Sadness Amidst the Benevolent Universe

- Sadness Amidst the Benevolent Universe

- ETF Talk: Shopping for a Broad-based Retail ETF?

- The High Velocity Options Solution

- Turtle Wisdom

***********************************************************

Sadness Amidst the Benevolent Universe

The year is nearly over, and compared to 2020, 2021 has been a relative return to normalcy.

I mean, despite this year’s political, social and pandemic tumult and flare-ups, compared to the previous year, we actually got to navigate some pretty tame waters.

Yet, in reflecting back on the events in my life that happened nearly one year ago to the day, I was overcome by a memory of personal sadness. You see, it was just one year ago that I learned of the death of one of the investment world’s outstanding pioneers, and also the creator of the original iteration of the Successful Investing newsletter, Dick Fabian.

Dick was an independent man of action, and someone who created opportunity out of adversity. After suffering big losses in the bear market and recession of the early 1970s, Dick decided that there had to be a better way to invest and a better way to help investors protect their money from the kind of market that hit so many so hard.

So, he sat down at his dining room table and began the process of thinking up a plan to track the wider trends in the market. It was there that he discovered that if you had owned shares in the market during periods when the domestic benchmark was trending above its 39-week moving average and, more importantly, if you were out of the market during the periods when that benchmark was trending below its 39-week average, you would have largely optimized your gains and minimized your losses.

It is this simple, yet brilliant, insight that allowed Dick Fabian to build one of the most successful, and longest-lasting, newsletters in the industry. And it is that same insight that his son, my friend and fellow investment guru Doug Fabian, continued to put into action in the service to help investors for decades when he took over the reins as editor.

Today, I am both humbly honored and proud to continue applying Dick’s brilliant insight and Doug’s expert stewardship to a new generation of investors through my leadership of Successful Investing. And whatever the new developments in the market may be, the heart of this service will always feel the distant beat of the man who sat down at the dining room table and subsequently created something from nothing via the power of his rational mind.

This kind of man is both rare and truly deserving of celebration.

I had the honor of celebrating his life just about a year ago at his memorial service in Southern California along with Doug and numerous members of the Fabian family, as well as Dick’s many friends and colleagues.

The famous clergyman Robert South once said, “If there be any truer measure of a man than by what he does, it must be by what he gives.”

Well, Dick Fabian’s gift to the world was his brilliant insight, and for that, we all must bow our heads in gratitude.

Finally, the end of 2021 is just a little more than two weeks away. And while this year had its challenges, it was nothing like 2020, a year which we’d all probably choose to lose from our collective memory, if we could. Yet what the two previous years have reinforced for us is that society has once again prevailed, mostly intact, throughout another bout of pestilence and political polarization.

And do you know why we prevailed?

It is because humans are the most resilient and most successful species on the planet, and the reason for our success is our reason, i.e., our only tool of survival, our rationality. Remember this, and revere this, and know that you are part of an exclusive club that conquers the adversity of existence with the power of thought.

Also, remember that while the past two years’ sadness and tribulations have tested our individual and collective mettle, the concept of what novelist/philosopher Ayn Rand called the “benevolent universe premise” remains intact.

What this means is that the universe and reality are “benevolent,” not in the sense that they are designed for humans in mind. They are not. In fact, I think the universe is entirely indifferent to humans.

What the benevolent universe premise means is that if we choose to think for ourselves, if we choose to adapt to the ever-changing nature of reality and if we act rationally — we can give ourselves the best possible chance to achieve our values.

So, despite the sorrow, hardship, pandemic, loss, suffering and sadness — the benevolent universe remains — and now it is up to us all to choose our own happiness.

***************************************************************

ETF Talk: Shopping for a Broad-based Retail ETF?

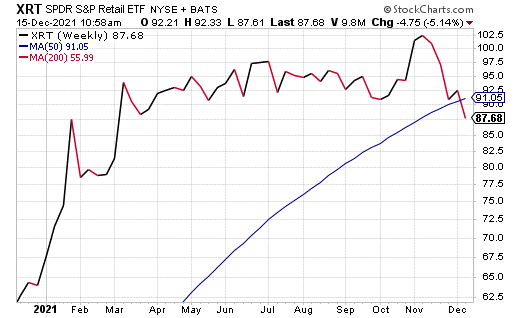

The SPDR S&P Retail ETF (NYSEARCA:XRT) tracks a broad-based, equal-weighted index of stocks in the U.S. retail industry.

XRT uses equal weighting rather than market-cap weighting to make radical differences in exposure and performance compared to its peers. The effect of equal weighting in XRT is keener than some other equal-weighted funds because it draws retail stocks, as defined by GICS, from the broad S&P Total Market Index that includes equities of any market capitalization.

The result is that XRT has greater micro- and small-cap exposure. The fund holds retail companies that stretch across multiple sub-industries such as apparel, automotive, computers and electronics, department stores, drugs, food, general merchandise stores, hypermarkets and super centers, internet and direct marketing retail, and specialty stores. The index is rebalanced quarterly.

Source: StockCharts.com

The fund has $971 million in net assets and a 0.02% average spread. Its expense ratio is 0.35%, meaning it is relatively inexpensive to hold in comparison to other exchange-traded funds. XRT’s share price, as of mid-December 2021, is just under $90, giving it a 0.68% distribution yield.

The investment seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of an index derived from the retail segment of a U.S. total market composite index. In seeking to track the performance of the S&P Retail Select Industry Index, the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, of its total assets in the securities comprising the index.

If this checks all the boxes an investor is looking for, then this could be a good investment. However, as with any opportunity, I urge all interested parties to exercise their own due diligence in deciding whether this fund fits their own individual investment and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

In case you missed it…

The High Velocity Options Solution

“It’s good to keep your options open.”

That’s one of the many slices of advice my father was fond of raining down on me in my youth. And though it is somewhat of a cliché, it’s also a pretty sound way to live. You see, what you want in life are choices, because the more choices you have, the better able you are to live the life that’s right for you.

When it comes to money, here, too, the more options, i.e., the more choices, the better. In fact, money should be looked at as a form of “choice currency.” What that means is that the more money you have, the more “units of choice” you have. And when you think about money that way, you realize that the more units of choice you have, the more you are able to “keep your options open” in life.

If you are a subscriber to one or more of my newsletter advisory services, you know that those publications are all about gaining a deeper understanding of the world at large and in particular, gaining a better understanding of the machinations of the economy and the financial markets. And, of course, they’re also about knowing which asset classes and which investments are likely to work best to achieve the overriding objective of increasing our “units of choice.”

Now, since December 2018, subscribers to my Bullseye Stock Trader service have been profiting mightily by buying the right stocks — and the right options on those stocks — that give us the ability to achieve double-digit- and triple-digit-percentage gains. It is those kinds of gains that give you those outsized “units of choice,” and I am very proud to have delivered on that front to subscribers over the past three years.

In fact, from late December 2018 to early December 2021, we have achieved an annualized return on all closed positions of 113.84%!

Moreover, our average holding time on each closed position is just 56.75 days! So, as you can see, we are collecting those gains fast — or to put it more eloquently, we are achieving these gains with “high velocity.”

Indeed, the concept of “high velocity” when discussing trading strategies is one that I like to use, because I’ve always been a fan of things that move fast. Fast cars, fast motorcycles, fast horses: they all have a special place in my fast-beating heart. And, of course, fast profits, i.e., high-velocity profits, also hold a special place in my head and my heart.

High velocity wins on the racetrack, and in your options trades.

Now, because of the success in my Bullseye Stock Trader service, I’ve had many subscribers ask me, no, beg me, for more trading advice.

And curiously, these subscribers were more interested in the high-velocity options trades than the common stock trades. In other words, the demand was overwhelming for an additional trading service that focused only on options trades, and one that didn’t even include stock recommendations.

So, being a person who is always persuaded by good reader ideas, I went to the drawing board with my publisher to figure out how we can bring out a service that uses my same winning investment strategies, yet that is ALL OPTIONS.

Well, after a few weeks in the think tank, we achieved our objective.

The result is my new ALL-OPTIONS trading service, which we appropriately call High Velocity Options.

This new service focuses on identifying “slightly out of the money” call AND put options with expiration dates of anywhere from 30 to 120 days, on average. These are the options trades that, based on my analysis — the same analysis that has more than doubled readers’ money every year in Bullseye Stock Trader — are perfectly positioned to help generate double- and triple-digit-percentage profits.

Now, another slice of advice my father was fond of telling me is that in life, “Timing is everything.” Well, that’s yet another cliché, but here again, it’s very sound advice. And that’s especially true for trading. You see, when trading options, you have to get your timing right. Yet timing is just one of the many factors I use when identifying the best options trades.

Oh, and speaking of timing, if you’re reading this, then your timing also is great, because this article was written on Dec. 8, just six days before the official Dec. 14 launch of my new “High Velocity Options” trading service. (NOTE: The Dec. 14 launch of High Velocity Options was a raging success, as was our Zoom call).

This service is designed for investors serious about making big profits, fast. It also is intended for those who want simple, easy-to-follow options strategies that involve buying calls and puts.

The put-buying element is one that distinguishes this service from my others, because it allows us to make money when the market is trending lower. Of course, despite the recent flux, we remain firmly ensconced in a bull market, and we have since then about May 2020.

Yet as we all know, there are times when stocks are going to trend lower, and there are times when certain sectors of the market are trending lower even when the rest of the market is soaring. When that happens, you need to be able to make money on the downside — and that’s what we intend to do, and expertly so, in High Velocity Options.

For more details on how you can become a charter member of High Velocity Options, and how you can watch a replay of our inaugural launch call via Zoom, simply go to my special offer now.

So, if you want more “units of choice” in life, then come along with me and we will “keep our options open” together in High Velocity Options.

*****************************************************************

Turtle Wisdom

“Most people were heartless about turtles because a turtle’s heart will beat for hours after it has been cut up and butchered. But the old man thought, I have such a heart, too.”

–Ernest Hemingway, The Old Man and the Sea

Poetic empathy wrapped in literary precision. That’s how I describe this pithy passage from the Hemingway classic, “The Old Man and the Sea.” Think about the concepts here. I mean, really stop to consider the truth that you are a carbon-based creature just like the rest of the carbon creatures in the world. Yes, we are the “rational animal” that Aristotle identified, and that gives us the unique ability to mold the world in accordance with our values.

Yet that ability to be rationally self-aware in the knowledge that we have essentially the same heartbeat as Triassic Period reptiles is both a humbling and empowering concept. Realize that you have a heart that beats with a million-year-old tempo and cherish that common rhythm. Doing so will help put any small, pedestrian problems you might have in their proper context.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods