The Freedom Party Can’t Start Soon Enough

- The Freedom Party Can’t Start Soon Enough

- ETF Talk: Accessing Companies That Support Just Business Behavior

- Powell, the Pandemic and the Plunge

- The Heart’s Protective Memory

***********************************************************

The Freedom Party Can’t Start Soon Enough

Let’s face it, 2020 has been the worst year ever so far.

Even for an optimist like me, this year just flat-out sucks! I mean, consider what we’ve had to grapple with in just the first six months of 2020:

- The worst global viral pandemic in over a century — a pandemic that’s now extinguished nearly 500,000 lives worldwide.

- A virtual shutdown of the U.S. and global economies.

- A plunge in the S&P 500 of some 30% in just a few weeks.

- Unprecedented intervention and open-spigot money printing from the Federal Reserve.

- Historic government fiscal intervention to the tune of trillions of dollars, with much more likely to come.

- The overreach of government into our personal lives and personal freedoms by issuing lockdown “orders” in many states.

- The largest social unrest and the biggest protest movements since the 1960s.

Yep, I think that qualifies the first half of 2020 as setting up to be the worst year ever.

Oh, and don’t forget that this year we’re also going to go through the agony, angst and uncertainty of what will likely be another extremely contentious and divisive presidential election.

So, right about now, what I need to cleanse my intellectual and spiritual palate is a feast — a freedom feast, if you will.

This is a gathering that is a feast for the mind, body and spirit, and one that immerses me with like-minded liberty lovers, friends, co-workers, intellectual brothers in arms, authors whose books I frequently read, podcasters whose podcasts I frequently listen to and the few and far between politicians who value freedom as much as I do.

And, I need this feast to take place in one of the most libertine and decadent cities in the world — Las Vegas.

Fortunately, I have just over a fortnight before that feast begins, (or should I say that “fest”) as this very occasion isn’t a mere figment of my sybaritic imagination. Rather, it’s a reality that I will soon live and breathe — and one that you can live and breathe alongside me.

I am referring here, of course, to the best week of any year, which is the week in which the largest gathering of free minds takes place. This is the week of the FreedomFest Conference, the summit for the liberty movement.

This year will undoubtedly be unlike any other at FreedomFest, and the reason why is because this year has been unlike any other. Sadly, freedom has become somewhat of a forbidden value during this pandemic and a value that government-friendly forces and those who want greater and greater social control have exploited for their own gain.

Yet, FreedomFest gives us a chance to talk these issues out with those who will actually preserve, protect and defend the moral and intellectual superiority of individual liberty, individual rights and the freedom of speech and thought that have come under such vehement assault in recent years. And just like any powerful and successful movement, we’ll do it with the love, joy, laughter, fervor and intellectual passion deserved of the primary value that makes all other values possible — the value of freedom.

You see, contrary to the line from the Kris Kristofferson classic, “Me and Bobby McGee,” freedom isn’t just another word for nothing left to lose. Instead, freedom really is the prime directive of reality and the directive that allows humans to reason their way through existence using our only tool of survival — our minds.

So, if you are a man or woman of the mind, and you want to help preserve the bedrock value that is freedom, then you need to join me at FreedomFest.

This year, FreedomFest is being held at the fabulous Caesars Palace in Las Vegas, Monday, July 13 through Thursday, July 16. Come join me and more than 200 dynamic speakers, think tanks, filmmakers, business innovators, politicians, policymakers and best-selling authors — all of whom will gather to exchange ideas and fight for the bedrock value that allows us all to pursue our own happiness.

I guarantee you’ll have fun while also celebrating, protecting and venerating your fellow freedom warriors.

To do your part, all you have to do is sign up for FreedomFest, book your room and make those travel plans. In other words, all you have to do is put on your bravest face and stand up for the prime virtue that is freedom.

Now I ask you, what can be more heroic than that?

**************************************************************

ETF Talk: Accessing Companies That Support Just Business Behavior

(Note: Second in a series of environmental, social and governance (ESG) ETFs)

Although the topic of corporate social responsibility is not a new one, it has gained considerable traction since the advent of the 2008 financial crisis as many people have blamed corporate greed for throwing millions of people out of work and into foreclosure when they could not pay their mortgages.

Similarly, opinion polls, such as the 2019 JUST Capital survey, have revealed that Americans, regardless of age group, political affiliation and income level, care a great deal about corporations walking the walk with regards to worker pay and well-being, customer treatment and privacy, beneficial products, preserving the environment and job creation.

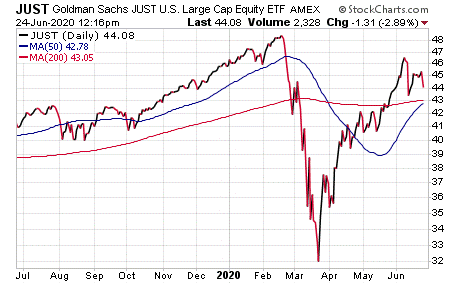

Well, an exchange-traded fund (ETF) recently has been created to reflect the importance of these values. The Goldman Sachs JUST U.S. Large Cap Equity ETF (NYSEARCA: JUST) tracks an index of U.S.-listed large-cap stocks that are selected through the use of a survey that ranks companies for their practices vis a vis environmental, social and governance issues. Specifically, this fund tracks the JUST U.S. Large Cap Diversified Index, which is made up of the top 50% of Russell 1000 companies in each industry. The companies are then rated according to JUST Capital’s survey results.

According to JUST Capital, when compared to the companies that are excluded from the index, the companies that remain listed are, for instance, more likely to pay their workers a living wage, create jobs in the United States at a greater rate, produce less greenhouse gas emissions, give more to charity and pay less in fines for unethical behavior. This ETF’s launch also was a stunning success, as the fact that it ended its first day of trading with $251 million in assets catapulted it into the echelons of the top 10 equity ETF launches in history.

Some of this fund’s top holdings include Microsoft Corp. (NASDAQ:MSFT), Apple Inc. (NASDAQ: AAPL), Amazon.com Inc. (NASDAQ: AMZN), Facebook Inc. Class A (NASDAQ: FB), Alphabet Inc. Class C (NASDAQ: GOOG), Alphabet Inc. Class A (NASDAQ: GOOGL), Johnson & Johnson (NYSE: JNJ) and Visa Inc. Class A (NYSE: V).

This fund’s performance has risen after the recent market downslide. As of June 23, JUST has been up 6.70% over the past month and up 40.88% for the past three months. It is currently down 1.62% year to date.

Chart courtesy of www.stockcharts.com.

The fund has amassed $128.19 million in assets under management and has an expense ratio of 0.20%.

In short, while JUST does provide an investor with a chance to merge a desire to profit with the need to sate one’s conscience, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

In case you missed it…

Powell, the Pandemic and the Plunge

A funny thing happened in the markets recently. Not funny “ha ha,” but rather, funny “unusual.” You see, after about four weeks of stocks surging some 12% or so, stocks abruptly turned tail and headed sharply south.

The one-day loss on Thursday, June 11, in the major domestic averages of approximately 6% took out roughly half of the progress this market made in those four weeks. This is what can happen when a market runs up too far, too fast. It also is the reality of this COVID-19 market.

So, what prompted the market plunge that day? Well, there were two proximal causes: Federal Reserve Chairman Jerome Powell and the pandemic.

Specifically, despite its dovish proclamations on interest rates likely remaining at basically zero for the next two-and-a-half years, the outlook on future economic growth from the Federal Reserve at the July Federal Open Market Committee meeting was anything but encouraging.

On Wednesday, June 10, Chairman Powell made no mention of a sustainable economic rebound, although he did acknowledge the improvement in the labor market. Yet it was the downbeat, even pessimistic, tone from the Fed chairman on future growth that upset markets.

As I’ve been telling readers of my Successful Investing and Intelligence Report advisory newsletters for months now, the economy needs to get back to something close to “normal” by the end of the summer/early fall if we are going to have the earnings and economic activity in 2021 that can support stocks at these valuation levels. The market is pricing in just that, or at least it did until Powell’s commentary.

Powell basically said that the economy was horrible, and there were no signs of a rebound on the horizon. Positively, however, Powell did say that the Fed is ready, willing and able to support the economy (and the markets) with whatever monetary policy easing it can deliver. Unfortunately, the bulls wanted a bit more positivity from Powell on economic growth, hence the first reason stocks plummeted.

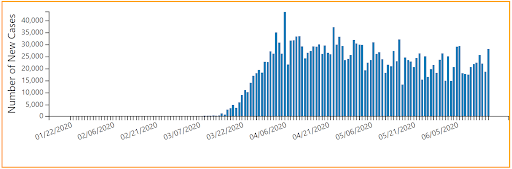

The second reason is something I’ve also been warning subscribers about, and that is the possibility of a “second wave” of coronavirus cases as we continue to relax the stay-at-home orders, social distancing measures and the wearing of masks. While we need to do this for economic reasons, I suspect it almost certainly will lead to more cases of COVID-19.

On that downbeat June 11 morning, the number of U.S. coronavirus cases topped 2 million, with the death toll rising past 111,000. According to data from Johns Hopkins University, there has been an uptick in cases in Florida, Texas and California. That spooked markets into concerns that a second wave of infections could lead to a return of restrictions on social and business activity. So, take a pessimistic Powell and fears over a second coronavirus wave in the same morning, and you get the worst day in markets since the COVID-19 crisis began.

Now the question becomes whether the June 11 sell-off is the start of a new downtrend or simply a healthy and much-overdue pullback in markets.

If I had to deliver an answer here, I would say that although the selling that day was intense, I don’t think it will end up being a bearish game changer. I say that because there really wasn’t any real news about an acute intensification of new coronavirus cases in the United States. As of now, the data do not support this fear.

Daily new coronavirus cases have been averaging around 20,000 for the past several weeks, and in the days leading up to this writing on June 17, the number of new cases nationwide was mostly trending lower. The chart here from the Centers for Disease Control and Prevention (CDC) of the number of new COVID-19 cases reported each day in the United States since the beginning of the outbreak tells us just that.

Of course, we are very likely to see this chart trend higher in the weeks ahead, and the reason why is the country is opening up again. Every state has eased restrictions to some extent, and most now are well past the initial post-lockdown stages. Oh, and then there were those nearly nationwide protests of late, which also are likely to increase transmission rates. Let’s face it; there wasn’t much “social distancing” going on in those throngs.

If we do see a significant second wave of the virus result in more economic disruption, that will bring about more selling in stocks. While that is certainly a possibility, at least for now, the data itself do not justify last week’s sharp plunge. And, that’s not just me saying it. From the June 11 close to the June 23 close, the major indices are up about 4%.

That’s a resilient market, and one that begs for the embrace of your investing capital.

*********************************************************************

The Heart’s Protective Memory

“…the heart’s memory eliminates the bad and magnifies the good, and thanks to this artifice we manage to endure the burden of the past.”

— Gabriel García Márquez, “Love in the Time of Cholera”

This Nobel Prize-winning novelist is considered one of the greatest writers of the 20th century, and here he gives us an example of the profound connection he had with his emotions, as well as his deft ability convey that emotion to the reader. And when it comes to the heart’s protective memory, who can disagree with this profound insight?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods