The Folly of Forgetting Phenomenal Fortune

Good fortune is a gift that deserves reverence. The writer Eckhart Tolle once said, “Acknowledging the good that you already have in your life is the foundation for all abundance.” Unfortunately, the sad and curious case of musician, actor and “Empire” star Jussie Smollett reminds us of the folly of forgetting phenomenal fortune.

If you know anyone in the entertainment industry, and I know many, making it in that competitive arena is no easy task. To stand out among the throngs of aspirants, you need to have talent and a determined work ethic.

If you’re a musician, or an actor, or a writer, you need to spend years learning, studying and practicing your craft. You also have to work hard to cultivate the right connections. Perhaps most importantly, you need a whole lot of good fortune that puts you in the right place at the right time.

It is this sort of combination of hard work and good fortune that I assume helped Mr. Smollett land a supporting role on the successful, long-running network television show. That role reportedly paid him $125,000 per episode. And because there are 18 episodes per season, that puts Smollett’s annual salary at $2.25 million.

The median household income in the United States last year was $59,055.

In addition to his “Empire” success, in March of last year Mr. Smollett released his debut album, “Sum Of My Music.” Now, by any objective measure, being paid more than $2 million per year as an actor and also having numerous top-rated R&B songs as ranked by “Billboard” would qualify to me as phenomenal fortune.

Yet for Smollett, it appears this phenomenal fortune wasn’t enough.

By now I suspect you are at least somewhat familiar with the details of the Jussie Smollett case. Indeed, it has been one of the biggest, most talked about news stories in recent memory.

That’s why today I am not going to spend time reiterating the details of the alleged hoax and staged hate crime for which Mr. Smollett has been charged by Cook County, Illinois, prosecutors. Nor am I going to go into detail on the cultural issues surrounding racism (Mr. Smollett is black), homophobia (Mr. Smollett is gay), the prevalence of hate crimes in America or the toxic history of bigotry in the country. Jason Riley of The Wall Street Journal has already written a great piece on those issues.

What I want to highlight here is the motivation of the alleged faked assault, and how it feeds into the all-too-common failing of ignoring profound good fortune.

According to many accounts, the reason Smollett allegedly staged the hate-crime hoax was to up his public profile, and to get even greater compensation from his employers at 20th Century Fox Television (the producers of “Empire”). On Friday, Smollett was suspended from the show.

Now, there has been some pushback on the thesis that Smollett allegedly staged the incident to get a higher salary. The entertainment industry website TMZ has reported that “none of the brass — producers or executive producers — heard even a whisper from Jussie grousing he was underpaid.”

I certainly am not in a position to make a judgement on all of the facts or the motives in this case, but I am sure they will come out in due time. But assuming the reports are accurate that Mr. Smollett is guilty of the allegations, and he did it as a ploy to get more money, or to gain a high-profile victim status that would up his monetary value, then I can only be forced to conclude that he was a man who stared his phenomenal fortune squarely in the face — and spat on it.

I guess the blessings of good looks, a great singing voice, acting skills, a major-label record deal and a $2.25 million salary weren’t enough good fortune for Mr. Smollett. Apparently, he just had to have more.

While the Smollett case appears to be an extreme example of not acknowledging life’s good fortune, we all are guilty at times of failing to put in perspective just how lucky we are.

Whenever my thoughts descend into this ungrateful realm, I stop to consider that by nearly every metric that matters — health, life span, inequality, environment, knowledge, safety, quality of life, happiness and especially wealth — the world has never been better than it is right now. If you don’t believe me, read Steven Pinker’s brilliant work, “Enlightenment Now: The Case for Reason, Science, Humanism, and Progress.”

As thoughtful humans, we owe it to ourselves to keep firmly in mind the extreme good fortune we have. If Mr. Smollett had done so, this whole sordid stain on society may never have occurred.

**************************************************************

ETF Talk: A Fund that Provides Exposure to the European Equity Market

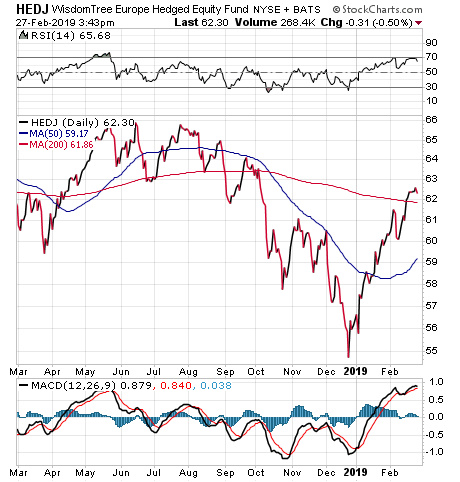

The WisdomTree Europe Hedged Equity Fund (HEDJ) is an exchange-traded fund (ETF) that provides investors with exposure to the European equity market while also hedging against possible fluctuations between the dollar and the euro.

This exchange-traded fund is based off the WisdomTree Europe Hedged Equity Index, which tracks European dividend-paying companies in the WisdomTree International Equity Index, trades in euros, has at least a $1 billion market capitalization and derives at least 50% of its revenue in the latest fiscal year from countries outside of Europe. The presence of a currency hedge also matters because there could be large movements in the exchange rate between the U.S. dollar and the euro.

At a time when the Italian economy is in a recession, Spain is undergoing political turmoil regarding Catalonian independence and populist politicians and parties are gaining sway across the continent, prospective investors in the European economy need all the protection that they can get.

The top 10 countries that this ETF is invested in include France (28.17%), Germany (21.19%), the Netherlands (18.71%), Spain (16.39%), Belgium (6.76%), Finland (5.22%), Ireland (1.26%), Italy (0.99%), Portugal (0.77%) and Austria (0.54%).

Chart courtesy of StockCharts.com.

Some of this fund’s top holdings include Anheuser-Busch InBev SA/NV (NYSE: BUD), Sanofi-Aventis SA (NASDAQ: SNY), Unilever NV (NYSE: UN), Banco Santander SA (NYSE: SAN), Telefonica SA (NYSE: TEF), Daimler Ag-Reg Shs (OTCMKTS: DDAIF) and LVMH Met Hennessy Louis Vuitton SE (OTCMKTS: LVMUY).

The top sectors that this ETF is invested in are consumer staples (20.95%), consumer discretionary (17.35%), industrials (15.93%), financials (11.85%), materials (10.53%) and health care (10.13%). The fund currently has $3.8 billion in net assets under management and has a $523,303 average 30-day volume. It also has an expense ratio of 0.58%, meaning that it is slightly more expensive to hold in comparison to other exchange-traded funds.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

It’s Time to Let Freedom Out of Its ‘Penn’

As you likely know, one of the core principles of The Deep Woods is freedom in all of its forms. Freedom of thought, speech, exchange, commerce, association and the freedom that states the unequivocal autonomy of the individual, is a concept that underpins my worldview.

And to perhaps no one’s surprise, my favorite event each year celebrates freedom in all its forms, and it also happens to be the brainchild of my friend and Fast Money Alert co-editor, Dr. Mark Skousen. Yes, it is the annual FreedomFest conference, and this year, it’s going to be extra special.

This year, Mark and his FreedomFest team have scored the great Penn Jillette of “Penn & Teller” fame, as one of the featured speakers. In this special FreedomFest talk, Penn will reveal the “sleight of hand” behind the dangerous new “socialist” agenda in America. His presentation is not to be missed!

He will speak on Friday, July 19, 2019, on “The Magic of Liberty.” After his evening talk, Mark will interview Penn about his incredible career, followed by Q&A from the audience and a private reception (including photo and autograph opportunities) with attendees and speakers (limited to 100 attendees).

Between Penn Jillette, Kevin O’Leary of “Shark Tank” fame, and yours truly, this year’s FreedomFest is going to be awesome. I recommend watching the three-minute video about this year’s big show at https://vimeo.com/311525927. Password: eastwood

And, for The Deep Woods readers, I am proud to offer a special “early bird” discount, which ends March 29. Just go to https://www.freedomfest.com/register-now/ or call 1-855-850-3733, ext. 202.

You will save $200 off the retail price, which means you pay only $495 per person or $795 per couple. Be a part of “the greatest libertarian show on earth,” including our three-day financial seminar sponsored again this year by Eagle Publishing and the Deep Woods.

So, come celebrate freedom with me in Las Vegas. I guarantee you’ll love it!

****************************************************************

Gaming 2019’s Biggest Surprises

At the beginning of the year, market prognosticators like to make calls about what they think will happen over the next 12 months. Most of these prognosticators turn out to be way off. Yet there are some market soothsayers who have proven to get many things right over the years, and one of them is Byron Wien of Blackstone.

As the year began, Wein issued his annual “Ten Surprises for 2019” list, which represents the man’s 34th year of issuing predictions for the coming year. According to Blackstone, Wein defines a “surprise” as an event that the average investor would only assign a one out of three chance of taking place, but which Wein believes is “probable,” i.e. having a better than 50% likelihood of happening.

This year, Wein has a few surprises on his list in which I strongly concur. Atop my agreement list is the following Wein surprise:

“The weakening world economy encourages the Federal Reserve to stop raising the federal funds rate during the year. Inflation remains subdued and the 10-year Treasury yield stays below 3.5%. The yield curve remains positive.”

I, too, think the Fed’s “pause” here is for real, and I do not suspect Chairman Powell and his colleagues will upset the market’s apple cart in 2019. Just today, we got confirmation of that via the minutes of the Fed’s January Federal Open Market Committee (FOMC) meeting. Here’s the key statement from the minutes:

“Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve’s asset holdings later this year. Such an announcement would provide more certainty about the process for completing the normalization of the size of the Federal Reserve’s balance sheet.”

Another point of agreement I have with Wein is this surprise:

“Growth stocks continue to provide leadership in the U.S. equity market. Technology and biotech do well as a result of continued strong earnings.”

Here, I also agree, but I don’t think this is that big of a surprise. Simply put, technology and biotech are where the innovation and big earnings growth are, and that’s where the growth and profit opportunities will continue to be for many years to come.

In fact, last week we added some technology exposure to our holdings in my Successful Investing advisory service.

Finally, there is this political surprise, which I also agree with, but which I also don’t think is a very big surprise based on what’s happened over the past couple of months.

“The Mueller investigation results in indictments against members of the Trump Organization closest to the president but the evidence doesn’t support any direct action against Trump himself. Nevertheless, an exodus of Trump’s most trusted advisors results in a crisis in confidence that the administration has the people and the process to accomplish important goals.”

We’ve actually seen this happen already, at least around the periphery with former campaign chair Paul Manafort. Yet I suspect things will get worse for President Trump in 2019 with respect to the Mueller probe, and that this will act as a general political headwind of uncertainty on stocks for the remainder of the year.

So, be forewarned.

*********************************************************************

On Style and Discipline

“Style begins by looking good naked. It’s a discipline. And if you don’t dress well every day, you lose the habit. It’s not about what you wear, but about how you live your life.”

— Oscar de la Renta

The designer, artist and fashion icon was a true innovator in his field. He also embodied a Renaissance Man ethos via his commitment to excellence, hunger for learning new things and his embrace of helping the world with his good fortune. In this famous quote, de la Renta reminds us that fashion is a function of both how you take care of your body and how you apply discipline to your daily presentation. Remember, how you do anything is how you do everything. And the better you do anything, the better you do everything.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods