This Is My New Favorite Economic Indicator

As an investor, newsletter writer and market commentator, I’m always on the lookout for a new way to look at the macro picture that will give me greater insight.

And while many of the tried-and-true indicators (moving averages, gross domestic product, 10s-2s spread, relative price strength) do a good job of telling us where markets are, and where they might be headed, there’s always a place for better, more precise (and more concise) tools.

Today, I am proud to introduce what is already my favorite new economic indicator, and it comes to us from my friend, colleague and macro-analyst extraordinaire, Tom Essaye of the Sevens Report.

Tom’s publications are required reading for any serious investor, and they are especially important for financial professionals who need to be able to explain to their high-net-worth clients what’s going in stocks, bonds, interest rates, commodities, currencies… and just about any major macro trend influencing the financial markets.

And because Tom has been spot-on over the years in his biggest calls, he’s someone who needs to be heard. So, when he introduced me to his latest invention, I had to share it with you.

The new indicator is called the Sevens Report Economic Cycle Index, and it’s a tool that gives us insight as to where we are in the economic cycle.

Indeed, one of the biggest question marks facing investors is whether we are at the end of an economic expansion or at the beginning of an economic slowdown.

Interestingly, it was last week’s comment by Caterpillar’s (CAT) management during the earnings call, where they said that profits had reached a “high-water mark” for the year, that brought this question to the forefront. The answer to this key question is critical, since it largely will dictate what we can expect from stocks, bonds and currencies over the next 12-24 months.

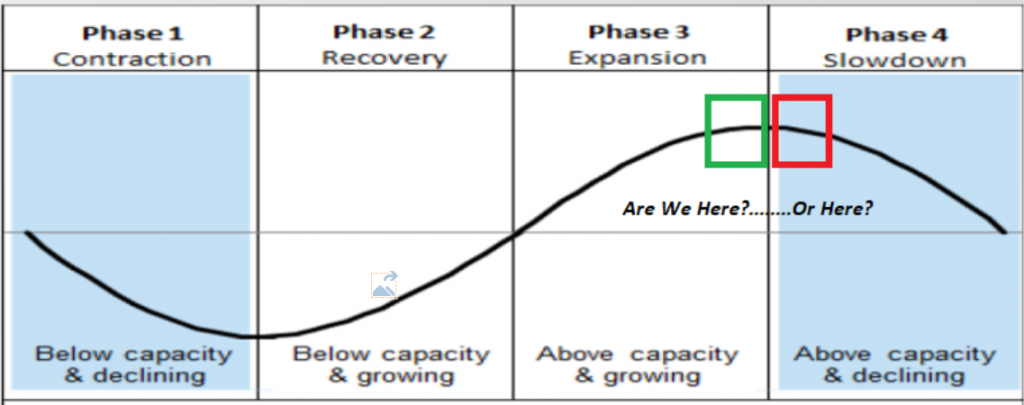

Now, as a bit of background, there are basically four stages of the economy: Contraction (when economic activity is falling), Recovery (when economic activity has bottomed and is starting to get less bad), Expansion (when the economy begins to grow again), and Slowdown (when economic growth loses momentum and growth begins to decline).

For the purposes of this discussion, we can forget about “Contraction” and “Recovery” because we’re not in those phases. Instead, the biggest question is whether we are nearing (but not yet at) the end of an expansion, or whether we are at the start of a slowdown.

Tom and I think there is a good case that can be made for both scenarios. Those who believe we are in an expansion will cite such things as solid absolute economic growth, rising earnings, rising inflation, still negative real interest rates and strong consumer confidence.

Those who believe we’ve just entered the start of a slowdown will cite things such as the Fed removing accommodation, economic growth losing forward momentum and a potential peak in earnings growth as inflation rises and, therefore, cuts into margins.

Up until Caterpillar’s “high-water mark” comments, the “Slowdown” argument largely seemed premature, given a lack of evidence. But the CAT comments provided the first anecdotal confirmation of that fear which, like a big endorsement for a fringe political candidate, has increased this idea’s credibility.

To be clear, getting this question answered correctly is very important. If we’re still in an expansion, then an eventual run towards S&P 3,000 isn’t out of the question. Conversely, if we are in a slowdown, the question is how long support at 2,550 will hold.

In developing the Sevens Report Economic Cycle Index, Tom wanted to try and determine the answer to this question by monitoring the facts, both economic, macro and markets based.

The tool he came up with is something I think provides a clear set of indicators that will help tell us, in real time, whether the economy still is in an expansion or if we’ve entered a slowdown.

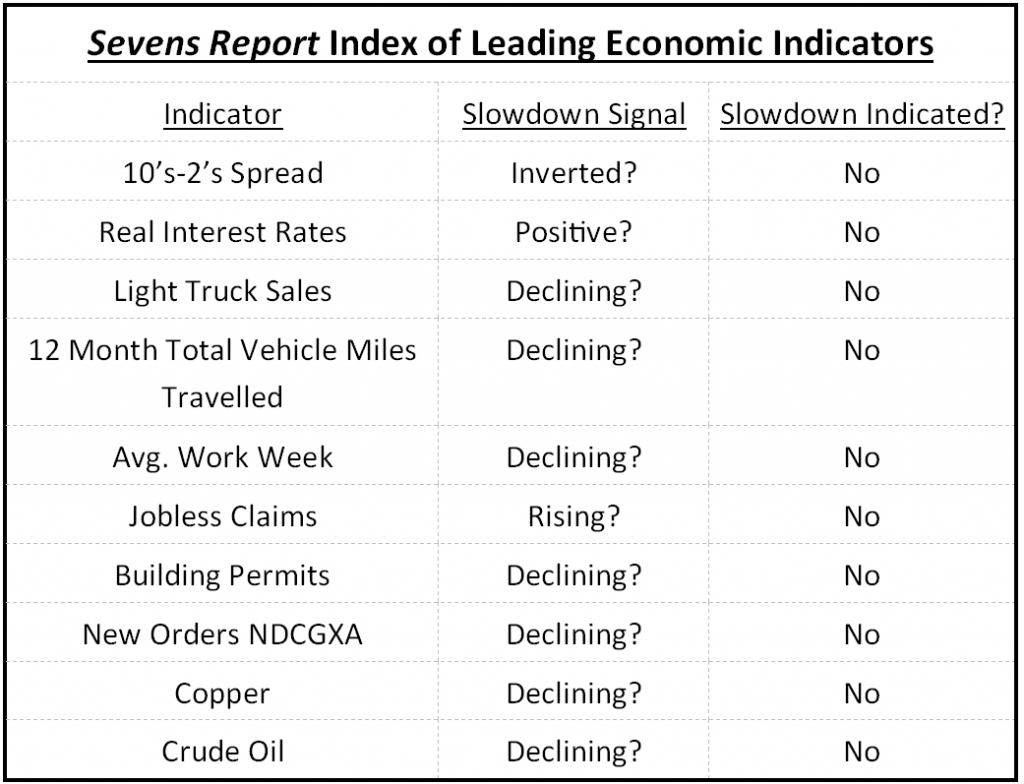

This index is comprised of 10 indicators, some macro based, some using hard economic data and some market based, that Tom believes will tell us when the economy has started to slow down. For the macro indicators (10s-2s, Real Interest Rates), we should be looking for violation of recession signals (inverted/positive).

For economic indicators (Light Truck Sales, 12 Month Total Vehicle Miles Traveled, Avg. Work Week, Jobless Claims, Building Permits, New Orders for Non-Defense Capital Goods Ex Aircraft), we should be looking for consecutive monthly declines in the data. And for market-based indicators (Brent Crude Oil, Copper), due to their volatility, we should be looking for multi-month lows (greater than three months).

Tom then assigns a score based on an aggregate signal, i.e., the more indicators that are indicating a slowdown, the greater the concern that we are transitioning out of an expansion and into a slowdown.

Looking at the inaugural edition of this index, you can see that none of these indicators are suggesting that the economy is in a slowdown.

Of course, this doesn’t mean that stocks can’t go down, especially over the near term. There are plenty of other factors (earnings, geopolitical tensions, Mueller investigation) that can stymie stocks in the short run. And, just because all these indicators aren’t signaling a slowdown, it doesn’t mean stocks can’t test recent lows.

Yet for medium- and longer-term investors, the set of indicators here in the Sevens Report Economic Cycle Index does provide us with a clear, fact-based mix of macro indicators, economic numbers and market-based measures of growth that both Tom and I believe will tell us when we transition from an expansion into a slowdown.

And when that transition occurs (and it always does), you’ll begin reading about it first in this publication, as well as my Successful Investing, Intelligence Report and Fast Money Alert advisory services.

***********************************************************

ETF Talk: Highlighting PowerShares CurrencyShares Japanese Yen Trust

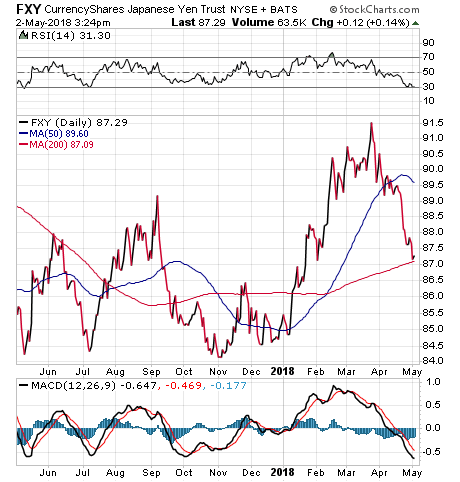

This week’s fund, the PowerShares CurrencyShares Japanese Yen Trust (FXY) tracks the changes in value of the Japanese yen.

FXY is a favorite among investors for both long-and short-term exposure to the yen. Its strategy is simple — it holds Japanese yen, which is the national currency of Japan, in a deposit account with JPMorgan.

