote about the motivation for the alleged hoax perpetrated by Smollett, which according to some reports was an attempt to up his public profile and to get even greater compensation from his employers at 20th Century Fox Television (the producers of “Empire”).

I also wrote that this unfortunate case appeared to be an example of someone who had completely failed to recognize just how lucky he was:

“I guess the blessings of good looks, a great singing voice, acting skills, a major-label record deal and a $2.25 million salary weren’t enough good fortune for Mr. Smollett. Apparently, he just had to have more.”

While the dropping of the charges and the subsequent sealing of the record in this case likely mean the whole truth may never come to light, the new revelations in this case of the “highly, highly suspicious” conduct by the Cook County State’s Attorney make the whole affair that much smarmier.

It’s rotten when a man fails to appreciate his good fortune — and it’s even more rotten if Shakespearean strings were pulled to absolve that man of 16 felony counts.

*********************************************************************

Aristotle the Capitalist

“When everyone has a distinct interest, men will not complain of one another, and they will make more progress, because everyone will be attending to his own business.”

— Aristotle, “Politics”

Sounds to me like the eminent philosopher was a free-market capitalist! Aristotle went further with his comments on the nature of private property, observing that it does not — as other thinkers argue — promote greed. In fact, Aristotle said private property was essential for the exercise of charity.

I always like reading about the history of markets because it makes you realize that no matter what time period you explore, the existence of free markets and free trade (or lack thereof) are essential to understanding any given culture. Aristotle’s defense of property rights, along with his brilliant defense of reason and the scientific approach to scholarship, are some of the greatest contributions to humanity ever.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods