Shooting Yourself in the Foot with a Fake Arrow

It is not often you see a politically savvy, likely presidential candidate shoot herself in the proverbial foot. Yet that’s exactly what Sen. Elizabeth Warren (D-Mass.) did this week, and you might say she did so with a fake Indian arrow.

Sen. Warren, who is widely seen as one of the front-runners for the 2020 Democratic nomination for president, has long said she is of Native American descent. In fact, Warren has proudly touted that claim on many occasions, including via family lore about her Cherokee ancestry.

She has told the tale of some Indian bigotry against her mother for her Cherokee blood. Warren has said that her father’s parents did not want him to marry someone (her mother) who was part Cherokee.

In her professional life, Sen. Warren has embraced the lore of her heritage by changing her listed ethnicity from white to Native American while teaching at the University of Pennsylvania Law School from 1987 to 1995. Warren was listed as Native American at Harvard University Law School, where she has taught since 1995. In fact, Harvard Law School even described Warren as the “first woman of color” on its faculty.

So, what’s wrong with being proud of your heritage and embracing your ancestry?

Nothing, as long as that ancestry is, in fact, true. But in the case of Sen. Warren, the Native American and Cherokee Indian narrative appears to be as fictitious as a James Fenimore Cooper novel.

Now, why do I think this narrative is likely fiction? Because the truth can be found in Sen. Warren’s own DNA.

Senator Elizabeth Warren speaks at a rally.

Ironically, Warren set out to prove via a DNA test that she does, in fact, have Native American blood coursing through her veins. The Senator even released a video on her website revealing the results, along with expert analysis, concluding that there was “strong evidence” that she is of American Indian ancestry.

But what did that evidence really show?

Well, it showed that Ms. Warren is, in fact, part American Indian. What part? According to the evidence, it’s somewhere between 1/64th and 1/1,024th Native American. That’s about 0.09% Native American, which experts say is roughly about half the rate of the average American.

That’s not much Native American blood. Moreover, it’s certainly not the kind of unequivocal ethnic heritage one would expect to be able to check the “Native American” box on any ethnicity documents. I mean, I have a hard time checking the “Hispanic” box on the U.S. Census given that I’m “only” 50% Latino.

As for Warren’s Cherokee ties, here the senator suffered a stinging rebuke from the tribe itself. Check out the blistering statement from Cherokee Nation Secretary of State Chuck Hoskin Jr. about this issue:

“Sovereign tribal nations set their own legal requirements for citizenship, and while DNA tests can be used to determine lineage, such as paternity to an individual, it is not evidence for tribal affiliation. Using a DNA test to lay claim to any connection to the Cherokee Nation or any tribal nation, even vaguely, is inappropriate and wrong. It makes a mockery out of DNA tests and its legitimate uses while also dishonoring legitimate tribal governments and their citizens, whose ancestors are well documented and whose heritage is proven. Senator Warren is undermining tribal interests with her continued claims of tribal heritage.”

Ouch!

Of course, the deeper issue here is why Sen. Warren is so intent on proving her Native American status?

The most obvious answer is her spat with President Trump, who has pejoratively referred to her as “Pocahontas” while also questioning her lineage claims. Most certainly, Warren is seeking to refute the president on this front.

Yet what’s more important here is that in 21st-century America, the more victimhood you can claim, the better your chances of success at the voting booth.

For Warren, who grew up of modest means, quit college to get married, had a daughter and later went back to finish college and law school, that narrative isn’t enough for the victimhood crowd. Hard work and achievement don’t really carry all that much weight with some in the Democratic Party. Instead, Warren needs to be part of a bigger victim group in order to have that downtrodden swagger, and what better group to be associated with than the original (and legitimate) victims of American racism — Native Americans?

Unfortunately for the senator, the race toward victimhood seems likely to backfire. And, that’s a good thing, in my view, because if you look at the types of extreme leftist policies a President Warren would bring to the country, well, we’d all quickly become victims of bad ideas.

**************************************************************

ETF Talk: A Smaller Fund That Focuses on the U.S. Floating-Rate Bond Market

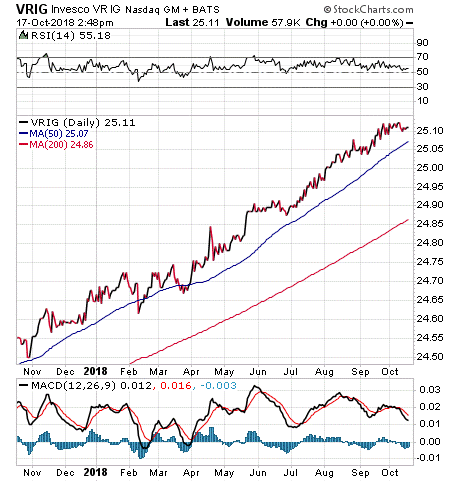

The Invesco Variable Rate Investment Grade ETF (VRIG) is an exchange-traded fund (ETF) that focuses on increasing its shareholders’ income through holding floating-rate debt securities while also maintaining a low portfolio duration and a focus on capital appreciation.

Generally, the fund will allocate around 80% of its net assets (along with any borrowed money) into a portfolio of investment-grade, variable-rate instruments that are U.S. dollar denominated and U.S. issued. These include floating rate U.S. Treasuries, government-sponsored agency mortgage-backed securities, U.S. agency debt, structured securities and floating rate investment-grade corporates.

The other 20% is invested in non-investment-grade securities. Overall, VRIG’s portfolio has the indications of being low-risk, since the majority of its assets are in AAA, AA or A backed securities. Plus, there are no assets invested in what have been popularly called “junk bonds.”

As a result, some of the fund’s holdings are in U.S. government bonds, Structured Agency Credit Risk Debt Notes, Invitation Homes, Freddie Mac MACS, Athene Global Funding, Federal Home Loan Mortgage Corporation and PHEAA Student Loan Trust Series. However, the investment in student loans could be a source of potential trouble to come.

With the comparatively recent news that student loan debt has surpassed credit card debt for the first time and the Democratic Party has pledged to abolish all student loan debt if it regains power in the 2018 midterm elections, such debt obligations are increasing in risk for investors.

Furthermore, while VRIG does invest in other countries around the world, it disproportionately invests in the United States at 89.74%. The fund invests much less in countries such as Japan, with 2.29% of the portfolio, the United Kingdom, 2.11%, and Switzerland, 1.86%, meaning VRIG is geared towards investors seeking exposure to U.S. debt securities.

Here, it is also important to note that the fund currently has $425.19 million assets under management, has a $3.10 million average daily trading volume and has an average 60-day spread of 0.04%. It also has an expense ratio of 0.30%, meaning that it is relatively cheap to hold in comparison to other exchange-traded funds.

At the same time, over the course of the past three years, the returns from VRIG holdings have been growing at a slower rate than the segment benchmark. For instance, VRIG holdings have grown 2.15% over the course of the last year but the Bloomberg Barclays U.S. Floating Rate Note Index has risen 2.45% over the same period.

Chart Courtesy of stockcharts.com

In short, while VRIG does have several advantages over some of its peer funds, it’s not without some considerable risks. Interested investors should to their due diligence to decide whether the fund is suitable for their portfolios.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Life Lessons from a West Point Graduate

Have you ever wanted to peek into the mind of a West Point graduate?

Have you ever wanted the opportunity to converse with a prominent precious metals dealer about how he got to where he’s at, and what drives his success?

In the latest episode of the Way of the Renaissance Man podcast, I accomplish both of these missions via my conversation with Rich Checkan, West Point graduate, former U.S. Army officer and president and COO of Asset Strategies International, which in my opinion is the best precious metals firms in the business today.

Some of the topics we cover in this episode include:

- What kind of training enables a person to succeed with confidence?

- Does circumstance dictate reality?

- What is really within your control as a human being?

- How military training fuels both Rich’s and Jim’s ability to succeed.

- Rich’s unique path to his career, including a stint doing door-to-door sales.

- The role of agility, malleability and adaptability in life.

I loved my talk with Rich, as we share a worldview that has been molded by our military service, our love of success and the underlying Renaissance Man ethos that animates us both. If you’ve ever wanted to listen in as two men discover their common values, then this episode is for you.

Finally, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

On the Virtue of Early Detection

“Any fool can tell a crisis when it arrives. The real service to the state is to detect it in embryo.”

— Isaac Asimov, “Foundation”

Last week’s equity selling could be over. Or, it could be the beginning of the end for the bull market. Of course, we won’t know which without the benefit of hindsight; however, when it comes to serious problems of all sorts, early detection can avoid a lot of suffering. This is true when it comes to health, business, relationships and particularly investing in financial markets.

As perhaps the greatest science fiction writer tells us, any fool can tell a crisis when it’s already here. The real key is to detect it early, i.e. in its embryonic state. That’s why I am watching all the essential metrics (earnings, economic data, technical levels, etc.) to make sure we detect when this market morphs from nine-year-plus bull to embryonic bear. Because the earlier you detect a problem, the better you can handle it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.