Thank You, Mr. O’Neil

Thank You, Mr. O’Neil

The Roman statesman and philosopher Cicero wrote, “The life of the dead is placed in the memory of the living.” This quote came into my consciousness for the first time in decades right after I learned of the death of my mentor, the great William J. “Bill” O’Neil. Businessman extraordinaire, investing genius and creator of the publication Investor’s Business Daily, Bill O’Neil died on Sunday at age 90 at his home in Santa Monica, California.

Now, why is “Mr. O’Neil” my mentor? Well, because my first real job when I got out of the U.S. Army in the early 1990s was at Investor’s Business Daily. Interestingly, at the time I didn’t really know much about stocks or investing, although philosophically I was a champion of free markets and capitalism, ideas I learned from brilliant thinkers such as Ludwig Mises, Milton Friedman, Adam Smith and Ayn Rand. Yet by happenstance, fate or just dumb luck, I was fortunate enough to begin my business career working for one of the smartest and most innovative men in the investing business, a man whose work has made countless individuals wealthy — including your editor.

Now, why do I call him “Mr. O’Neil” and not Bill O’Neil? Well, because his presence commanded respect, a respect that I will always hold for the man based on what he taught me, what he did with his life and what he did for me and so many others. I think the best way to describe Mr. O’Neil is that he was a no-B.S. straightshooter with a purpose. That purpose was to make money in the stock market, and to show others how to do the same.

Indeed, his seminal book on investing was basically named after his mission. “How to Make Money in Stocks,” first published in 1988 and revised and updated multiple times since, remains to this day the very best book on investing I’ve ever read. And if you haven’t read it, then get yourself a copy today. Subscribers to my trading services will no doubt recognize Mr. O’Neil’s DNA throughout my investing philosophy, strategy and tactics. I mean, when the man himself teaches you his strategies, how can it not?

Now, one of my proudest moments in business is when I was selected to create and write online courses teaching the investing ideas in “How to Make Money in Stocks.” I still remember the famous “education modules” as we called them, which premiered in the earliest online platforms such as America Online and CompuServe. In those days, the internet was just getting started as a place for publishers to add value to existing content. I recall arguing with some skeptical Investor’s Business Daily colleagues, including Mr. O’Neil, that the internet and online publishing would soon replace print as the dominant way to convey information. Needless to say, my prognosis proved prescient.

One thing that I always loved about Mr. O’Neil is that despite understandable skepticism regarding the future migration of his company to a predominantly online platform, he was always ready to embrace a good idea. This willingness to adapt to changing circumstances and to adopt new tools is a quality found in every really successful person I’ve ever met. I think the reason why is because recognizing the need to adapt to change is the mark of a person guided by reason, not dogma. And because man’s only tool of survival is his rational mind, the recognition of needed adaptations is always a precursor to continued success.

Mr. O’Neil proved his ability to adapt using reason in the 1960s, when he was an early adopter of computers used to analyze stock market data much more efficiently. By the mid-1970s, he was using a computer program to help pick stocks. “What we’re trying to do is take emotion completely out of the market,” Mr. O’Neil once told The New York Times.

While a reduction of emotion via identifying key metrics that make stocks go higher (e.g. earnings growth, relative price strength, industry strength, overall market conditions, chart patterns, etc.) was his goal, Mr. O’Neil never lacked emotion in his approach to success. My recollection of him was always a man driven to achieve. A man who embodied the “can do” ethos in his very being. I mean, just the way he walked, talked and looked into your eyes when he spoke with you gave one the very real sense of a man not messing around with reality. A man who was always intent on getting things done. Indeed, a man who loved the doing.

As Ayn Rand famously wrote in “The Fountainhead,” “Before you can do things for people, you must be the kind of man who can get things done. But to get things done, you must love the doing, not the secondary consequences. The work, not the people. Your own action, not any possible object of your charity.”

That is the ideal that I associate with Mr. O’Neil, and it’s one of the reasons why I consider myself most fortunate to call him my mentor.

Now, over the past couple of days, I’ve read a few good obituaries about Mr. O’Neil that dig into more details about his upbringing and his early idea formation. I recommend you read these obituaries as a way to get more acquainted with the facts of what made him who he was. Yet, obituaries always seem to fall short of the emotional imprint that a life leaves on those profoundly influenced by it.

Yet, if Cicero is right, the life of the dead is placed in the memory of the living, then Mr. O’Neil will remain alive and well within those he helped live a better life — and for those who revere men who love the doing.

***************************************************************

ETF Talk: Learn to Invest in Deep Learning AI

With the tech sector soaring to seemingly astronomical heights, a key driver appears to be artificial intelligence (AI).

AI technology is still new and exciting, with expectations of its growth continuing to rise, leaving many investors wanting a piece of the profit pie. Let me introduce a fund that can offer investors exposure to this tempting opportunity.

Enter the TrueShares Technology, AI & Deep Learning ETF (LRNZ). LRNZ is an actively managed, concentrated portfolio of global stocks centered around the development and utilization of artificial intelligence and deep learning technologies. The fund holds 20-30 mostly large-cap stocks at a time, all of which either derive at least half of their revenue from, or are seen to have a competitive advantage in, AI technologies.

The fund’s stocks are sorted into one of three categories. The first, secular growth, consists of stocks the fund managers use as a buy-and-hold strategy. This category is expected to have the greatest number of holdings. The second, cyclical growth businesses, are monitored to identify shares that ideally can be bought at the bottom of a cycle and sold at their peak. Finally, there are initial public offering positions, which are built over several months following an IPO.

LRNZ contains primarily U.S. stocks, which consist of more than 99% of its holdings. Over 72% of its assets are in technology services, with additional smaller holdings in electronics, health technology and retail trade. Top current holdings include NVIDIA Corp (NDVA), Advanced Micro Devices, Inc. (AMD), Snowflake, Inc. (SNOW), Schrodinger, Inc. (SDGR), Mobileye Global, Inc. (MBLY), SentinelOne, Inc. (S) and Samsara, Inc. (IOT).

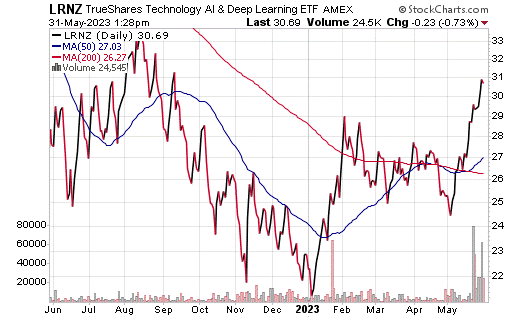

Chart courtesy of StockCharts.com.

As of May 29, LRNZ is up 20.19% in the last month, 16.78% in the past three months and an astonishing 32.68% year to date (YTD). The fund also boasts a current expense ratio of 0.69%.

While this window into the world of AI investing is exciting, it’s always important to consider your personal financial situation and goals before making any investment. Investors are always encouraged to do their due diligence before adding any stock or ETF to their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Let the Freedom Party Begin

If you know me, you know I’m always up for a good party. And while my wild, all-night music business soirees of the 1990s now have given way to more substantive intellectual gatherings, a great party is still a great party — especially if that party is in the service of liberty.

Today, I am honored to invite you to what I suspect will be one of the very best parties of the year, and it’s all going down in the land of the Delta blues!

Yes, I’m talking about FreedomFest, the world’s largest gathering of free minds. This year’s event theme is “The Soul of Liberty,” a theme that I really love. The reason why is that my conception of “soul” is one that exists free of coercion, free of servitude and one imbued with libertarian freewill.

As the brilliant novelist/philosopher Ayn Rand wrote in “Atlas Shrugged,” “As man is a being of self-made wealth, so he is a being of self-made soul.” Indeed, I think we are beings of self-made soul, but in order for that soul to prosper, we require the freedom to choose. Yet as Ronald Reagan once warned, “Freedom is a fragile thing and is never more than one generation away from extinction.”

Now, while freedom is a beautiful concept, it’s also one under constant assault.

Anti-freedom, authoritarian forces on both extremes of the political and philosophic spectrum actually abhor the notion of liberty, as free minds thinking for themselves are viewed as a threat to their ability to impose control. And guess what, they are right.

Free-thinking humans are always a threat to wannabe demagogues, would-be dictators, authoritarians, nationalist movements or any other stripe of collectivism intent on telling you that they know what’s in your best interest and how you should live better than you do.

Well, I reject this concept, and I do so by assuming the responsibility of thinking for myself. And, knowing that I have the responsibility of thinking for myself is why I love FreedomFest.

You see, in order to come to rational decisions about the world, one must be exposed to the best ideas. Moreover, one must also be exposed to ideas that one may disagree with, because it is only through carefully weighing opposing views that you can truly understand and properly defend your own views. And at FreedomFest, there are many opposing views presented, which is one of the reasons why I love it.

For example, one of the featured speakers last year was businessman and former Democratic presidential candidate Andrew Yang. Now, I wouldn’t vote for Andrew Yang, as we have very different views on politics and the role government should play in our lives.

Your editor exchanges ideas over libations with Andrew Yang at FreedomFest 2022.

Yang wants to provide everyone with a “universal basic income,” and I want to provide everyone with “universal basic reason.” Still, Yang was offered a platform at FreedomFest to talk about his new project, the Forward Party. Here is an area of agreement I do share with Yang, as the new party’s motto is “Not Left. Not Right. Forward.”

Now, this week, it was announced that the keynote speaker at this year’s FreedomFest is who my friend, colleague and FreedomFest founder Mark Skousen calls, “the man who has restored his faith in America.”

That man is Mike Rowe, executive producer of such TV series as “Dirty Jobs,” “Somebody’s Gotta Do It,” “How America Works” and “The Story Behind the Story.” Mike also is the author of the New York Times bestseller, “The Way I Heard It,” and he’s also a podcaster extraordinaire.

One reason why both Mark and I really like Mike Rowe is that he brings Americans together. Here’s a man who can comfortably talk with Chris Cuomo on NewsNation (and CNN before that) and Tucker Carlson on Fox News. Now how rare is that!

I’m really looking forward to hearing Mike’s message about how he is making a difference in reinvigorating America’s work ethic through his mikeroweWORKS Foundation. I’m also looking forward to sampling some of Mike’s Knobel Tennessee Whiskey, as his sample offerings will no-doubt result in one of the most popular booths at the Memphis bash.

Of course, Mike Rowe is only one of the many fantastic speakers already inked for FreedomFest. The line-up also includes Steve Forbes, John Fund (National Review), Steve Moore (Heritage Foundation), Tulsi Gabbard (a former Democratic congresswoman), Michael Shermer (Skeptic magazine), Enes “Freedom” Kanter (a former NBA basketball player), David Boaz (Cato Institute), Bryan Kaplan (GMU), Douglas Brinkley (“America’s Historian”), Grover Norquist (Americans for Tax Reform), Art Laffer (famed economist), Richard Epstein (New York University law professor), Amity Shlaes (historian), Magette Wade, Barbara Kolm (VP of the Austrian central bank) and many more. Go here for the full lineup.

Returning as master of ceremonies is Lisa Kennedy, host of Fox Business, and returning as cohost is my most excellent friend, the sublime Heather Wagenhals. There’s the Anthem film festival, a libertarian comedy festival and a full three-day investment conference, including such financial gurus as Alexander Green (Oxford Club), Louis Navellier and David Bahnsen. Plus, there will be a special interview with Jeremy Siegel, the “Wizard of Wharton,” and Burt Malkiel (Princeton).

And last but definitely not least, my fellow financial editors at Eagle Publishing will be at FreedomFest — including Bryan Perry, George Gilder, Roger Michalski, Paul Dykewicz — and of course, Mark Skousen and yours truly.

Finally, we are expecting a full house in July, but we have saved room for The Deep Woods reader, and at a special $77 discount off the registration fee. Use the code EAGLE77 to save $77 off the registration fee by going to www.freedomfest.com. Or call Hayley at (855) 850-3733, ext. 202.

The $77 discount will end today (May 31). No exceptions. So, sign up now and the join me, Mark, Mike Rowe and everyone else at “the world’s largest gathering of free minds.” I guarantee you the joint will be jumpin’.

*****************************************************************

O’Neil Wisdom

“Over-diversification is a hedge for ignorance.”

–Bill O’Neil

Mr. O’Neil was never hesitant to speak his mind. I remember one time when he addressed complaints about the editorial pages being too political. He said, and I’m paraphrasing, “If people don’t like it, they can go out and start their own newspaper. After all, it doesn’t cost much money.” That is the kind of humor and unapologetic wit he regularly demonstrated. In the quote here, he wasn’t hesitant to criticize those who argue in favor of a widely diversified investment portfolio, describing it as a “hedge for ignorance,” was one of his many caustic-yet-thoughtfully accurate observations.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

P.S. Come join me, some of my Eagle colleagues and more than 30 other speakers at the Annual Summer Market Summit. This virtual event is from June 5 through June 8. Click here now to sign up for this free, virtual event! See you there!

P.P.S. Come join me and my Eagle colleagues on an incredible cruise of our own! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.