A Q3 Look Back and a Q4 Look Ahead

I don’t know about you, but to me it just didn’t feel like we had the best quarter for stocks since 2013. I say that because throughout the third quarter, there has been a waft of uncertainty over Wall Street and Washington that’s served to somewhat obscure the evidence of just how strong stocks have been.

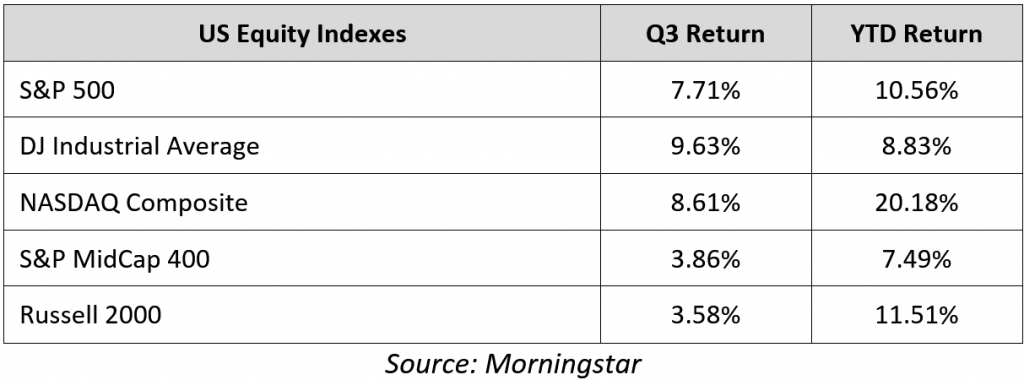

Consider that the S&P 500 finished Q3 with a blistering total return of 7.71% and, as of Sept. 28, the broad measure of the domestic equity market was up 10.56% year to date. The Dow Jones Industrial Average also has enjoyed a stellar quarter, up 9.63% in Q3 and 8.83% year to date.

The NASDAQ Composite also was up sharply in the third quarter, gaining 8.61% and coming in as the clear victor year to date with a total return of 20.18%. Small-cap stocks, as well as mid-cap stocks, did well in Q3, although both segments lagged their larger-cap brethren.

The broad gains in domestic equities during Q3 were largely driven by strong economic data, solid earnings growth and improved clarity on global trade. Perhaps not surprisingly, those positive factors often were overlooked, as news headlines focused on various political firestorms and the continued trade uncertainty between the United States and China.

Yet, in what has become a recurring theme for the 2018 market, positive economic and corporate fundamentals once again outweighed the admittedly unnerving political headlines. The fact is when it comes to economic growth, it’s simply the best we’ve seen in years.

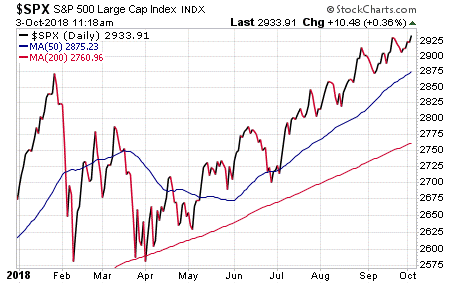

Chart courtesy of stockcharts.com

The final reading of second-quarter Gross Domestic Product (GDP) showed growth above 4% annually. According to the Atlanta Federal Reserve GDPNow estimates, we can expect a similarly strong number for the third quarter. To put that in its proper context, the last time the U.S. economy posted two consecutive quarters of annual GDP growth close to 4% was in mid-2014. Prior to that, it was late 2004!

Corporate earnings growth also remained very strong during the third quarter, as more than 80% of S&P 500 companies reported earnings above consensus expectations. According to financial data firm FactSet, that’s a record high. Aided by the tax cuts passed at the end of 2017, S&P 500 corporate earnings growth for 2018 is expected to rise above 20% year over year. Moreover, analysts expect strong earnings growth to persist into 2019, with current estimates calling for 14% earnings growth for the S&P 500 next year.

Regarding the one big headwind of global trade concerns that seemed to dominate the headlines in Q3, we’ve seen material progress on three of the four uncertain fronts at the start of the quarter.

Yes, concerns about the U.S.-China trade relationship remain, but the third quarter also saw important resolutions to the other trade situations. In July, the United States and the European Union reached a trade agreement that would prevent retaliatory tariffs and promised to investigate ways to further promote free trade. In August, the United States and Mexico agreed to a trade framework to replace the North American Free Trade Agreement (NAFTA), and on the final day of September, Canada reached an agreement to join the existing U.S.-Mexico deal, settling another potential U.S. trade dispute.

As mentioned, we started the third quarter with four areas of trade-related concerns, and now we have just one (albeit the biggest) area of concern — China. And while the U.S.-China trade relationship definitely represents a potential risk to the global economy and markets, it’s important to remember that so far in 2018, a strong U.S. economy and healthy corporate fundamentals have powered stocks higher through multiple periods of trade, political and international uncertainty — and that’s a critical context to consider as we enter the final quarter of the year.

So, what’s likely ahead for stocks in Q4?

As things stand right now, U.S. economic and corporate fundamentals remain very strong, and those two factors are likely to continue providing firm support for the markets.

Will we see volatility in Q4? I think we can safely say that this quarter will be more volatile than Q3, simply because last quarter, stocks just kept pushing the gas pedal. Markets need to brake now and then, so look for some slowing over the next couple of months (remember, September and October are traditionally down months for stocks).

As for the big questions facing markets in the fourth quarter, they include:

- Can the United States and China strike a trade deal?

- Will corporate earnings growth continue to meet expectations?

- Will disruptive political events from Washington (personnel turnover, midterm elections, the Mueller investigation) put a fear bid in on stocks?

It’s unclear how, or when, these questions will be answered, and what those implications will be for markets. Yet as 2018 has shown us so far, uncertainty is not, by itself, enough to offset strong fundamentals in the U.S. economy and corporate America.

Also remember that markets always face uncertainties, especially at the start of a new quarter. Yet, over the long term, it is core economic and corporate fundamentals that drive market returns — and not the seemingly omnipresent waft of uncertainty generated by media headlines.

Finally, would you like to approach the markets with a proven plan that’s helped investors just like you protect and grow their money for more than four decades? If so, then I invite you to check out my Successful Investing advisory service, right now!

Upcoming Appearances

I will be appearing at the Dallas MoneyShow on Oct. 4-5. I will be giving two presentations, “How to Invest Like a Renaissance Man,” and “7 ETFs to ‘Trump’ the Market.” For more information, or to register for this event, just follow the Dallas MoneyShow website link.

**************************************************************

ETF Talk: Introducing a U.S. Dollar-Denominated Floating-Rate Bond Fund

The SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN) tracks an index of U.S. dollar-denominated, investment-grade floating-rate notes.

One of the fund’s main goals is to provide investors with exposure to debt instruments that pay a variable coupon rate, a majority of which are based on the three-month London Interbank Offered Rate, a benchmark that some of the world’s leading banks charge each other for short-term loans with a fixed spread. With a total of $4.08 billion in assets under its management and a high average daily trading volume of $32.10 million, FLRN is a large fund that’s easy to trade.

In addition, its expense ratio of 0.15% means it’s relatively cheap to hold. As a U.S.-based exchange-traded fund (ETF), FLRN has a relatively diverse country exposure, with U.S. issues only making up about half of its debt holdings. Its sector breakdown is fairly concentrated, however, as corporate financial bonds make up 57% of FLRN’s holdings, following by corporate industrial bonds at 27%.

FLRN has quite a lot in common with last week’s featured ETF, iShares Floating Rate Bond ETF (FLOT), but also a lot of differences. Click here to read last week’s ETF Talk. Here is a quick breakdown of both funds.

While both funds track debt instruments with maturities lower than five years, handle around 450 holdings and have broad international exposure, FLOT is more than twice the size of FLRN and is more liquid. However, FLRN is cheaper to hold, with a slightly lower expense ratio of 0.15%, versus FLOT’s 0.20%. FLRN also has a higher distribution yield of 2.92% versus FLOT’s 2.64%. FLRN further has slightly less default risk than FLOT, according to an analysis by Nasdaq. Overall, both funds should provide investors with good floating-rate exposure. Interested investors should do their due diligence before deciding which one is better suited to their portfolio.

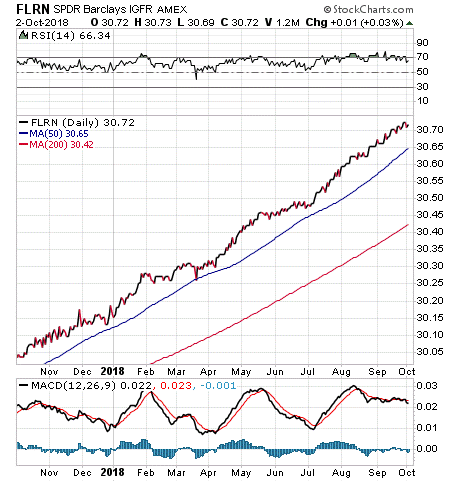

FLRN’s one-month return is 0.25%. Year to date, the fund’s total return reached 1.61%. FLRN’s option-adjusted duration is 0.09 years, indicating the fund offers reduced sensitivity to rising Treasury yields, which is important in the face of the continuing interest rate hikes by the Federal Reserve.

Chart courtesy of stockcharts.com

FLRN holds treasury notes with maturity dates of less than five years in some of the biggest financial institutions around the world. Top holdings include Inter-American Development Bank, 0.75%; Morgan Stanley, 0.73%; Goldman Sachs, 0.63%; BNG Bank, 0.61%; and Morgan Stanley, 0.60%. The small percentages speak to the diversity of FLRN.

Investors seeking a diversified play in the floating-rate bonds field can look to SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN) as a potential candidate to purchase.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Discovering ‘The Virtue of Happiness’

Happiness.

Is happiness a goal we should aspire to, or is it something more? And, how do you achieve real happiness?

Let’s face it, happiness is a serious problem. That’s because happiness is difficult to define, and the feelings associated with happiness can be both evanescent and elusive.

In the latest episode of the Way of the Renaissance Man podcast, I speak with Dr. Joel Wade, author of the fantastic book, “The Virtue of Happiness.”

Dr. Wade is a psychologist who specializes in marriage and family therapy. He’s also a life coach, podcast host and author.

In this discussion, we talk about happiness the way Aristotle defined it, i.e. “eudaimonia” or “the success of being human.” According to Dr. Wade, happiness should always be “on your radar like a point on the shore to aim your boat.”

Dr. Wade wants people to create what he calls a “virtuous cycle,” which means focusing on cultivating key virtues such as gratitude, courage and integrity that create the foundation necessary for a truly happy life.

We also talk about the role of “grit,” i.e. the ability to persevere through challenges and hardship to achieve goals over time, and how that relates to happiness.

I really enjoyed my discussion with Dr. Wade, and I think you will, too.

Finally, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

******************************************************************

Why Doing Less Allows You to Achieve More

Want to achieve more in life?

For most of us, the answer is yes. Yet, also for most of us, the idea of achieving more comes with the corollary notion that we are going to have to do a lot more, put in more hours, work harder and generally take on more and more tasks and responsibilities.

Yet what if doing less could allow you to achieve more? Now, when I say “doing less,” I am not talking about slacking off and just letting fate’s wind sail you across life’s lake. What I am referring to here is taking on fewer overall tasks and really concentrating on getting the critical things in life right.

Another way to describe this principle in action is to hone your focus on the most important tasks at hand, and thereby become a “master of selectivity.” You see, it is by concentrating your efforts on the most important priorities needed to achieve your goals, and letting go of extraneous and often distracting tasks, that you can enhance your performance in business and in life.

This idea of mastering selectivity and prioritizing tasks was the subject of a Wall Street Journal article titled, “How to Succeed in Business? Do Less,” by Morten Hansen, former management consultant and now professor of management at the University of California, Berkeley.

In the article, Hansen explained how his strategy for success at his “dream job” at Boston Consulting Group was to work exorbitant hours, a practice which he said often resulted in 90-hour work weeks. Yet despite all his time and hard work, there was one colleague he had that put in far fewer hours, yet always had better solutions to problems than he did. Moreover, this co-worker put in a normal 8 a.m. to 6 p.m. day, never stayed late and never worked nights or weekends.

So, was this outperforming co-worker just that much smarter and talented than Hansen (as well as the rest of his colleagues)?

What Hansen discovered later in his academic research is it’s not a case of “talent” or “natural ability” or the willingness to “work hard” that can result in successful outcomes. Rather, what researchers have found that what is even more important to success is the ability to master selectivity.

“Whenever they [top performers] could, they carefully selected which priorities, tasks, meetings, customers, ideas or steps to undertake and which to let go,” wrote Hansen. “They then applied intense, targeted effort on those few priorities in order to excel.”

Hansen’s research also found that just a select few critical work practices related to such selectivity accounted for as much as two-thirds of the variation in performance among the subjects in a 2011 research study. “Talent, effort and luck undoubtedly mattered as well, but not nearly as much,” wrote Hansen.

So, how did the best performers in his study do this?

According to Hansen, “Rather than simply piling on more hours, tasks or assignments, they cut back.” Hansen then likened this ability to cut back and focus on what really makes the most difference to the philosophical principle known as Occam’s Razor. Named after philosopher and theologian William of Ockham, this principle stipulates that the best explanation in matters of philosophy, science and other areas is usually the simplest.

“At work, this principle means that we should seek the simplest solutions — that is, the fewest steps in a process, fewest meetings, fewest metrics, fewest goals and so on, while retaining what is truly necessary to do a great job,” wrote Hansen. “I usually put it this way: As few as you can, as many as you must.”

I like to apply this principle to my own life via something called the “minimum effective dose.” What this means is you want to concentrate on doing the things that have the most impact on your results, and that have the fewest extraneous elements and/or time commitments.

For example, in the realm of fitness, I engage in what’s known as high-intensity training, or HIT, to get the best strength and conditioning results in the briefest period of time, and in the safest, most efficient manner.

When investing and selecting top-performing companies for my newsletter advisory services, I concentrate on finding stocks with the strongest earnings, strongest relative share-price performance and stocks that are in the strongest industry groups. By focusing on these key components and filtering out much of the “noise” of extraneous data, I am better able to make good investment choices.

Finally, the principle of focusing more on less, i.e. focusing your effort on the most critical elements of a task or objective rather than becoming sidetracked by the superfluous, is something we can all apply to nearly every part of our lives.

So, if you want to achieve success in any walk of life, focus on the critical elements — and then get them right. Once you do that, you’ll often find the rest tends to fall into place.

*********************************************************************

The Secret to the Future

“The secret of your future is hidden in your daily routine.”

— Mike Murdock

A close friend once told me that how you do anything in life is how you do everything. I love that, because it means that if we do the little things right, it can have a material affect on our futures. And as Mike Murdock reminds us, the secret to our future is within our daily routine.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods