Paul Volcker’s Destructive Legacy

- Paul Volcker’s Destructive Legacy

- ETF Talk: Gain High-Yield Corporate Bond Exposure with This Fund

- The Most Hated Man in a Room Full of Politicians

- This Is What Man Can Do

- Sound Money is Illegal

***********************************************************

Paul Volcker’s Destructive Legacy

Have you heard the one about the pyromaniac firefighter?

He’s the person who, by his own hand, ignites an inferno so that he can come to the rescue and boldly conquer the conflagration.

This analogy seems appropriate this week, as the world received word of the death of former Federal Reserve Chairman Paul Volcker. A giant of a man, both literally and in the banking world, Volcker stood some 6’ 7” and was a physically imposing figure. As head of the U.S. central bank from 1979 to 1987, Volcker implemented his top-down edicts on monetary policy in an equally imposing manner.

Paul Volcker (Photo: Wikimedia Commons)

Interestingly, what is so often the case with those in political power, and in this case those with the power to control the cost of capital, Volcker’s passing brought out the usual doting remembrances. And while I can certainly understand wanting to fondly remember a seminal figure in American society, I also think it’s important to call out that figure’s destructive legacy.

In a brilliant article at the American Institute for Economic Research (AIER) website, economist and thinker extraordinaire Richard M. Salsman puts the Volcker legacy in what I think is its proper perspective. In the article, “Paul Volcker: Foe of the Gold Standard, Fan of Fiscal Profligacy,” Salsman begins by citing what he calls the “the usual but undeserved encomiums from media outlets.”

Comments by pundits extolling Volcker as “the savior our economy needed,” and as someone who “made quick use of the Fed’s toolbox, elevating the Fed to its modern-day reputation as the first responder to economic crises” in an effort to combat inflation, are pointed out by Salsman as just the kind of wrongheaded thinking about the Fed that we all need to check our premises on.

Here’s how Salsman phrases it: “The naïve imagery of Volcker or the Fed as fixers with a ‘toolbox’ has been common among Fed apologists for decades. Yet the facts show that the Fed particularly and central bankers generally have instigated many of these troubles.”

And here is where the pyromaniac firefighter analogy comes in.

You see, as Salsman points out, “It is now long forgotten by most monetary economists and biographers that for five years (1969-1974) Volcker was undersecretary for monetary affairs at the U.S. Treasury and in 1971, after just two years on the job, joined Milton Friedman and others in pushing President Nixon to jettison the gold-exchange standard… The subsequent decade saw wildly fluctuating exchange rates, double-digit inflation, a dollar crisis, and economic stagnation. Not coincidentally, post-war U.S. productivity gains began diminishing in the 1970s and have never fully revived. Few economists today will attribute it to our inferior monetary regime.”

Pause on that observation for a moment.

Volcker, along with Milton Friedman (yes, the same Friedman who in other contexts was a brilliant voice of freedom and reason), were in part responsible for President Nixon taking America off the gold standard. Hence, starting what soon would become the ensuing massive monetary wildfire. And when the move from sound money to unsound money resulted in the printing of excess currency and its corollary consequent, explosive inflation, firefighter Volcker came in to douse the flames, which also happened to extinguish much of the country’s economy.

As Salsman writes, “Mr. Volcker has long been portrayed as slayer of some inflation dragon, when in fact he unleashed it; thereafter, in his first few years as Fed chairman (1979-1982), he put the Fed funds rate above 20%, forcing the U.S. economy to suffer two brutal recessions.”

Now, in this publication, I like to drill down to the philosophic principles at work that result in the actions people and societies take. In the Volcker case, his economic philosophy clearly motivated his behavior. As Salsman puts it: “Duly trained as a Keynesian, Volcker thought prosperity caused inflation, so he tried to kill the former.”

Indeed, that is precisely what Volcker did — and that destructive legacy still permeates society today.

But don’t take it from me. I’ll let the facts speak for themselves on this adjudication of Volcker’s legacy. Once again, as Salsman reminds us:

“By helping to cut the dollar’s tether to gold, Volcker helped Washington’s politicians engage in perpetual fiscal profligacy, which he complained about without ever citing the source of the problem. Since 1971 in the U.S., compounded, annual rates of change in federal debt, money supply (M-1), and the Consumer Price Index have been 8.6%, 6.1%, and 3.9%, respectively, while real GDP and the Industrial Production Index have grown by merely 2.8% and 2.2% p.a. In contrast, under the Bretton Woods gold-exchange standard (1948-1971), when the dollar was defined and fixed at 1/35th an ounce of gold, real GDP and the Industrial Production Index grew robustly (by 3.9% and 4.2% p.a.) while federal debt, money supply, and Consumer Price Index increased by only 2.1%, 3.1%, and 2.2% p.a.”

As piano man Billy Joel might put it, “We didn’t start the fire.”

No, that fire was started by Mr. Volcker and like-minded Keynesians, and any efforts to extinguish the runaway flames should be viewed as anything but messianic.

**************************************************************

ETF Talk: Gain High-Yield Corporate Bond Exposure with This Fund

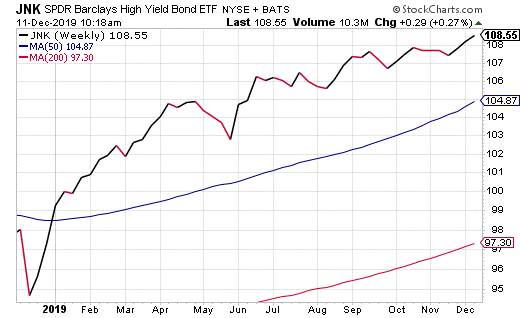

The SPDR Bloomberg Barclays High Yield Bond ETF (JNK) tracks a market-weighted index of highly liquid, high-yield, U.S. dollar-denominated corporate bonds.

JNK seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg Barclays High Yield Very Liquid Index. It is a cost-efficient way to implement a high-yield exposure, compared to individual bonds.

The exchange-traded fund (ETF), which rebalances its holdings on the last day of each month, is a hugely popular, liquid high-yield corporate bond fund. The ETF’s portfolio is one of the broadest in the segment. It charges a reasonable fee, but its tracking has been a bit sloppy at times, so investors may find the holding costs more than advertised.

The fund trades well, however, so it offers liquidity and has a huge asset base. JNK competes most directly with HYG, an iShares ETF by BlackRock that I featured in last week’s ETF Talk, which also is extremely large and liquid.

Heavily weighted in the United States (81.77%), the fund also is invested in Canada (4.88%) and the United Kingdom (3.17%). Its main two sectors are Industrial (74.08%) and Financial (21.64%). JNK’s overall portfolio composition consists of 98.76% bonds.

Courtesy of StockCharts.com

The fund has more than $10 billion in assets under management, 895 holdings and an average spread of 0.01%. With an expense ratio of 0.40%, it is relatively inexpensive to hold in relation to other exchange-traded funds. It is listed on the NYSE Arca Exchange and has been around since November 28, 2007.

With a 5.55% yield, a monthly dividend distribution policy and a dividend increase of almost 5% year to date, JNK could be a good equity for investors looking to gain high-yield exposure in the bond market.

However, as always, all interested investors are urged to conduct their own due diligence before deciding whether this fund suits their individual portfolios.

Rest assured, I remain as happy as ever to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk and you’ll know where it originated.

********************************************************************

The Least Popular Man in a Room Full of Politicians

Get a bunch of politicians together and they’ll disagree on almost everything. Yet the one thing they’ll all agree on is the desire to keep their jobs.

But there’s one man who has dedicated himself to making the profession of politics a part-time avocation.

His name is Nick Tomboulides, the Executive Director of U.S. Term Limits, a Washington-based group that advocates for term limits at all levels of government.

In the latest episode of the Way of the Renaissance Man podcast, you’ll hear Nick’s compelling arguments for why term limits are a must, and how the implementation of term limits is the first step to giving power back to the American people.

You’ll also discover why change in government isn’t about electing a new captain, it’s about trying to fix a damaged ship first.

Plus, find out why term limits are key to preserving natural rights, and why they represent a check and balance on government power.

Nick is a very articulate, very interesting man who is committed to his laudable cause, as you’ll soon hear in this episode.

********************************************************************

In Case You Missed It…

This Is What Man Can Do

This summer, the world quietly celebrated an event that illustrates what humans are capable of achieving when they apply the tremendous power of reason to a goal.

I say “quietly,” because while there were some public commemorations, and many congratulatory events in scientific and technology circles, there really wasn’t a massive public celebration surrounding what can be viewed, both technologically and philosophically, as one of the greatest achievements in human history.

That achievement culminated on July 20, 1969, when Neil Armstrong became the first man to walk on the moon. That seminal event came as part of the Apollo 11 mission, and it remains, to this day, an example of the very best within us.

I was only a five-year-old when that “one small step for man, one giant leap for mankind” took place, yet it was my first real memory of a life event. And, I must say, history couldn’t have picked a better, more heroic, first memory to shape a young man’s psyche. Yet, it wasn’t until about two decades later that I really understood what the true philosophical meaning of this event was.

I credit my philosophic insight into Apollo 11’s true meaning to novelist/philosopher Ayn Rand. I discovered her works in the early 1980s, first via “Atlas Shrugged,” then “The Fountainhead” and then subsequently every work of fiction, non-fiction, op-ed, essay, lecture, letter, etc. that I could get my hands on.

Your editor reading Ayn Rand’s essay collection, “The Voice of Reason.”

In my zeal to consume all things Rand, I came across her essay titled, “Apollo 11.”

Here, Rand wrote of her eyewitness account of the July 16, 1969, Apollo 11 launch, as she was a special VIP guest of NASA at the Space Center on Cape Canaveral to watch the historic achievement.

Observe the power, grandeur and sense of awe in the following account of the launch:

“It began with a large patch of bright yellow-orange flame shooting sideways from under the base of the rocket. It looked like a normal kind of flame, and I felt an instant’s shock of anxiety, as if this were a building on fire. In the next instant the flame and the rocket were hidden by such a sweep of dark red fire that the anxiety vanished. This was not part of any normal experience and could not be integrated with anything.

“The dark red fire parted into two gigantic wings, as if a hydrant were shooting streams of fire outward and up, toward the zenith, and between the two wings, against a pitch-black sky, the rocket rose slowly, so slowly that it seemed to hang still in the air, a pale cylinder with a blinding oval of white light at the bottom, like an upturned candle with its flame directed at the Earth.”

That’s a description by a fiction writer at the peak of her powers. Yet, what followed in the essay is perhaps uniquely Rand, because it is via the following that she captures the philosophic meaning of the Apollo 11 launch:

“What we had seen, in naked essentials — but in reality, not in a work of art — was the concretized abstraction of man’s greatness.

“One knew that this spectacle was not the product of inanimate nature, like some aurora borealis, or of chance, or of luck, that it was unmistakably human — with ‘human,’ for once, meaning grandeur — that a purpose and a long, sustained, disciplined effort had gone to achieve this series of moments, and that man was succeeding, succeeding, succeeding!”

Rand then takes the meaning of this event one philosophic layer deeper, by putting in context what this event means for the spirit of humanity:

“For once, if only for seven minutes, the worst among those who saw it had to feel — not ‘How small is man by the side of the Grand Canyon!’ — but ‘How great is man and how safe is nature when he conquers it!’”

“That we had seen a demonstration of man at his best, no one could doubt — this was the cause of the event’s attraction and of the stunned numbed state in which it left us. And no one could doubt that we had seen an achievement of man in his capacity as a rational being — an achievement of reason, of logic, of mathematics, of total dedication to the absolutism of reality.”

Now, while most achievements of the human mind won’t literally rise to the heights that Apollo 11 did, there are achievements of similar scale and heroism taking place every day in our world.

From the creation of platforms that allow the world to search, communicate and interact with a simple click of a mouse, to the invention of life-saving drugs, therapies and medical devices, to the development of technologies that enhance food production, improve access to clean water, increase personal and societal safety and thereby lift the standard of living for the entire world — mankind’s heroic application of reason to achieve a goal is alive and well.

And the true beauty of this heroism is that we, as investors, also can participate in this rational achievement. You see, by putting our money to work in companies creating value, generating revenue and producing wealth via the byproduct of reason, we too can be part of this heroic human achievement.

So, be a hero, and invest in the human mind — because this is what man can do.

*********************************************************************

Sound Money is Illegal

“Sound money and free banking are not impossible; they are merely illegal. Freedom of money and freedom of banking… are the principles that must guide our steps.”

— Hans F. Sennholz (1922-2007)

As the first PhD student in the United States of the great Austrian economist Ludwig von Mises, Hans Sennholz carried the torch of sound money and liberty that Mises so brilliantly set ablaze. In this quote, Sennholz reminds us that it is government that makes monetary freedom impossible via legal barriers. If freedom were allowed to flourish, so too would money and banking.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods