Time to Kill All Tariffs

It’s not often you get a politician to admit they might be wrong on an issue, but that’s actually what happened recently, and of all things, it happened on the subject of tariffs.

Now, I have long been an opponent of tariffs, as they are essentially a tool used by government that punishes its citizens by making them pay more for goods. Moreover, they are a violation of the free-market principles by which I think economies should be structured around.

I was an ardent opponent of the tariffs former President Donald Trump imposed on steel and aluminum, and I am equally opposed to those same tariffs that President Joe Biden has left in place.

The fact is that tariffs of all kinds, in addition to being immoral tools of control used by government, also raise prices on goods. And given the current, multi-decade high in inflation, it’s time for tariffs to disappear.

Incredibly, one Biden administration official at least partially agrees with me. Her name is Gina Raimondo, and she also happens to be the Secretary of Commerce.

Now, hat tip to my friends at Reason.com for alerting me to this issue, and particularly writer Eric Boehm. In his article “Tariffs Are Adding to Inflation. Biden’s Commerce Secretary Says Repealing Some ‘May Make Sense.’”, Boehm points out that when asked during a CNN interview whether the administration would consider rolling back some tariffs to fight inflation, Raimondo admitted that it “may make sense” to do that.

Of course, this small nod to reality also came along with additional bad ideas from Raimondo, who in virtually the same breath suggested that the Trump-imposed tariffs on steel and aluminum would remain in place, “because we need to protect American workers and we need to protect our steel industry; it’s a matter of national security.”

One thing to note here is that whenever a government wants to impose controls on its citizens, it will do so either A) in the name of national security or B) in the name of protecting children. And as a general rule, most policies designed to control the populace neither add to national security nor protect children.

There is, however, a silver lining in this cloudy thinking by Raimondo. In that same interview, she admitted that aside from aluminum and steel, there are other products where it might make sense to remove tariffs, items such as household goods, bicycles, and other goods. Raimondo said, “I know the president is looking at that.”

Well, it’s a good thing the president is looking at that, because his earlier proposals to tackle inflation, which he released on a speech on May 10, will do nothing to combat inflation. Bromide notions of taxing the most successful in our society to bring down the deficit by making them “pay their fair share” and “investing” in alternative energy with taxpayer money are both pro-inflationary, not to mention a further immoral imposition on citizens.

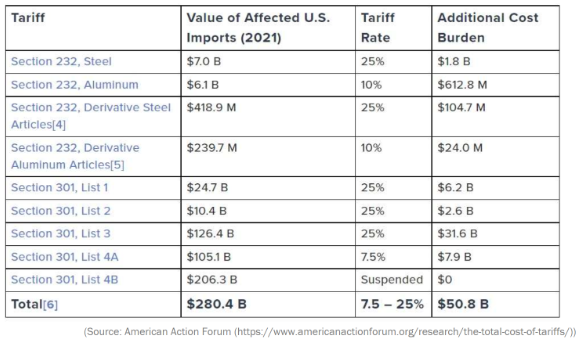

But just how much are those tariffs costing Americans? As Boehm points out, “The set of tariffs imposed by Trump and maintained by Biden — including those on steel and aluminum, along with a host of imports from China — is applied to approximately $280 billion of imports every year. Those import taxes add about $51 billion annually to Americans’ consumer costs, according to an analysis by the American Action Forum, a pro-market think tank.”

Boehm included the chart here in the American Action Forum analysis that breaks down that nearly $51 billion of additional cost burden created by these tariffs.

Of course, the solution to inflation isn’t just to eliminate tariffs. The problem is a whole lot bigger than that, and even beginning to tackle the issue in earnest would require a new paradigm regarding how we look at both monetary and fiscal policy.

Yet one thing is certainly true here, and that is tariffs are a penalty on taxpayers — a penalty that raises prices, because that’s precisely what tariffs are designed to do.

So, if you want to combat inflation, start with an easy, baby step that is both rational and moral — kill all tariffs!

***************************************************************

ETF Talk: Invest in Emerging Markets and High Yields

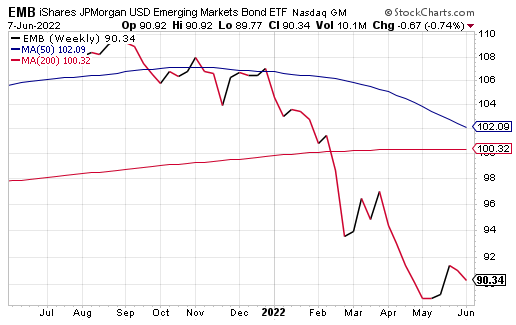

The iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ: EMB) seeks to track an index of U.S. dollar-denominated, sovereign debt issued by emerging-market countries.

EMB, one of the first emerging-market debt exchange-traded funds (ETFs) to be launched, tends to own strong assets and offer consistent liquidity. It is like many peer funds, but EMB is U.S.-dollar-denominated rather using local-currency debt. This eliminates direct currency risk for U.S. investors but increases credit risk that a strengthening dollar or weakening local currency could make the debt harder to service.

Each issuer must have at least $1 billion outstanding, and bonds need a minimum of two years remaining to maturity. The fund typically favors longer maturities and tends to lean toward riskier paper, both of which increase yield. One of EMB’s strongest selling points is its strong liquidity, enhancing its appeal for traders.

Source: www.stockcharts.com

EMB has $15 billion in assets under management and a 0.01% average spread. It has 614 holdings and an expense ratio of 0.39%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

The fund will invest at least 80% of its assets in the component securities of the underlying index and will invest at least 90% of its assets in fixed income securities of the types included in the underlying index. The index is a broad, diverse U.S.-dollar-denominated emerging markets debt benchmark that tracks the total return of actively traded, external debt instruments in emerging market countries.

iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ: EMB) provides exposure to U.S. dollar-denominated government bonds issued by emerging market countries, access to the sovereign debt of 30+ emerging market countries in a single fund, a potentially superior yield to its peers and emerging markets allocation.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Victory Belongs to the Most Tenacious

The statement “Victory belongs to the most tenacious” is stenciled onto the inside of the stands on Court Philippe-Chatrier, the center court at the Stade Roland Garros.

In English, the “Stade Roland Garros” translates from French into “Roland Garros Stadium,” and it is the name of the complex of tennis courts located in Paris that hosts the French Open. That tournament is taking place right now, and on Tuesday, the viewing world was treated to an epic match between two of the greatest in the history of the sport, Novak Djokovic and Rafael Nadal.

The outcome was a Nadal victory in four sets, with the final set an intense tiebreaker that saw some of the match’s most brilliant shots. It also showed the resolute nature of both men, battling with what appears to be every fiber of their respective beings in the pursuit of a single goal, i.e., to make a great shot, to win a point, to win a game, to win a set, to win a match and to win a tournament.

Both incredible competitors will go down in the annals of the sport as two of the most tenacious players ever to pick up a racket. And that is appropriate, because tenacity is a trait that embodies the actual person the Stade Roland Garros was named after.

Now, you might think (as I naturally did) that given this is a tennis stadium, the Stade Roland Garros would be named after a tennis great. I mean, in America we hold the U.S. Open at the National Tennis Center in Flushing Meadows, New York, and the featured center court matches there are played in Arthur Ashe Stadium. That stadium was named after one of the greatest American tennis stars, Arthur Ashe, a man who won the inaugural U.S. Open event in 1968.

Yet Roland Garros wasn’t a professional tennis player.

The intense eyes of Roland Garros betray his tenacity. Photo is in the public domain.

Roland Garros was a French businessman, an aviator, a World War I fighter pilot, an inventor, a skilled pianist, a pioneer, a hero, a trailblazer — definitely a Renaissance Man. Born in Saint-Denis de la Réunion on October 6, 1888, Garros was educated at the HEC business school. At the age of 21, he started his own company, a car dealership near the Arc de Triomphe in Paris. Now, mind you, this was in 1909, and there weren’t many car dealerships at that time.

Interestingly, in August 1909, his life changed as he attended his first air show in the Champagne region of France. Garros is said to have fallen in love with these new winged machines, and soon thereafter, he bought a plane and taught himself how to fly.

Two years later, September 6, 1911, Garros broke his first altitude record, reaching 3,910 meters (about 13,000 feet). He was soon a regular on the nascent air show circuit and in competitive air races, and he became known for his daring aviation skills. He even became a bit of a star in the aviation world, as hundreds of thousands of people in both Europe and South America would come to watch him in action.

Just two years after that altitude record, Garros took his airplane across the Mediterranean Sea, something that had never been done at the time. On September 23, 1913, he flew from Saint-Raphaël on the French Riviera to Bizerte (Tunisia), a journey that took nearly eight hours.

At the onset of World War I, Garros employed his aviation skills in defense of his native France. Now, at that time, aviation in war was new, and airplanes were equipped with little or no weaponry. That changed, however, once Garros decided to invent a machine gun that could be mounted on a fighter plane — one that could be synchronized to fire through the propeller.

In April 1915, Sub-Lieutenant Roland Garros had already used his aviation skills and new invention to win several aerial battles against German aircraft. But on one mission, his plane was hit by German anti-aircraft fire over Belgium. Garros was forced to land, and he was subsequently taken prisoner before he had chance to destroy his plane. His brilliant invention unfortunately fell into German hands, and that nation’s engineers used his ideas and adapted them to their own aircraft.

But the story gets even better. After three years in captivity, Roland Garros escaped his captors, and he did so disguised as a German officer. Unfortunately, his health had suffered mightily during captivity, but that didn’t stop the tenacious Garros from rejoining the fight.

As a result of his capture, he became badly short-sighted and had trouble seeing well enough to fly a plane. But Garros didn’t let this ailment deter him. So, he made himself eyeglasses in secret, not telling any of his fellow French aviators, so that he could see well enough to keep flying and keep battling the Germans. Sadly, on October 5, 1918, Roland Garros was killed in the skies of the Ardennes, doing what he wanted to do, and becoming legendary in the process.

In 1928, about a decade after his death, France had turned her attention to sport via the building of a large tennis stadium in Paris. One of the heads of this tennis stadium project was a man named Emile Lesueur, a former business school classmate of Roland Garros at the HEC. It was Lesueur who made sure that the Stade Français would be named Stade Roland Garros in honor of his friend and fallen hero.

So, what can we take out of this story that I suspect you never knew about until now?

Well, by reading about the valorous lives of those who shaped the world around us with their intelligence, courage and, most importantly, their tenacity in the face of unspeakable adversity, we can draw inspiration in our own lives when it comes time to meet our own challenges, set our own records, battle our own enemies, escape our own captors and rejoin the fight to defend our values.

Because as Garros said, “Victory belongs to the most tenacious.”

*****************************************************************

Moore Wisdom

“In almost every case, whenever a tariff or quota is imposed on imports, that tax is strongly supported by the domestic industry getting the protective shield from lower-priced foreign competition. The sugar industry supports sugar tariffs; textile mills lobby for tariffs on foreign clothing.”

— Stephen Moore

Economist Stephen Moore knows of what he speaks when it comes to free markets, and here he confirms this week’s theme with an additional point about tariffs, and particularly how those already in positions of strong market share support the protective and punitive effects of these pernicious policy instruments.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.