St. Patrick and the Myth of Snakes

Today is St. Patrick’s Day, and all around the Western world, there will be celebrations commemorating Ireland’s patron saint. Yet, like so many things about reality, the facts surrounding a situation are sometimes quite different than the myths associated with that situation.

For example, did you know that St. Patrick wasn’t Irish? In fact, he was born in Britain, not Ireland, near the end of the 4th century. Interestingly, at age 16, he was kidnapped by Irish raiders and sold as a slave to a Celtic priest in Northern Ireland. He later escaped captivity and returned to Britain. However, after becoming a Christian missionary, he returned to the Emerald Isle to help spread the gospel.

One of the more interesting notions about St. Patrick is that he was the man who rid Ireland of snakes. As the legend has it, St. Patrick once stood atop an Irish hillside and banished snakes from the island. After his proclamation, legend has it that all of Ireland’s serpents simply slithered away into the sea.

Unfortunately, scientific research suggests snakes never actually occupied the Emerald Isle, as there are no signs of snakes in the country’s fossil record. Moreover, water has surrounded Ireland since the last glacial period, and before that, the region was covered in ice, which means it would have been too cold for reptiles to survive.

So, in the case of St. Patrick and the myth of snakes, well, it’s a case of a myth busted.

Now, when it comes to investing in financial markets, there is no shortage of myths. And unfortunately, some of these myths can do a lot of harm to your financial well-being.

One of the biggest myths I see that hurts investors’ bottom lines, and that also creates way too much unnecessary angst, is the myth that investing and politics go hand in hand.

For example, after the 2020 presidential election, many of my friends asked me if they should sell all their stocks and go to cash because they thought the Biden administration would cause markets to plunge. President Trump even warned of such an outcome if Biden were to be elected.

I told my friends, as well as readers of my advisory newsletters, that this type of irrational move would be a huge mistake. The reason why is because history tells us that politics and investing do not go hand in hand.

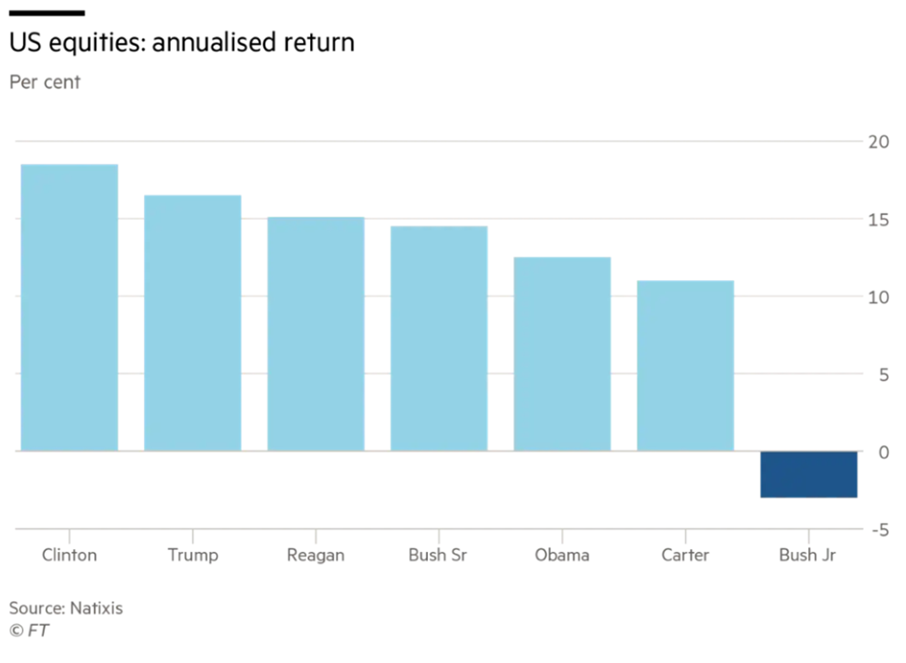

Take a look at the annualized return results here (as compiled by Natixis) under the various presidential administrations.

As you can see, the results over seven administrations are decidedly mixed among Democrats and Republicans in the average annual return category. Indeed, results here confirm that there is no precise way to predict the outcome of stock market returns under a specific political party.

The reason for this is simple, and it is that politics and investing do not go hand in hand. It’s simply a myth that they do. The better realization here is that there are countless variables that influence equity prices, from societal trends to technological innovations to human psychology.

Now, this is not to say that politics and policies such as tax rates and regulatory policy don’t have anything to do with equity returns; they do. Yet they are not the determinant factor, and to make bad decisions with your money (i.e., going to cash or 100% gold) just because one party is in control of the White House and/or Congress is just plain silly.

So, don’t allow yourself to be a victim of myth.

Make the best decisions with your money, and your life, that you can with the best, most rational and most objective information and advice you can find. Doing so will help you bust bad myths, and it might even turn you into your very own patron saint of higher returns.

***************************************************************

ETF Talk: Staving Off Inflation With the iShares 0-5 Year TIPS Bond ETF

For investors looking for a fund that provides excellent coverage of the U.S. short-term Treasury Inflation-Protected Securities (TIPS) market, the iShares 0-5 Year TIPS Bond ETF (NYSEARCA:STIP) may be of interest.

The fund tracks TIPS with a remaining maturity of fewer than five years and offers a somewhat more diverse portfolio than competitor PIMCO 1-5 Year U.S. TIPS Index Exchange-Traded Fund (NYSEARCA: STPZ), which excludes TIPS bonds that have a maturity of less than one year. Though bonds that have a shorter maturity have a lower yield, they are a wise choice for investors seeking protection from interest rate risk.

Investors who are looking for comprehensive exposure to the short-term TIPS market may want to look into STIP. The fund provides ample liquidity for all types of traders and trades briskly every day with small spreads. In terms of the fund’s efficiency, it ranks highly as it maintains tight tracking and has a minimal fee that keeps holding costs to a minimum.

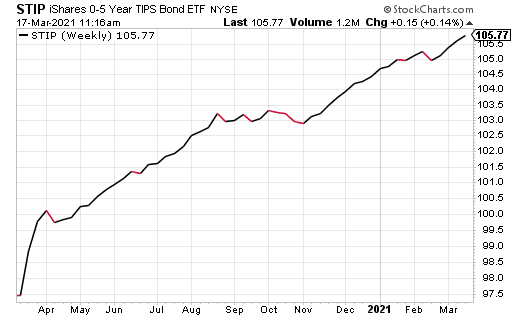

The fund has an expense ratio of 0.05% and a dividend yield of 1.33%. STIP has $3.92 billion in assets under management and $3.68 billion in net assets. It launched in late 2010, and it has performed steadily in the last year, as the chart below shows.

STIP spiked greatly in April and climbed upward from that point. It dipped mildly at the beginning of November and then regained its traction toward the middle of the month. This morning, March 17, the fund opened at $105.83, which is at the high end of its 52-week range.

Courtesy of Stockcharts.com

The ETF’s top three holdings, which make up 22.12% of its total assets, are: United States Treasury Notes 0.63%, 10.18% of assets; United States Treasury Notes 0.13%, 6.24%; and United States Treasury Notes 0.5%, 5.71%.

This fund is a highly efficient one with strong liquidity. Moreover, it is less risky than other funds as it holds short-term bonds that are well-shielded from interest rate risk. STIP is a better match to the market it tracks than its competitor STPZ, as it holds bonds with a maturity of fewer than five years, while STPZ does not hold bonds with a maturity of less than a year. So, for investors looking for a briskly traded, low-fee fund with comprehensive exposure to the short-term TIPS market, the iShares 0-5 Year TIPS Bond ETF (NYSEARCA:STIP) may be of genuine interest.

However, I urge interested investors to conduct their own due diligence to decide whether this fund fits a particular individual’s personal portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

A Curious Conversation in Three Parts (Part II)

Want to know what happens when a Renaissance Man is put in the interview spotlight by two of the nation’s leading business consultants?

Well then, you’re in luck, as Part II of a three-part interview with Gabe Bautista and “Dr. Speed Selling” John Paul Mendocha, from the Position to Win Podcast, is available right now.

In this episode, we talk more about the financial markets, what it means to “sell short” and the implications of the GameStop (GME) short squeeze. We even talk about cultivating the hardened resolve required to succeed in life the way Sylvester Stallone of “Rocky” and “Rambo” fame has.

I suspect you’ll enjoy listening to this second of the three episodes with my friends John Paul and Gabe as much as I enjoyed speaking with these two brilliant gents.

*****************************************************************

In case you missed it…

Of Masks and Men

The mask.

It has become the must-have accessory of the COVID-19 pandemic. In fact, right now, I would venture to guess that you possess more than one style of mask, and perhaps a few masks that brandish a logo of some sort — either a corporate identity, a sports team or a political message.

You probably also have masks with various levels of protection. I have three-ply surgical masks with N95 protection, and I also have a few of the bigger N95 surgical masks that I was fortunate enough to procure early in the pandemic.

I have a white mask, a red mask, a blue mask and multiple black masks. I mean, one has to color coordinate, right?

I also have my own branded masks, complete with the logo from my lifestyle and podcast website, Way of the Renaissance Man. These, too, have space for the N95 filter inserts. I mean, you have to look good and be protected, right?

Your editor in his studio wearing a mask. And no, I don’t usually wear one indoors.

Unfortunately, the mask has become a lightning rod of sorts for people on the various sides of the polarized politics of this pandemic.

For those who are militant about continuing the lockdowns and those most vigilant about wearing masks, the notion of shedding the facial accessory when coming in contact with others is social heresy. There is even a term used by this group to describe those who don’t follow social protocol by wearing a mask 24/7, and that term is “Maskhole.” I will let you connect the dots here as to what that means.

Then there’s the other side of the issue, which is those people who have mostly eschewed the mask everywhere save for the absolutely necessary times where government or businesses have strict rules demanding it. This group is equally vigilant about not wearing the mask as a matter of social protest and government defiance. Call it an act of civil disobedience, if you will.

Now, for most of the last 12 months, the mandating of masks has been both the literal and practical law of the land. Yet, that mandate has changed recently, as Texas, Mississippi, Iowa, Montana and North Dakota are the latest states to have ended, or that will very soon end their respective statewide mask mandates.

These states now have joined 11 other states — Alaska, Arizona, Florida, Georgia, Idaho, Missouri, Nebraska, Oklahoma, South Carolina, South Dakota and Tennessee — that never required face coverings statewide.

The good news here is that due to a combination of falling COVID-19 rates (including lower hospitalization and death rates), the rollout of what is now three vaccines in use and the number of people who are likely to be resistant to the virus due to prior contraction, many states have determined now is the time to release citizens from the mask mandate and liberate businesses to invoke their own policies regarding the safety of their customers.

I am of the opinion that individuals must be responsible for their own actions. That means we all need to choose the best way to keep ourselves and others safe during this pandemic.

I’ve said this multiple times over the past year, but the reason why I wear a mask in public isn’t that the president says I should, or because my governor says I must. I’ve worn a mask this past year because it is in my own rational self-interest to stay safe and to not jeopardize the safety of my fellow man.

Now, however, with viral conditions starting to improve, and with a return to economic and social “normal” very close, we all can soon begin easing the restrictions we have lived under for over a year. That is going to be a big relief not just from a personal standpoint, but also from a broader societal aspect.

The reason why is because humans are social creatures. We survive and thrive by interacting with others. And we flourish when those interactions are mutually beneficial, and when the peaceful and profitable exchange of ideas, goods and services is able to flow freely.

Let’s hope the ultimate removal of masks from our post-pandemic world can usher in a new era of post-pandemic, benevolent human interaction. I know I will be doing my small part to help foster this effort, and I hope you will, too.

*****************************************************************

All Around the World Wisdom

Over the mountain

Down in the valley

Lives a former talk-show host

Everybody knows his name

He says there’s no doubt about it

It was the myth of fingerprints

I’ve seen them all and man

They’re all the same…

— Paul Simon, “All Around the World or the Myth of Fingerprints”

Do you know what ‘the myth of fingerprints’ is? Literally, it’s the myth that all fingerprints are different and unique. But as science tells us, that’s not actually true, it’s a myth. What also is a myth is that our differences as humans are so great that we need to embrace hatred, war, tribalism, racism, class warfare and other toxic ideas in order to survive.

Perhaps if we focused less on the trivial and relatively insignificant aspects of ourselves (skin color, geography, gender, politics, etc.) we would actually discover that we have far more in common with each other. And that realization just might make the world a whole lot better.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.