Revisiting Modern Monetary Theory

- Revisiting Modern Monetary Theory

- ETF Talk: Invest in Contrarian Themes with This Small-Cap Fund

- A Conversation with The Texas Piano Man

- Play at Your Epistemological Peril

- The Idea of Renaissance

***********************************************************

Revisiting Modern Monetary Theory

This week, I present to you a guest editorial by my friend and macro-analyst extraordinaire, Tom Essaye of Sevens Report Research. I highly recommend Tom’s work, as he is the best that I’ve found at identifying key trends that move markets, and at explaining those trends so we can understand them. Here, Tom explains “Modern Monetary Theory” or MMT. This is the en vogue idea that government can spend virtually unlimited money with economic impunity. But is that true? Let’s do a deeper dive, courtesy of Tom Essaye.

***

What a difference a year makes. Last year, about this time, the topic of Modern Monetary Theory (MMT) was being widely discussed by the financial media, and largely disavowed by mainstream economists and government officials, including Treasury Secretary Mnuchin and Federal Reserve Chair Powell. Yet in a month, we will effectively celebrate the one-year anniversary of the quasi-stealth adoption of Modern Monetary Theory, and it’s only going to get bigger in the months and quarters ahead. The consequences for assets could be substantial over the longer term.

Given this looming anniversary, and in anticipation of MMT becoming a more common topic of conversation, given the new administration, I wanted to take time today to review MMT and explain: 1) What MMT is, 2) Why it’s more familiar than you think, 3) If it’s really that bad and 4) What it means for assets.

What Is Modern Monetary Theory? MMT essentially says that as long as government spending creates a higher growth rate than it does inflation, then any debt or deficits the spending creates really doesn’t matter.

To use a simple analogy, MMT states that it really doesn’t matter how much credit card debt I pile up as long as 1) My income is more than the minimum monthly payment and 2) I can always open more credit cards once I’ve maxed out my limit.

That’s quite a departure from previous economic theories (both governmental and personal), which say that debt needs to be reduced, and deficit spending needs to be offset and “paid for.” Simply put, it abandons the idea that government needs to be able to afford its spending.

Why MMT Is More Familiar Than You Might Think. While MMT has been derided as an unstable fiscal policy, the truth is that MMT has been the de-facto fiscal policy of virtually every administration (Republican and Democrat) for the past 20 years (and really even longer). Look at the national debt and the size of the deficits — they’ve exploded higher over the past 20 years, as government spending has increased for multiple reasons.

But, while this was the stealth de-facto fiscal policy for the last few decades, the pandemic has essentially removed the “stealth” part of it, as both parties in Washington eagerly embraced a total explosion in government spending in response to the pandemic, and in return, a surge higher in the national debt and deficits. And based on President Biden’s stated policies, we can only expect government spending, deficits and debt to grow even larger in the years ahead.

So, If the U.S. Government Has Been Doing Stealth MMT All This Time, Is It Really That Bad? That’s a good question, and so far, the answer is “no.” National debt and fiscal deficits have exploded higher over the past 20 years, yet inflation, as measured by the government, has been virtually non-existent. Meanwhile, bond yields remain at multi-decade lows (so loan rates are on the floor) while the U.S. dollar has largely held its value. The only actual negative from the stealth implementation of MMT has been unrelenting asset inflation (stocks, real estate, cars, planes, etc.). So, given this history, one can be forgiven for thinking that MMT really isn’t bad after all (and it might even work!).

So, Does MMT Work? Of course not, at least not over the longer term (it will work in the short/medium term until it becomes unsustainable). Modern Monetary Theory makes a few very large assumptions that have been true (and allowed it to work for the past several years), but these assumptions can, and likely will, change based on MMT itself.

Here’s what I mean. The inherent premise of MMT, that countries that control their currency can effectively deficit spend forever as long as growth outruns inflation, is false (just look at Argentina, Russia, Turkey, etc.) The problem is that, like all deficit spending, it eventually becomes too much, and inflation begins to overtake growth.

The key that has allowed the United States to implement stealth MMT is that “too much debt/deficits” are still a long way off, thanks to two unique factors: The U.S. dollar being the reserve currency of the world, and U.S. Treasuries having no viable alternative in the global debt marketplace. Those two factors have allowed the U.S. unmatched fiscal leniency, and in many ways, made it so that MMT actually works (for now). Here’s why:

First, because the dollar is the world’s reserve currency, the explosion of U.S. debt and deficits hasn’t resulted in a material decline in the dollar. As such, the stable dollar has held statistical inflation largely in check (preserving the key tenet of MMT, i.e., that growth outpaces inflation). But that can change, and it eventually will change. The U.S. dollar won’t be the world’s reserve currency forever. It’s not changing any time soon, but at some point, it will, and actively embracing MMT (and accelerating it) will only hasten the time when “some point” arrives.

Second, because there is no rival to U.S. Treasury bonds on the global marketplace, the United States hasn’t really seen any ill effects of stealth MMT. Going back to my initial credit card analogy, having no viable alternative to U.S. Treasuries ensures that the United States can always open a new credit card, i.e., borrow enough money to finance the deficit spending. But that can also change, especially if inflation begins to take hold, and if/when that happens, the declines in the U.S. dollar and U.S. Treasuries will be painful and scary.

Positively, this outcome likely remains years in the future. But then again, we’ve never seen anything like the amount of stimulus and quantitative easing (QE) being unleashed on the economy, and frankly, no one knows what that will bring in the coming quarters and years (and it is entirely possible that inflation accelerates faster than expected).

What Does This Mean for Markets? As we think about the impact of MMT on markets, we think that looking back to the first two years of the Obama administration are a rough guide, because essentially what we saw back then was “MMT Lite” via increased QE from the Fed and increased government spending (but nothing even close to the scale of what we’re seeing today).

So, we reviewed the performance of a mix of assets from November 2008 (when Democrats won the election) through November 2010 (when Republicans took the House following the midterms and created a divided government for the next six years).

During those two years of Democrat control, here’s what outperformed: gold (up 79%), tech (NASDAQ returned 60%), equal-weight S&P 500 (RSP up 49%), hard asset stocks (HAP up 46%), and industrials (XLI up 34%). Growth outperformed value over the two-year period, but it’s important to remember that what sectors make up value and growth exchange-traded funds (ETFs) have changed over the years.

Additionally, this analysis has to be taken with a grain of salt because markets didn’t bottom until March 2009 due to the continued fallout from the financial crisis, and in this look back, financials badly lagged as they recovered from the financial crisis. But this time, we’d expect financials to outperform on rising yields.

Bottom line: while there are differences between the two periods, we think it’s reasonable to expect more of what we saw during the 2008-2010 period, given the Biden administration’s embrace of MMT (whether they admit it or not). So, we view this past performance as validation for having the Invesco S&P 500 Equal Weight ETF (RSP) as a core equity holding going forward, along with increased allocations for cyclicals (financials/industrials) as well as hard asset-related equities, while maintaining a healthy (yet not massively overweight) tech allocation.

***

Thanks, Tom, for an excellent analysis. Also, note here that the Invesco S&P 500 Equal Weight ETF (RSP) is a core holding in my Successful Investing advisory service. Find out more about this fund, along with the other funds and stocks in the portfolio, by checking out Successful Investing right now.

***************************************************************

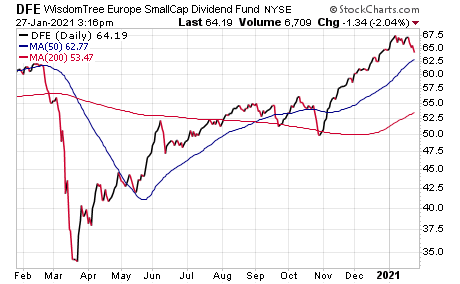

ETF Talk: Invest in Contrarian Themes with This Small-Cap Fund

Out-of-favor stock-picking themes can return to favor at any time.

Some might argue that there are greater potential profits to be had in choosing the right moment, when stocks fitting certain themes might have been beaten down for a long time, to jump into a turnaround play. One exchange-traded fund (ETF) that mixes several out-of-favor themes that have been underperforming for years but have real potential is WisdomTree Europe SmallCap Dividend Fund (DFE).

Dividend-paying stocks are rarely a poor choice, although their returns can sometimes not live up to more exciting and dangerous growth plays. But the confluence of European and small-cap stocks is what really makes this fund a bit of a contrarian play in the current market landscape.

It also is an interesting take on that market segment, because small-cap stocks aren’t necessarily known for their dividend payments. The fund weights its holdings, not by market cap, but by dividend payment.

This fund has underperformed in the last 12 months — up just 3%. Its returns are similar to those of iShares Europe ETF (IEV), a fund that just tracks a European theme. DFE’s yield is 2.42%, which may help investors balance out its somewhat high expense ratio of 0.58%. The fund holds $289 million in assets and is open-ended. The current price-to-earnings (P/E) ratio of its holdings is 16.3, which may make it more appealing from a valuation perspective than American blue-chip stocks.

Chart courtesy of StockCharts.com

The fund’s holdings hail from all over Europe, but the largest portions are allocated to the United Kingdom, Norway and Sweden. Financials and industrials lead its sector holdings. The top holdings include Jupiter Fund Management plc, 2.60%; Ferrexpo plc, 2.26%; TGS-NOPEC Geophysical Company ASA, 2.22%; Kardex Holding AG, 2.04%; and ANIMA Holding S.p.A., 1.96%. Just under 20% of the fund’s assets are allocated to its 10 largest holdings.

For investors looking for a thematic paradigm shift in the market to happen in the immediate future, WisdomTree Europe SmallCap Dividend Fund (DFE) provides access to investment themes that are off the beaten path right now.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

Talking Music with Texas Piano Man Robert Ellis

Every once in a while, you come across a musical artist who really touches you on numerous levels. That’s how I describe my latest Way of the Renaissance Man podcast guest, the singer/songwriter Robert Ellis.

Also known as the Texas Piano Man, Robert is a consummate composer, pianist, guitarist and vocalist who has managed to create a unique sound that’s part Americana, part country, part rock, part jazz and part Laurel Canyon.

In this episode, you’ll learn about Robert’s musical history, his professional journey, the struggles associated with mixing genres and developing his own sound and his constant desire to always be learning and to always be getting better.

You’ll also learn about Robert’s admiration for artists such as Neil Young, Paul Simon, George Jones and Willie Nelson, the critical role honesty plays in art and his love of simple tools for improvement, such as the metronome.

Plus, as he describes his work and the songwriting process, I point out the many ways Robert exemplifies and embodies the Renaissance Man ethos.

Robert Ellis is an artist who is committed to the love of discovery and the process of creation. By doing so, he’s given the world the beautiful gift of his music… a gift we all get to share with an exclusive solo acoustic performance of his song “Perfect Strangers” just for my podcast’s listeners.

I loved my conversation with the great Robert Ellis, and I know you will, too.

***********************************************************

In case you missed it…

Play at Your Epistemological Peril

Last week, Joseph R. Biden Jr. took the oath of office as the 46th president of the United States. And, while you may not have voted for Mr. Biden, if you are a real American who cares about the country, you need to accept the fact that he is the legitimate president.

The reason why is because reality dictates that you do so.

By “reality,” I mean the unassailable fact that Mr. Biden captured far more votes in more key states than now former-President Donald J. Trump.

Yet still, there appears to be a rather large swath of the country, including many smart people that I personally know, who thinks that the election was “stolen” and that voter irregularities and mass fraud were perpetrated to produce the Biden win. Yet, when given the opportunity to argue the facts of this situation in the courts, those who promulgated this theory had their claims summarily rejected in more than 60 cases.

Now, you may still think that there was mass election fraud, despite the lack of substantive evidence. But if you play that game, you play at your own epistemological peril.

I say that, because to believe something to be true without sufficient evidence, i.e., with just conspiratorial suspicions about a hidden, left-wing cabal engineering things behind the scenes, is to essentially obliterate the only tool of survival you possess — your reason.

Here, we must apply the scientific and philosophical rule known as Occam’s razor to this situation. This rule basically says that, given two explanations that account for a set of facts, the simpler one is more likely to be correct.

So, in the case of the 2020 presidential election, what is the simpler explanation? That millions more people actually voted for Joe Biden and in sufficient numbers in key battleground states, or that there was a coordinated mass deception by shadowy forces intent on installing Mr. Biden and removing Mr. Trump from office?

What is more logical? That more people desired a change of leadership in the Oval Office after a year of a devastatingly inept response to a global pandemic, or that voting machines were hacked and/or otherwise controlled by George Soros and the deceased Hugo Chavez?

What is simpler? The fact that there are more Democrats (31%) and Independents (41%) than Republicans (25%) in the country (according to the latest Gallup data on party affiliation), or that those Republican votes were somehow sheltered and destroyed in the service of a Biden win?

Unfortunately, the claims by Mr. Trump himself that the election was stolen were the underlying cause of the repugnant assault on Capitol Hill three weeks ago by a cadre of his fanatical supporters. Here’s what President Trump said about the election that Wednesday morning to a throng of supporters who just shortly thereafter stormed the Capitol with destructive intent.

“Today I will lay out just some of the evidence proving that we won this election and we won it by a landslide. This was not a close election.”

Then Mr. Trump went on to provide zero evidence for this claim.

Instead, he told the crowd to go to the Capitol to urge senators and members of Congress to confront the “egregious assault on our democracy.”

Here are the exact words Mr. Trump used:

“And after this, we’re going to walk down, and I’ll be there with you, we’re going to walk down, we’re going to walk down.

Anyone you want, but I think right here, we’re going to walk down to the Capitol, and we’re going to cheer on our brave senators and congressmen and women, and we’re probably not going to be cheering so much for some of them.

Because you’ll never take back our country with weakness. You have to show strength and you have to be strong. We have come to demand that Congress do the right thing and only count the electors who have been lawfully slated, lawfully slated.

I know that everyone here will soon be marching over to the Capitol building to peacefully and patriotically make your voices heard.”

It was this exhortation that has been blamed for inciting the seditious actions of the mob that day. And while I think it’s fair to criticize President Trump for consistently promulgating a falsehood about the election results, contrary to what many have said, I do not think it’s fair to actually accuse him of directly causing the violence.

I mean, he did explicitly say that the group should “peacefully” make their voices heard. He did not say the protests should be violent.

That said, the purported notion that Mr. Trump won in a “landslide” and that the election was stolen, and that therefore Mr. Biden is not the legitimate 46th president of the United States, is not only a dangerous one for society, it also is a dangerous one for an individual’s mental cohesion.

Because if you believe things for bad reasons, your mind and your life will be in conflict with reality — and that is a prescription for an unhappily disappointing existence.

*****************************************************************

The Idea of Renaissance

“I love the idea of renaissance. If my career is like painting a canvas, I want to have as many different colors in there as I can.”

–Nolan Gerard Funk

The actor hits the mark here when it comes to aspiring to add as many “colors” to one’s life and career as you can. If you want to keep growing and keep learning, be open to the idea of renaissance. Doing so is not only fun, but it keeps you young.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods