The Cold Hard Truth About Bear Markets

- The Cold Hard Truth About Bear Markets

- ETF Talk: Make Money When the Market Struggles with This ETF

- My Five Favorite Quotes to Live By

- Tough Folks Do

***********************************************************

The Cold Hard Truth About Bear Markets

I’ve come to set the record straight

I’ve come to shine the light on you

Let me introduce myself

I’m the cold hard truth

–George Jones, “The Cold Hard Truth”

Country music legend George Jones is known for living a hard life, one replete with a lot of hard drinking, a lot of heartbreak and the realization of more than a few of life’s cold hard truths. Now, in the realm of money and investing, there is one cold hard truth that we’ve all come to learn in 2022, and that is that stocks do not always go higher.

Of course, you knew that already, but it is easy to forget that the last time we saw stocks plunge this much was during March 2020, when the world was essentially on lockdown because of COVID-19. Yet that pandemic pullback didn’t last very long, and since those March 2020 lows, markets have really pushed higher.

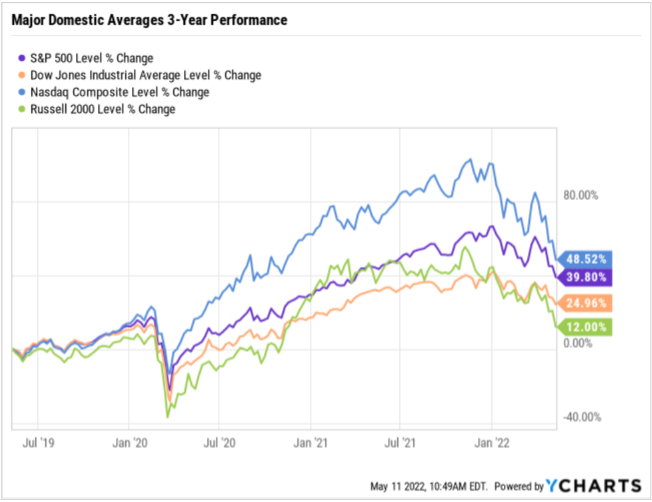

The chart here of the major domestic equity averages — the Dow Jones Industrial Average, S&P 500 Index, Nasdaq Composite and Russell 2000 — over the past three years shows that sharp pullback in the first quarter of 2020, and now the pullback so far in 2022.

Technically speaking, the Nasdaq Composite and the Russell 2000 officially fell into bear market status this year, and while the Dow and S&P 500 are “merely” in correction territory and not officially in bear status, it sure feels like the world is awash in ursine forces beyond our control.

Yet what is the cold hard truth about bear markets? How long do they typically last, how much damage do they do and how do these market cycles really work?

To answer that question, I uncovered some research conducted by Hartford Funds that I think will be quite valuable to review here. I suspect that if you are like me, the data will both surprise and placate your restless mind.

- Stocks lose 36% on average in a bear market. By contrast, stocks gain 114% on average during a bull market.

- Bear markets are normal. There have been 26 bear markets in the S&P 500 Index since 1928. However, there also have been 27 bull markets, and stocks have risen significantly over the long term.

- Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years.

- Bear markets have been less frequent since World War II. Between 1928 and 1945 there were 12 bear markets, or one about every 1.4 years. Since 1945, there have been 14, one about every 5.4 years.

- Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34% of the market’s best days took place in the first two months of a bull market, before it was clear a bull market had begun.

- A bear market doesn’t necessarily indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time. Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming.

- Bear markets can be painful, but overall, markets are positive a majority of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Stated differently, stocks have been on the rise 78% of the time.

So there you have it, the cold hard truth about bear markets. As you can see, the reality is that while bears are real, destructive forces in the market, they are no reason to panic and no reason to avoid investing in stocks.

The stock market remains the very best wealth-creation engine ever devised, and you need to realize that, even when you see stocks plunging.

Yes, you need to be cautious and reduce the risk in your portfolio when the trend is bearish. But DO NOT let trepidation and ursine phobia paralyze you.

Be intrepid, be smart — and be an investor.

***************************************************************

ETF Talk: Make Money When the Market Struggles with This ETF

An ongoing theme in the markets lately has been the sound of doom and gloom.

Be it geopolitical concerns, inflation or Fed moves, investors are seeing an increased need to run for cover. And technology stocks have been bearing the brunt of recent sell shocks.

But just because the market may not be cooperating doesn’t mean a savvy investor can’t find a way to make money. When others run for the hills, another option is to profit from market downturns with an exchange-traded fund (ETF) like Direxion Daily Technology Bear 3X Shares (TECS).

The strategy of this fund is simple enough. It provides highly leveraged inverse exposure to a broad basket of U.S. large-cap tech companies. When the S&P Technology Select Sector Index goes down, this fund goes up by approximately three times as much. Of course, the reverse is also true, so wild fluctuations in price are the norm with this ETF.

Because of its nature as a bearish ETF, this fund tends to lose value over time. Investing in it is all about timing. And the last year is no exception; it’s down 26%. However, the last three months have been a sweet spot, as TECS is up 41.26% during that time period.

Using an investment like TECS means betting against such names as Apple Inc. (AAPL), Microsoft Corp. (MSFT), NVIDIA Corp. (NVDA), Visa Inc. (V) and PayPal Holdings Inc. (PYPL). Needless to say, given their historical performance, that is a risky proposition. That’s why this investment vehicle is more of a short-term trade. It can also be used as a hedge against a market downturn, although the leverage may make it a risky way to do so.

For investors who believe they can see a market downturn coming, Direxion Daily Technology Bear 3X Shares (TECS) could be the key to short-term gains during a difficult time for the market.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

My Five Favorite Quotes to Live By

When it comes to the wisdom required to get us through life and to help us navigate its inevitable turbulent swings, sometimes all we need is the power of a great quote.

As a self-described “Renaissance Man,” I’m a big fan of finding wisdom about life from all sorts of disparate sources. That wisdom could come from literature, or from song lyrics or from sports figures.

Yet wherever it comes from, the wisdom we can gather from others can help keep us high during the best of times… and help us keep our heads high during the worst of times.

Here are five of my favorite quotes that apply to both life — and investing.

“Every man’s life ends the same way. It is only the details of how he lived and how he died that distinguish one man from another.”

–Ernest Hemingway

One of my favorite writers, Ernest Hemingway, knew how to live life on the intense edge. Here, the pugnacious novelist reminds us that all that really matters in life is how you spend your days.

When it comes to investing, like Hemingway, you need to be aggressive and intense, as really good results come to those who embrace the action.

“Hemingway” also is the name of my trusty canine.

“I was blessed with talent, but I worked like I had none.”

–Kobe Bryant

The Los Angeles Laker great always worked harder than just about any of his competitors. Could Kobe have coasted on his innate talent and still done well? Probably. However, it was his attitude and work ethic that set him apart from the rest, and that made him one of the greatest players of all time.

Whatever you do in life, if you adopt the work ethic and attitude of Kobe Bryant, you are likely going to do very well.

If I took the time to bleed from

All the tiny little arrows shot my way,

I wouldn’t be here!

–Rollins Band, “Shine”

In-your-face punk rocker Henry Rollins is a personal hero of mine, as his focused lyrics and penetrating ideas on cultivating strength of will are indeed inspirational.

Here, Rollins reminds us that you are always going to be criticized by others for what you do. And so what?

Do what you think is best and ignore the haters, as they’ll always want to shoot arrows your way.

From first to last

The peak is never passed

Something always fires the light

That gets in your eyes

–RUSH, “Marathon”

The quintessential progressive rock trio has the best lyrics in all of rock music. In this song, RUSH tells us that no matter how much you achieve, you can always challenge yourself and achieve more.

This is a great lesson for anyone because no matter how well you do, you can always be a little smarter, a little savvier and a little more fulfilled.

“The quickest descent into unhappiness is to constantly compare yourself to others.”

–Jim Woods

This final one is my own, and it’s helped keep my restless mind in check on countless occasions.

While it’s natural to gauge your success in life by the success or lack thereof in others, you will drive yourself crazy if you obsess over what others have, or how others are living or what others have achieved.

To be truly happy, you need to be happy with your own striving for success, and for your own victories. In fact, the only person you should compare yourself with is you.

So, strive to be better than you were the previous day. If you can achieve that, you’ll be on the path toward happiness.

*****************************************************************

Tough Folks Do

Life ain’t fair

Saddle up, boy, and see it through

Tough times don’t last

Tough folks do

–American Aquarium, “Tough Folks”

We have all heard the cliché, “When the going gets tough, the tough get going.” Here, the great folk rock band American Aquarium puts its lyrical twist on that sentiment — a sentiment that we all should adopt in everything we do, including our approach to investing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods