Selling into the Messy Tax Cut Process

Stocks have seen losses over the past week, and there’s basically one reason why — the machinations on tax reform.

Traders, individual investors and professional money managers mostly have profited mightily over the past year, as the Trump pro-growth trade gave the bulls hope that regulations would be reduced (i.e. Obamacare repeal and replace), that infrastructure spending would be enacted and, of course, that taxes would be cut both on the individual and corporate fronts.

Yet, the process we’re witnessing right now on Capitol Hill isn’t pretty. As I told subscribers to my Successful Investing advisory service on Friday, if you’ve read Upton Sinclair’s classic novel, “The Jungle,” you know just how ugly the operations of the meat industry were in the early 1900s.

And while this novel’s goal was to promote and advance socialism in the country (a goal that I abhor), the novel was an eye opener for the vile conditions that existed in the slaughterhouses and meat factories of the day.

I thought of that novel last week, and again this week, as I watched the metaphoric sausage being made in Congress on tax cuts.

From comments by Treasury Secretary Mnuchin on a possible delay of the corporate tax to the Senate’s outlined version of tax reform that included seven individual tax brackets, the tax reform outlook got decidedly muddy.

We know that because, last Thursday, stocks declined sharply after Mnuchin’s comments. For the most part, that slide hasn’t really ceased (although the decline isn’t substantial enough to make me fear that a correction is imminent).

Yes, I realize this is all part of the tax cut sausage being made. The Senate will unveil its bill likely before Thanksgiving, and then the House will vote on its version of the bill. Then, the real “fun” begins, with the House and Senate going into reconciliation to see if they can come out with some substantive reforms.

Unfortunately, as I said last week, tax reform is no guarantee. And, the proposed tax reform I’ve seen so far doesn’t represent the kind of big economic stimulus I had hoped to see.

So, from a market perspective, it makes sense to see traders and professional money locking in some gains here, especially in front of the uncertainty of tax reform.

The Smart Money is fully aware that at current multiples, tax cuts are priced into this market. That means any major disappointment on tax cuts, i.e. a complete whiff on getting any bill passed, will likely take this market down.

If tax reform resembles another Obamacare redux of Congress keeping the status quo, then look for the selling gates to swing wide open.

And if those selling gates do swing open, how will you know when it’s time to exit? Subscribers to Successful Investing will know, and that’s because of the built-in “safety switch” in markets that protects us from being in the market during significant corrections and bear markets. To find out more, I encourage you to check out Successful Investing, today.

*************************************************************

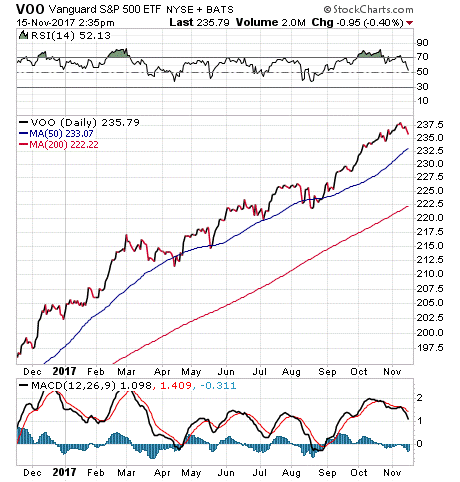

ETF Talk: This Vanguard Fund Emulates the S&P

The Vanguard S&P 500 ETF (VOO) is an exchange-traded fund (ETF) that, as its name implies, invests in stocks that compose the S&P 500 Index.

The Standard & Poor’s 500, commonly known as the S&P 500, is one of the most popular American stock market indices. S&P 500 includes 500 of the largest U.S. companies based on market capitalization.

These are some of the most well-known and most traded companies in the world. As a result, the S&P 500 has been considered by many analysts to be one of the best representatives of the U.S. stock market and even the overall economy.

VOO’s goal is to track this index, which it does with a great degree of precision. Consequently, VOO has enjoyed great popularity among investors who are seeking exposure to large-cap stocks in the U.S. market.

The S&P 500 typically has been heavy on technology, and this fact is reflected in VOO’s portfolio. The fund invests 23% of its assets in the information technology sector, with 14.50% in financials and health care and 12% in consumer discretionary companies. The effect of this skew is that VOO offers high potential for investment growth.

The fund’s managers have stated that VOO is “more appropriate for long-term goals” for investors who want growth in their investments greater than what usually can be achieved by holding bonds. However, this also means that the fund comes with its fair share of risk. Vanguard classified VOO as an aggressive fund and gives it a risk rating of four, with five representing the highest risk.

VOO is a huge, liquid fund, with assets under management totaling $79.82 billion and a daily trading volume of $370.51 million. Its expense ratio is 0.04%, which is 96% lower than the average expense ratio of funds with similar holdings.

Year to date, VOO has returned 15.32%. It pays a quarterly dividend, with a yield of 1.89%.

Top holdings for this fund include Apple Inc. (AAPL), 3.67%; Microsoft Corp. (MSFT), 2.65%; Facebook Inc. A (FB), 1.87%; Amazon.com (AMZN), 1.77%; and Johnson & Johnson (JNJ), 1.61%.

For investors who believe in the strength of the U.S. stock market, I encourage you to look into Vanguard S&P 500 ETF (VOO).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

The Year of Living Dangerously

One year ago, America elected Donald J. Trump to be its 45th president of the United States. The incredibly unlikely ascent of the billionaire businessman to the highest office in the land defied the odds, stunned the world and rewrote the book on political propriety. The Trump victory also has brought about something that few pundits (although there were some) failed to predict.

That something was the rise of hope.

This is a hope laced with optimism, and a renewed sense that the economy finally had a chance to extricate itself from the shackles of onerous big-government regulations, mandates and high taxation.

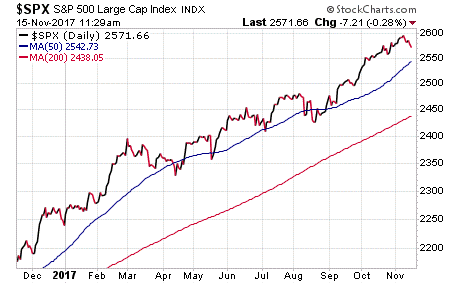

Indeed, it’s that hope that’s driven financial markets to one of their best years in a very long time. The chart below of the S&P 500 Index over the past 52 or so weeks clearly shows the dramatic 17.8% ascent in markets.

As you can see, markets have barely tested the 50-day moving average (blue line) let alone tested the long-term, 200-day moving average over the past year. That move is a testament to the Trump pro-growth hope trade that remains intact… yet that’s clinging precariously.

In fact, one could describe this market in literary terms as, “The Year of Living Dangerously.” That’s a reference to the 1978 C.J. Koch novel of the same name, which also was made into an outstanding, and highly recommended, 1982 film of the same name.

I say that because we are dangerously close to failing on all three fronts that ignited the Trump hope trade.

Those three fronts are: increased infrastructure spending, deregulation (the main component here was the repeal/replace of Obamacare) and, most importantly, tax reform.

Well, Washington is currently without a win so far, but there’s still a chance to get that most-important big win, and that’s tax reform.

Unfortunately, tax reform is no guarantee. Moreover, the proposed tax reform I’ve seen so far doesn’t represent the kind of big economic stimulus I was hoping for. Now, to be fair, I am a purist on taxation, so zero income tax is my idea of proper (and moral) taxation.

That said, what’s come from the House so far is, I fear, a lukewarm proposition that cuts some taxes, but that does not go far enough in terms of an overseas profit repatriation plan, or in terms of individual tax rates. Those individual rates also include the controversial high-profile reductions in state and local taxes, and restrictions and caps to mortgage interest deductions.

If this market is to continue the Trump hope trade, we need to see improvement on the tax front in the Senate, and then again in House where the tax bill will go into reconciliation for its final adjustments.

If we fail to get something substantive out of Washington, this year of living dangerously for the bulls could turn into a hostile takeover for the bears.

***************************************************************

Uncle Milton on Taxes

“I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible. The reason I am is because I believe the big problem is not taxes, the big problem is spending.”

— Milton Friedman

The Nobel Prize winner was a brilliant economist, but he also was a great conveyor of information to the public. Friedman could explain things in a concise, clear fashion often laced with homespun wisdom, humor and a great sense of irony that made him eminently understandable.

If you want a good lesson on why real tax reform is impossible, watch a speech given by Friedman in 1978. This nearly 40-year-old talk could be delivered today as an indictment on what’s going on at Capitol Hill right now. The essence of Friedman’s argument is… it is government that stands to lose most from reducing taxes and simplifying the tax code. As the French say, “Plus ça change, plus c’est la même chose.” The more that things change, the more they stay the same.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report