Real Conversations Matter

- Real Conversations Matter

- ETF Talk: S&P 400 Managed Risk Fund Offers Appreciation Potential

- Cannot Stop the Battery

- Honest and Gentle Reflections

***********************************************************

Real Conversations Matter

The first presidential debate of 2020 took place last night, and if you came away from the roughly 90 minutes of verbal chaos as disappointed in the result as I was, then you’re not alone.

Even my random late-night sampling of opinions from both sides of the political aisle revealed just how unsatisfied the exchanges were between President Trump and former Vice President Biden. Perhaps I am too optimistic, but I didn’t think it was too much to ask that the two men vying for the de facto title of “Leader of the Free World” have an actual conversation.

Instead, the event last night was, as The Wall Street Journal editorial headline put it, “A Depressing Debate Spectacle.” The subhead of the WSJ piece encapsulated what I think most people came away with after watching the event, and that is that, “Pro wrestlers are more presidential than either man Tuesday night.”

Here is the money quote from the WSJ editorial:

“The event was a spectacle of insults, interruptions, endless cross-talk, exaggerations and flat-out lies even by the lying standards of current U.S. politics. Our guess is that millions of Americans turned away after 30 minutes, and we would have turned away too if we didn’t do this for a living.”

That pretty much sums up my opinion of the “debate,” if you can call it that.

Yet, in some ways, I am grateful that I witnessed this epic failure of conversation last night. I say that, because it reaffirmed a principle that I live by, and one that I think is critical to making any kind of social progress. That premise is that real conversations matter.

Now, when I say, “real conversations,” I am just slightly amplifying what the Oxford English Dictionary defines as: “a talk, especially an informal one, between two or more people, in which news and ideas are exchanged.”

The operative concept here is the exchange of ideas, and the reason why this is so important, and the reason why I think real conversations matter so much, is because conversations are our best way to resolve conflict and to make social progress.

As philosopher and neuroscientist Sam Harris puts it: “We have a choice. We have two options as human beings. We have a choice between conversation and war. That’s it. Conversation and violence.”

In pandemic America 2020, we’ve already seen the failure of conversation result in social unrest, riots, looting, impeachment, science denial, history denial, racism, the rise of cancel culture, the siloing of news and information, radical left-wing lawlessness and the rise of radical right-wing hate groups. In short, our collective failure of conversation is laying the foundation for a future American dystopia that all but the most fervent nihilist would find disastrous.

Yet before you conclude that I am a fatalist on this issue, I do think there is hope for a brighter, more articulate and more well-reasoned future. I say that, because I am actually encouraged by the outpouring of discontent regarding the dreadful presidential debate.

I also am encouraged by the rise of so many long-form conversations that have been facilitated in recent years by digital platforms such as podcasts, YouTube videos and streaming media services such as Spotify. The rise of the long-form conversation as a force in American media can be seen via the recent announcement of an exclusive deal between Joe Rogan and Spotify that is reportedly worth some $100 million.

Indeed, the appeal of long-form, real conversations of all sorts in recent years is, in part, responsible for me launching my own podcast, Way of the Renaissance Man. And not coincidentally, today also happens to mark the official launch of Season Three of the podcast.

In this kickoff episode, I am joined by my producer and media consultant Heather Wagenhals.

In this real conversation, we take a deep dive into what precisely defines what I call the “Renaissance Man ethos.” You might recall The Deep Woods issue of Aug. 19, with the lead story titled “Focus, Integration, Celebration.” Well, those concepts in action are what make up the three pillars of the Renaissance Man ethos, and in this episode, you will discover exactly why.

Finally, we take a look back at some of the highlights of the first two seasons of the show to demonstrate the Renaissance Man ethos in action, and why so many of my fascinating guests embody the very best within us all.

I am extremely proud of the podcast and lifestyle website we’ve created, and we celebrate this pride of achievement in the Season Three kickoff episode. It also happens to be the 30th episode of the Way of the Renaissance Man podcast.

So, if you still have a bad taste in your mouth after last night’s failure to have a real conversation, I invite you to cleanse your intellectual palate with the Renaissance Man.

***************************************************************

ETF Talk: S&P 400 Managed Risk Fund Offers Appreciation Potential

(Note: second in a series on hedged-equity, low-volatility ETFs)

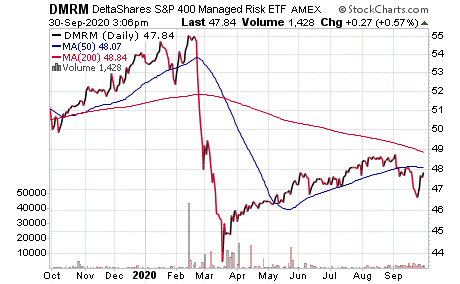

The DeltaShares S&P 400 Managed Risk ETF (DMRM) seeks to track the investment results, before fees and expenses, of the S&P 400 Managed Risk 2.0 Index.

This exchange-traded fund (ETF), created on July 31, 2017, has amassed $87.52 million in total assets by offering investors exposure to mid-sized U.S. companies. DMRM is intended to satisfy investor demand for mid-cap equity exposure during rising markets, while using risk management strategies aimed at limiting losses amid sustained market declines.

In addition, DMRM was created to help construct increasingly efficient portfolios that can complement U.S. mid-cap equity positions. With 404 holdings, the fund offers plenty of diversification to reduce risk.

The holdings of DMRM currently are 60.17% invested in Treasury instruments, accounting for $51.85 million. The next four largest positions, their percentage share and their asset value in the fund are: Pool Corp. (NASDAQ:POOL), 0.32%, $274,987.98; FactSet Research Systems Inc. (NYSE:FDS), 0.31%, $265,164.24; Fair Isaac Corp. (NYSE:FICO), 0.30%, $258,889.26 and Trimble Inc. (NASDAQ:TRMB), 0.30%, $255,655.92.

DMRM has a net expense ratio of 0.45, and its primary benchmark is the S&P MidCap 400. The fund also has offered a yield of 0.98% during the past 12 months with quarterly dividend payments. The ETF’s investment manager is Transamerica Asset Management, Inc., and its sub-adviser is Milliman Financial Risk Management LLC (Milliman).

Chart Courtesy of www.stockcharts.com

As for total returns, DMRM is up 1.24% for the past week and down 1.66% for the last month. It further eked out a 0.72% gain in the past three months, following losses of 11.91% for the year-to-date and 6.62% for the one-year time periods.

As usual, I encourage you to conduct your own research to consider whether this fund warrants a place in your personal portfolio. Each investor should consider his or her own goals and risk tolerance before making an investment.

In closing, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

In case you missed it…

Cannot Stop the Battery

Pounding out aggression

Turns into obsession

Cannot kill the battery

–Metallica, “Battery”

Elon Musk. The name is synonymous with eccentric genius. When it comes to his electric car company, the mighty Tesla, Inc. (TSLA), well, that stock has been an investor juggernaut that’s up some 370% year to date. Yes, you read that number correctly. Yet today, TSLA shares were down (about 7.5% midway through Wednesday’s session). One reason why was a sell-the-news reaction to the company’s “Battery Day” on Tuesday.

Yet that selling aside, the big picture indicates that, when it comes to the electric car and the technology that is destined to exponentially improve in the coming years, well, to borrow a verse from the great Metallica, you “cannot kill the battery.”

Think of Tesla’s Battery Day as a sort of PR event/shareholder meeting. And in inimitable style, Musk and key executives conducted the outdoor event, not just to a crowd of socially distanced people, but to a parking lot of socially distanced Tesla automobiles with their shareholder drivers inside. The drivers even honked their horns in what was presumably mass approval at what they heard.

Musk and his executives discussed the current state of Tesla, and consistent with his tendency to make new model news, Musk announced a yet-to-be-named $25,000 Tesla vehicle that is in the works. That reduced price will be offered thanks to what he said would be cost savings in battery production that will touch all the company’s products.

And it is about that battery technology that this Battery Day was focused on. Specifically, Musk said that there are three key components to a future world of sustainable energy: sustainable-energy generation, storage and electric vehicles. “So, we intend to play a significant role in all three,” stated Musk. Hey, would we expect Elon Musk to play anything but a significant role in whatever he does?

To get there, Musk and team theorized that the world needs to produce 10 terawatt-hours’ worth of energy per year. To give you an idea of how much energy that is, Musk said that that amount was more than 100 times Tesla’s current terawatt hours’ production level.

“Today’s batteries can’t scale fast enough. They’re just too small,” Musk said. In order to have electric cars continue their growth against their fossil fuel-powered rivals, they’ll need to continue to get cheaper. To achieve that cost savings, Tesla plans to halve the cost of producing every kilowatt-hour with what are known as continuous cylindrical cells.

These continuous cylindrical cells represent a new battery architecture that Musk says will result in five times more energy production and a 16% increase in vehicle battery range that also comes with six times the power output. Musk also said that the production of this new technology was already beginning at a pilot plant.

“It will take about a year to reach the 10-gigawatt-hour capacity,” according to Musk, who added that by 2030 he expects Tesla would be able to produce three terawatt-hours of energy every year.

Musk also mentioned another development that actually had wider implications for the lithium industry, particularly companies such as leading lithium producer Albemarle (ALB). Tesla executives said that the company acquired a 10,000-acre mining site to produce even more of its lithium battery components in-house.

“There really is enough lithium in Nevada alone to electrify the entire U.S. fleet,” said Tesla executive Drew Baglino, senior vice president of power train and energy engineering.

The combination of new technologies that use less lithium, yet deliver more power at a lower cost to Tesla via its entry into the mining space, created a sell-off in ALB as well as big-name lithium stock Sociedad Química y Minera de Chile S.A. (SQM). Yet, despite the double-digit-percentage selling in ALB and SQM today, I think it behooves us to remember Metallica here, because even Tesla “cannot kill the battery” — either the existing battery technology or the companies that produce the lithium which goes into all sorts of batteries, not just Tesla automobiles.

So, while the long-term trend in lithium is for new and better technology to continue making lithium batteries more efficient (and therefore require less lithium), the counterbalancing trend is a world increasingly looking to add electric vehicles of all sorts to the global transportation grid.

This electrification of transportation will mean more aggregate lithium demand and the need to make more and more batteries — and that means long-term opportunity for investors in both Tesla and in lithium manufacturers.

*******************************************************************

Honest and Gentle Reflections

“The most fundamental aggression to ourselves, the most fundamental harm we can do to ourselves, is to remain ignorant by not having the courage and respect to look at ourselves honestly and gently.”

— Pema Chödrön

Life demands our allegiance to reality. What that means is that we must not choose to remain ignorant, especially if that ignorance is out of a lack of self-respect. While it’s not always easy, our lives demand that we look at ourselves honestly, but also gently. By doing so, we just might be able to affect change in our own lives — and by extension, change in the world.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods