Podcasters of the World Unite

- Podcasters of the World Unite

- ETF Talk: Invest in High Shareholder Yields with This Fund

- The ‘Red Pill’ of Real Estate featuring Dutch Mendenhall

- The Ultimate ‘Fixer Upper’ for Your Portfolio

- The Freedom to Offend

***********************************************************

Podcasters of the World Unite

When a star player in your profession comes under attack, it behooves you to take a look at the reasons why, and to see if there is any “there,” there. I say that because if the biggest name in a given industry has come under fire for supposed wrongdoing, then you can bet that anyone in that industry will be subject to that same kind of scrutiny.

Such is the case with podcaster Joe Rogan, and his amazingly successful, entertaining, and educational podcast, “The Joe Rogan Experience.” Now, in the interest of full disclosure, I am a fan of Joe Rogan. I think he is a brilliant stand-up comedian, an excellent analyst and commentator for the Ultimate Fighting Championship, and he is hands-down the most accomplished podcaster in the world today. I also consider him a “Renaissance Man” in the true sense, as he has mastered a variety of different skills in multiple fields.

In fact, it’s undeniable that Joe Rogan is a huge reason why podcasts have become so popular in recent years. And admittedly, listening to Rogan’s casual, long-form conversations replete with interesting guests on all sorts of fascinating topics is in part what inspired me to create my own podcast, “Way of the Renaissance Man.”

So, what is the deal with Rogan and the controversy he’s currently mired in?

The recent hullabaloo began after a group of medical experts complained about Rogan “broadcasting misinformation, particularly regarding the COVID-19 pandemic.” The group of 270 experts penned an open letter addressed to the audio streaming service Spotify Technology S.A. (NYSE: SPOT), the streaming service that broadcasts “The Joe Rogan Experience,” condemning Rogan’s “platforming” of what they considered misinformation about the pandemic, the efficacy of the COVID-19 vaccines and the controversial scientists who don’t share the mainstream scientific opinion on these issues.

The controversy was exacerbated by rock legend Neil Young, as he offered up his own protest of Spotify and Rogan by threatening to pull his music off the site. “They can have Neil Young or Rogan. Not both,” said Young. Once again, in the interest of full disclosure, I am a huge Neil Young fan, and one of the best concerts I have ever attended was Young’s solo-acoustic show at the Dolby Theatre in Hollywood a few years ago.

Moreover, I can totally understand Young’s stance on this issue. He is exercising his freedom of choice in the service of his ideas, and though you may not agree with those ideas, Neil Young has every right to do with his music what he chooses, including pull it from Spotify in protest.

Now, once again, I am going to admit something here to you, and say that I was actually bothered by Rogan’s focus on alternative scientific opinions when it comes to COVID-19, the vaccines and the platforming of dissenting voices. It’s not that I don’t think those voices should be heard, far from it. Instead, I think that with an issue of such crucial, life-and-death importance, such as how best to wage war on a global viral pandemic, one should make every effort to present all sides of an issue — including the mainstream side — so that individuals can make up their own minds.

Much to his credit, Rogan agreed with this sentiment, as he issued an apology to the public regarding the issue, saying, “I’m not trying to promote misinformation. I’m not trying to be controversial.” Rogan added, “I think if there’s anything that I’ve done, that I could do better is have more experts with differing opinions right after I have the controversial ones. I would most certainly be open to doing that.”

To me, that should have ended the controversy, as Rogan basically did what any rational, moral person should do in this instance, and that is recognize a possible mistake was made and pledge to correct that mistake. Or in special ops terms, Rogan took “extreme ownership” of the situation, and acted like a noble, honorable man.

Yet Rogan’s ownership of this situation wasn’t good enough for some. Instead, the smear merchants came out of their moral hovels and launched a hit campaign against the podcaster using the most grotesque canard one can hurl at a person, the accusation that Rogan is a racist.

Now, I don’t think this accusation deserves the dignity of me presenting the details of their lowly smear campaign, other than to say that it is obvious that Rogan’s use of the vilest racial epithet in American history was in the context of discussing how that racial epithet came to be so toxic, and how it is used in society today.

It’s also obvious that if someone, or some group, wants to decimate another person’s reputation, the easiest way to do so is to construct a racial straw man against them. Forget about the facts, or the context, or the details of one’s life. If you want to hurt a person, just paint them as a “racist.”

Yet the way I see it, if all you’ve got is to accuse someone of racism for discussing words and ideas openly, well, then that’s all you’ve got. And all you’ve got is pretty damn thin.

So, my advice to all of my fellow podcasters, podcast listeners, and readers of The Deep Woods is to rise up and unite in support of Joe Rogan. You may not like him, and you may not agree with his views or his choices. But to dismiss him based on the ugly accusation of racism is to be complicit in the crudest, most despicable, most anti-reason form of character assassination.

***************************************************************

ETF Talk: Invest in High Shareholder Yields with This Fund

The Cambria Shareholder Yield ETF (BATS:SYLD) offers active exposure to U.S. stocks with attractive cash flow characterized by dividends, share buybacks and net debt paydown.

SYLD actively selects U.S. stocks that exhibit high shareholder yield, which is calculated by considering a company’s cash flow measures. Selection starts with the top 20% of stocks by combining two popular themes: dividend payments and share buybacks.

The fund’s quantitative algorithm then factors in the debt paydowns of the remaining stocks and applies valuation factors. The top 100 stocks that represent the best combination of shareholder yield characteristics and value metrics form the final portfolio.

The fund equal weights its holdings during normal market conditions, and it is rebalanced and reconstituted quarterly. SYLD generally holds large-cap stocks but may invest in small- and mid-cap companies. Prior to March 26, 2018, the fund was actively managed, and before June 1, 2020, it tracked the Cambria Shareholder Yield Index.

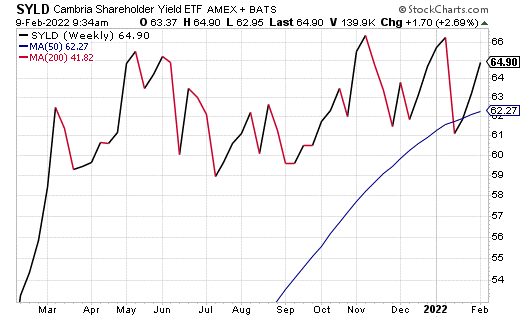

Chart courtesy of StockCharts.com

As you can see in the chart above, the fund has done well over the trailing 12-month period, when its share price rose over 20%. In addition, it has a nice 1.42% dividend yield.

The fund has amassed $347 million in net assets. It has a 0.59% expense ratio, meaning its cost to own is on par with other exchange-traded funds in its group.

SYLD utilizes a quantitative approach to invest in U.S. equities with high cash distribution characteristics. The initial screening universe includes stocks in the United States with market capitalizations over $200 million.

The ETF is comprised of the 100 companies with the best combined rank of dividend payments and net stock buybacks, which are the key components of shareholder yield. It also screens for value and quality factors, including low financial leverage.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

The ‘Red Pill’ of Real Estate featuring Dutch Mendenhall

What happens when you put two entrepreneurial Renaissance Men together in a recording studio?

You get a wide-ranging podcast that includes topics such as real estate investing, healthy eating habits, Chinese politics, technology, sensory deprivation tanks, capitalizing on history, gun rights, the psychology of foreclosures and a peek inside the unique RAD Diversified REIT.

Jim Woods and Dutch Mendenhall discuss real estate investing, capitalizing on history, and sensory deprivation tanks.

In this episode, I discuss all of these topics and much more with the very interesting Dutch Mendenhall, president of RAD Diversified.

You can read all about RAD Diversified and the company that Dutch built, and the investment opportunities in their unique real estate investment trust (REIT), in my new special report, “The Ultimate ‘Fixer Upper’ for Your Portfolio.”

If you want to get to know more about the man behind the RAD Diversified REIT, then this podcast is for you.

*****************************************************************

In case you missed it…

The Ultimate ‘Fixer Upper’ for Your Portfolio

“Landlords grow rich in their sleep.” — John Stuart Mill

The English philosopher and political economist John Stuart Mill is one of the most influential figures in intellectual history and the classical liberalism movement. Mill is best known for his theory of “Utilitarianism,” which in essence states that an action or type of action is right if it tends to promote happiness or pleasure and wrong if it tends to produce unhappiness or pain.

Now, the details of Utilitarianism are interesting to debate, especially for someone like me who spent his undergraduate years majoring in Philosophy at UCLA. Yet what might be an even more interesting concept is Mill’s pithy statement here, that “Landlords grow rich in their sleep.”

Indeed, if you’ve ever owned residential and/or commercial investment property you know that it can be a lucrative endeavor — if you get the variables right. Yet you also likely know that there are a lot of variables you must get right to be successful. Get a few things wrong in the process, and rather than growing rich in your sleep, you might just wake up in a cold, nightmare-induced sweat.

So, how do you get the variables right in real estate?

One great way to do that is to align yourself with a team of experts, and doing that right now is as simple as reading my new, free special report, aptly titled, “The Ultimate ‘Fixer Upper’ for Your Portfolio.”

In this report, I tell you all about a company whose mission, business model, structure (a Real Estate Investment Trust, or REIT), expert management and track record of success represent a way for investors to participate and potentially profit mightily from a specialized segment of the real estate market that involves buying distressed assets, fixing them up and then renting the properties out to credit-worthy tenants.

That’s why I call this the ultimate “fixer upper” for your portfolio, because an investment in this non-public REIT is like having a team of real estate experts doing all of the hard work for you. All you must do is put some money to work in this pre-IPO deal — and start watching your returns accumulate.

The name of the company is RAD Diversified REIT, and it is a Regulation A+ offering.

What that means is that you can invest directly in the shares of the company without even a brokerage account. Moreover, you don’t have to be a “qualified investor” to do so, the way you have to for traditional Initial Public Offerings (IPOs).

Of course, if you are reading this, you likely have a long history of putting money to work in the public markets via a brokerage account, and if you’ve been following the recommendations in my newsletter advisory services, then you have likely done extremely well.

Yet what you might not have had access to before are these pre-IPO, Regulation A+ private offerings that allow you to buy shares of the company with as little as $1,000.

Well, RAD Diversified REIT is one such company, and I think it represents an outstanding opportunity for investors looking to supercharge returns in the real estate market without ever swinging a hammer, taking on a commercial or residential mortgage, or having to maintain a physical asset.

So, what, exactly is RAD Diversified REIT?

In essence, the real estate experts at RAD “turn ugly into pretty.”

What that means is that they look for residential and multi-family properties in key real estate markets across the United States that they can buy at a discount. Often, these purchases are made in properties with tax liens, tax deeds and foreclosures.

Indeed, it is the company’s ability to use multiple channels to purchase properties well below market value and leverage the knowledge and experience of its management team to maximize returns for its investors.

So, think of it as a twist on the old Wall Street maxim, “Buy low, sell high.”

With RAD, it’s “buy low, rent high, collect the rents, pay a distribution, increase the share price for investors.”

Here’s the basic strategy RAD employs to get this job done, using a strategy that they call “The Compound Acceleration.”

According to RAD’s official language: “We rehab, we rent, we leverage, we repeat. We will spend more money to find good deals than anyone else, obtaining more properties than anyone else. We buy something to make it better and we spend more money to make our properties more valuable.”

That’s why I call this company the ultimate fixer-upper for your portfolio. The experts at RAD know how to find the properties, how to “fix them up” to increase their value and how to translate value into the share price of their REIT.

But how well has this strategy worked?

I mean, as a reader of mine you know I am all about the earnings prowess of companies and the returns they offer. So, how about the following audited results:

RAD Diversified REIT made a 36.7% annualized return in 2020, including unrealized gains (based on net asset value (NAV) per share on January 1, 2020, compared to NAV per share on January 1, 2021). As you likely know, that is a major league high performance, and it’s the kind of performance that you want when considering putting your money to work.

For much more detail on the investment opportunities in RAD Diversified REIT, and how you can get in on this Regulation A+ private offering that allows you to buy shares of the company with as little as $1,000, then read my new special report, “The Ultimate ‘Fixer Upper’ for Your Portfolio,” today.

This report is absolutely free, and you don’t even need to provide your email to access it. All you must do is read it, click a few links and you’ll be ready to conquer the real estate market!

*****************************************************************

The Freedom to Offend

“What is freedom of expression? Without the freedom to offend, it ceases to exist.”

–Salman Rushdie

The brilliant writer knows all too well the real-world danger of anti-freedom ideologies, having famously had a bounty placed on his head by theocratic bullies for the “crime” of writing a novel. And though the Rushdie example is a disgustingly egregious instance of an attempt at censorship, any such attempts at censorship of ideas — whether those ideas are benign or controversial — is, in my view, a serious threat to freedom and human flourishing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods