Welcome to Intelligence Report

Hello, Jim Woods here.

Intelligence Report is my comprehensive advisory service designed for the serious investor.

It has been around for 30+ years, and is one of the most highly respected publications in this field.

Not only is Intelligence Report a doorway to super-profitable investments that investors may not hear about from their brokers…

It also gives them access to sophisticated hedging strategies, investments and techniques that lets them protect their portfolios from any sudden — or even cataclysmic — selloff in the markets.

Once you sign up for your new membership, you’ll also get:

- Intelligence Report Quick Start Guide

This step-by-step plan provides all the information and essential actions you should take first as a new Intelligence Report subscriber.

By following the instructions, new members will ensure that they hit the ground running and maximize the money-making potential of their subscription.

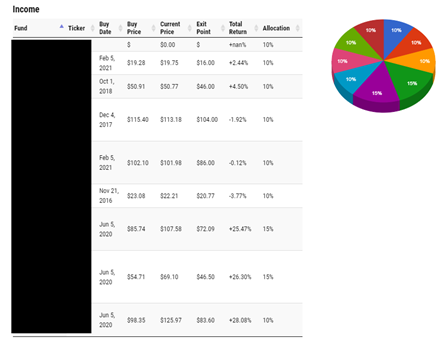

- Full Access to the Income Multipliers Portfolio:

This portfolio includes a basket of 20 investments spread over 11 different sectors, all of which are established companies that have been paying out sizable dividends reliably for many years — some for over a century.

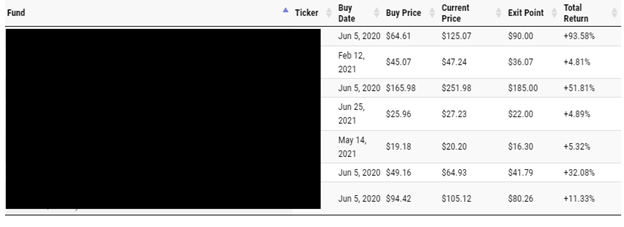

Simply put, no matter how bad the markets get, these are investments that will still hold steady and grow your income. They’re the ones that will survive this imminent crash. - Full Access to the Protection Portfolio:

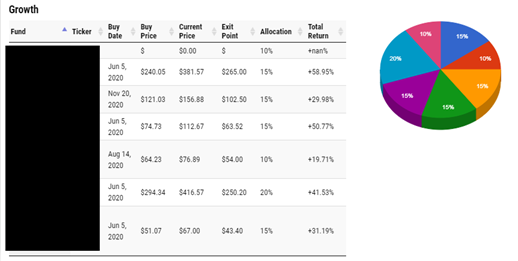

This portfolio includes some of the safest funds on the planet to place your money in. Think of them as a highly secured vault. - Full Access to the Tactical Trends Portfolio:

These are trending investments that have extremely high upsides. They’re where you make a killing no matter what market conditions are. - 12 Monthly Issues of the Intelligence Report newsletter:

Delivered digitally every month, you’ll get my research and analysis on what’s going on in the financial markets, in plain English.Intelligence Report also comes with updates on the Income Multipliers, Protection, and Tactical Trends portfolios, including what to buy and sell when the time is right.

What’s more, the “What’s Up, What’s Down” section covers the performance of 27 different key indexes over the past 15 years, so you’ll know the general trend of the financial markets. - 52 Weekly Email Hotline Updates:

On top of the monthly Intelligence Report issues, you’ll be receiving a market update from me at least once a week. That means I’m going to keep a close eye on the upcoming crash for you.

If anything changes, you’ll hear about it as soon as possible. It’s the same when market conditions turn… you’ll be the first to hear from me through these exclusive hotlines. - 24/7 Exclusive Access to Our Members-Only Website:

Your all-access pass to the members’ area, where all the income-multiplying information is stored. Here, you’ll be able to view all our back issues and reports, as well as keep up with all the major financial market trends and opportunities I’m tracking… and you can access it anytime, anywhere as long as you have an internet connection. - LIVE Quarterly Mastermind Calls:

Every three months, I hold a mastermind call exclusive to current subscribers. I go through the existing portfolios and investments I’m keeping track of as well as answer questions from readers so everyone is on the same page. - My Investing Masterclass Video Series:

You’ll get to hear about my rationale for how I choose picks for both the Tactical Trends and Income Multipliers portfolios… so you’ll be well equipped with knowledge of and confidence in your investments when you’re done watching this exclusive three-part video series. You’ll understand how I came to pick these special investments set to survive this impending crash. - VIP Concierge Service:

If you have any questions, feel free to call our VIP Concierge service number during market hours and we’ll assist you with them. - Investing Master Class:

From my good friends at Trusted Trading Institute. New subscribers will learn the seven pillars that can help them rig the markets for success, three elements to increase their trading results in surprising ways, how tp better control their long-term profitability… and more. They’ll also get a 30-45-minute one-on-one coaching session with one of their experts.

All of these benefits are yours for just $249 per year.

You’re also protected by my:

30-Day, 100% Money-Back Guarantee

Take the next 30 days to look through everything…

If you decide it’s not what you’re looking for…

Simply call our VIP Concierge service number Monday-Friday, 9am-5pm Eastern time, or send an email to CustomerService@JimWoods.com and you’ll get every penny of your subscription fee back. No questions asked.

But here’s the amazing part.

Even if you do cancel, you’ll still get to keep every one of the reports sent to you.

It’s our way of saying thank you for putting your trust in us.

Fill out the secure order form below to get started.

Jim Woods

Investment Director, Intelligence Report