Surfing With Billionaires

- Surfing with Billionaires

- ETF Talk: Obliquely Investing in Fitness and Wellness with Millennial-Approved Stocks

- Meet the Bard of Fine Cigars

- Eww, That’s Gross!

- Embrace Better Reasons

***********************************************************

Surfing with Billionaires

One week ago today, I had the profound pleasure of attending an actual, real-life black-tie dinner and gala. That’s right, an event with actual people, in an actual physical space, with actual speakers and actual humans interacting with each other.

Yes, we had to wear masks at the outset of the night. But this event also included rapid COVID-19 testing for attendees. And while no test is infallible, what we did know is that everyone at the event tested negative before we were allowed into the party (even though the party was held outside).

This event included a host of speakers, including Peter Diamandis, the founder of the X Prize, pro volleyball great Gabby Reece and her husband, big wave surfing legend and all-around cool dude, Laird Hamilton.

Your editor with surfing legend Laird Hamilton

One of the speakers at this event was Chip Wilson, founder of athleisure brand extraordinaire Lululemon Athletica Inc. (NASDAQ:LULU). Chip said something to me that really stuck in my head. He said, “If you want to be a billionaire, figure out a way to help a billion people.”

I love that sentiment because it represents the true essence of capitalism. That is to say, someone has to come up with an idea, product, service, etc., that makes lives better and that people are willing to pay more for than it costs to make.

That ethos also is at the heart of what we do in all of my investment advisory services, because whether it is investing and building wealth for the long term, or making aggressive/tactical buys and sells for short-term gains, the goal here is to put our money to work by harnessing the power of capitalism in the pursuit of becoming a billionaire, millionaire — or just getting a lot richer via the focused allocation of our investment dollars in the financial markets.

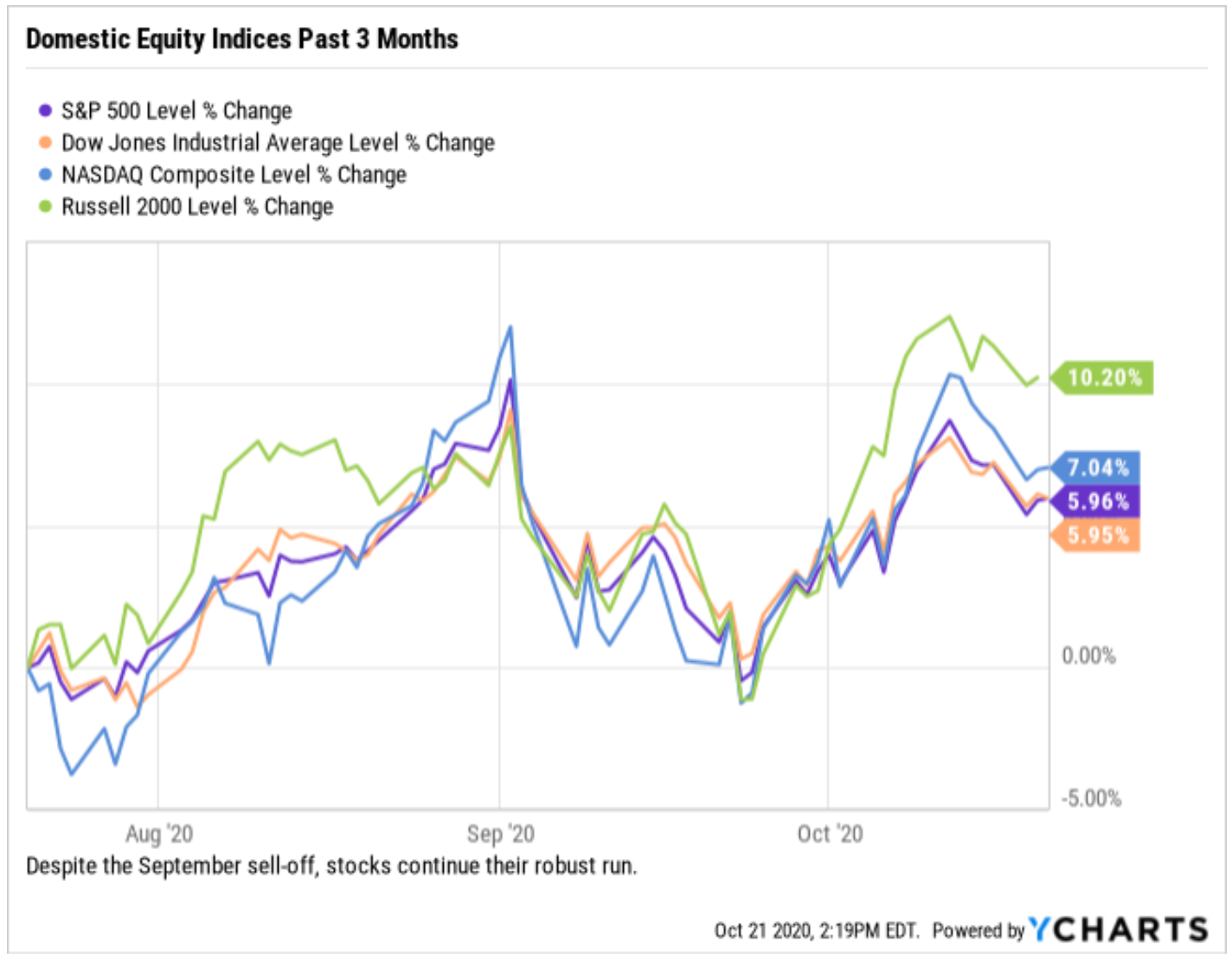

And speaking of those markets, while domestic equities hit a bit of an air pocket in September, when we shift to a three-month lookback, we can see that stocks have remained robust in the face of a host of uncertainties, including the continued stalemate on a new coronavirus fiscal aid package in Congress, increasing numbers of COVID-19 case counts in the United States and in Europe, and, of course, election angst over the outcome of the vote on Nov. 3.

Of course, all of these unknowns will be resolved at some point, but hopefully sooner rather than later. Yet, even if things are messy for longer than we’d like, capitalism and the desire of aspiring billionaires to figure out how to help a billion people will always be something we can profit from — and that will be true regardless of who resides at 1600 Pennsylvania Ave., or what party calls the shots on Capitol Hill.

Finally, I want to add a personal note here about my negative COVID-19 test. Until last week, I had not been tested for the virus (although I had no symptoms to suggest I had contracted it). Still, I must say that, although I fully expected to test negative, it was more than a huge relief to learn that I had actually tested negative. That test gave me the peace of mind that I was safe and that those who I regularly come into contact with will also be safe.

If you have yet to be tested for COVID-19 and you think you might have somehow been acutely exposed to someone who was or is positive, then take a test. I know the peace of mind was definitely reassuring for me.

***************************************************************

ETF Talk: Obliquely Investing in Fitness and Wellness with Millennial-Approved Stocks

An old adage states that “there is nothing new under the Sun.”

Indeed, as far back as anyone can remember, generations of human beings always have been locked in disagreement with each other about the various political, economic and social issues of the day. For instance, the Greatest Generation’s viewpoint conflicted with Generation X.

Later, Generation X’s ideas began to run into resistance from Generation Y, and it seems like this process will continue for the foreseeable future. Since Generation Y, also referred to as millennials born between 1981 and 1996, compose the largest cohort since the Baby Boomers, it is not surprising that the tastes, interests and desires of people in that group will shape the modern economy for some time to come.

The key characteristics of millennials are their racial and ethnic diversity, their independence and their sense of empowerment. Companies likely will need to change their product offerings to attract and retain the attention of the children of the technological revolution.

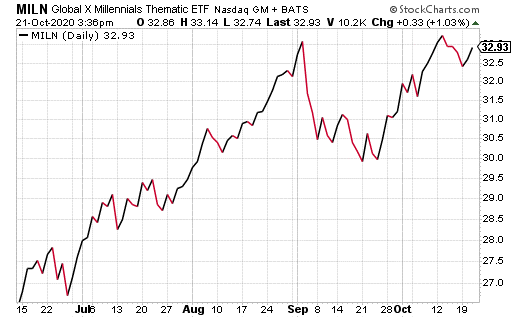

An exchange-traded fund (ETF) called the Global X Millennials Thematic ETF (NASDAQ:MILN) was specifically constructed to reflect the zeitgeist of this new generation. Thus, MILN tracks an index composed of U.S.-listed companies that derive a significant source of their revenue from spending categories associated with millennials.

The index divides the market into several spending categories that its managers deem to be of vital importance to millennials. These include entertainment, travel, food, education and so on. Then, between five and 15 companies are placed in each category and scored by the level of their exposure. From there, the companies that are deemed to have the highest level of focus vis-à-vis millennials are scored by another scale and then weighted by market capitalization.

Some of this fund’s top holdings include Square, Inc. Class A (NYSE:SQ), PayPal Holdings Inc. (NASDAQ: PYPL), Lowe’s Companies (NYSE: LOW), Apple Inc. (NASDAQ: AAPL), Spotify Technology SA (NYSE: SPOT), eBay Inc. (NASDAQ: EBAY), Amazon.com, Inc. (NASDAQ:AMZN) and Facebook, Inc. Class A (NASDAQ: FB).

Chart courtesy of www.stockcharts.com

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Oct. 20, MILN has been up 8.07% over the past month and 10.92% for the past three months. It is currently up 25.94% year to date. The fund has amassed $101.52 million in assets under management and has an expense ratio of 0.50%.

In short, while MILN does provide an investor with a chance to tap into the hip, modern, trendy and cool world of the millennials, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Meet the Bard of Fine Cigars

There is perhaps no more iconic symbol of the ethos of celebration than a fine cigar.

In the new episode of the Way of the Renaissance Man podcast, I speak with tobacconist, historian and purveyor of the Way of the Renaissance Man brand cigars, David Haddad, creator of Fumar cigars.

David is a most interesting gentleman. He’s a man that can regale you with true stories of his interactions with U.S. presidents, military leaders and world diplomats, as well as the key role he and the cigar have played in recent diplomatic history.

Through developing a new business model with the luxury cigar experience at the epicenter, David has traveled the world, bringing the celebration of the cigar to some of the most hostile, war-torn places on the planet.

A former child actor, former golf pro, current entrepreneur and philanthropist, this is one Renaissance Man who has truly earned the moniker.

I very much enjoyed my conversation with David, and I suspect you will too.

******************************************************************

In case you missed it…

Eww, That’s Gross!

When I was in grade school, I remember the in-vogue expression among the girls in my class was, “Eww, that’s gross!

The term was used to convey dislike and disgust towards a variety of behaviors from uncouth school-age boys. And, looking back on the silly things that boys do in their formative years, I can retroactively sympathize with the girls.

Yet, fast forward a few decades to adult life, and I’m now proud to actually promote something that’s also “gross,” i.e. I am proud to tell you about “Gross Output,” or simply “GO,” which is a new and better way of assessing the health of the economy. Now, in the interest of full disclosure, GO is a tool promoted by my Fast Money Alert co-editor, the always-brilliant Dr. Mark Skousen.

But what, exactly, is GO and why is it a better measure of the economy? To understand GO, I will quote from Dr. Skousen’s website on the subject, Grossoutput.com.

“In economics, gross output (GO) is the measure of total economic activity in the production of new goods and services in an accounting period. It is a much broader measure of the economy than gross domestic product (GDP), which is limited mainly to final output (finished goods and services).

GO is defined by the Bureau of Economic Analysis (BEA) as “a measure of an industry’s sales or receipts, which can include sales to final users in the economy (GDP) or sales to other industries (intermediate inputs). Gross output can also be measured as the sum of an industry’s value added and intermediate inputs.”

So, when we analyze GO and GDP simultaneously, we can get a much fuller, much more accurate picture of what is really going on in the economy. The key here is that GDP accounts for final output only: the finished goods and services bought by consumers, business and government. In contrast, GO measures total spending at all stages of the supply chain.

What I find most interesting about GO is that it allows us to know much more about the true condition of the economy. Moreover, GO is especially significant during economic downturns.

As Dr. Skousen wrote in a recent Wall Street Journal op-ed, “In past recessions, GO declined much faster than GDP and gave an earlier view of the depth of the recession. During the financial crisis in the fourth quarter of 2008, GO fell 6.6%, compared with a 2% drop in GDP — more than three times as fast. The GO decline showed that even while consumer sales held up, businesses were slowing investment in future production.”

So, what is GO telling us about our current COVID-compressed economy?

As Dr. Skousen writes: “In 2020, that trend is clearly reversed. In both the first and second quarters, GO fell slightly less than GDP. In the second quarter, real GO declined by 8.4% while real GDP decreased by 9% (in quarterly, nonannualized terms). GO didn’t collapse by multiples of GDP as it has in past recessions. The decline was close to 1-to-1, rather than 3-to-1.”

Dr. Skousen concludes that while it is clear that consumer spending dropped sharply in 2020 as a result of the COVID -19 lockdown, businesses were wise enough to think long term and toward an expected recovery — and thus to adjust accordingly.

So, despite the headline GDP “bad news” in the economic data, the GO “good news” suggests the recovery from this recession will be faster than most analysts thought. And as Skousen writes, “The sooner states open up their economies, the faster we will see a return to a dynamic American economy.”

A dynamic American economy — now, there is nothing gross about that!

P.S. The presidential election, and more importantly, our Post-Election Summit are only two weeks away!

This private, in-person, “off the record” financial summit sponsored by the Investment Club of America. This confidential meeting will take place on Nov. 6-7 (right after the elections) in an undisclosed location in Las Vegas.

As it stands today, the election betting odds favor the Democrats. If the Biden/Harris ticket wins and the Democrats take over the House and the Senate, what will that mean for investors, entrepreneurs and the citizens of America? What happens if President Trump is re-elected, but the Democrats take control of both houses of Congress?

To help make sense of it all, we have brought together some of the world’s top experts to discuss the outcome of the November elections, including Mark Skousen, Hilary Kramer, Bryan Perry, and yours truly, to name just a few.

Due to legal restrictions, attendance at the Post-Election Global Financial Summit will be limited. We urge you to register now and not be disappointed.

To learn more about the conference, go to https://globalfinancialsummit.co/.

*******************************************************************

Embrace Better Reasons

“The first duty of a man is to think for himself.”

— José Martí

While this might seem like a basic truism, the duty of thinking for yourself is actually rare. How do I know this? Well, try this thought experiment. Think about something you believe in right now and make it a conviction that you hold deeply. Now, ask yourself how you came to believe in it.

Most likely, if it’s something that your parents drilled into you, or if it’s a majority opinion in the wider world, or a common belief, did you really come to that conclusion by thinking for yourself? Hopefully, the answer is yes. But if you can honestly say that you’ve just always thought that way because that’s how you were brought up, well, then you simply need better reasons than that. Challenge yourself to embrace the better reasons.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods