The Best TV Commercial Ever

I don’t know about you, but I don’t usually pay particularly close attention to TV commercials. As a good capitalist, I realize that commercials are the fiscal lifeblood of the broadcasting business. Yet, it’s just a fact that it’s impossible to take in all the advertising messages we are bombarded with daily.

There is one commercial I saw recently that grabbed my attention, and I think it might just be the best TV commercial ever.

The commercial I’m enamored with here is from enterprise software firm SAP SE (SAP), and it stars the captivating actor Clive Owen. Yet it’s not Owen that makes this commercial so great. What makes the SAP commercial so excellent is its philosophical content, and particularly its message that business is the solution to virtually all the world’s problems.

“The best-run businesses can make the world run better,” says the ad, “Because solving big problems is what business does best.”

Boom! It’s that message that resonates so deeply with me, as a free-market purist and an advocate of laissez-faire capitalism. It’s also a message that slaps aside the notion that government is the solution to the biggest problems in society.

Indeed, the SAP ad starts out by mentioning many of those big, global problems, including: Overproducing (i.e. pollution), overcrowding, overheating (i.e. global warming), an aging infrastructure and workplace bias.

The genius of this commercial is that it asks, “Who’s going to fix all of this? An actor? Probably not.”

Then SAP correctly identifies what truly is the only real solution to nearly every problem of scarcity and unintended consequences the world grapples with, saying: “But you know who can solve it? Business.”

Now, aside from correctly identifying the only real solution to human problems, i.e. the ingenuity of humans focused on a goal and driven by the profit motive, what makes this commercial even more philosophically powerful is the insinuation that this kind of activity is a moral virtue.

“And doing good is just good business.”

Finally, the SAP commercial tells us that whether it’s growing more food with less water, or making “healthcare, more healthy,” or taking on other social issues such as the wage gap, the opportunity gap and the achievement gap, “Together, we can tackle every elephant in the room.”

I couldn’t agree with this commercial any stronger, and I applaud SAP for coming out with this unabashed defense of what they do, what business in general does and what capitalism can do for humanity.

And, as the closing lines go… “Because whatever the problem is, business can help. And I know who can help them do it… SAP.”

Bravo, SAP. You’ve managed to make a commercial that not only positions your company as one that can aid in resolving the world’s biggest issues, you’ve also succeeded in making this free-market warrior smile with philosophic delight.

If you want to learn how I apply my laissez-faire economic mindset to help my newsletter subscribers win big in the markets, then I invite you to check out my Successful Investing, Intelligence Report and Fast Money Alert advisory services, today.

**************************************************************

ETF Talk: Seeking Dividends from Overseas

Many investors actively seek out companies with high dividend yields because of several unique advantages, such as providing a source of steady income, offering reduced comparative risk, etc.

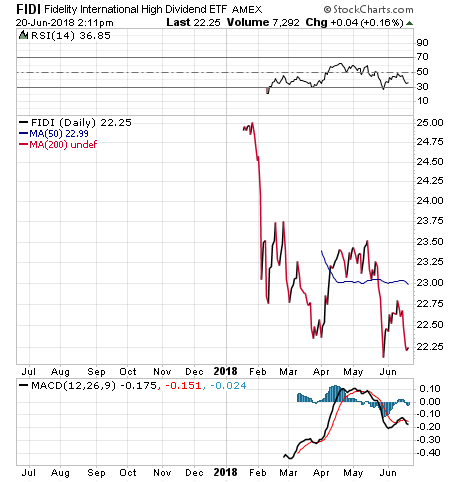

One example is the Fidelity International High Dividend ETF (FIDI), which is an exchange-traded fund (ETF) exclusively built to maximize gains from dividends. As a twist, however, FIDI holds a portfolio of 100 large- and mid-cap high-yielding stocks from developed markets that do not include the United States.

As a new fund with an inception date of January 16, 2018, FIDI was designed by Fidelity Investments to cater to “an increased interest among Fidelity clients” who are seeking factor-based investments, as well as international exposure away from the United States.

The fund considers the following factors in selecting its equity holdings: dividend yield (70% weight), payout ratio (15%) and dividend growth (15%).

And as a new fund, FIDI has just $15.95 million in assets under management and an average daily trading volume of $180,000. Over its brief existence, FIDI has slid 8%. However, over the same period, the market has fared worse, falling 9.4%. The fund’s expense ratio of 0.39% is on the lower end of the norm, compared to other exchange-traded funds that focus on dividend-paying holdings. FIDI’s dividend payout is about 4%, which may well attract investors.

Chart courtesy of Stockcharts.com

FIDI’s top five holdings are Royal Dutch Shell PLC (RDSB), 3.27%; Vodafone Group PLC (VOD), 3.23%; Telstra Corporation Ltd (TLS), 3.14%; SSE PLC (SSE), 3.01%; and BT Group PLC (BT.A), 2.80%.

For investors seeking a dividend-paying fund with an international focus, Fidelity International High Dividend ETF (FIDI) could be worth your time to consider, especially after its recent pullback. As always, make sure to do your due diligence before making any investment decisions.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*************************************************************

‘Paving for Pizza’: A Free-Market Ideal

“But Jim, who would build the roads if we didn’t have government?”

That’s the bromide argument that any free-market, small “l” libertarian like me hears whenever we suggest that government isn’t required to carry out societal tasks such as building infrastructure like dams, bridges and roads.

Of course, most people know that government performs these tasks, and just about every task, inefficiently, expensively and poorly. That’s certainly been the case with roads, as America’s city streets are plagued with a profusion of potholes.

How bad is the pothole situation? Well, according to TRIP, a national transportation research group, my home city of Los Angeles, California, and the surrounding Southern California cities are the worst-ranked when it comes to road conditions.

TRIP reports that 63% of the Los Angeles-Long Beach-Santa Ana area roads are ranked in “poor” condition. Yet lucky for me, my vehicles and the roads I frequently traverse — and lucky for America at large — one company refuses to rely on government to repair damaged roads.

That company is Domino’s Pizza (DPZ), and the fast-food delivery chain has taken it upon themselves to conduct widespread road fixes with its “Paving for Pizza” campaign.

The company is promising to partner with customer-nominated towns to fix potholes, repair road surfaces and to help provide a service that many Americans think of as the exclusive province of government.

Here’s how the Domino’s Paving for Pizza website humorously describes the project’s mission:

Potholes, cracks, and bumps in the road can cause irreversible damage to your pizza during the drive home from Domino’s. We can’t stand by and let your cheese slide to one side, your toppings get un-topped, or your boxes get flipped. So we’re helping to pave in towns across the country to save your good pizza from these bad roads.

Yes, this is tongue and cheek, but there’s nothing funny about the principle being applied here. That principle is economic self-interest, and it’s the easiest answer to anyone who argues that “without government, who would build the roads?”

The answer is: Those with an economic incentive, and those who have an economic self-interest in fixing the roads.

This is true for Domino’s Pizza, and it’s true for all of the nation’s roads, bridges, tunnels, dams, power plants, railways, etc. Those with an economic incentive, i.e. those who benefit most via the acquisition and/or maintenance of profits, can and should be the ones who build out infrastructure.

Infrastructure should not come from big government boondoggle projects that contain earmarks for powerful senators, congressmen and the pet projects in their districts, usually in exchange for a favorable vote somewhere down the line.

Now, when it comes to roads in particular, the reason they exist is to service people’s transportation needs. That need could be getting to and from work or school or getting freight of nearly every variety from one city or state to another. Or, it could simply mean getting a pizza buyer a hot product — without the delivery agent sustaining damage to his vehicle in the process.

Whatever the transportation goal, a free-market alignment of the funding of roads is what will make an infrastructure buildout more responsive to the end users. And just like in the case of Domino’s, the cost of roads and other infrastructure would be borne by those with the self-interest and financial incentive to do so.

Of course, I know the Paving for Potholes project is more publicity stunt than an actual free-market response to our nation’s infrastructure needs. Yet the fact that Domino’s is doing this does serve to demonstrate the principle that government isn’t required to do what people would otherwise do if there were not government involvement in such activities.

For bringing this realization into the public square, I am going to thank Domino’s tonight by ordering an extra-large pie with pepperoni, meatballs and extra cheese.

Fast Money Summit and FreedomFest Just Three Weeks Away!

What to do with some of your investing profits? How about rewarding yourself and joining other investors at this year’s Fast Money Summit and FreedomFest, July 11-14, Paris Resort, Las Vegas? It starts in one month! Over 1,000 people have already signed up for “the world’s largest gathering of free minds.” If you haven’t attended, you are in for a treat, including a major debate about the future of Tesla (Nasdaq:TSLA). We’ve now posted the entire schedule online at https://www.freedomfest.com/agenda-3/.

Plus, we just confirmed a new speaker. Yeonmi Park, a North Korean defector who has shared her journey to freedom in a book called “In Order to Live,” will give us her views on the impact of the historic summit between President Trump and North Korean dictator Kim Jong-un.

Now is the time to sign up. Our discounted room block ends this week! Save $100 on the registration fee by using coupon code EAGLE100. Sign up here at www.freedomfest.com/register-now/ or call toll-free 1-855-850-3733, ext. 202.

*********************************************************************

The Power of Words

“If you want to change the world, pick up your pen and write.”

— Martin Luther

The theologian and church reformer famously challenged papal authority, and in doing so changed the course of history. Perhaps more importantly, he did so via the power of the pen. The lesson here is that if you have a societal grievance, or even just a small personal grievance, there’s no better remedy than putting your thoughts out to the world in writing. Remember, never underestimate the power of a few well-placed words.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.