Slam Dunkin’ with Shaq

- Slam Dunkin’ with Shaq

- ETF Talk: Reveling in Industrial Real Estate

- Revisiting A Healing Molecule

- Always Be Learning

***********************************************************

Slam Dunkin’ with Shaq

Pass me the pill, and I’ll slam dunk ya like Shaquille O’Neal…

–Ice Cube, “Wicked”

This week marks a personal milestone for me, as the podcast and lifestyle website I created, “Way of the Renaissance Man,” has just turned four years old.

I’ve learned a lot over the past four years, and I’ve been fortunate to have met and interviewed some of the most interesting people in the world. Now, this time last year, I interviewed one of those interesting people, basketball legend and omnipresent pitchman Shaquille O’Neal.

In honor of the Way of the Renaissance Man podcast anniversary, today I am republishing the lead story of a year ago in “The Deep Woods” titled, “What I learned from Shaq.”

Not only do I suspect you’ll be swayed by the “Big Fella’s” charm, but you’ll also find about an investable opportunity that Shaq’s involved with that I think could be a big winner for investors.

So, let’s dig into that article right now:

I’m a very lucky man.

I have been blessed with myriad opportunities from an early age, with parents who took an active interest in my education and who always pushed me to be my best.

In fact, my mother did so in a very shrewd way. For example, say I came home from school with a 97% on a test. My mother would look at the result, pause contemplatively, and then say, “Well, Jim, that means there’s room for improvement.”

Now, you might think this is a bit harsh, but it actually was the epitome of love. You see, love is expecting the best out of someone, including yourself, in every situation. It is also holding yourself up to the highest standards, or the term that I often use, and that serves as the closing thought in every one of my publications, and that is to act “in the name of the best within us.”

But why am I bringing up this blend of history and personal philosophy? Well, because both really are at the animating core of my work, not just here in “The Deep Woods,” but in all my investment advisory newsletters. And, this is particularly true of my labor-of-love project, the Way of the Renaissance Man lifestyle website and podcast.

Today, I am proud to present the kickoff episode of Season Four of the podcast, and this week’s guest is by far the most famous individual I’ve had on the show.

Indeed, all I must do is to you his abbreviated first name and you’ll know exactly who it is… “Shaq.”

That’s right, on the new episode of the Way of the Renaissance Man podcast, I speak with basketball legend, entrepreneur, actor, musician, corporate spokesman and investor Shaquille O’Neal.

Now, when you grow up in Los Angeles like I did, the Lakers are practically a religion even if you don’t closely follow sports. So, as you might imagine, speaking with one of the high priests of the Lakers for the kickoff episode of Season Four was a true delight.

In this conversation with Shaq, we were joined by The Alkaline Water Company Chairman Aaron Keay. Now, as you may recall, Alkaline88 water is the only brand of water that I endorse, and it’s also the brand that Shaq represents.

Now, in this episode, you’ll learn how Shaq decides what business projects to get into, and just how intimately he’s involved in the details of his business ventures. As Shaq says, “he’s not just a pretty face” when it comes to business. In fact, he’s extremely hands on.

Plus, you’ll learn all about Shaq’s influences and mentors, including his main mentor since age 18, both on the court and in business, fellow Laker priest and entrepreneur Earvin “Magic” Johnson. Interestingly, I share an anecdote about when I first met Shaq and Magic some three decades ago, even before Shaq was in the NBA.

If you’ve always wanted to peek into the mind of a legendary athlete, as well as an extremely successful businessman, then I invite you to listen to the Season Four premiere episode of the Way of the Renaissance Man podcast with Shaquille O’Neal.

Finally, it’s hard to believe that we are already on Season Four of the Way of the Renaissance Man podcast. It seems like just yesterday we published the very first episode of the show, which featured tax cut warrior Grover Norquist. Yet, that first episode was almost exactly three years ago to the day (four years, now).

Yes, we’ve come a long way in our journey to help each other discover the tools needed to better focus our minds, integrate our thoughts with actions and live the lives we really want.

So, to all of those involved in making the podcast possible, and to all the fantastic guests I’ve been privileged to speak with, and most of all, to you, the podcast listener and reader of “The Deep Woods,” I want to thank you for allowing my labor of love to be part of your life.

May we continue sharing that love for years to come.

Important Note!

I’m excited to announce that I’ll be speaking at the W3BX conference Oct. 10-13 in Las Vegas. Join some of the biggest names in the industry, including my colleagues Bryan Perry and Jon Johnson, along with our publisher Roger Michalski, to learn more about investing in blockchain, cryptos, NFTs, Metaverse, mining and all things Web 3.

The Web 3 sector is expected to grow from $3.2 billion to $81.5 billion by 2030. The more you know about it, the more potential money you can make from this explosion.

Click here now to learn more about the conference and be sure to enter the code “EAGLE” when you register to save 20%. I’ll see you in Vegas!

***************************************************************

ETF Talk: Reveling in Industrial Real Estate

There is nothing typical about the state of the current economy.

Over the last few years, it has been hit by a pandemic, high inflation and supply chain shortages. However, not all atypical things are bad, and one example is the exchange-traded fund (ETF) Pacer Benchmark Industrial Real Estate SCTR ETF (NYSE: INDS).

The fund, along with several others of its type, may actually benefit if bond yields begin to come back down due to a slowing economy. Unlike the majority of real estate funds, which focus on all U.S.-listed real estate companies, INDS is far pickier, and the majority of its holdings derive the bulk of their revenue from industrial real estate ventures.

These industrial real estate ventures include warehouses, distribution centers and self-storage facilities. This non-diversified fund invests at least 80% of its assets into the industrial real estate sector, and individual securities are capped at 15%. Its underlying index is subject to quarterly rebalancing.

As seen in the chart below, INDS is a strong performer. Though it experienced a sharp dip in early June, it quickly regained its momentum. As of this writing, the stock is trading at $45.58, which is roughly a 10% gain since its June dip.

Currently, the fund has $302.95 million in net assets, a 0.60% expense ratio and a solid 1.96% yield.

The ETF’s top five holdings include Duke Realty Corp. (DRE), 14.95%; Prologis Inc. (PLD), 14.88%; Americold Realty Trust (COLD), 10.80%; Life Storage Inc. (LSI), 4.75%; and Innovative Industrial Properties Inc Registered Shs (IIPR), 4.61%.

In short, while INDS does provide investors with access to REITs, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Revisiting a Healing Molecule

Almost one year ago to the day, the lead story in this publication was titled, “Molecules From the Healing Gods.” That story was, and still is, very close to my heart for two main reasons. First, there’s a matter of personal history, which you will see in a moment. Second, there’s the matter of informing The Deep Woods readers about investable opportunities not likely to find their way into your regular financial news diet.

So, given this nearly one-year anniversary, today I am going to republish the original story. And after you read it today, I’ll give you a bullish update on the situation.

So, now please enjoy this reprise edition of “Molecules From the Healing Gods”…

January 16, 1991. That was the day that the first fighter aircraft were launched from Saudi Arabia, as well as off of U.S. and British aircraft carriers in the Persian Gulf, to commence the shock-and-awe bombing runs of Operation Desert Storm. The U.S.-led offensive against Saddam Hussein’s Iraq continued all night, and for many days later, as coalition forces pounded targets in and around Baghdad as the world watched the events transpire in television footage transmitted live via satellite.

But why am I bringing up this nugget of military history? Well, it’s because on January 16, 1991, I was about one week away from graduating from the U.S. Army Airborne School at Ft. Benning, Georgia. Now, as you might imagine, I was admittedly terrified at the prospects of being sent over to Iraq to jump into a hot war zone after only being in the Army for a little more than six months. Yet that is where I thought I was headed.

Of course, my fellow Airborne infantry and special operations cohorts were all quite boastful and outwardly courageous at the prospect of getting into the fight for our country. After all, we had volunteered for one of the most dangerous jobs in the U.S. military, and we were being trained well in the serious business of killing. Yet underneath our tough exterior, we were all downright scared (or at least I know I was, and I knew my mates in the unit were too, because they admitted as much over many nervous rounds of beers).

One evening that week, a group of soldiers including yours truly were talking to one of the Airborne School instructors, also known as a “Black Hat.” This man had been in the Army many years and was a veteran of many combat missions. We were all excited and being boisterous about the possibility of jumping into Iraq, saying things like we are going to, “Kick Saddam’s ass and kill all of his elite Republican Guard.”

Well, after several minutes of this chatter, the Black Hat had heard enough, and with a calm yet commanding voice, he looked at us with an intense gaze and said something chilling that I shall never forget: “Guys, please don’t wish for combat. It will ruin your life.”

Fortunately, I was not sent into Iraq, and I did not have to suffer any of the trauma and life-ruining post-traumatic stress of war. Yet I was one of the lucky ones. Many of my friends and fellow soldiers were sent into harm’s way during that campaign, and a few didn’t make it back. And many that did make it back outwardly unscathed, later had to grapple with the remnants of deep psychological wounds that, in many ways, did, in profound ways, ruin their lives.

This was particularly true of the post-9/11 wars in Afghanistan and again in Iraq, only those wars lasted far longer and took a much, much greater toll on so many men and women of the armed forces.

According a 2013 study by the Veteran’s Administration, from 1999 to 2010, about 22 veterans died by suicide every day. That’s about one ruined and extinguished life every 65 minutes. And thousands more veterans, men and women just like me only not as lucky, have struggled mightily with post-traumatic stress syndrome, or PTSD.

Of course, PTSD is an extreme form of stress. And while war-related PTSD is serious, the number of afflicted pales in comparison to the estimated 40 million American adults who suffer from anxiety, and the 17 million or so who experienced at least one major episode of depression. According to the Anxiety & Depression Association of America, in 2017 approximately 6.7% of American adults 18 or older, or about 17.3 million, grappled with this debilitating depression condition.

Now, statistics are one thing, but when it comes to anxiety, depression, alcoholism and addiction, and even PTSD, the numbers are somewhat shallow.

In fact, I am willing to bet that if you are reading this, you likely know a family member, close friend, professional colleague, or someone you are otherwise acquainted with who has suffered from these or other mental disorders. And if you are unlucky enough, perhaps you are the one grappling with your own inner demons.

If you know someone like this, or if that someone is you, then you know that help is hard to find. Sure, there are many good counselors, and many well-meaning doctors out there. Yet the tools they have to treat these ailments are severely lacking in both efficacy and permanence. In fact, the results are so dismal that all the medical profession can really do at this juncture is give patients daily medication designed to mask the physical symptoms.

But what if there were a safe form of treatment that could really “reboot” the human brain and allow it to be more receptive to discarding the anxiety, depression, and trauma that so many of us suffer from?

Well, there is such a treatment, and the substances used in these treatments have been known to humans for thousands of years. These substances are called psychedelics, and with the help of modern science, they are poised to become one of the most promising treatments on the mental health front in years.

Psychedelics are a class of hallucinogenic drugs whose primary effect is to trigger non-ordinary states of consciousness (known sometimes as “trips”) via serotonin 2A receptor agonism. This causes specific psychological, visual and auditory changes, and often a substantially altered state of consciousness.

Classical psychedelics, the psychedelics with the largest scientific and cultural influence, are mescaline, LSD, DMT and psilocybin.

It is the latter of these, psilocybin, that we are most interested in here, because synthetic psilocybin molecules, or what I call “Molecules From The Healing Gods,” are manufactured in the laboratory and designed for clinical therapeutic use are one of the most interesting, and most investable, trends in biotechnology.

And the company at the tip of this curative spear is Cybin Inc. (NYSE: CYBN).

Cybin is a publicly traded life sciences company focused on psychedelic drug development, delivery mechanisms, improved novel compounds and protocols that target psychiatric and neurological diseases. The shares were just uplisted to the New York Stock Exchange from the “pink sheets,” a big promotion to legitimacy from the investing community.

The company’s mission is to promote and progress psychedelic therapeutics by utilizing proprietary drug discovery platforms, innovative drug delivery systems, novel formulation approaches and treatment regimens for psychiatric disorders.

According to Cybin CEO Doug Drysdale: “We are focused on addressing the mental health crisis and transforming the treatment landscape. To do that, we are combining technology and our scientific expertise to pair novel psychedelic molecules with controllable drug delivery systems, aimed at improving outcomes for patients.”

In June (2021), I spoke with Doug and with Cybin Co-Founder, Executive Chairman and President, Eric So, via video conference about the company (isn’t that the way most meetings are held in COVID America these days?). Although neither knew this at the time, I already knew all about the financials and what the company did. In this call, I was really just trying to size up their personalities to see if I could get a read on their focus and commitment to this venture.

Well, both gents passed my “authenticity test” with high marks, and if you are a reader of my publications, you know that I am a man who values authenticity and sincerity in corporate management quite a bit — perhaps more so than many of my colleagues. Of course, authenticity is one thing, but results, along with the promise of real opportunity for investors, is what I am most concerned about.

Here, Cybin and the psylocibin-assisted therapy they are involved with shows very promising results. In addition to being used by non-traditional medical practitioners for thousands of years, there have been many recent studies showing the efficacy of modern, clinical psylocibin-assisted therapy.

I go into far more detail about the recent positive clinical trial results, as well as much greater detail on Cybin the company, and the potential investment opportunity in this stock for those who are interested in getting in on an emerging biotech company on the bleeding edge of treating the gargantuan problems of mental health and addiction issues.

If you are interested in this subject, and I think we all should be, then I invite you to download my free special report, “Cybin: Molecules From The Healing Gods.”

I am very proud of how this free special report turned out, and I am also privileged to present to you a company that I suspect can help millions around the world overcome some of the most-difficult medical issues in society today. So, check out the free special report today. I suspect that after you read it, you’ll be as interested in this subject as I am.

*********

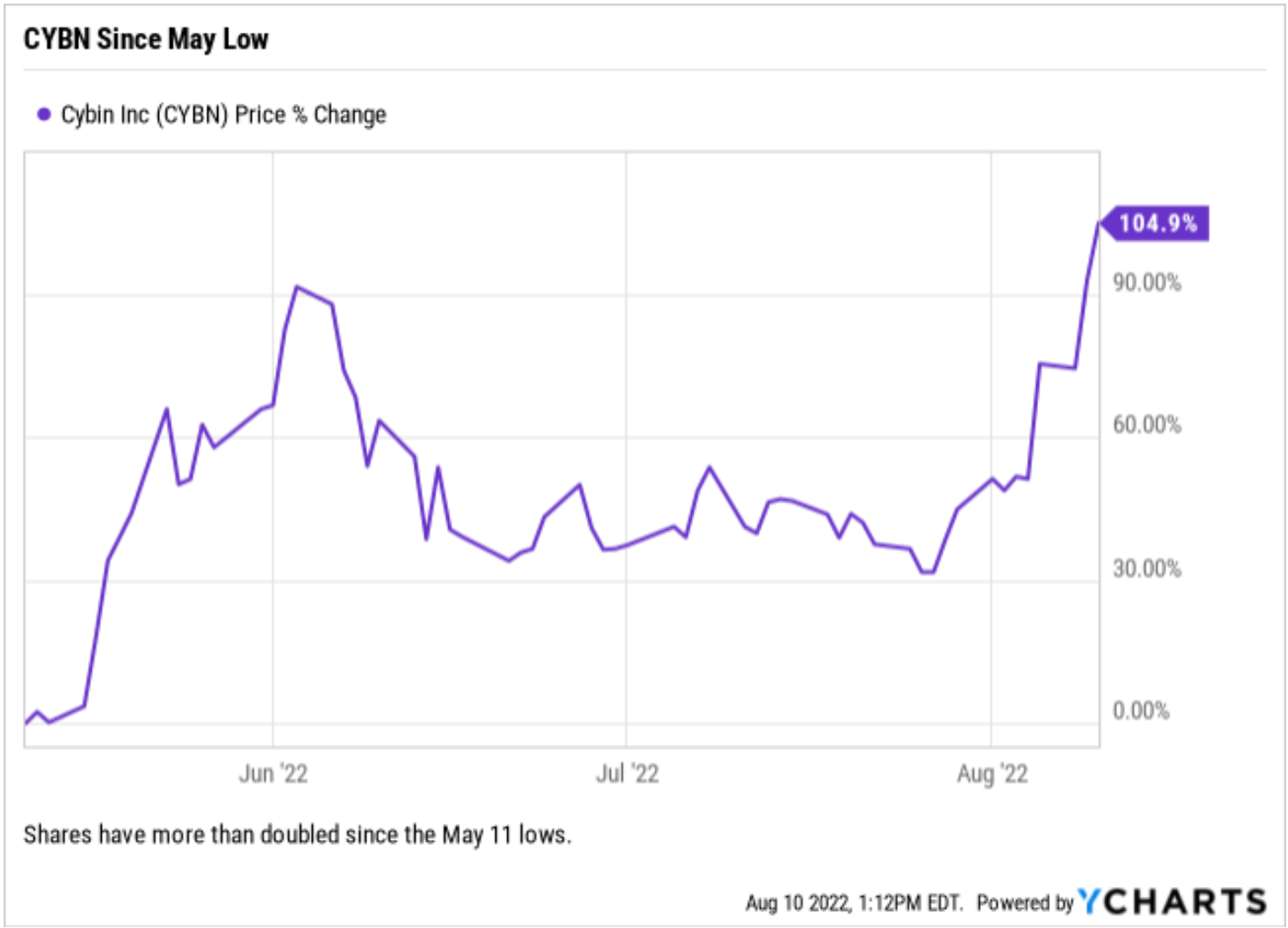

As promised, the bullish update here is that since falling to its May 11, 2022, low of $0.41 per share, the stock has more than doubled. As of this morning, CYBN shares traded at $0.83, more than double the value in just three months.

The chart here shows the recent rise in CYBN shares, and the clear momentum in the stock over the past several weeks.

On Monday, Aug. 8, Cybin reported earnings for the quarter ended June 30. I won’t dig into the details of that earnings report here, but I invite you to check it out, as there are some very bullish positives for the company going forward.

I know that; Wall Street knows that — and now, you know it, too.

*****************************************************************

Always Be Learning

“You teach best what you most need to learn.”

–Richard Bach

Over the past four years of doing the Way of the Renaissance Man podcast, I’ve learned that the best way to teach others about a subject is to first have that insatiable curiosity to learn the subject for myself. Fortunately, my “superpower” of sorts is my intellectual curiosity, as I want to know everything I can about everything I can. So, if you want to teach others about a subject, start by nurturing your love for learning.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods