Talk Doesn’t Cook Rice, But It Might Cook Markets

There’s a well-known Chinese proverb that says, “Talk doesn’t cook rice.”

The warning here is a reminder that simply thinking about, planning and especially just talking about something won’t get what you want done. To really get something done, you must take action.

While I agree with this sentiment, I also think it’s important to note that certain kinds of talk can serve to sabotage a project.

That certainly seems like what’s happening now politically, as President Trump’s latest and, in my opinion, truly stunning comments Tuesday regarding the ugly events over the weekend in Charlottesville, Virginia, have the potential to sabotage what’s left of the administration’s pro-growth agenda.

While making a pitch for a massive infrastructure buildout, a proposal that on the surface is truly red meat to big-spending politicians on both sides of the aisle, the president essentially reverted back to blaming deadly violence in Charlottesville on both sides of the protest.

The comments, which were delivered in a combative way to the press (a tactic the president obviously enjoys, and that has worked well for him), basically pushed away even members of his own party who also found the remarks to be astoundingly tone deaf to the reality of the situation.

Equivocal comments such as, “I think there is blame on both sides,” when speaking of neo-Nazi and Ku Klux Klan violence that killed one person and injured more than 30 others, is the kind of rhetoric that makes members of Congress cringe.

Indeed, the president’s remarks Tuesday completely obscured the message he wanted to deliver on infrastructure. The comments also sparked intense criticism from Congressional Republicans who don’t want any stench of racism to cling to them.

For example, House Speaker Paul Ryan called white supremacy “repulsive,” and said “there can be no moral ambiguity.” Rep. Ileana Ros-Lehtinen, a Republican of Florida, also criticized Mr. Trump for blaming “both sides.” Then there was Republican Sen. Marco Rubio of Florida, who said white nationalists in Charlottesville were “100% to blame.”

Rubio wrote in a tweet: “The #WhiteSupremacy groups will see being assigned only 50% of blame as a win. We cannot allow this old evil to be resurrected…”

That’s about as unequivocal as it gets.

The point here is that President Trump has the power to derail his own agenda with his divisive rhetoric, especially if that rhetoric causes the Republican leaders in Congress to turn their backs on him.

And, one of the easiest ways for Republicans to justly turn their backs on the president is for Mr. Trump to appear as though he is making excuses for the repugnant, raced-based ideology of the sort that just decades ago helped plunge the world into the deadliest conflict in history… one that cost the lives of some 60 million people.

*************************************************************

ETF Talk: Investing in Value Stocks in a Growth Environment

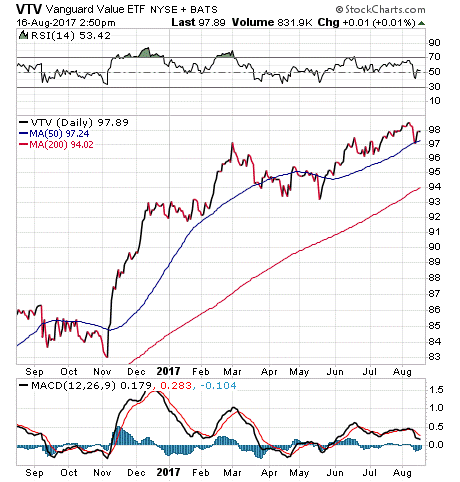

Exchange-traded funds (ETFs) such as the Vanguard Value ETF (VTV) allow investors to access multiple stocks deemed to be “undervalued” by the market while requiring minimal personal research.

Buying undervalued investments is called “value investing,” a time-honored strategy that has been employed by conservative investors for many years. Brought to the forefront of investors’ awareness by well-known investor and author Benjamin Graham and his classic book “The Intelligent Investor,” value investing uses fundamental analysis to determine when stocks are potentially undervalued by the market, making them ripe to rise when that irrationality is resolved.

By contrast, growth investing aims to pick stocks that have demonstrated better-than-average gains in earnings and are expected to keep delivering high levels of profit growth. But there are no guarantees. As a result, growth stocks tend to be more volatile than their value-based counterparts.

VTV, as one of the largest value ETFs, invests in a spread of more than 330 positions. This significant diversification means that VTV’s return is tied more to the success of the strategy than any one stock’s performance. However, the fund does weight holdings by market cap, which makes it a somewhat stable ETF.

In an article published in The Motley Fool on July 24, VTV was listed as one of the top value ETFs, surpassed only by the mammoth iShares Russell 1000 Value ETF (IWD) with its $36.5 billion in assets under management. Interestingly, all of the funds listed were either iShares or Vanguard funds, which have a reputation for keeping their expense ratios as low as possible. Fittingly, VTV’s expense ratio is only 0.06%.

Since 2017 has been a good year for the market and especially growth stocks, it is no surprise that VTV has slightly underperformed the S&P 500 in the past 12 months to gain around 10% and 7% year to date. However, value stocks likely will gain favor again at some point, so this fund could have another day in the sun. Assets under management total $32 billion and the fund pays a respectable 2.4% dividend yield.

VTV allocates 26.9% of its assets to its top 10 holdings. These include “value-investing” names such as Microsoft Corp. (MSFT), 4.69%; Johnson & Johnson (JNJ), 3.14%; Exxon Mobil Corp. (XOM), 3.02%; Berkshire Hathaway Inc. (BRK.B), 2.89%; and JPMorgan Chase & Co. (JPM), 2.86%. The most represented sectors are financials, health care and technology.

If you believe in the principle of “buy low and sell high,” consider investing in value stocks. To avoid tying your fortune to only a few companies, the Vanguard Value ETF (VTV) lets you invest in one fund and gain exposure to all of the stocks in its portfolio. Decide if this ETF could be a useful investment for you.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

************************************************************

Birthday Bull Market Musings

German philosopher Friedrich Nietzsche famously wrote, “That which does not kill us, makes us stronger.” I’ve always lived by those words, and I think it’s important for us to always be pushing our boundaries. This is true physically, mentally and even emotionally.

I think this is especially true during times when personal reflection just comes more natural than at other times, as in important anniversary dates… and especially birthdays.

Last week, I turned the page on another year on this beautiful planet, and so I got to thinking deeply about ways I could push the limits a bit more in a variety of ways.

For you, the Weekly ETF Report reader, that means I plan to push the boundaries by adding even more personal, even more in-depth, and even more interesting content to this publication.

Hey, it’s my view that no matter how good things currently are, I always can try to make them better. And, that’s my promise to you going forward, as I not only value your time… I value your trust. And, anything that can help foster that trust and make our bond stronger, that’s what I will do.

This week, I have a special content feature for you from my friend and uber-smart market analyst Tom Essaye of the Sevens Report.

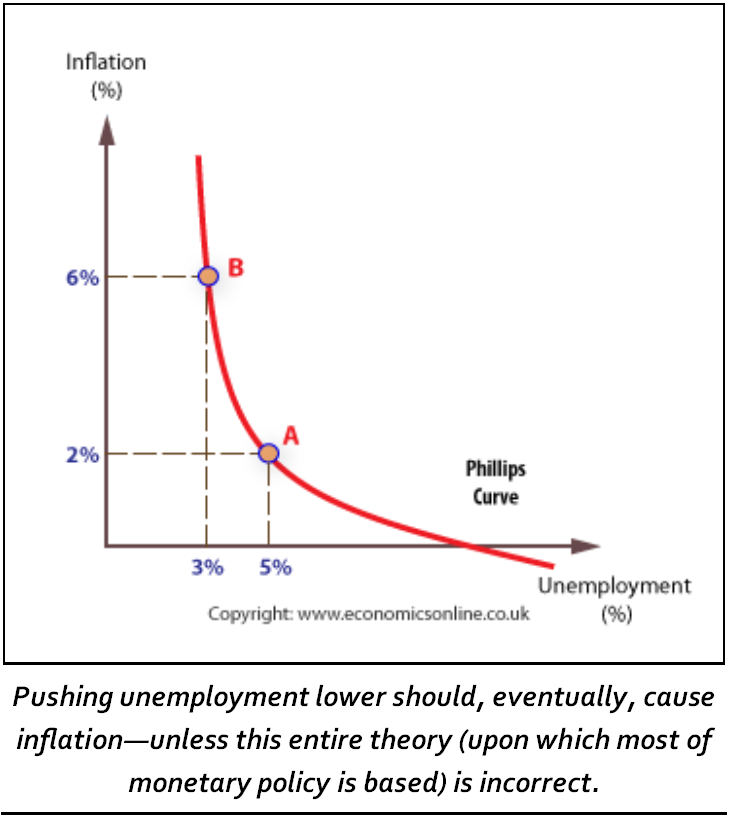

This feature is all about something you may have heard about of late, or that you likely will hear about soon. It is called the Phillips curve, and it is a thesis that factors in heavily in Federal Reserve policy decisions.

Unfortunately, the Phillips curve thesis may be breaking down.

Here is how Tom explains it:

The Phillips curve is a term you’re likely seeing and hearing more recently than at any time previously in your career (regardless of how long it is). The reason the Phillips curve is being discussed so much is simple: There’s a growing school of thought that thinks the Phillips curve is broken, and if that’s the case, then the Fed and other central banks may be largely powerless to spur inflation (which is a potential negative for the broad markets).

Before we get into this debate, first let’s get a bit of background on the Phillips curve. Basically, the Phillips curve is just a graph of this simple idea — Low unemployment creates higher inflation.

From a common-sense standpoint, it is logical. Less available workers and robust business activity (so low supply and high demand for workers) will cause salaries (the “price” of a worker) to rise, and that in turn will flow through to the entire economy.

So, the Phillips curve says low unemployment will spur inflation. And, this idea has been the cornerstone of Fed policy for decades.

But, there’s a small problem: It doesn’t appear to be working in today’s economy, as historically low unemployment is failing to spur inflation.

Now, this may seem like a theoretical, academic conversation, but it has real, near-term market consequences. For instance, the entire mid-July rally in stocks came because the Fed began to note low inflation more than low unemployment. That caused the decline in Treasury yields and exacerbated the drop in the dollar.

However, that may have changed with the recent jobs report. The unemployment rate hit 4.3%, a fresh low for this expansion and a multi-year low. So, while there is a debate about the Phillips curve still being accurate, the bottom line is that the Fed still follows it. At some point, if unemployment continues to drop, the Fed will have to continue with its rate increases.

So, the 4.3% unemployment rate was the reason the jobs report didn’t spur a rally in stocks. And, going forward, whether unemployment continues to decline will have an important impact on returns, regardless of inflation.

If unemployment grinds towards 4% or below, the Fed will have to get hawkish or either 1) Abandon decades of monetary policy that has largely worked, or 2) Risk a significant rise in inflation down the road (according to the Phillips curve) that would require a sharp, painful increase in interest rates — a move that almost certainly would put the U.S. economy into recession.

Thank you, Tom, for that outstanding analysis. I know I will be watching the Phillips curve much closer from here on.

***************************************************************

You Are How You Practice

“You are how you practice. The quality of your practice time, not the amount of time you practice, is what determines how efficiently your practicing develops your performance ability.”

— Les Wise, musician and educator

My very good friend, Les Wise of the Deliberate Musician, is a one of the greatest guitar teachers in the world, having taught tens of thousands of students over a four-decade-plus career. Here, Les gives us wisdom about practicing that not only applies to being a musician, but that also applies to being a good investor, or a good writer, a good golfer… or a good anything.

You see, it’s the quality of the effort that matters, much more so than the number of hours you spend on that activity. So, whenever you’re engaged in an activity that you want to get better at, keep in mind that quality is more important than quantity. Then, seek out the best quality advice you can, and implement it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.