Renaissance Man 2019: An Antidote to Chaos

One of the biggest breakout best-sellers of 2018 was the intellectual self-help work, “12 Rules for Life” by Dr. Jordan Peterson.

The subtitle of this excellent and highly recommended book is “An Antidote to Chaos.” As Peterson explains throughout the work, life, by its very nature, is fraught with chaos that constantly must be put into order. This order is hierarchical, philosophical, political, social and, most importantly, personal.

I agree with much of what Peterson writes in “12 Rules for Life,” although I disagree with a lot of his overall work. I’ll save our points of disagreement for another time, as I want to focus on the key takeaway here, which for me is that the chaos of life — as well as the chaos in financial markets that we all painfully lived through in the fourth quarter of 2018 — does demand an antidote.

For subscribers to my newsletter advisory services, we take on this chaos by employing sound investing principles, proven tactics and strategies, focused fundamental and technical analysis, a psychological understanding of market behavior and an awareness of the current zeitgeist in markets (something I call “NewsQ”) to help us navigate.

We also need tools to help us navigate accurately in life. In the year ahead, perhaps more than ever, it’s important to put as many tools in our kit to deal with what appears to be some truly overwhelming societal, political, financial and even personal chaos.

Last year, my team and I launched a tool to help with that personal chaos, and it is the Way of the Renaissance Man website and podcast. From fighter pilots to West Point grads, from samurai to psychologists, from anarchists to anti-tax warriors, and from radio hosts to FBI agents to war heroes, the inaugural season of the Way of the Renaissance Man podcast had a little something for every curiosity seeker.

We kicked off the season with Grover Norquist, president of Americans for Tax Reform. Grover is a man on a mission to help you keep more of your money. More importantly, we discussed what it really takes to be truly committed to an idea.

In my discussion with Rich Checkan, West Point graduate and businessman, we talked about the military ethos and how it can help define one’s focus and help integrate concepts and ideas into real-world action.

West Point grad, former U.S. Army officer and businessman Rich Checkan of Asset Strategies International dons his very own Way of the Renaissance Man t-shirt.

I found a similarly invigorating discussion with former Marine Corps fighter pilot Ed Rush, who shared some success-enabling habits he learned during his military service. Ed also let me in on some of his fascinating “21-day adventures” in self-improvement.

With psychologist Dr. Joel Wade, author of the fantastic book “The Virtue of Happiness,” we discussed the nature of happiness, what it is to be happy and what the “success of being human” really means.

Life is never dull when you’re speaking with the always-entertaining creator of the Financial Survival Network, Kerry Lutz. Here we riffed on Facebook, the value of skepticism and even Yossarian, the unforgettable protagonist from Joseph Heller’s masterpiece, “Catch-22.”

In season one, I also spoke with the eminently interesting anarchist and “dollar vigilante” Jeff Berwick, an extremely passionate man who takes life seriously, and who also has a lot of fun doing so. The inaugural season also brought us two major figures in the war on terror, retired FBI Special Agent and counterterrorism expert John Iannarelli and Afghanistan subject matter expert and Coalition Forces interpreter Saber Rock, who survived near-fatal wounds inflicted by the Taliban.

Both John and Saber are fighting the same battle, namely the forces of theocratic tyranny. And, both of these men helped us understand how to be your best self in the face of incredible adversity.

Finally, I got a chance to connect again with my longtime friend, fellow market analyst, motorcycle enthusiast and real-life samurai Keith Fitz-Gerald. If you want wisdom from one of the smartest men on planet Earth, this episode is must listening.

Now, in addition to the amazing guests I had the privilege of interviewing, I also was able to share some interesting views via my articles, speeches, media appearances and quotes in the areas of ideas, high-intensity pursuits, human relationships, health and fitness, and finance and money. We also featured some great guest contributions this year.

Some of my favorite articles include:

How You Park Your Car is How You Approach Life

3 Renaissance Man Rules of Wealth Building

5 Favorite Renaissance Man Quotes to Live By

8 Keys to Cultivating a Renaissance Man Mindset

In the spirit of the aforementioned antidote to chaos, I started this project as a free adjunct to my work here at The Deep Woods, and as a supplement to my newsletter advisory services Successful Investing, Intelligence Report, Bullseye Stock Trader and Fast Money Alert, which all can be accessed simply by going to JimWoodsInvesting.com.

I did so because, in an era of chaos characterized by a frequent lack of intellectual curiosity, mental laziness, destructive “conventional wisdom” that is anything but wise and even the willful evasion by good people of facing evil, it’s important to put as much ammunition in your arsenal as you can to win the battle for your values.

The Way of the Renaissance Man website and podcast is there to help us all focus on what matters, and to integrate that knowledge and meaning into our lives so that we can rationally celebrate our victories and continue battling our dragons. Anything short of that is just letting yourself down in the most important pursuit you’ll ever engage in… the pursuit of your own values.

In 2019, the Way of the Renaissance Man will continue this pursuit with a vengeance, and together, we help each other discover the tools needed to better focus our minds, integrate our thoughts with actions and live the way we really want.

May the new year bring you continued focus, integration, celebration… and a true antidote to chaos of all stripes.

**************************************************************

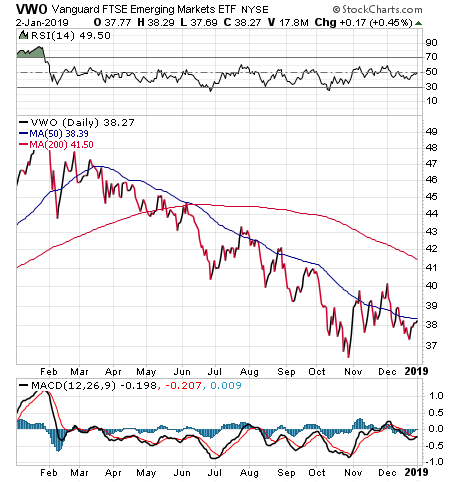

ETF Talk: Consider This Emerging-Markets ETF

The Vanguard FTSE Emerging Markets ETF (NYSE: VWO) invests in stocks of companies located in emerging markets around the world.

The fund’s goal is to track the return of the FTSE Emerging Markets All Cap China A Inclusion Index. Thus, VWO’s investment strategy is to hold a broadly diversified collection of securities that mimic the key characteristics of the market-capitalization-weighted FTSE China A Inclusion Index, which consists of 3,550 stocks of large, mid-size and small companies in emerging markets around the world.

The fund’s top holdings include Tencent Holdings Ltd. (OTCMKTS: TCEHY), Taiwan Semiconductor Mfg. Co. Ltd. (NYSE: TSM), Alibaba Group Holding Ltd. (NYSE: BABA), Naspers Limited (OTCMKTS: NPSNY), China Construction Bank Corporation (OTCMKTS: CICHF), Industrial and Commercial Bank of China (OTCMKTS: IDCBY), Ping An Insurance Group Co. of China (OTCMKTS: PNGAY) and China Mobile Ltd. (NSY: CHL). These stocks make up 20.20% of the fund’s total assets.

The fund’s investments are mostly in Asia, including 34.7% in China, 14.1% in Taiwan, 11.7% in India, 4.0% in Thailand and 3.2% in Malaysia. VWO also invests in other emerging market nations, such as Brazil, with 8.5% of its assets, 6.8% in South Africa and 3.8% in Russia.

The ETF currently has $77.8 billion in net assets and an expense ratio of 0.14%, so it is relatively cheap to hold in comparison to other exchange-traded funds. Indeed, its expense ratio is 90% lower than the average expense ratio of funds with similar holdings.

However, Vanguard rates the level of risk in this ETF five out of five, meaning that it is quite risky for investors. This is not surprising because not only are foreign stocks more volatile and less liquid than American stocks, but investing in emerging markets is inherently riskier than investing in more developed economies, since emerging markets often have less developed legal, tax and regulatory systems.

In addition, this fund’s heavy investment in current global “hot spots,” such as China and Taiwan, as well as in countries such as Brazil that have elected populist candidates, indicates the fund has taken on additional risk.

Long-term investors who are looking for exposure to emerging markets should consider this fund, which also is a good way to add international diversity to a portfolio. As always, investors should exercise their due diligence in deciding whether VWO is a worthwhile investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

The 2018 ‘Best of’ Issue

When historians look back at the year that was 2018, it’s probably going to be remembered for the bearish turn of events that began in early October.

The sharp selling started then, and it continued through the night before Christmas. Today, stocks are up sharply, and the bulls are hoping Santa will keep bringing the holiday cheer for the remainder of the year.

So, while the markets enjoy this long-overdue, oversold bounce, I’ll take this opportunity to look back on the year and present to you what I call the “Best of” issue, i.e. The Deep Woods articles I thought were the most important of the year. And this was a very important year for this publication, as it was only in July that we changed our name from the Weekly ETF Report to The Deep Woods.

We did this to better reflect the broader scope of this publication, and to more accurately define the in-depth focus on the principled issue affecting markets, the economy, society and culture. As one reader put it, “I like that you peel the onion skin back to show us what’s going on beneath the surface of things.”

There was perhaps no better example of an issue that required peeling the onion skin back this year than the trade war. Throughout the year, the market has been plagued by what I consider an unnecessary, dangerous and destructive trade war between the United States and China that is anti-individualist, anti-free trade and even borders on being anti-American.

I say that because America is not about the government erecting barriers to your freedom to trade with others. America is about erecting barriers that protect the individual from government.

The tariffs imposed by the Trump administration as a “negotiating ploy” are one of the biggest causes for the market selling, because it’s causing uncertainty and fear that corporate bottom lines will come in a lot softer in the fourth quarter and for the full year.

In “Whiskey, Tailpipes and Tribalism: Singing the ‘Trade War Blues’,” I wrote about the damage of the trade war and its casualties, including companies such as Brown-Forman Corp. (NYSE: BF-B) and Harley-Davidson (NYSE: HOG).

In August, I addressed the trade war’s detractors, the libertarian-leaning Koch brothers, and their fight with President Trump. In what was one of the most widely read columns of the year, “Forget Pepsi Vs. Coke, Now It’s Trump Vs. Koch,” I asked you to tell me which party you thought was on the correct side of the tariff debate. The results were almost evenly split, with a slight edge going to the president.

Other columns related to freedom, free markets and free trade that made my Best of 2018 list include “Reflections on the Best FreedomFest Ever,” “Dear Uncle Sam, Please Stay out of My Mouth” and my takedown of Columbia University law professor and antitrust champion Tim Wu in “In Defense of Economic ‘Bigness’.”

Yet this year wasn’t just about advocating for freedom. This year also was about celebrating our good fortune and remembering the importance of sharing that good fortune with others.

In “The Best of Times Is Right Now,” I wrote about attending a lecture by Harvard University psychologist Steven Pinker on the topic of his great book, “Enlightenment Now: The Case for Reason, Science, Humanism, and Progress.” This lecture not only inspired me, but it allowed me to keep in perspective just how great we have it in 21st-century America, and what that greatness is built upon, i.e. reason, science and enlightenment values.

In “The One Frequency to Tune in This Holiday Season,” I wrote about how fortunate I feel to be in a position to help support my favorite charity, Texas-based Upbring, a nonprofit organization working to break the cycle of child abuse by empowering children, families and communities. There’s still time to make a difference in 2018, and I encourage you to do so via a donation to Upbring.

This year, I also reflected on the deaths of two high-profile political figures, President George H.W. Bush and Arizona Sen. John McCain. The respective passing of these two men of character reminded the nation that character still matters, and that class, respect and love for America isn’t just about slogans and bluster.

In 2018, I also was proud to announce the launching of two new projects in The Deep Woods. The first was my new podcast and website, Way of the Renaissance Man, a show about ideas, personal empowerment and celebrating the rational life. The goal of this project is to help us all discover the tools needed to better focus our minds, integrate our thoughts with actions and live the lives we really want.

Later in the year, I also told you about my new advisory service, Bullseye Stock Trader, a stock and options trading publication designed to identify the best-of-breed stocks displaying the fundamental and technical attributes that allow them to continue leading the market higher.

Finally, although I was proud of all The Deep Woods issues in 2018, perhaps my very favorite came the day before Thanksgiving, when I told you “This Year, Also Be Thankful for Dragons.”

I’m not alone here, as I had several readers tell me this also was their favorite. I even had one reader tell me they thought it was directly about them, as the message of struggling mightily to achieve one’s values, even in the simple tasks of life, can be supremely liberating and supremely personal. The reason why is because when you prevail in such a fight, you are both better and more gratified than you were before the engagement.

It is this embrace of these battles, both big and small, that I will take into 2019 and beyond. Because in The Deep Woods, we love to slay dragons of all varieties, both the mighty, exogenous kind, and the smaller, more personal kind.

Thank you for a fantastic 2018, and here’s to a tremendous 2019.

*********************************************************************

Discipline vs. Brilliance

“Investment success accrues not so much to the brilliant as to the disciplined.”

— William J. Bernstein

Intelligence is fantastic. Brilliance is even better. Yet what really wins in the long term is discipline. Fortunately, we can cultivate discipline a lot easier than we can intelligence or brilliance. So, in 2019, exercise your discipline to make it better, stronger and faster. Your life will thank you for it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.