The Bigger the Virus, The Louder the Government

- The Bigger the Virus, the Louder the Government

- ETF Talk: A Semiconductor ETF for a V-Shaped Recovery

- Why Most Businesses Fail in the First Five Minutes

- Make the Coronavirus Kindness Choice, an Audio Essay

- Tumult Never Stops

***********************************************************

The Bigger the Virus, the Louder the Government

“Never allow a crisis to go to waste.”

That’s the newly reprised sentiment from Rahm Emanuel, the former mayor of Chicago and chief of staff to President Obama.

In 2008, Emanuel became well known for this rather sinister exhortation because he used it as a justification to grow big government during the 2008 financial crisis. Yet this past Sunday, Emanuel brazenly said it again during an interview on ABC’s “This Week.”

Now in fairness, Emanuel was referring to the need to start planning for the future, so that, when another global pandemic hits, we will have economic measures in place which will prevent another Great Depression. Yet, the sentiment here permeates through the halls of political power, because crises such as wars, economic upheaval and widespread health emergencies are often springboards for more government intrusion in our lives. And most often, that intrusion doesn’t go away once a crisis is over.

Today, Congress is about to make Emanuel smile because it has concocted a “ginormous” emergency spending bill estimated at some $2 trillion. Though the full text of the bill has yet to be released, indications are that the legislation will provide direct financial checks to many Americans of up to $1,200. The bill also will drastically expand unemployment insurance, offer hundreds of billions in loans to both small and large businesses and extend additional resources to health care providers.

In a statement, Senate Majority Leader Mitch McConnell (R-KY) said, “This is a wartime level of investment into our nation.” He also added, “The men and women of the greatest country on Earth are going to defeat this coronavirus and reclaim our future.”

Now, I agree with the sentiment here from Sen. McConnell when it comes to Americans facing war-like conditions from the coronavirus. I also agree with him on our country’s greatness and our need to defeat our viral enemy and reclaim our future.

What scares me, however, is a future where government has grown into an even more massive leviathan than it already is. The reason why is because just about every government program that’s ever been implemented remains alive and well. In most cases, the leviathan grows and grows and grows, infecting (no pun intended) the freedom of every citizen.

Just look at how big the government was before this crisis. Indeed, we were running massive, trillion-dollar debts to finance the cash-hungry leviathan — and that was before this pending $2 trillion stimulus bill went into effect.

Now, unlike some of my free-market colleagues, I don’t think that there is an easy answer to the economic devastation that’s hit the United States and the rest of the world. When the government essentially shuts down economic activity by proclamation in an effort to contain the spread of the coronavirus (e.g. government “shut-in” orders), it does seem incumbent upon that government to act in order to ameliorate the economic destruction it knows will follow.

That’s what is supposedly going on in Congress right now. While the action that has been taken in Washington is music to Wall Street’s ears (the Dow Jones Industrial Average is up more than 17% since Monday’s close), I suspect that the new “Fortissimo” tune of Big Government will remain long after COVID-19 becomes “Pianissimo.”

For those of us who love freedom, individual rights, property rights and as little government as possible, the negative lingering effects of Big Government’s growth, due to the coronavirus, will be a challenge. That’s why it is more important now than ever before to get our arguments clear, to argue from principles and to work hard against the admittedly tempting notion that government will come to the rescue and save us from any and all adversity.

In the weeks to come, I’ll be peeling back the intellectual layers of this complex and problematic onion skin. Here, I plan to look at the many reasons why government regulations are largely responsible for the shortages of many of the crucial medical supplies that we need in this crisis. I also plan to explore the economic fallout from the massive debt and deficits we’ll face when this situation is over. Finally, I’ll look at the wider issue of the government’s role in protecting individual rights and why those rights always become a casualty during times of acute crises.

So, please stay tuned.

P.S. Do you know precisely when to sell your stocks? We do, because we have a plan in place to tell us when to buy — and more importantly — when to sell our positions. That plan is the proven, four-decade-plus trend-following plan at the core of my Successful Investing advisory service.

If you want to make sure you have our proprietary “Safety Switch” in place that tells you when this market should be sold, and when it’s safe to get back into the market after you sell, then you simply must check out my Successful Investing advisory service, today.

**************************************************************

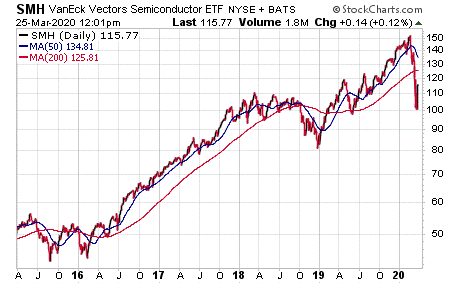

ETF Talk: A Semiconductor ETF for a V-Shaped Recovery

The devastating wealth destruction that has been caused by the coronavirus is unprecedented. And as bad as it’s been for the equity markets, we do know that when the virus is defeated, the buying will begin again. When that happens, there will likely be a “V-shaped recovery” that will send some of the highest-quality sectors higher. The V-shaped rebound also will likely send some of the most beaten-down market sectors higher as well.

Over the next several weeks, the ETF Talk will feature several funds that are likely to do well when the market rebounds. Leading things off is a fund that’s pegged to the technology sector and one that offers direct exposure to semiconductor chipmakers. These are the hardware stocks that develop, manufacture and power the brains behind all our technological devices.

The VanEck Vectors Semiconductor ETF (NASDAQ:SMH) tracks a market-cap-weighted index of 25 of the largest U.S.-listed semiconductor companies.

Since it only holds companies that are listed in the United States, it is easier to trade, but has a somewhat limited scope. SMH allocates about one-third of its portfolio to Intel NASDAQ:INTC) and Taiwan Semiconductor (NYSE:TSM). Still, with only 25 holdings, the fund is a highly concentrated play on the market.

As one of the most liquid semiconductor exchange-traded funds (ETFs) on the market, SMH trades in large volumes with penny-wide spreads to match, and its underlying liquidity is ideal for block traders. It’s also an efficient fund with a modest expense ratio and reliable tracking. It appears to be a strong play in the semiconductor space for those who are willing to accept the extra exposure to the United States.

With the recent state of the market, SMH is available at a discounted price. As you can see in the chart below, SMH has been trending upwards for a long time and has shown its ability to weather market corrections.

Chart courtesy of StockCharts.com

The fund has $1.84 billion in assets under management, a 0.2% spread and a 0.35% expense ratio, meaning that it is less expensive to hold relative to other exchange-traded funds. SMH shares are trading around $115, down from a 52-week high of $152.62. The fund has a distribution yield of 1.61%. Its next distribution date is on Dec. 21.

In short, SMH is a concentrated, predominantly U.S.-based ETF consisting of mega-cap semiconductor companies. Due to being heavily weighted in the United States, the fund has a somewhat narrow scope. However, investors who are looking to gain exposure to the semiconductor space should consider this fund.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Why Most Businesses Fail in the First Five Minutes

It often is said that more than half of new businesses fail during the first year, but that’s actually a bit too optimistic. The fact is most businesses fail in the first five minutes.

That’s the premise, and the title, of the new book by two of the nation’s leading business consultants, my friends John Paul Mendocha and Gabe Bautista.

In the new episode of the Way of the Renaissance Man podcast, John Paul and Gabe join me directly from the W Ranch for an intimate dining room conversation about why most businesses are doomed to fail from the start, why it usually takes several years to realize it and why correct positioning is essential for anyone who wants to create a successful enterprise.

Gabe, Jim, Paratrooper the Quarter Horse and John Paul at the W Ranch

More importantly, you’ll find out how and why John Paul and Gabe are both Renaissance Men, and why I am so excited to share their eclectic backgrounds, experience and their years of hard-earned knowledge and wisdom about how to properly position your business, and your life.

If you’ve ever wanted to learn why some businesses succeed while others fail miserably, then this episode is positioned to win just for you.

********************************************************************

Make the Coronavirus Kindness Choice, an Audio Essay

In last week’s issue, our lead story was about how you can “Make the Coronavirus Kindness Choice.”

This story was well-received, and I want to thank those who wrote in to tell me they found it valuable.

Given the nature of the topic, as well as its timeliness, I decided to do a special audio essay version of the article for those who enjoy listening to content.

This audio essay is a slightly edited version of the original piece that was published in this column on March 18.

So, if you are someone who enjoys listening to audiobooks, podcasts, etc., I think you’ll like this special audio essay version of “Make the Coronavirus Kindness Choice.”

*********************************************************************

Tumult Never Stops

“For the righteous the tumult of the world never stops.”

–Samuel Beckett, “Molloy”

The social, economic and market tumult caused by the coronavirus pandemic has been trying for everyone. Yet if you are a righteous person who cares about the world, you have no doubt taken it upon yourself to do what you must to help humanity. That help may be as simple as just staying at home, or it might be as complex as going into a lab and trying to bioengineer a COVID-19 vaccine. Whatever your contribution, please continue to stay righteous — because the tumult of the world never stops.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods