The Recent Storm of Contract Dysfunction

Word is bond.

That’s the phrase that keeps coming to mind for me amidst the two most prominent political stories of the day — the Stormy Daniels affair and the latest push to restrict gun rights.

Now, “word is bond” is urban slang shorthand for the longer phrase “your word is your bond,” meaning that if you give someone your word, then you also are giving them your solemn promise.

In the case of Stormy Daniels, the former adult film actress gave her legal promise (which included the signing of a non-disclosure agreement, or NDA) that she would not reveal the details of her alleged affair with Donald Trump. In exchange for that promise, Daniels would receive the sum of $130,000.

That payment was made, yet Daniels still talked.

Her recent appearance on “60 Minutes” was just the latest violation of the word-is-bond ethic.

Now, I want to go on record here as saying that I think the whole Stormy Daniels/Donald Trump incident is repugnant on many fronts. And I am most definitely not arguing for the propriety of Mr. Trump and his associates in this matter.

I also am not an attorney, so I can’t attest to the relevance of any lack of signature on the agreement by Donald Trump via an alias, or to whether that legally invalidates the contract. These legal intricacies are all extraneous to my ethic.

What I am saying is that when you make an agreement with another party, and then you violate your part of the agreement, you are guilty of what I consider the most serious ethical breach… i.e. the breach of “word is bond.”

In my own business career, I have signed many NDAs having to do with the trade secrets, methods and practices of my employers. And if I were to violate those agreements, I would rightly deserve the social and legal scorn coming to me.

Call me old fashioned, but I believe the principle that “word is bond” is sacrosanct.

I also believe that when it comes to our rights as Americans, the word-is-bond ethic also applies.

That’s why it’s been disturbing to me to see the latest push for a restriction of our Second Amendment rights.

The March for Our Lives protest last weekend in Washington, D.C., and in dozens of cities around the world, has focused attention on ending the horrific gun violence and mass shooting incidents that afflict our society.

And while I sympathize and agree with the need to make our society safer for all Americans, I also can’t help but think that the focus on restricting gun rights is a violation of the word-is-bond ethic in the United States Constitution.

You see, the Founding Fathers were intent on creating a nation free from government tyranny.

That’s why it is no accident that the ability to speak freely (the First Amendment) as well as the means by which to protect oneself from government-initiated physical force (the Second Amendment) are bedrock foundations of a tyranny-free state.

I see the Constitution as a kind of word-is-bond agreement between the Founders and future generations of Americans. A word-is-bond agreement that ensures and safeguards our liberties better than any other document in world history.

Now, however, there are those who wish to essentially default on that agreement because they think it will make society safer.

Indeed, even a former Supreme Court justice thinks we should alter our Constitutional bond, arguing that the Second Amendment is a “relic of the 18th century.”

Of course, part of the brilliance of the Constitution is the provisions in it that allows Americans to alter that agreement provided there is enough consensus.

So, if we want to have that debate, then we should have it.

If we do, I suspect we’ll discover the true wisdom in the concluding text of our Founders’ promise, “…the right of the people to keep and bear Arms, shall not be infringed.”

Word is bond.

***********************************************************

ETF Talk: Reducing ‘Contango’ through a Commodities Fund

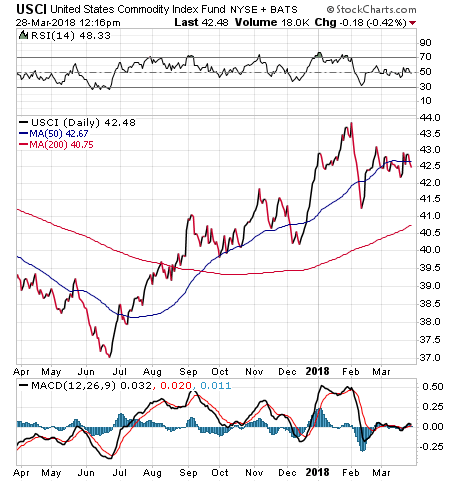

Based on its name, the United States Commodity Index Fund (USCI) seems to be just another broad play on the commodities sector, but the fund is much more than that.

USCI has been referred to as the “ultimate contango killer” fund. Contango, according to Investopedia, occurs when investors are willing to pay more for a commodity via futures contracts than the commodity is expected to be worth at that time in the future.

Investors who are long in commodities, or have a long time horizon, can be in trouble when this occurs, since a futures contract would have to fall in price to match the expected actual, or spot, price of the commodity in question. As a general rule, investors want futures contracts to rise in value, not decline.

The fund combats contango via a rather unique rebalancing strategy. Each month, out of 27 possible commodities, USCI picks the seven commodities with the greatest amount of backwardation (least contango) and the seven commodities with the greatest 12-month price momentum. The 14 futures contracts on these commodities are equally weighted, rebalanced every month and can represent six possible sectors: Energy, Precious Metals, Industrial Metals, Grains, Livestock and Softs.

USCI, launched in 2010, experienced a number of years with negative returns as the domestic market roared ahead and global markets lagged. However, that trend has reversed recently and rising inflation is back, which is historically good for hard assets.

USCI reached a low of $36.98 on June 20, 2017 but is up nearly 16% since then. The fund does not pay dividends but does have more than $550 million in assets and decent average daily trading volume in excess of $3 million.

One rather significant downside investors should be aware of is the fund’s high expense ratio of 1.03%. Additional fees for trading the fund can make the expense ratio as high as 1.3%.

If compared to the other top five commodity ETFs in terms of total assets, USCI is the most expensive one by far, as the closest competitor would be the PowerShares DB Commodity Tracking ETF (DBC) with its 0.85% expense ratio.

Because USCI is dependent on futures contracts, the fund does not hold shares in public companies the way most other ETFs do. However, USCI may hold U.S. government obligations with remaining maturities of two years or less.

As of March, USCI’s portfolio consists of the following futures contracts: Crude Oil (Brent) FEB19, Gas Oil DEC 18, Live Cattle JUN18, Crude Oil (WTI) MAR19, Heating Oil MAY18, Soybean Meal OCT18, Nickel APR18, Copper FEB19, Tin MAY18, Cocoa MAY18, Zinc AUG18, Gold AUG18, Sugar (#11) MAY18 and Cotton JUL18.

Investors who favor portfolio diversification and an inflation hedge over high returns may find the United States Commodity Index Fund (USCI) to be an intriguing play.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

The Best of Times Is Right Now

What do you get when you put a Harvard psychologist on stage at the same Hollywood venue where they hold the Academy Awards?

The answer is one gigantic dose of feel good.

That was my takeaway after attending a recent lecture and discussion by Harvard University Professor Steven Pinker. The psychologist and best-selling author has just released his new book, “Enlightenment Now: The Case for Reason, Science, Humanism, and Progress.”

The central thesis of this work is that by nearly every metric that matters — health, lifespan, inequality, environment, knowledge, safety, quality of life, happiness, and especially wealth — the world has never been better than it is right now.

The cause of this human progress, argues Pinker, is the embrace of enlightenment values, chiefly reason and science, and the real-world application of these principles toward enhancing human existence.

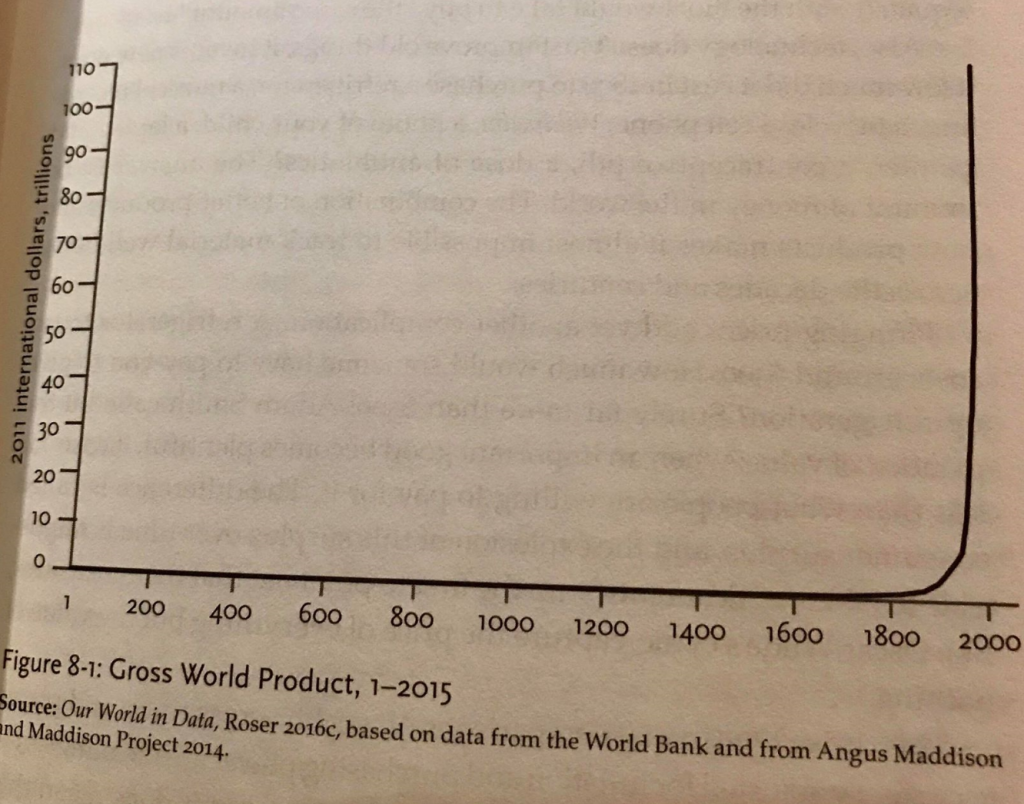

In one truly dramatic chart from the book, Pinker shows the rise of Gross World Product from the year 1 through 2015. Here’s a snapshot of that chart that I took from my own copy.

As you can see, up until the late 1800s, the world made little-to-no progress in terms of economic growth.

Then, the graph goes parabolic, as the rise of capitalism, the industrial revolution and the growth of cities creates an undeniable and stunningly dramatic surge in economic flourishing.

It is charts like this, some 75 of them, that make this book so beautiful, and so uplifting.

It’s not often that you get to see the how great human beings are, and how well we’ve done with our world. And despite all our Shakespearean flaws, bellicose urges and tribal tendencies, we’ve managed to continually improve, enhance and recreate our societies in an onward march toward more human flourishing.

Yes, there are some things we haven’t got right along the way (two world wars in the 20th century, for example). But the evidence of progress is undeniable, and it’s presented brilliantly in this must-read work.

So, in the spirit of Professor Pinker’s work, consider that over the past 12 months (as of March 21), the Dow is up more than 20% while the S&P 500 is up nearly 17%. The NASDAQ Composite has surged some 27.5%.

Looking further back, the Dow is up 72% over the last five years while the S&P 500 is up 77%. The NASDAQ Composite is up 129%.

I could go back further, and the results would be even better, but I’ll stop here for now as I suspect you get my point.

The thing to realize here is that while there is no guarantee that human progress, and equity market progress, will continue in an upward trajectory, history clearly shows we’ve done a stellar job of making fools of the purveyors of doom and gloom.

Keep this in mind whenever you hear from those warning about the next devastating market crash.

**********************************************************

On Freedom, Fast Money and Sin City

What’s the one thing you can do to increase your freedom?

While some might say it’s getting politically active and working to enact legislative change, I say there’s something much more personal — and eminently easier — that you can do to increase your freedom quotient.

And, the best part of this freedom-enhancing move on your part is that you’re also going to have a lot of fun in the process.

You see, the one thing you can do to increase your freedom is to get richer.

Yes, accumulating wealth is perhaps the best way to increase your personal freedom. The reason why is that having financial peace of mind allows you the freedom to do what you want—and to do it on your own terms.

Fortunately, increasing your wealth doesn’t have to be a mystery. In fact, all it takes is a little discipline, a little confidence and a little knowledge.

And, when it comes to the knowledge component, I am proud to announce that I, along with my investment advising partner and world-renowned economist, Dr. Mark Skousen, will be teaming up to help provide you with the knowledge you can use to supercharge your freedom.

Along with Eagle Financial Publications partner and publisher Roger Michalski, Mark and I will be holding a special event we’re calling the “Fast Money Summit” at this year’s FreedomFest conference.

Known as “The World’s Largest Gathering of Free Minds,” FreedomFest takes place from July 11-14, 2018, at the Paris Resort, Las Vegas, NV.

Dr. Skousen and I will start the summit with a special session of our Fast Money Alert service, revealing our winning formula for successfully maneuvering through the treacherous marketplace by using our own special brand of fundamental and technical analysis.

In the past year, we’ve used our system to make substantial profits, including a stock that rose 120% in only six months.

Our session will include a specific stock recommendation that has equal potential to double in price in 2018.

Then you will meet with our experts in the “Eagle’s Nest,” a designated room for subscribers, and hear them reveal their most valued secrets to make you a much better investor and speculator. Roger Michalski, Eagle’s Publisher, will be the moderator.

The Fast Money Summit also will feature some of the best and brightest of the investment field, including such luminaries as Jim Rogers, Donald Smith, Rob Arnott, Gary Smith, Doug Casey, Peter Schiff, George Gilder, Mark Mobius, Keith Fitz-Gerald, Alex Green, Robert Kiyosaki and many, many more.

If you want to put yourself on the path to achieving more personal freedom, then this event is aimed directly at you.

And, if you register for this event by March 31, you’ll get a very special discount price—and one that increases your freedom even more by increasing your savings!

We hope to see you there.

*********************************************************************

Adams’ Rib

“And that the said Constitution be never construed to authorize Congress to infringe the just liberty of the press, or the rights of conscience; or to prevent the people of the United States, who are peaceable citizens, from keeping their own arms…”

— Samuel Adams

The is no doubt that the Founding Fathers were intent on creating a nation free from government tyranny. This fact remains regardless of today’s tearfully loud youth protestations or arguments impugning the applicability of these principles some 230 years later.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.