The Refreshing Scent of Musk

“I’ll say what I want, and if the consequence of that is losing money, so be it.”

This is one of many refreshingly honest, bold and yes, eccentric quotes by the inimitable Elon Musk during his much-talked-about interview Tuesday with CNBC’s David Faber.

Musk offered this thought in response to Faber’s question about the Twitter CEO’s sometime caustic, inflammatory and darkly conspiratorial tweets, and whether he was concerned that his tweets could scare off potential Tesla Inc. (NASDAQ: TSLA) buyers or Twitter advertisers.

What I found eminently fascinating and most important about the Musk interview, which I strongly recommend you watch in its entirety, is that Musk is one of the few public figures, and certainly one of the few public company CEOs, that has enough courage to actually speak his mind.

Now, you may love what Elon Musk is saying, or you may hate it. Either way, as an informed citizen and as an investor in the equity markets, you had better listen, as Musk’s opinions matter to society more than nearly everyone else’s.

I say that because Elon Musk is not just a normal CEO. He’s a polymath of the highest order, and a man who has done more with his 51 years on earth than just about anyone who has ever lived. So, when he speaks, it behooves us all to pay close attention.

Another important observation I had in watching the CNBC interview was just how thoughtful Musk is when answering questions. In response to many of Faber’s tough and provocative inquiries, Musk’s immediate response was a pregnant pause that revealed a man who actually thinks deeply about issues. Indeed, when you watch the interview, you can see a man whose “gears are turning” and who actually is calculating not just what he “should” say about an issue, but what he “thinks” about an issue. That kind of honesty is rare, regardless of whether you think his honest opinions are right.

What I also find interesting is that Musk’s thoughtfully blunt responses were reminiscent of the time I met with, and interviewed, him. I was at an alternative energy investing conference in 2008, where Musk was a speaker/panelist. He also gave select investors demo rides in what was then the first Tesla Roadster. I was fortunate enough to be given one of these demo rides, and to ask Musk a few questions about what was then a relatively new (and not-yet-publicly traded) electric car company.

Well, what I saw Tuesday on CNBC was similar to what I saw up close and personal. That is to say, a man who actually thinks deeply, and who gives clear and well-thought-out answers to questions of importance to us all.

Now, there were many other newsworthy thoughts offered in the CNBC interview, particularly on controversial and critically important subjects that affect the future of humanity. One area of inquiry important here, particularly to investors, is the subject of artificial intelligence, or A.I.

Here, I thought Musk was a bit more optimistic about A.I. and the role it could play in humanity’s future than he has been in past interviews, when he warned that A.I. could lead to “civilization destruction.” Now, Musk reiterated that the chance of A.I. going very wrong is still present, but he made sure that he said he thought the chances of that outcome are small. What he also said was that Tesla is on the forefront of A.I., and that at some point soon, he expects Tesla will have a “ChatGPT moment” with full self-driving cars. Musk has been promising fully autonomous, or “self-driving,” cars for some time now, but the company isn’t there yet.

Another example of just how refreshing the scent of Musk’s responses were to Faber’s questions is when he discussed politics. Musk admitted that he voted for President Biden, and that he believes Biden won the 2020 election and that it wasn’t “stolen.” However, Musk also said that he did think there was at least some voter fraud.

Yet, the most refreshing part of Musk’s response here was what he said about the nature of the people who have recently occupied the Oval Office: “I wish we could have just a normal human being as president.”

Here, the refreshing scent of Musk is a fragrance we all should fancy.

***************************************************************

ETF Talk: Thinking Outside the Proverbial Box

Sometimes, especially during times of economic uncertainty, bank failures and high interest rates, it is best to play it safe and stay within the comfortable domain of well-known and safe sectors of the market.

After all, the demand from products in those sectors will always be high, regardless of wider economic conditions, as those are the goods that enable us to live the comfortable life that we have come to know. Returns from these stocks may not be extremely high, but they are safe, regular and somewhat predictable.

At other times, however, it is far wiser to take risks and plunge headfirst into sectors or areas of the market that may be less well-known or more risky than safer sectors. One such sector in the market is made up of a group of exchange-traded funds (ETFs) that are classified as uncorrelated, meaning that their portfolios are structured in such a way that they react much less than correlated stocks to fluctuations in the bond or equity markets.

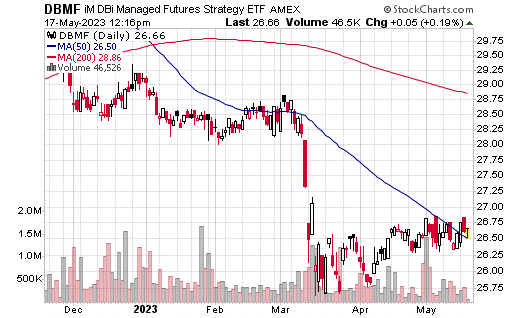

Enter the iMGP DBi Managed Futures Strategy ETF (NYSEARCA: DBMF), an ETF that seeks long-term capital appreciation through the employment of long and short positions in derivatives, primarily futures contracts and forward contracts that involve equities, fixed income, currencies and commodities.

The goal here is to provide an alternative to traditional long-only and equity and fixed income strategies, which aren’t doing so well due to high inflation and the contagion in the banking sector, with an adaptive strategy that can invest in long and short equity, bond, currency and commodity and precious metal indexes.

In other words, the fund’s managers look at the moving day average of their proprietary Managed Futures trend-following system and calculate its trajectory. A movement upward means that the portfolio will go long. If the movement is downward, the portfolio will go short.

Top holdings in the portfolio include Treasury Bills, Japanese Yen Currency Futures June 2023, Euro FOREX Currency Futures June 2023, MSCI EAFE June 2023, S&P 500 EMINI Futures June 2023, Gold 100 Ounces Futures June 2023 and Three Month SOFR Futures September 2024.

As of May 16, 2023, this fund has been up 0.42% over the past month, down 7.02% over the past three months and down 8.59% year to date. This ETF has total net assets of $748 million and an expense ratio of 0.85%.

Chart courtesy of StockCharts.com.

DBMF is not your typical ETF in terms of the way that it’s structured, and investors should be aware of the risks associated with investing in such a fund and always do their due diligence before adding any stock or fund to their portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

10 Punk Rock Rules for Success

“I just wish to shine brighter, and if it burns my body to a crisp, I’m happy to go right now.”

That bit of high-intensity wisdom comes from a man who I admire deeply: singer, songwriter, spoken-word artist, author, actor, radio and TV show host, publisher and true renaissance man Henry Rollins.

Henry made his mark on pop culture as the frontman for the quintessential punk rock band Black Flag, and then later via the Rollins Band, and he turned that experience into a multi-faceted and eminently interesting career fit for a true polymath. His career continues today, mostly through writing and one-man spoken word shows that combine the intensity of a punk rock concert with the intellectual stimulation of a TED Talk.

If you are a longtime reader of The Deep Woods, you probably know that I am a huge music fan and a huge fan of renaissance men (and women) who are able to do many different things in life and to do those things very well. In fact, I have an entire website and podcast appropriately called Way of the Renaissance Man, which is dedicated to extracting wisdom and knowledge from these types of individuals so that we can apply that wisdom and knowledge to our own lives.

A couple of years ago, another polymath I admire, entrepreneur, investor and business inspirer Evan Carmichael, compiled a list that he called “Henry Rollins’s Top 10 Rules for Success.” You can watch the video on YouTube. I recommend doing so, as it will give you a sense of the intensity and focus Henry puts into just about every breath he takes.

Here is a list of those top 10 rules (complete with sage advice straight from Henry himself), rules that I also try to live by, and rules that can help everyone — regardless of what stage they are at in life — achieve just that little bit extra that makes life glorious.

Rule 1: Be Driven

Rollins says he uses childhood anger and fear of failure to fuel his sense of drive. “I descend from the sky and land on things really hard, and I go at everything with that amount of fury,” Rollins says. Now that is a definition of drive that we all can admire.

Rule 2: Work Hard

Rollins says that no matter what he does, he goes at everything “fully engaged, and that intensity has served him quite well.” He also credits his punk rock roots for that work ethic, as everything in the early days was a sort of do-it-yourself exercise in just trying to make it from week to week.

Rule 3: Keep Moving Forward

Continue to consistently work hard and always move forward in life. “I keep moving forward boldly because I have nothing to lose,” Rollins says. Of course, regardless of whether you think you have nothing to lose, life requires constant movement, or we fall into stagnation. “I like to work… It’s about activity and challenge,” he adds.

Rule 4: Just Do It

He tells the story about starting his own book publishing company, which was the essence of punk rock “DIY.” “You just do it; you don’t even think about it… and without hesitation I’m making my own book company. Stop me. I dare you,” Rollins recalls.

Your editor doing a little Henry Rollins reading.

Rule 5: Take Your Shot

The “shot” for Rollins came when he was asked to audition as the singer for the iconic punk band Black Flag. He took a train from his home in Washington, D.C., to New York City and sang every song the band had. About 10 minutes after the audition was over, he was offered the job as the frontman of his favorite band. Now that is taking advantage of your “shot” in life.

Rule 6: Communicate Emotionally

“I feel a genuine need to communicate with an audience,” Rollins shares. That’s the way he describes his interaction with a crowd, because he sees it as the best way to genuinely connect with others. “It’s about communication, warning, broadcasting, emitting and trying to leave something of myself with the audience,” Rollins says. This rule is one of my favorites, because it’s also what I attempt to do each week in this publication.

Rule 7: Try Out Different Things

“Yeah, I’ll try that. I mean, why would I hold back?” This also is one of my favorite rules, as it encapsulates the fearlessness with which life should be approached. If there is something you want to do in life, try it out. The worse that can happen is you don’t like it, or you aren’t good at it. So what? At least you challenged yourself to stretch out and experience life in a different way.

Rule 8: Manage Yourself

“The repeating factors of my life have been application, discipline, focus, repetition,” Rollins says. These keys for Rollins are also largely the keys to success of many high achievers. The reason why is because application, discipline, focus and repetition are how you really get good at something. No matter how much natural talent you might possess, you never will be extraordinary at a skill unless you apply yourself with the requisite discipline, focus and repetition required to achieve the highest levels of whatever it is you do.

Rule 9: Learn from Your Past

“The past holds all of your mistakes and humiliations. The future holds whatever you can make it,” Rollins says. He doesn’t think you should ignore the past, but he doesn’t think you should dwell on it and be miserable. Instead, you should learn from it and move on. “The future’s ready for you to not make those mistakes,” Rollins adds.

Rule 10: Have Passion

Here is the key rule to life that both Rollins and I embrace, as it’s really at the heart of your existence. Because whatever you do, and whatever time you have to do it, why not live it all the way? Forget about half-hearted effort or “just okay” results.

Have the passion to attack life like a punk rock frontman — with all the intensity and hardcore aggression that meets life head on and that embraces the struggle. Because in the end, all we have is how we lived.

P.S. If you like this article, then I invite you to listen to a very special audio version of “10 Punk Rock Rules for Life,” which has just been posted to my website, Way of the Renaissance Man.

*****************************************************************

Thoughts on Finality

“Don’t cry because it’s over. Smile because it happened.”

–Dr. Seuss

The world never stops changing, we all know that. But that change is permanently punctuated when someone significant in our lives dies. During these poignant points, it behooves us to follow the wisdom of the great Dr. Seuss. So, don’t cry at the finality, smile at the fortuity. Those who have left us would likely want it that way.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods