A Retail Rout and Recession

- A Retail Rout and Recession

- ETF Talk: Profit from Volatility with This Fund

- The Cold Hard Truth About Bear Markets

- Of Tigers and Bears

***********************************************************

A Retail Rout and Recession

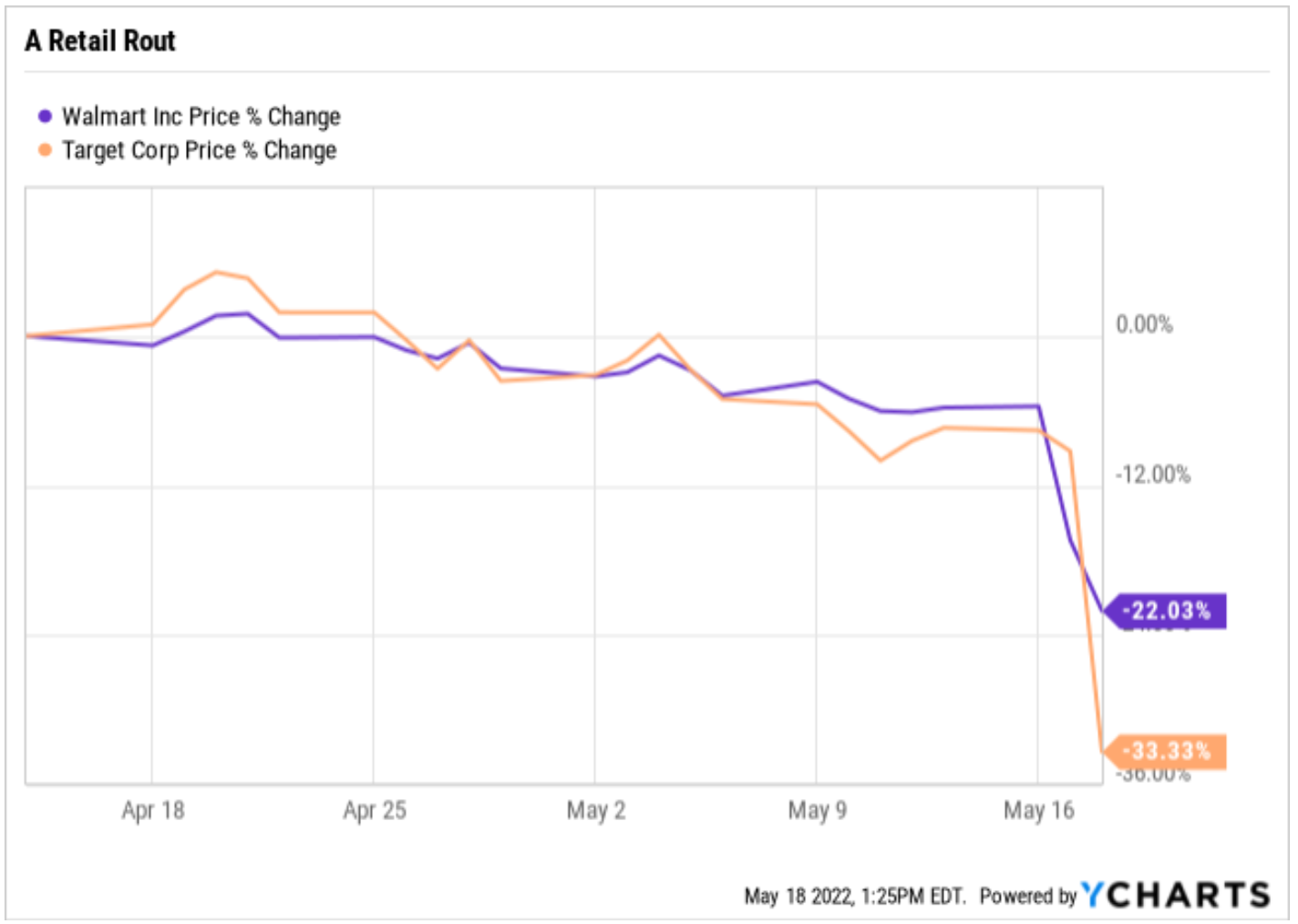

Retail stocks are getting slammed, and the culprit is something that has Wall Street rightly concerned.

On Wednesday morning, retail giant Target Corp. (NYSE: TGT) reported a very ugly first-quarter earnings miss, as the company cited cost increases in areas such as freight and inventory for its very bad results. About halfway through the trading session, TGT shares were down more than 26% — yes, that’s just today!

On Tuesday, the world’s biggest retailer, Walmart Inc. (NYSE: WMT) also reported pressured earnings and, like TGT, the company saw cost increases compress its margins. Also like TGT, shares of WMT were down big on Tuesday, and again today (albeit not nearly as much).

“The conclusion from both reports is the same: Consumers are starting to tighten their belts and switching from discretionary items to staples such as food,” said Tom Essaye of Sevens Report Research. Tom is my personal go-to source for making sense of the macro and how it influences markets.

“More broadly, the weakness in WMT and TGT over the past two days reinforces a point I’ve been making for months: Despite equity market volatility, we have not even started to see the negatives from a slowing economy, and that’s one of the main reasons we’re hesitant to declare last week’s low the bottom,” added Essaye.

In this morning’s issue of my daily marketing briefing, the Eagle Eye Opener, I explained to readers that Walmart missed earnings because of two main factors. First, consumers bought less high-margin merchandise and instead, spent more money on lower-margin food. Additionally, WMT saw a shift from brand names to private label.

This is potentially important because those two shifts (from merchandise to food and brand names to private label) both anecdotally imply the middle and lower-end consumers are starting to get squeezed by inflation, and they are beginning to “cut back” on non-essential items.

To a point, this also was partially confirmed by the Home Depot (NYSE: HD) results, although that company had a much better quarter. HD beat earnings and raised guidance. The stock rallied. But while sales amounts were strong, customer transactions fell 8.2% in the quarter. That drop in business was offset as the average ticket price per sale was up 11.4%.

The truth here is that the economy and investors are in very unfamiliar waters right now, and nobody knows just how quickly the economy will slow. Right now, the market is facing multiple 50-basis-point interest rate hikes in the months ahead, something we haven’t seen in more than two decades. And now that we are starting to see inflation really affect retail earnings, the thought of a real recession hitting the economy is causing both a retail stock rout and, at least today, a huge equity sell-off.

Now, I want to be clear that the downbeat retail earnings this week do not necessarily mean that we’re headed for a pernicious recession. They also don’t necessarily mean that stocks will plunge well below last week’s lows. After all, we have already seen a lot of selling in this market already, so the downside from here is arguably largely baked into the current valuations.

Yet as of this midday Wednesday, the Dow Jones Industrial Averages was down more than 1,100 points, or some 3.4%. As such, the reality is the bears are still very much center stage, and they’re still delivering their morose monologue for this market.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

***************************************************************

ETF Talk: Profit from Volatility with This Fund

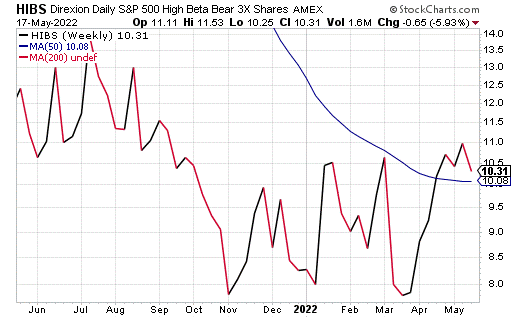

The Direxion Daily S&P 500 High Beta Bear 3X Shares (NYSEARCA: HIBS) provides 3x daily inverse exposure to a beta-weighted index of the 100 highest-beta stocks in the S&P 500.

HIBS is passively managed to select the top 100 stocks from the S&P 500 Index with the highest sensitivity to market movements (beta) over the past 12 months, while weighting each of them based on its calculated beta. The fund is designed to deliver 3x inverse exposure to those 100 highest-beta stocks, aiming to provide -300% of the index’s return for a one-day period.

To achieve its goal, the fund holds swaps, futures, short positions or other financial instruments that, in combination, produce inverse exposure to the index.

HIBS gets the added exposure by using short-term financial instruments that are high quality. The index is reviewed and rebalanced quarterly. As a levered product, HIBS is not a buy-and-hold exchange-traded fund (ETF). Rather, it should be used as a short-term, tactical position.

Chart courtesy of www.stockcharts.com

Direxion Daily S&P 500 High Beta Bear 3X Shares has $44 million in assets under management with a 0.19% daily spread. Its expense ratio is 1.08%, meaning it is relatively expensive to hold in relation to other exchange-traded funds.

As with any instrument, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Cold Hard Truth About Bear Markets

I’ve come to set the record straight

I’ve come to shine the light on you

Let me introduce myself

I’m the cold hard truth

— George Jones, “The Cold Hard Truth”

Country music legend George Jones is known for living a hard life, one replete with a lot of hard drinking, a lot of heartbreak and the realization of more than a few of life’s cold hard truths. Now, in the realm of money and investing, there is one cold hard truth that we’ve all come to learn in 2022, and that is that stocks do not always go higher.

Of course, you knew that already, but it is easy to forget that the last time we saw stocks plunge this much was during March 2020, when the world was essentially on lockdown because of COVID-19. Yet that pandemic pullback didn’t last very long, and since those March 2020 lows, markets have really pushed higher.

Yet so far this year, the major domestic equity averages –the Dow Jones Industrial Average, S&P 500 Index, Nasdaq Composite and Russell 2000 — all have seen a sharp pullback. Technically speaking, the Nasdaq Composite and the Russell 2000 officially fell into bear market status this year. While the Dow and S&P 500 are “merely” in correction territory and not officially in bear status, it sure feels like the world is awash in ursine forces beyond our control.

Yet what is the cold hard truth about bear markets? How long do they typically last, how much damage do they do and how do these market cycles really work?

To answer that question, I uncovered some research conducted by Hartford Funds that I think will be quite valuable to review here. I suspect that if you are like me, the data will both surprise and placate your restless mind.

- Stocks lose 36% on average in a bear market. By contrast, stocks gain 114% on average during a bull market.

- Bear markets are normal. There have been 26 bear markets in the S&P 500 Index since 1928. However, there also have been 27 bull markets, and stocks have risen significantly over the long term.

- Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years.

- Bear markets have been less frequent since World War II. Between 1928 and 1945, there were 12 bear markets, or one about every 1.4 years. Since 1945, there have been 14, one about every 5.4 years.

- Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34% of the market’s best days took place in the first two months of a bull market, before it was clear a bull market had begun.

- A bear market doesn’t necessarily indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time. Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming.

- Bear markets can be painful, but overall, markets are positive most of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Stated differently, stocks have been on the rise 78% of the time.

So, there you have it, the cold hard truth about bear markets. As you can see, the reality is that while bears are real, destructive forces in the market, they are no reason to panic and no reason to avoid investing in stocks.

The stock market remains the very best wealth-creation engine ever devised, and you need to realize that, even when you see stocks plunging.

Yes, you need to be cautious and reduce the risk in your portfolio when the trend is bearish. But DO NOT let trepidation and ursine phobia paralyze you.

Be intrepid, be smart — and be an investor.

*****************************************************************

Of Tigers and Bears

“An infallible method of conciliating a tiger is to allow oneself to be devoured.”

— Konrad Adenauer

Tigers have a lot in common with bears. They’re both top predators, and they can both fell you with one swipe of their paws. Right now, there’s a bear swiping away at shareholder value, but one sure way to placate that bear is to let yourself be consumed with the fear that accompanies its presence.

Yes, bear markets are scary. Yet they are eminently navigable, and sometimes the best strategy is to just stay calm and stay the course. Easier said than done, I realize, but whoever said making the right decisions in life was easy?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods