The Kindness of Capitalism

The Kindness of Capitalism

We live, and then we die.

That’s a reality we all must grapple with each minute. The fact that life is finite has implications for everything we do. And no matter what your beliefs are about the existence of an afterlife, there is no doubt that life on earth, as we experience it, is going to come to an end for us all.

This admittedly morbid, yet eminently liberating, realization is at the spine of nearly all our decisions, even though many times we fail to realize it. Think about the actions you take each day.

You wake up after a night of sleep because your body requires sleep. You consume food because your body requires energy. Then, for most of us, we engage in some form of productive activity that nets us financial compensation so that we can attain the capital required to fund our existence.

If we’re lucky, we have family and friends whom we love that we can share our lives with, and that allow us to both provide and receive mutual support.

The requirements of a finite life also have a profound effect on your decisions about what to do with your money, how to spend that money, how to invest it and how to plan for a time when you may not be able to, or may no longer want to, work. Then, there’s your family, and the work involved in making the right decisions to provide for them when you’re no longer here to do so.

For a special audio essay version of this article, click here.

Now, much of my newsletter advisory services are aimed at the nuts and bolts of how to put your money to work in the financial markets so that you can maximize this critical aspect of your life. Yet, as you likely know, in The Deep Woods, I like to peel back the layers of the onion skin so that we can access the principles at the root of the issue.

And when you think about it, what is at the essence of our quest to make sure we are financially secure enough to take care of ourselves and the ones we love?

To me, the answer is simple: It’s a desire to be kind.

Indeed, the desire to be kind, i.e., the quality of being caring, attentive, considerate and otherwise thoughtful of others, is something that we all should strive to be motivated by. I know for me, the actions I take out of kindness not only feel good, but they’re always in my rational self-interest to do so.

Acts of kindness don’t mean self-sacrifice. Rather, it means acting and interacting with others so that both parties receive maximum benefit from the interaction.

Extended out to the political realm, the desire for kindness is why I am a passionate advocate for laissez-faire capitalism. You see, capitalism is the only social system where people are free to interact with each other based on the principle of exchanged values.

For example, this morning, I went to my local Starbucks and paid $4.95 for a latte. I wanted the latte more than I wanted the $4.95, and Starbucks wanted the $4.95 more than it wanted the latte. I didn’t exercise physical force to extort the latte from my barista, and she didn’t wrestle me into the store from the street to confiscate my money.

Instead, we engaged in a mutually kind exchange of values that also was mutually beneficial. This kindness is the essence of capitalism, and it’s the opposite of the Marxist idea that capitalism exploits the proletariat.

In my view, the prescription for increasing societal happiness is to increase kindness. Not only in terms of our daily human interactions, but also in the wider sense of people interacting with each other via the kindest of all principles — the principle of free exchange.

Finally, I’ll leave you with a powerful quote from philosopher and neuroscientist Sam Harris regarding kindness.

As Sam writes: “Consider it: every person you have ever met, every person will suffer the loss of his friends and family. All are going to lose everything they love in this world. Why would one want to be anything but kind to them in the meantime?”

If you want to make yourself and the world a better place, try to be more kind.

***************************************************************

ETF Talk: Invest in Artificial Intelligence and Big Data with This Fund

Will the bots rule the world?

While the fear and promise of artificial intelligence (AI) has been heightened by recent high-profile news events such as the release of the remarkable ChatGPT software, the reality for investors is that AI is a good place to search for potential profits.

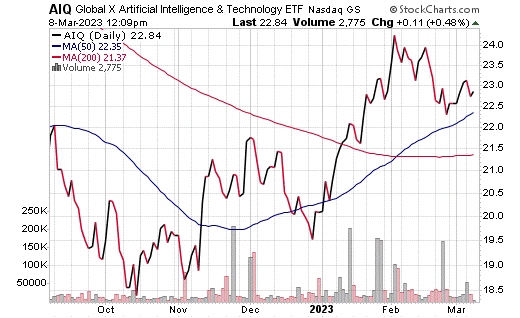

One such fund that provides exposure to this fascinating market segment is the Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ). AIG tracks a market-cap-weighted index of developed market equities involved in artificial intelligence (AI) and big data.

AIQ is passively managed to invest in developed market companies that are involved in the use of artificial intelligence to analyze big data, whether for their own operations, as a service to other companies or through the production of related hardware.

The fund determines this classification based on a composite analysis of public filings, products and services, official company statements and other information regarding direct involvement in the artificial intelligence and big data categories. AIQ’s constituents are market-cap weighted with a semi-annual re-weighting and are reconstituted annually.

AIQ had a rough 2022 in terms of share price performance, as did most tech sectors. Yet since the October lows, AIQ has spiked to a robust 23%! That’s proof of the new interest in this bleeding-edge market segment.

Chart courtesy of www.stockcharts.com

The fund has an average weighted market cap of $319 billion and an average spread of 0.75%. It currently has a 1.04% dividend yield and 79 holdings. Among the top holdings and percentage of the fund’s portfolio are Tesla (NASDAQ: TSLA), 3.88%; Meta Platforms Inc. (META), 3.82%; NVIDIA Corp. (NVDA), 3.60%; Salesforce Inc. (CRM), 3.49% and Apple Inc. (AAPL), 3.19%.

While AIQ provides investors with access to exciting new technology in artificial intelligence and big data, I urge all interested parties to exercise their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Bidding Farewell to a Mettle-Building Site

On Sunday, I learned that the auto racing group, NASCAR, had sold the land that houses the motorsports venue Auto Club Speedway in Fontana, CA. The reported sale of $543 million for the estimated 568-acre parcel went to Hillwood Development Co., a Dallas-based commercial real estate firm headed by Ross Perot, Jr.

Although Hillwood didn’t comment on the transaction, there are rumblings that a new NASCAR track will be built on part of the grounds sometime in the next couple of years. Now, I am not a huge NASCAR fan; however, I do have a personal connection with the Auto Club Speedway. You see, I live just a few miles from this facility, and I consider it my “home track” for all of my own personal amateur motorsport adventures. In addition to NASCAR events, the facility also held many sports car and motorcycle events open to the public, where enthusiasts could take their own cars and bikes on the track to test their skills.

One such mettle-building adventure at the Auto Club Speedway was chronicled in a previous issue of The Deep Woods. So, this week, in honor of the sense of nostalgic loss that I feel for the shutting down of the facility, I’ve decided to present you with that article. Doing so will serve as a fitting tribute to a place that will always live in my heart, as it is a place that tests one’s courage, challenges one’s skill and uplifts one’s sense of life.

Lessons Learned at 168 Miles Per Hour

Some people play golf. Some people play tennis.

And while I certainly understand the appeal of these great activities, I prefer to engage in recreational activities that are, shall we say, a little more extreme.

Another way to describe my proclivities is the way many of my friends and family do, and that is to just say that, “Well, Jim’s just a little bit crazy.”

Now, I know what my friends and family mean when they say I’m a little crazy. And I know that they don’t mean that in the clinical sense. What they do mean is that the recreational activities I engage in are usually relatively high-risk, and often come with an intensity factor that’s a little bit high on the extreme scale.

Tactical marksmanship, Gracie jiu jitsu and high-intensity training to build muscular size and strength are some of these activities. Yet there are even more extreme arrows in my recreational quiver.

I bring this up, because some of the greatest insights I’ve gleaned about myself, including insights on risk taking, risk management — even the meaning of life itself — have come to me while engaged in extreme pursuits.

Moreover, these insights have helped me become a more skillful writer, entrepreneur, investor… and just a more well-rounded Renaissance Man.

Perhaps, most importantly, I suspect some of these insights can help you do the same.

For many years, I was really into motorcycles, and not just riding motorcycles around on the weekends exploring the country. My motorcycle pursuits involved sport bikes and, in particular, road racing bikes. These are the bikes that go really, really fast, and the bikes that require you to lean off of them and drag your knee on the ground to go really fast around turns.

In other words, they are the kind of motorcycles that can get you into a lot of trouble, if you don’t know what you’re doing.

So, when I decided to buy my first road racing bike in the mid-2000s, I didn’t just go to the dealership, jump on the prettiest model and ride off the lot with abandon. Instead, I did my research on what was the best model of road race bike for riders just getting into the sport.

Then, I researched which training facilities were considered the most effective, and the ones that stressed safety first. I also made sure I researched the right safety equipment, including which brands offered the best protection in the event of the inevitable crash.

It was only after doing this due diligence on what the sport requires to be able to excel, stay relatively safe and really enjoy the experience that I actually embarked on the motorcycle road race journey.

It is this kind of thorough due diligence that I bring to the rest of my personal life, and to my professional life as an investment newsletter writer.

Yet, aside from the lesson of proper due diligence, I think the real lessons one learns in life are those garnered under heavy stress. You see, it’s the presence of stress — literally life-threatening stress — that teaches us a lot about ourselves, our resolve and our ability to focus our minds on a singular task.

That’s the lesson I learned after participating in several motorcycle road racing “track days.” This is where you go out with a group of riders of similar experience and try to do your best lap times around a professional racetrack.

The track where I really learned a lot was the Auto Club Speedway in Southern California. This track has one of the longest straightaways in road racing, and experienced riders regularly reach speeds north of 170 mph.

Your editor tackling the turns at the Auto Club Speedway.

After several “timid” laps around the track reaching top speeds of 130, then 140 and then 150 mph, I finally felt comfortable enough to open up my machine to see what she could really do. Yet this decision came toward the end of the day, and my brakes weren’t working as well as they had been early in the session.

I found this out quickly, as I spun up the engine on the Honda CBR 1000, hitting an exhilarating 168 mph on the front straight before applying the front brake — only to find that I was getting little response.

Moreover, as I looked ahead, there was a pack of riders in front of me who were slowing down for the next turn, a task I should have already done seconds before. I decided there were only a couple of things I could do. I could apply both the front and rear brakes as hard as I could, hoping the bike would slow enough for me to pull off the racing line, or I could dump the bike while going about 160 mph and risk severe injury (but still manage to avoid my fellow riders).

My decision had to be split second, and as you can imagine, it was under extreme duress. I opted to trust my equipment, and my training, by pumping the lever that controls the front brake, downshifting into a lower gear to slow the bike down and gently but steadily applying the rear brake to help slow the bike and steady the chassis. The maneuver worked, and I was able to guide the bike — and myself — back into the pit lane safely.

That day, I learned to A) Trust my equipment, B) Trust my training and C) Trust my judgement under stress.

If I had panicked and opted to get off the bike, the consequences could have been disastrous.

So, the next time you’re faced with a situation where a potential calamity quickly approaches, trust your due diligence, trust your training (i.e., your accumulated knowledge) and, above all, trust your judgment and wisdom.

It is the knowledge of self and confidence in your own decisions that will carry you through times of acute stress.

Whether that stress is manufactured by your “crazy” choice to ride a motorcycle really, really fast, or whether that stress is created by an investment you’ve made in the equity markets, in a business or anywhere in your personal life, what will get you through is a clear mind, good preparation… and trust in your good judgment.

*****************************************************************

We Dream of Money

“We must never forget that we are human, and as humans we dream, and when we dream, we dream of money.”

Last week, I presented a provocative and touching quote from Guillermo del Toro’s “Pinocchio” that celebrates life’s beauty and brevity. That quote prompted one reader (thank you, Mike G.) to write in and ask me if I would provide more film quotes in this section of The Deep Woods. So, just for you, Mike, this week’s quote comes from the fascinating film, “The Spanish Prisoner,” written and directed by the sublime David Mamet.

The film is a mystery of sorts featuring an elaborate con game, corporate secrets, murder, lust and of course, the human need to acquire a lot of money. The role of the suave and wealthy con man is played brilliantly by Steve Martin, an actor you might not think would fit the role, but that does so perfectly. If you want a great film-watching experience, one replete with intelligence, suspense, action and the trademark witty and thoughtful dialogue of the kind only Mamet can deliver, then you simply must watch “The Spanish Prisoner.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods