What Valentine’s Day Teaches Us about Investing

Today is Feb. 14, which in America is also known as Valentine’s Day.

This is the day we’ve designated to celebrate our romantic relationships. It also is a day where many people spend a lot of money on things like flowers, candy, teddy bears, champagne and dining out… all in an effort to revel in their relationships.

While I get this impulse, for me, Valentine’s Day also serves another function. For me, Valentine’s Day can be used as a pedagogic tool that can help us learn and understand some of the key principles involved when finding the right investments.

You see, when it comes to matters of the heart, most of us feel as though this part of our lives is directed and governed by intense emotions. These emotions are essential to human beings, and life would be rather empty without them. Perhaps that’s why the longing for love in all its forms (romantic love, love for a child and immediate or extended family, love of career, money, health, etc.) is so sought after by virtually everyone.

Yet my view here is that the intense amorous emotions we feel on so many fronts are a direct result of our rational (and sometimes irrational) needs. For example, the search for romantic love is based largely on our biological need to reproduce. That need burns deep in most humans, and it compels us to throw ourselves headlong into the search for the right mate.

When it comes to investing, our rational need is to protect and grow our money so that we can use it to fund our retirements, to live a life free of financial stress or to be able to live a more prosperous and luxurious existence.

And much like we search for the right romantic partner and life mate, proper investing involves searching for the right stocks, exchange-traded funds (ETFs), mutual funds and other asset classes that fit our rational needs.

In the case of a romantic partner, most of us want the excitement and passion of a physical, emotional, even spiritual connection. Most of us also want the safety, stability and security of a rational spouse who can provide us with the emotional comfort we need to get through life’s inevitable pain.

Of course, most of us know that combination is not very easy to find in one person. Yet if we’re lucky enough to find it, we have to cherish and nurture that find — and I think that’s what Valentine’s Day is all about (at least, it is for me).

Now, when it comes to your money and investments, the right stocks, ETFs, mutual funds, etc. also aren’t very easy to find.

To find the right asset mate, you have to define your rational goals, which includes identifying your time horizon, assessing your risk profile, evaluating your overall financial picture and determining a host of other considerations.

It is only after you know what you want that you can find the right “investment mate.”

For example, if you are looking for a stable, safe and secure life mate, then you usually don’t want to go for the “bad boy” or the “wild girl” type. And if you’re looking for a stable, safe and secure investment, then you don’t want to buy high-yield junk bonds or bitcoin. Here you would be better off with a bond fund and/or dividend-paying equities.

Of course, there is one thing that investing has over the search for that perfect Valentine, and that is diversification. Every investor can construct his or her portfolio with a combination of equities, fixed income and alternative assets that fit his or her rational goals. But unless you have a very open situation, it’s hard to “diversify your portfolio” when it comes to mates.

Score one here for investing over the search for the perfect Valentine — although I doubt any of us would trade the perfect spouse for a winning investment portfolio.

Fortunately, you don’t have to choose one or the other. You can celebrate both by making the right investment choices for your rational goals — and by finding the right person to be that special Valentine.

So, if you have that special person, celebrate that today… and every day.

***********************************************************

ETF Talk: Is It Time to Short Long-Term Bonds with This Fund?

With the Fed widely expected to raise interest rates several times in 2018, we turn our attention to an exchange-traded fund (ETF) that could benefit from the rate hikes.

The ProShares UltraShort 20+ Year Treasury (TBT) stands out as a strong contender. As bond prices and interest rates are inversely related, this means that an increase in interest rates leads to a decrease in bond prices and vice versa. Because of its bond bear nature, some investors consider TBT a good hedge against inflation.

As its name implies, TBT shorts, or bets against, U.S. Treasury bonds with maturities greater than 20 years. TBT uses leverage to provide investors with twice the inverse of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Index. Note that TBT resets its holdings daily, meaning that its holdings are actively evaluated on a day-to-day basis and changed by management as deemed necessary.

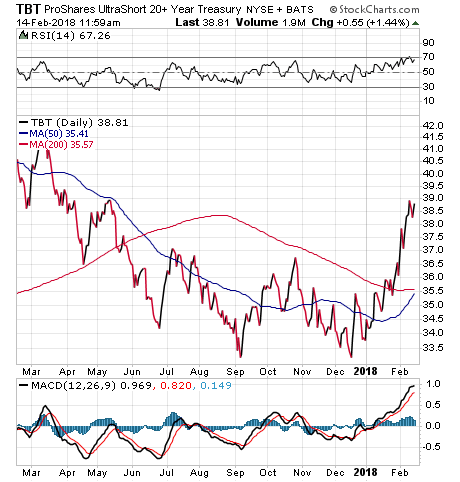

In the chart below, you can see that TBT has been on a downward trend since the beginning of 2017. However, that trend has reversed in 2018, thanks to the Fed’s plan to gradually raise rates. TBT’s one-year return is -1.96%, but its year-to-date return is 14.24%. TBT has an expense ratio of 0.90%.

As an inverse ETF, TBT’s portfolio makeup is very different from regular ETFs. Because it shorts Treasuries rather than holds them, the fund has “negative” holdings in its portfolio. As of Feb. 12, TBT holds -28.57% in Swap Goldman Sachs International bonds, -24.60% in Swap Societe Generale bonds and -22.82% in Citibank bonds.

For investors who are seeking a way to benefit from the upcoming Fed interest rate hikes, I encourage you to look into ProShares UltaShort 20+ Year Treasury (TBT).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************************

Learning to Match the Beat of the ‘New World Man’ Market

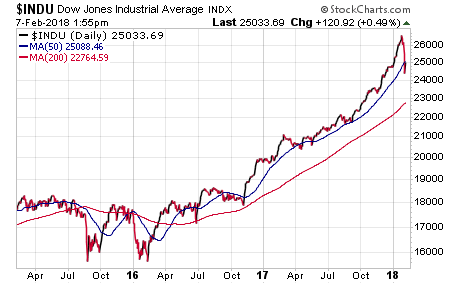

On Monday, Feb. 5, the Dow Jones Industrial Average tumbled 1,175 points, its biggest one-day point decline in history. And though the session saw “only” a 4.60% drop, putting it far down the list of biggest one-day percentage declines, the rapid descent was enough to fill even the most intrepid investor with a sense of dread.

That Monday’s Dow decline was compounded by the fact that on Friday, Feb. 2, the Dow plunged 666 points, or a 2.54% drop. Yet what was even scarier for strident bulls, cautious bulls and really anyone who owns stocks, is what happened on Tuesday morning, Feb. 6.

That day, markets opened with a serious plunge that turned the fear dial all the way up, so much so that in the first hour of trade I suspected we could be at the precipice of a full-blown correction… and possibly even knocking at the door of a bear market.

But then, things changed.

After gyrating wildly throughout Tuesday, February 6, trade, the Industrial Average closed 567 points higher, or 2.33%. That move included an incredibly wild 1,167.5-point swing during the session.

When asked about what I thought of this hyper volatility by a colleague, my first thought was that we’re living in a “new world” where computer algorithm trading, a.k.a. “algos,” are ginning up the rapid rise and fall of markets.

You see, by having automated buy and sell orders in place at certain floor and ceiling levels, trading volumes — and share price swings – get exacerbated in a way that an “old world” market rarely witnessed. And, when I say, “old world,” I’m talking about just a few years ago.

Yet the prominence of algos on the trading scene has ushered in a new era, and that era isn’t going away. In fact, it’s likely only to get more prominent.

So, what’s the “New World Man” investor to do here?

Interestingly, the answer to that question lies in the wisdom of a progressive rock masterpiece of the same title, “New World Man,” by the Canadian trio Rush.

Check the lyrics here from the 1982 release off the band’s “Signals” album.

He’s not concerned with yesterday

He knows constant change is here today

He’s noble enough to know what’s right

But weak enough not to choose it

He’s wise enough to win the world

But fool enough to lose it

He’s a New World Man…

Let’s unpack those lyrics as the apply to markets, and as they apply to us — i.e., the virtual “New World Man” investor.

First, we cannot change what happened on Feb. 6. Markets are going to do what they do, and there’s nothing we can do to alter that. Yes, we can learn from it, but what we must realize is that constant change is here today. That means we must always prepare for what could happen, what is most likely to happen… and what is not likely to happen.

In markets, what is likely to happen is a correction nearly every year.

I say that because a look at the historical record tells us that on average, the market has seen a decline of at least 10% from its most-recent highs (but not a decline of more than 20%), every year since 1900. That makes corrections about as common as your birthday.

And just like you have a birthday every year, the chances are you are going to see a correction in markets on a nearly annual basis.

Of course, last year we didn’t have a correction. In fact, the last real pullback we had was in the first quarter of 2016.

One glance at the three-year chart (see above) of the Dow will show you what’s happened since that correction.

If this current market volatility becomes a full-fledged correction, then it will just be part of the normal, constant change that’s here today in markets.

Now, back to the lyrics, a New World Man investor is one who knows what’s right — but is often weak enough not to choose it.

I wonder how many long-term investors got spooked to the point of selling all their stocks and going to cash on Tuesday, Feb. 6, as the market plunged — before it closed up?

If you made that move, then you let your weakness get the better of you. I say that, not because selling and going to cash to sidestep a bear market isn’t warranted sometimes. Yet before you make a material adjustment to your investment strategy, you better be noble enough to know what’s right… and to act on that nobility.

In my Successful Investing advisory service, we’ve been helping investors navigate both the old and new world markets with a proven plan to get investors in the market when its trending higher, and out of the market when it’s trending lower. So far, the past week’s wobble hasn’t gotten us near a confirmed downtrend.

Could that confirmed downtrend happen soon? Yes. However, it hasn’t yet.

That is why we must do, as the song suggests, and be “wise enough to win the world,” and not be “fool enough to lose it.”

Yes, it’s a New World Man investing landscape, and as such you must adjust your mindset to it. That means you must be noble enough to know what’s right, and strong enough to choose it.

If you want to succeed, then learn to match the beat of the New World Man market.

*********************************************************************

Ben’s Beautiful Wisdom

“Either write something worth reading, or do something worth writing.”

— Ben Franklin

When it comes to admonitions of wisdom, the genius of Ben Franklin has special standing for me. In fact, the above quote operates for me on both levels. That’s because I’ve always strived to write things worth reading, and I’ve also always strived to do things worth writing about. So, to Ben’s beautiful wisdom, I say, “Why not do both?”

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.