Japan’s central bank, the Bank of Japan (BOJ), currently is using a quantitative easing policy to spur economic growth in the country. At its March meeting, BOJ confirmed its stance on keeping interest rates near 0% by removing a target date for achieving its 2% inflation goal.

Leaving policy unchanged shows BOJ’s willingness to stick with its aggressive easing program, which contrasts with the Fed continuing to hike rates. Reduced interest rates spur increased spending in the economy.

The Japanese Yen/USD exchange rate, like foreign exchange rates in general, can be volatile and difficult to predict. Investors should do their share of due diligence before investing in the fund.

The fund, launched in February 2007, has a 30-day average daily trading volume of 222,787 shares. In addition, FXY has a market value of roughly $170.2 million and an expense ratio of 0.40%.

Year to date, FXY has returned 5.92%. FXY recently pulled back from its 52-week high of $91.62 to give investors a potentially attractive entry point at the current time.

For investors who believe in the strength of the Japanese yen, I encourage you to look into the PowerShares CurrencyShares Japanese Yen Trust (FXY).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

Paying Tribute to a Great American Educator

If you grew up in the 1970s or 1980s, or if you raised children during that period, you probably know all about “Schoolhouse Rock.”

I know as a child growing up in the post-Nixon-turmoil era, I learned a lot about how government works by watching the Saturday morning television hits, including “I’m Just a Bill” and “The Preamble.” I also learned how math works: “Three Is a Magic Number” and “Ready or Not Here I Come.”

Yet my favorite “Schoolhouse Rock” episode is “Conjunction Junction.”

Not only did the jazz/blues-driven tune teach me all about a part of speech, BUT it did so in a fun AND memorable fashion AND it helped me put together sentences as a youth. Neither dull NOR boring, “Schoolhouse Rock” was the bridge between often-boring learning at school AND fun learning at home OR at a childhood friend’s house.

If you know the melody, I doubt you’ll be able to read the following lyrics without humming along:

Conjunction Junction, what’s your function?

Hooking up two boxcars and making ’em run right.

Milk and honey, bread and butter, peas and rice.

Hey that’s nice!

On Saturday mornings, the three-minute long Emmy Award-winning musical vignettes of “Schoolhouse Rock” (1972-85) educated children about math, grammar, science, history and finance. Tom Yohe and George Newall were the original creative forces of the series.

Credit: ABC PHOTO ARCHIVES ©1979 American Broadcasting Companies, Inc.

I bring this subject up because on Monday, the world lost Bob Dorough, the creative force behind “Schoolhouse Rock.”

Dorough wrote the music and the lyrics for most of the episodes, including all of the multiplication series, my cherished “Conjunction Junction” and one of my other favorites, “Lolly, Lolly, Lolly Get Your Adverbs Here.” The pianist and composer died April 23 at his home in Mount Bethel, Pennsylvania. He was 94.

While I didn’t know Bob Dorough personally, his work touched my life, as it touched the lives of countless others in my demographic and far beyond.

The way I see it, when someone who touches your life dies, I think we owe it to his memory, and to ourselves, to acknowledge the importance. Doing so connects us with each other and with ourselves and our place in the world. And though I felt sad to hear about Dorough’s death, I also felt a profound sense of gratitude for what he gave me.

What he gave me, and what he gave the rest of the world, was the mental stimulation needed to discover, learn and think about different aspects of reality in a fun, accessible and eminently memorable way.

It is for this achievement that I think we should celebrate Bob Dorough, as well as the other composers who worked on “Schoolhouse Rock,” as truly great American educators. By doing so, we can let the rest of the world know how important the role of a truly good educator is and how much inspiration they can provide.

On a personal level, I like to take the approach that learning about markets, the economy and the virtue of capitalism and its philosophic underpinnings should be a fun journey into this corner of reality.

That’s why you often will see my writing infused with song lyrics, quotes from great literature and quotes from philosophers, poets and even pop culture figures. It is the integration of these various elements that help to make the sometimes-arcane details of fundamental and technical equity analysis both understandable and entertaining.

In some ways, you might say I try to pay tribute to Bob Dorough in everything I write in my e-letter, articles and my investment advisory newsletters, all of which can be found at www.JimWoodsInvesting.com.

So, if you want to be reminded of just how fun education can be, or if you just want to spend a few minutes putting a smile on your face, then do yourself a favor and watch a few “Schoolhouse Rock” episodes.

Not only will it send you back to your youth, it will help you celebrate the achievement of a great American educator.

*********************************************************************

A Bird’s Wisdom

“I never saw a wild thing sorry for itself. A small bird will drop frozen dead from a bough without ever having felt sorry for itself.”

— D. H. Lawrence

The poet’s short, yet eminently powerful verse reminds us that human self-awareness can at times be a curse. Yes, the world is full of sadness, and every day we are legitimately tempted to feel sorry for ourselves. But my advice is to avoid that temptation. If you want your spirit to fly through the world, then be like Lawrence’s wild bird, and live until your final breath without ever having felt sorry for yourself.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.