The Tax Plan Favors the Rich, Because That’s Who Pays

In a recent New York Times column, “The G.O.P. Is No Party for Honest Men,” Keynesian warrior and Nobel Prize-winning economist Paul Krugman starts out by admitting he is confounded that only 60 percent of Americans in a recent poll think that the tax plan favors the rich.

According to Krugman, “It’s shocking that as many as 40 percent of Americans don’t realize this.” Well, you might be surprised that I agree that the tax plan does favor the rich… and it should.

Indeed, one of the most aggravating accusations levied against the Trump administration and the GOP’s tax reform proposals is that it favors the rich.

I say aggravating, because that criticism is analogous to saying that the lunch special at the Chinese buffet favors those who eat a lot.

Of course, the tax plan, i.e. tax cuts, are going to favor the rich. That’s because it’s the rich who pay the taxes.

This simple fact of reality seems to be lost on those who are quick to criticize tax cuts, chief among them Krugman. Surely, the Yale and MIT-educated professor knows that the overwhelming majority of income tax revenue collected by the federal government comes from the richest Americans, i.e. the much-maligned “top 1%”?

According to Krugman, “The main elements of the [GOP] plan are a cut in top individual tax rates; a cut in corporate taxes; an end to the estate tax; and the creation of a big new loophole that will allow wealthy individuals to pretend that they are small businesses, and get a preferential tax rate. All of these overwhelmingly benefit the wealthy, mainly the top 1 percent.”

Again, I agree, and that agreement should make perfect sense to anyone looking at things objectively. I mean, after all, shouldn’t a tax-cut plan be designed to give tax relief to those who pay the most taxes?

Now, if you don’t believe me, let’s just take a look at the numbers — numbers so clear that even the Nobel Prize winner can understand them.

According to data from the non-partisan, yet conservative-leaning Tax Foundation, there’s no denying who bears the greatest burden in terms of overall income taxes paid.

The most recent data analysis published at the Tax Foundation is for 2014, and it tells us the following:

- In 2014, the top 50 percent of all taxpayers paid 97.3 percent of all individual income taxes while the bottom 50 percent paid the remaining 2.7 percent.

- The top 1 percent paid a greater share of individual income taxes (39.5 percent) than the bottom 90 percent combined (29.1 percent).

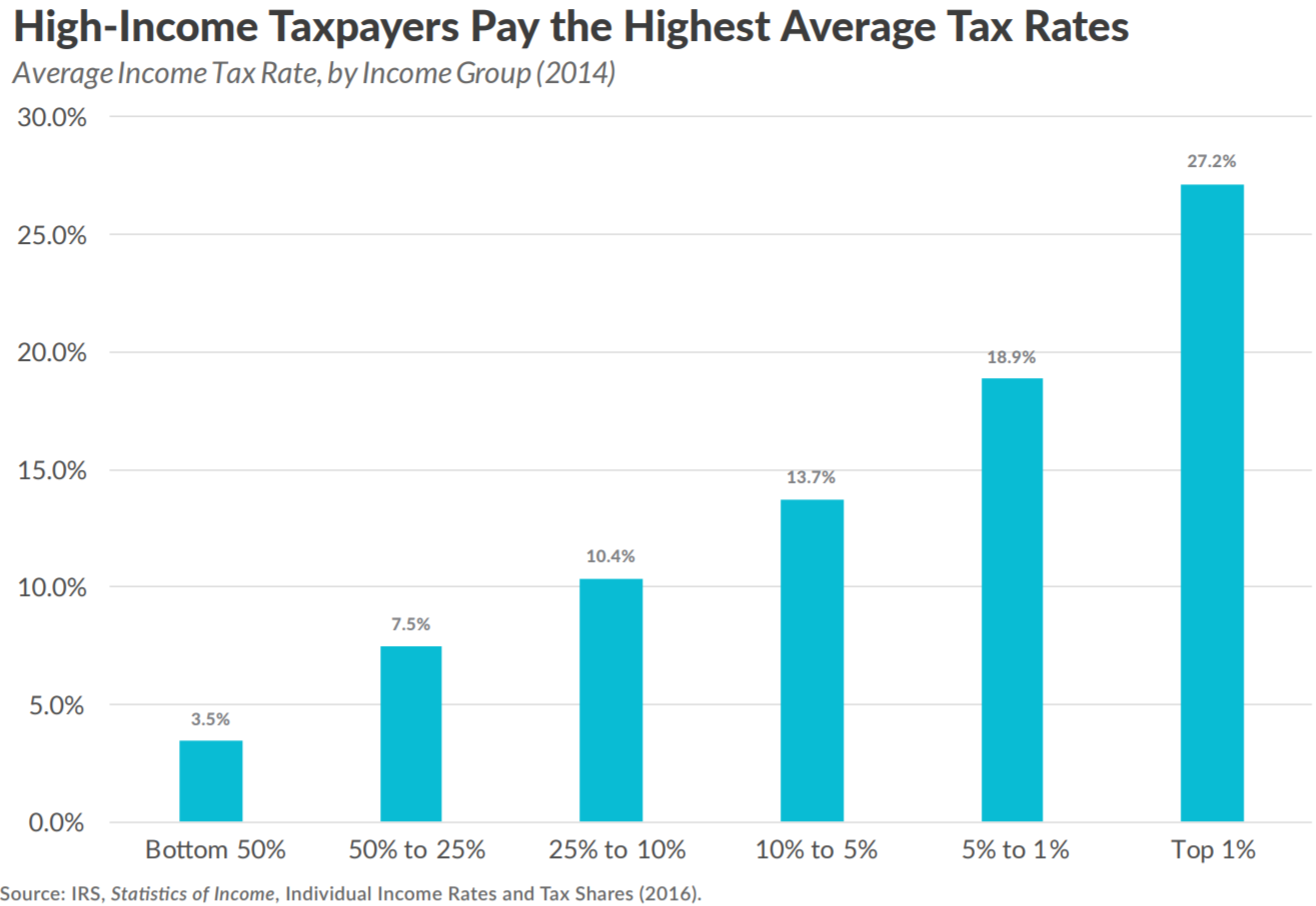

- The top 1 percent of taxpayers paid a 27.1 percent individual income tax rate, which is more than seven times higher than taxpayers in the bottom 50 percent (3.5 percent).

The chart here illustrates this final point quite vividly.

What we have here is irrefutable evidence that the overwhelming burden of the overall tax base falls on the shoulders of the richest taxpayers.

So, I ask again, if you are going to cut taxes, why wouldn’t you start by cutting the taxes of those who pay the most taxes?

Yet these numbers don’t seem to matter to Krugman and others who share his view that tax policy should unduly harm the most successful in society. To Krugman and his ilk, taxes should be punitively progressive, meaning they should punish those at the top.

Then, they want that tax revenue redistributed via government bureaucracy to the projects, policies and political goals of those who hold power.

It is not enough to just give those who pay the most in taxes a tax break. The Krugmans of the world want to squeeze the rich for as much as they can because, in their grand philosophic view, society is the real owner of that money, not the individual.

Yet I have a solution for Professor Krugman and those in his intellectual camp that should appeal to them, especially if their interest is purely one of fairness.

How about a HUGE tax cut for EVERYONE?

The only entity that would suffer from tax reform of that sort is government — and that’s why leftists and progressives will never support it.

*************************************************************

ETF Talk: This Aerospace and Defense Fund Gets the Job Done

The PowerShares Aerospace & Defense ETF (PPA) is a smaller exchange-traded fund (ETF) than the two “big guns” in the aerospace and defense sector — the SPDR S&P Aerospace & Defense ETF (XAR) and the iShares U.S. Aerospace and Defense ETF (ITA) — but the mighty mite has generated some substantial returns this year.

This fund offers a traditional take on a market sector by investing in defense companies. The defense industry makes up about 5% of U.S. gross domestic product (GDP).

The fund allocates to the companies it holds by using a market-cap-weighting strategy. As a result, more than half of PPA’s assets are invested in large-cap securities, with mid-caps making up another 35%.

The companies held in the portfolio range between value and growth, with a greater percentage of the companies characterized as growth investments, but only narrowly so. This fund pays out a dividend yield of slightly more than 1%, while the expense ratio comes in at around 0.6%. Assets managed currently total $775 million.

Over the last 12 months, PPA has had a strong showing, rising 39.63%. Compared with the 19% return of the S&P 500 Index over the same time, PPA’s return is virtually double the amount. This performance is slightly weaker than that of the other defense funds, but is not far behind. As the chart below shows, PPA has seen fairly smooth sailing all year long, as the fund’s share price has come nowhere near its 200-day moving average.

The top 10 holdings of PPA comprise 56.7% of its assets. The top five are United Technologies Corp. (UTX), 6.98%; Lockheed Martin Corp. (LMT), 6.90%; Honeywell International Inc. (HON), 6.84%; Boeing Co. (BA), 6.81%; and General Dynamics Corp. (GD), 6.58%. None of the top 10 companies should be surprising fixtures in a large-cap aerospace and defense fund and many are household names.

For investors seeking a typical ETF investment strategy in the aerospace and defense sector at a cheaper price than other options, the PowerShares Aerospace & Defense ETF (PPA) makes for a solid and uncontroversial choice.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**********************************************************************

Still Bow Down to the Dow

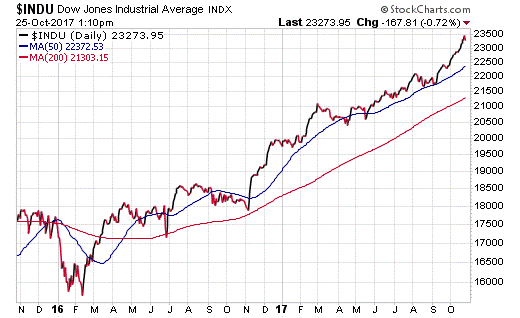

It is midday Wednesday, Oct. 25, and as I write this week’s Alert, the Dow Jones Industrial Average is down about 160 points after just having vaulted nearly 200 points in Tuesday’s session. Of course, those gains come after last week’s historic surge past yet another major milestone — the 23,000 mark — a number that was almost unthinkable just nine years ago.

Take a look at a two-year chart of the Dow below. Here we can see the remarkable resilience since early 2016.

We also can see that except for a brief pullback below the 200-day moving average in June 2016 due to the “Brexit” scare, the Dow has been in a confirmed bull market since basically March 2016 — or more than 18 months!

To this I say we must pause, bow down to the Dow… and give it respect.

I say that, because this has been the most unloved bull market in my professional lifetime, and one that has been haunted by the ghosts of the Great Recession, as well as a near-oppressive cloud of skepticism over what’s driven stocks higher.

The main driver, of course, has been the Federal Reserve and its money printing scheme that’s artificially inflated equity prices. While I certainly understand the skepticism brought about by the unprecedented moves by the central bank to pump excess liquidity into the system via the numerous quantitative easing permutations, the fact is that if you had put money to work in the Dow when that money printing began you would have more than doubled your money.

Yet the reason the Dow (i.e. the broad market) also deserves to be bowed down to is because despite the Fed’s return to rate normalization, 2017 has been one of the best years in recent memory.

The Industrial Average is up nearly 18% year to date, and that’s been a direct result of the Trump pro-growth hope trade, improving economic data and surprisingly strong corporate earnings.

And, those gains have come despite the Fed hiking rates, and signaling more rate hikes later this year, and after announcing its intentions to start reducing its balance sheet.

Yes, there are those elusive “animal spirits” pushing investors into equities this year, and many on the Street (particularly the merchants of doom, who always see a black cloud on the horizon) think those animal spirits are both irrational and too exuberant (Hello, Mr. Greenspan).

Yet until this market proves, via objective price action, that it no longer has the will to continue moving higher, we must still continue to bow down the Dow (and the S&P 500, the NASDAQ Composite, the Russell 2000, the NASDAQ 100, semiconductors, super-cap internet, etc., etc., etc.…

If you’d like to find out how we determine when to be in stocks, and more importantly, when it finally makes sense to be out of stocks, then I invite you to check out my Successful Investing advisory service.

Hey, it’s not like we have a proven track record of winning market calls for the past four decades… oh wait, we do!

**************************************************************

Power and Hypocrisy in Tinsel Town and the Media

Growing up in Southern California, and doing my undergraduate work at the University of California, Los Angeles (UCLA), I have always been surrounded by the entertainment industry. I have friends “in the business,” including actors, writers, directors and those in back-office production roles.

The people I know in the industry either love their jobs (or really like their jobs). They’re well-compensated, and they help produce a product that the world generally loves.

Yet I have never met a person in the entertainment industry that’s ever denied the reality that there’s widespread misuse and abuse of power by those at the top. And, I have never met anyone who hasn’t acknowledged there’s widespread, blatant hypocrisy practiced on the part of so many elitist Hollywood liberals who generally advocate for liberal/progressive ideas, but whose own behavior falls far short of their stated ideals.

Now, abuse of power and blatant hypocrisy isn’t unique to Hollywood. Every industry, and every segment of society has its nefarious practitioners. Yet when it comes to the entertainment industry, the high-profile, worldwide platform it enjoys makes it especially ripe for egregious hypocritical behavior.

The latest example here is that of Harvey Weinstein.

By now, I suspect most people have read about the allegations levied against the mega-producer, which include a decades-long history of sexual misconduct, harassment and even sexual assault.

If you want to get a look into the details of this rather harrowing tale, I highly recommend The New Yorker article by Ronan Farrow, “From Aggressive Overtures to Sexual Assault: Harvey Weinstein’s Accusers Tell Their Stories.”

Warning, however, you may find yourself in need of a shower after reading about Weinstein’s alleged misbehavior.

Yet perhaps not surprisingly, Weinstein was revered by many on the political left, as he was a big donor to many high-profile campaigns, including those of President Obama, President Bill Clinton and two-time presidential loser Hillary Clinton.

Weinstein also was an outspoken advocate of progressive causes, and a harsh critic of conservatives and Republicans.

The hypocrisy here is that Weinstein was apparently the epitome of a smarmy man who used his power and influence to get what he wanted from women — women whose careers he knew he could make or break at any moment.

So much for the progressive values of equality in the workplace, women’s rights, a hostility to the “white-male power structure,” etc.

Weinstein’s alleged sexual misconduct, even sexual crimes, spit in the face of these values, all while his millions were going to help foist these ideals into the public conscience.

Yet what also disturbs me, perhaps even a bit more than the alleged Weinstein behavior/hypocrisy, is what now appears to be an attempt by NBC News to scuttle the Farrow piece. Surely a media icon of NBC News’ status would want to report on a famous, influential, politically connected and undeniably newsworthy figure like Harvey Weinstein.

But apparently, that wasn’t so. In fact, according to one report, NBC News President Noah Oppenheim made a judgment this past summer that Farrow’s reporting on the Weinstein story wasn’t ready for prime-time.

In an interview on MSNBC’s “The Rachel Maddow Show,” Farrow disputed that claim, and he did so vehemently. Maddow told Farrow: “NBC says that the story wasn’t publishable, that it wasn’t ready to go at the time that you brought it to them.”

Farrow retorted by saying: “I walked into the door at The New Yorker with an explosively reportable piece that should have been public earlier. And immediately, obviously, The New Yorker recognized that. And it is not accurate to say that it was not reportable. In fact, there were multiple determinations that it was reportable at NBC.”

In my opinion, the alleged actions of NBC News seem to represent another form of hypocrisy, even cover up. That hypocrisy is one where you conceal an ugly truth to protect someone in your ideological camp.

Now, to MSNBC’s credit, which is an NBC Universal property just like NBC News, the topic was discussed. Also to Maddow’s credit, the host brought up the subject. I don’t often agree with Ms. Maddow’s political views, but one thing you cannot accuse her of here is hypocrisy, and for that she deserves respect and acknowledgment.

If there’s any good to be taken from the Weinstein episode, and from similar episodes in recent years, it is that sexual harassment and the abuse of power must not be tolerated. It is truly a scourge on society, as it nullifies the victim’s rational pursuit of a career, and turns a mutually beneficial employer/employee situation into an ugly sexual power play.

There’s no room for it in America. Full stop.

***************************************************************

Platonic Tax Thoughts

“When there is an income tax, the just man will pay more and the unjust less on the same amount of income.”

— Plato

The father of philosophy knew that the income tax was a corrupting idea that nudged citizens to do what they otherwise might not. Indeed, whenever you have compulsion by the hand of government, you get those who fight it by any means necessary.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.