The Fed’s Racing Toward Dead Man’s Curve

Dangerous curves come in all sorts of forms.

A woman can have dangerous curves that can lead a man to make some very bad decisions. I mean, before you know it, you’ve bought a ring, then a house, and then you’re changing diapers.

Then there are dangerous medical curves, such as diseases of the spinal cord that can cause the bowing of a person’s back. Often, these kinds of dangerous curves can be constant sources of pain and agony for the afflicted.

Then there’s the dangerous curves on the roads we drive, as many unlucky motorists are killed each year in automobile accidents. Perhaps the most popular dangerous curve was made famous by the musical duo Jan & Dean in their 1963 hit, “Dead Man’s Curve.”

Here’s the opening stanza from the song, which as you will soon see, I manage to connect to financial markets.

I was cruisin’ in my Stingray late one night

When an XKE pulled up on the right

And rolled down the window of his shiny new Jag

And challenged me then and there to a drag

I said, “You’re on, buddy, my mill’s runnin’ fine

Let’s come off the line now, at Sunset and Vine

But I’ll throw you one better if you’ve got the nerve

Let’s race all the way to Dead Man’s Curve”

This song tells the tale of an impromptu road race located near my old stomping grounds in Los Angeles close to where I spent my college years at UCLA. Now, there are several things about this song that I identify with, so indulge me for a few sentences here.

First off, I’ve owned both of the cars in the race (a Corvette Stingray and a Jaguar XKE). The Stingray was the essence of American muscle while the Jag was classic British elegance. And while the Stingray was faster, the Jag was no lackey in the speed department. I also identify with the song because on many weekend nights, I would go with my “car guy” friends to drive Sunset Boulevard from the UCLA campus, head east toward Vine, then come back home late at night through the winding road filled with tough-to-navigate turns and traffic lights that would come up on you unexpectedly — even though you knew they were there.

Yes, I did get more than a few speeding tickets on that road over the years, and one too many of those is what inspired me to go to the legal safety of the racetrack, where I could drive as fast as I wanted without the threat of law enforcement engagement.

Ok, so, I’m coming to the part that relates to financial markets. You see, “Dead Man’s Curve” was actually a real part of the road on Sunset Blvd. near Doheny Dr. in the 1950s and ’60s. The road has long since been fixed, but in the Jan & Dean era, it was a dangerous turn that took many lives. It also nearly ended the life of “Bugs Bunny,” or at least the voice of Bugs Bunny. In 1961, the great voice actor Mel Blanc was severely injured when his car crashed and went off the road at Dead Man’s Curve.

Today, the Federal Reserve appears to be facing its very own Dead Man’s Curve, i.e. a treacherous section of road that must be carefully navigated lest you lose control and cause your vehicle to crash — and in the Fed’s case, cause the vehicle that is the U.S. economy to crash into a ditch called inflation.

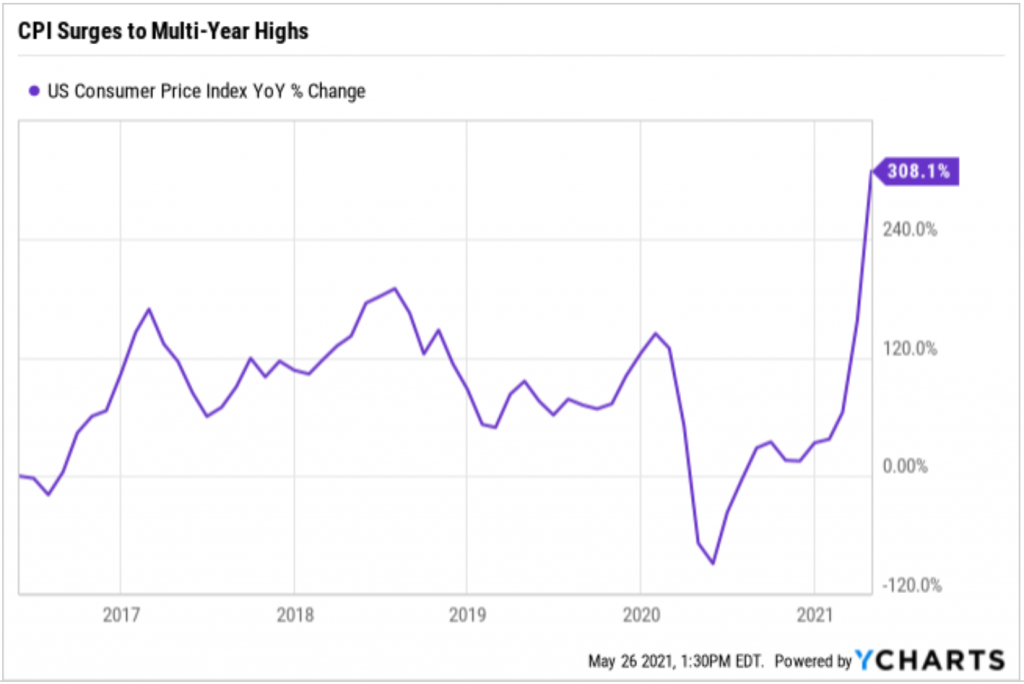

Indeed, the major question for markets right now is not whether there is inflation, but whether the Fed is right in its assessment that the increase in inflation is just temporary, or “transitory” as the Fed calls it, or whether it’s a more structural result of the massive flood of loose fiscal policy, i.e. federal spending related to the pandemic, and Federal Reserve accommodation, i.e. massive bond buying via quantitative easing (QE)?

The market is certainly beginning to get spooked about inflation, and that was evidenced by the May 12 release of, and swift and downbeat market reaction to, the April headline Consumer Price Index (CPI). That metric rose to its highest level since 2008 at 4.2%, while the all-important “core CPI” figure rose 0.9% to its highest level on a month-over-month basis since 1981. Not coincidentally, that’s also the last time inflation was a real problem for the economy.

The stronger-than-expected numbers resulted in a “hawkish” reaction across markets, as stocks plunged, and Treasury yields rallied. However, while clearly inflation pressures are stronger than economists’ forecasts, “reopening” and temporary-related issues did make these numbers run hot.

Case in point, within the details of the CPI report we saw airfare, used vehicle prices and lodging prices all rose 10%. Those are enormous, unsustainable gains that were related to reopening (e.g. travel) and supply issues (e.g. semiconductors). If those metrics had been ignored, core CPI would have risen just 0.4% month/month, less than half of the 0.9% increase and just above economists’ forecasts for a 0.3% rise.

While inflation pressures in the April CPI report were stronger than expected, there’s still a lot of evidence to imply that those pressures are being caused by temporary factors. So, despite the market reaction on Wednesday, May 12 (recall the S&P 500 sank 2.14% that day, igniting several days of selling) nothing in the CPI report substantively changes the outlook on inflation, nor does it imply the Fed is “wrong” about its contention that surging inflation is transitory.

I say that because sustained inflation and an economy that is running “too hot” essentially flips the script on the Fed and investors, at least the script that’s worked for the past two decades. Let me explain.

You see, since roughly the late 1990s, investors have been conditioned to believe that whenever there is any economic or market trouble, the Fed will ride in and save the day via interest rate cuts and/or QE. How long it takes for these Fed measures to essentially “fix” any market declines has varied depending on the severity of the crisis/economic pullback, but ultimately the result has been the same: The economy and markets get in trouble, the Fed cuts rates and/or does QE, and some years later, stocks are at new highs. Additionally, and most importantly, the Fed riding to the rescue allows the market to essentially look past near-term economic pain and move higher. This was especially evident exiting the financial crisis, as the stock market rallied consistently despite the actual economy taking a long time to recover, and again last year when stocks aggressively rallied despite a raging pandemic and partially shut down economy.

As it is often said, markets don’t care about now, they care about what’s next. And the Fed cutting rates and instituting QE reassured the markets that brighter days were ahead, which is why stocks have quickly recovered from any economic setback during the last 20-plus years.

But the reason sustained inflation and a potential “economic overheat” is such as scary road to navigate (like that Dead Man’s Curve) is because, in that paradigm, what has saved the markets for the past 20-something years will only make the problem worse and make stocks and bonds fall.

If markets are worried about inflation and an economic overheat, and stocks and bonds begin to fall as a result, the Fed can’t just hint at rate cuts or keeping QE on forever to fix the problem. Those are the policies that would be causing the problem, and doing more of them will only make the problem (inflation) and market reaction (declines) worse.

Instead, in this scenario, the only policy the Fed can employ to actually fix the underlying problem is to hike rates. This situation famously played out under the helm of then-Fed-Chair Paul Volker, who aggressively raised interest rates throughout the late ’70s and early ’80s, culminating in a double-dip recession in 1981/’82.

As anyone around back then can attest, that situation was painful. Unfortunately, that pain is likely to be dwarfed by comparison, as this time there’s massive bond and fixed income ownership due to aging Baby Boomers, and those investments (which haven’t gone down in 20 years, broadly speaking) will get hit very hard. Additionally, with Consumer Credit near multi-year highs, a painful increase in interest rates would be a substantial headwind on the economy and consumer spending.

Thankfully, it remains entirely possible the Fed is right that inflation is only “transitory.” Sadly, though, there’s not been a Fed in history that thought it was willingly creating an inflation problem. Yes, these people are very smart and experienced, but like all people, they aren’t perfect.

That’s why over the coming months and quarters, I will be hyper-focused on whether inflation is temporary (or not), and whether the economy is overheating — because the stakes are high for the markets and the economy for the remainder of 2021 and well beyond.

***************************************************************

ETF Talk: Consider This Fund to Invest in Gold

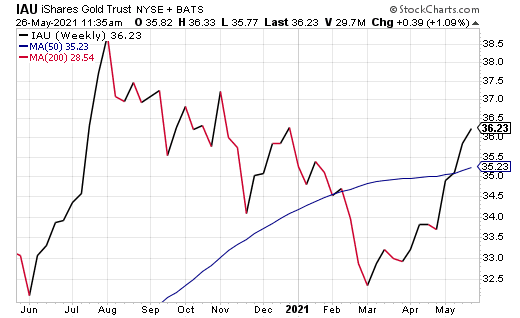

The iShares Gold Trust (NYSEARCA:IAU) tracks the gold spot price, less expenses and liabilities, using gold bars held in vaults around the world.

IAU is an efficient way for investors to hold physical gold. For retail investors, the fund removes the complexities of buying, transporting, storing and insuring physical gold.

Using a grantor trust structure, the fund is very stable. The underlying gold bars are held in vaults around the world, with an inventory list available on the issuer’s website.

Similar to its competitor, SPDR Gold Trust (NYSEARCA:GLD), investors should take into consideration that long-term gains have noteworthy tax liabilities, since IAU is considered a collectible.

The daily net asset value (NAV) of the trust is based on a given day’s LBMA Gold Price PM. Where IAU shines for buy-and-hold retail investors is in its low expense ratio of 0.40%.

At launch, shares of IAU corresponded to 1/100th of an ounce of gold (though this will decrease over time due to expenses). The fund has $29 billion in assets under management and offers a solid choice for gold investors.

Source: StockCharts.com

The investment seeks to reflect generally the performance of the price of gold. The Trust seeks to reflect such performance before payment of expenses and liabilities. It is not actively managed.

The fund does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of gold. An investment in physical gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, warehousing and insurance of the metal.

However, any interested investors should exercise their own due diligence in deciding whether or not this fund fits their own individual portfolio needs and goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Putting One Fake Foot in Front of the Other

Some men, when faced with overwhelming, life-shattering adversity, choose to embrace the circumstance. And in doing so, they live a life of epic inspiration.

In the new episode of the Way of the Renaissance Man podcast, I speak with just such a man, former Army soldier and retired police officer, Steve Martin.

Steve is an Afghanistan war veteran whose battlefield injuries cost him both of his legs.

Yet rather than allow that to stop him, Steve chose to overcome his personal battles, conquer his inner demons, and live a life that we all can aspire to.

From overcoming pain medications and becoming one of the first double-amputee field police officers in the country, to becoming an athlete whose participation in high-profile competitions has elevated awareness for life after amputation, Steve is a man whose mindset we all can learn from.

If you want to be motivated by a real-life hero and learn about his new adventure with an organization that I am proud to sponsor and support, Friends of Freedom USA, then you will really enjoy my inspiring conversation with Steve Martin.

*****************************************************************

In case you missed it…

Introducing My Secret Market Insider

Step aside, Woodward and Bernstein, I have my very own “Deep Throat.”

That’s right, I have my very own “insider,” in much the same way the two celebrated Washington Post reporters had in the 1970s when they broke open the Watergate story that eventually toppled President Nixon.

Only my insider isn’t telling me about the lurid political machinations at the White House. Instead, my insider tells me every day what is really happening in financial markets, why it’s happening and what the most important things are for me to focus on in the short and intermediate term to gain that extra alpha on the competition.

Now, I promised this insider that I would never reveal his identity, and because I am a man of my word, I never will. Yet what I have persuaded him to do is to share his insights with you, in much the same way that I get his insights each and every market day.

So today, I am proud to introduce a new product in Jim Woods’ universe of newsletter offerings. That product is called the Eagle Eye Opener, and it made its official debut on Monday, May 17, at 8 a.m. EST.

So, just what is the Eagle Eye Opener?

Well, think of it like a top-level intelligence briefing that gives you the heads up on what’s moving the markets and, more importantly, why markets are moving.

This insider intelligence also identifies the trends that day, what’s likely to happen in the short term and the medium term, and most importantly — what is the best course of action for you to take to profit from multiple market scenarios.

If you already subscribe to one or more of my newsletter advisory services, you know that I put a lot of research into each issue, and that I back up our investment decisions with that in-depth research. Well, a lot of my knowledge is bolstered by my market insider, as he is not only a friend, but he is also one of the smartest and wisest Wall Street analysts I know.

Most importantly, he has earned my trust over the years with his spot-on analysis and wise counsel.

And now, I can share that expert analysis and wisdom directly with you via the Eagle Eye Opener.

This publication comes out every trading day at 8 a.m. Eastern Time, and the best part about it is it only takes about five minutes each morning to read. That’s right, in just five minutes in the morning (maybe 10 minutes if you are like me and prefer to read slowly and methodically) you can gain an edge on the markets using the same institutional-level intelligence the pros on Wall Street use to make their big-money decisions.

Perhaps most importantly, the Eagle Eye Opener will help you avoid getting blindsided by market developments not covered deeply in the mainstream financial media.

Think of this publication as a kind of intel playbook. So, if you read it every day, you’re going to know what’s driving the market. You’ll know which way the markets are likely to go… and what to do when that happens.

You’ll also know what to do if it does the opposite.

That means you’ll know what to do ahead of time, whichever way the market swings… and you’ll know why and where the profit zones are.

Now, I am not claiming that this information is some kind of crystal ball, as there is no such device. However, it is the best tool I’ve found, and it’s the same information that Wall Street elites have at their fingertips each day — and now you can have it, too.

Once again, when you subscribe to Eagle Eye Opener, every trading day at 8:00 a.m., I’ll send you proprietary intel that was once for institutional investor eyes only. The intel covers breaking opportunities in:

- Stocks

- Exchange-traded Funds (ETFs)

- Bonds

- Currencies

- Commodities

You’ll also get the latest economic data that impacts investors in the market, as well as special features that more deeply analyze certain market sectors or developments (e.g., the current spike in inflation, the latest on when the Federal Reserve is likely to consider tapering its bond buying scheme and what to look for in terms of the next big market catalysts).

For me, the content in the Eagle Eye Opener gives me the confidence of being forearmed with this information before the opening bell… all in just about five minutes of your time.

For more about the Eagle Eye Opener, and how it can do for you what it does for me and thousands of other Wall Street pros each morning, I invite you to check it out right now.

As you know, knowledge is power. And with the Eagle Eye Opener, that power translates directly into profits.

*****************************************************************

On The Road Again

On the road again

Just can’t wait to get on the road again

The life I love is making music with my friends

And I can’t wait to get on the road again

–Willie Nelson, “On The Road Again”

The country music icon is still going at it at age 88, hitting the road again and doing what he does best — playing some of the best music ever written. This summer, Willie and an all-star cadre of country and Americana acts will be playing live shows again, and this time at a series of events called the Outlaw Music Festival. And after last year’s pandemic-punctuated absence of live music, I can’t wait to attend this event, as well as many others.

Your editor with Americana singer/songwriter and Oscar winner Ryan Bingham.

So, if you are in Southern California in October, and you see a stocky editor in a black shirt and a cowboy hat watching Willie, Ryan Bingham, The Avett Brothers, Chris Stapleton, Sturgill Simpson, Kathleen Edwards and many more performing, then don’t hesitate to come up to me and say hello. It’s high time we all celebrate existence with live music again.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.