Hi, Jim Woods here.

This document I’m holding contains what I believe are the three most important stock tickers in the world…

I call it “The Perfect Portfolio”…

Because if you had owned just these three stocks for the past two decades…

You wouldn’t have lost ANY money during stock market crashes…

AND…

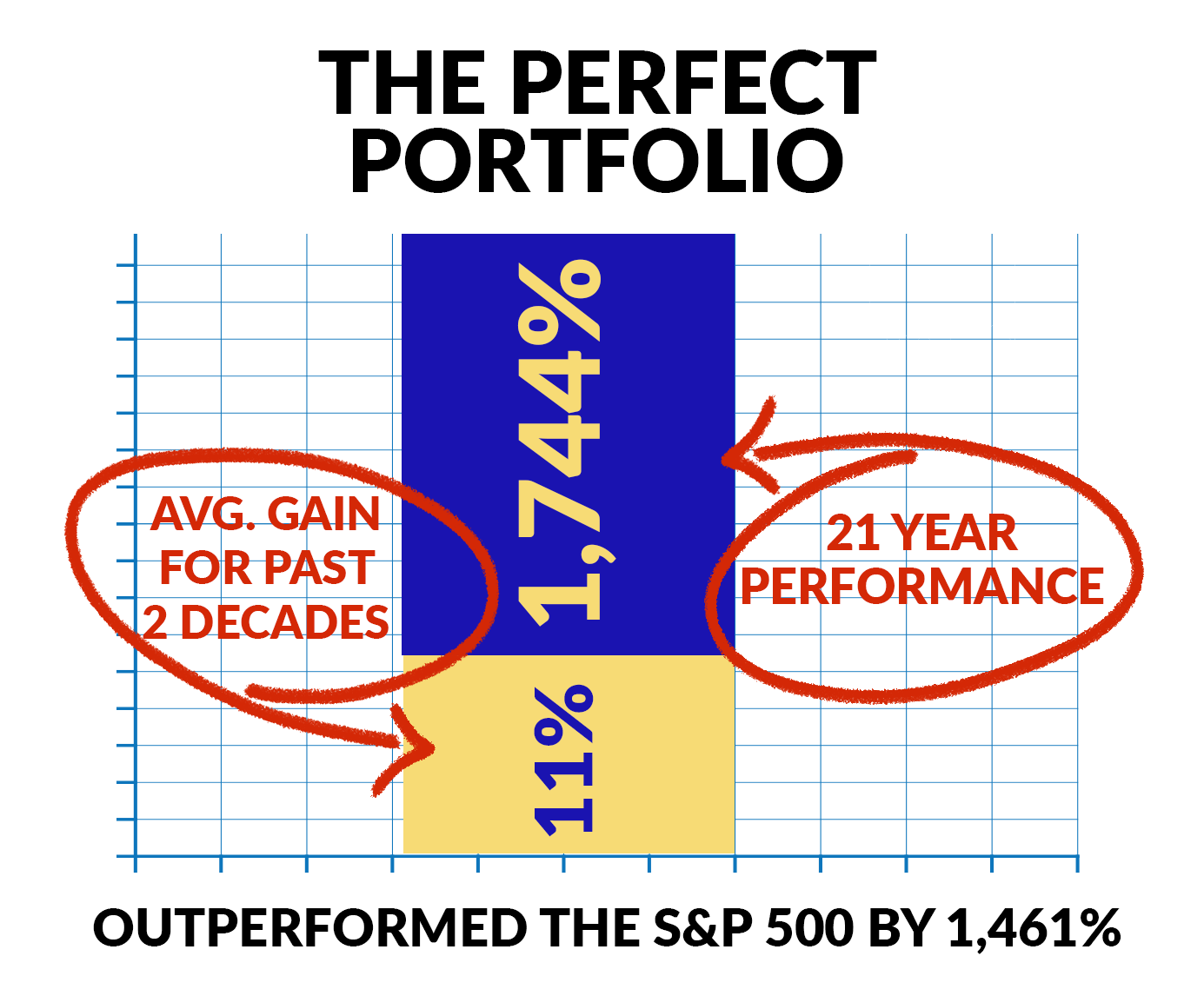

You would have outperformed the S&P 500 by an amazing 1,461%!

In fact…

During the 2000 dotcom crash… the 2008 financial crisis… the 2020 Covid panic… and the 2022 market meltdown…

The Perfect Portfolio could have helped you avoid any devastating losses… and actually given you an 11% gain… while stocks cratered.

And over the entire 21-year period, this unique group of just three stocks could have given you a sensational 1,744% return…

That could have helped you turn a relatively modest $100,000 stake into more than $1.7 million… with much less risk than if you simply bought a stock market index fund.

Now you can see why I call this The “Perfect” Portfolio.

Because for more than two decades, it’s delivered truly phenomenal performance that’s been out of reach for nearly all investors.

In just a few minutes, I’m going to give you access to these three extraordinary stocks…

And I’ll show you an entirely new way to invest that you’ll never hear about from a financial advisor or the mainstream financial media.

But first, a word of warning…

If you’re an adrenaline junkie who somehow enjoys the roller-coaster ups and downs of a volatile stock market… you should exit this page now.

This isn’t for you.

Because The Perfect Portfolio has delivered truly spectacular gains from a special collection of low-volatility stocks.

Low volatility means no wild price swings.

And that means far less downside risk.

Look, I know what you’re thinking…

“Lower-risk stocks can help protect you from market crashes… But they can’t deliver life-altering gains.”

I used to believe that too…

Until I discovered the strange market anomaly I’m revealing to you today.

Institutional Investor magazine said that this anomaly is…

And Harvard Business School researchers went so far as to call it:

In just a moment, I’m going to show you how to start taking advantage of it yourself with The Perfect Portfolio.

And maybe the best part is…

You don’t need much money to get started with this strategy…

Because you only have to buy three stocks… which means you can participate with as little as $1,000…

And once you do, you’re done.

With The Perfect Portfolio, you’re not continually monitoring and rebalancing your portfolio.

You just buy three extraordinary stocks and do nothing.

It’s the ultimate “set it and forget it” investment strategy.

And you can start using it for yourself today.

But before I show you how, let me fully introduce myself…

As I mentioned, my name is Jim Woods.

I’m a 30-plus-year market veteran.

I worked as a stockbroker and a hedge fund trader before becoming the Editor-in-Chief of the influential newsletters Successful Investing, Intelligence Report and Bullseye Stock Trader.

I’ve also co-authored two international best-sellers: The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash and Billion Dollar Green: Profit from the Eco Revolution.

The independent rating firm TipRanks.com ranked me as the #1 financial blogger in the world — out of more than 14,000 people tracked…

And they’ve calculated that over the past five years, I’ve made nearly 500 total recommendations, with a double-digit average return for EACH recommendation .

I’ve made a name for myself by helping everyday investors achieve financial freedom through a simple, no-nonsense approach to investing.

My low-maintenance investing strategies are designed to give folks like you a stress-free competitive edge in the markets.

And the strategy I’m revealing to you might be the greatest market edge I’ve ever uncovered…

Because if you followed The Perfect Portfolio during the last two decades…

You NEVER had a sleepless night worrying about your nest egg during market crashes…

AND

You NEVER missed out on massive gains during bull market runs…

Look, if you’re like most folks, you had a tough year in the markets last year.

The S&P 500 was down 18%… and the NASDAQ cratered nearly 31%…

Many people are still trying to dig out of those holes.

And that hasn’t been an easy task to do this year, with market volatility still high and many analysts insisting a painful recession is looming.

With so much uncertainty in the air, you’re trying to find a low-stress way to make some good money.

And I believe the investing strategy I’m revealing to you today could be precisely what you’re looking for.

Because the low-volatility technique behind The Perfect Portfolio has delivered HIGHER RETURNS from LOWER RISK for a really, really long time…

You don’t need to take my word for it…

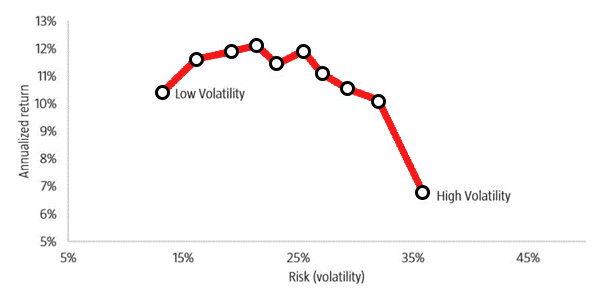

Have a look at the following chart from Robeco Investment Research in December 2021…

It tracks portfolio volatility performance going all the way back to 1929…

As you can see, the lowest-volatility portfolio outperformed the highest-volatility portfolio by nearly 4% per year… through all kinds of bull and bear markets… for more than nine decades!

So for at least 90 years, a low-volatility portfolio has delivered higher relative

stock market returns…

And not by a little!

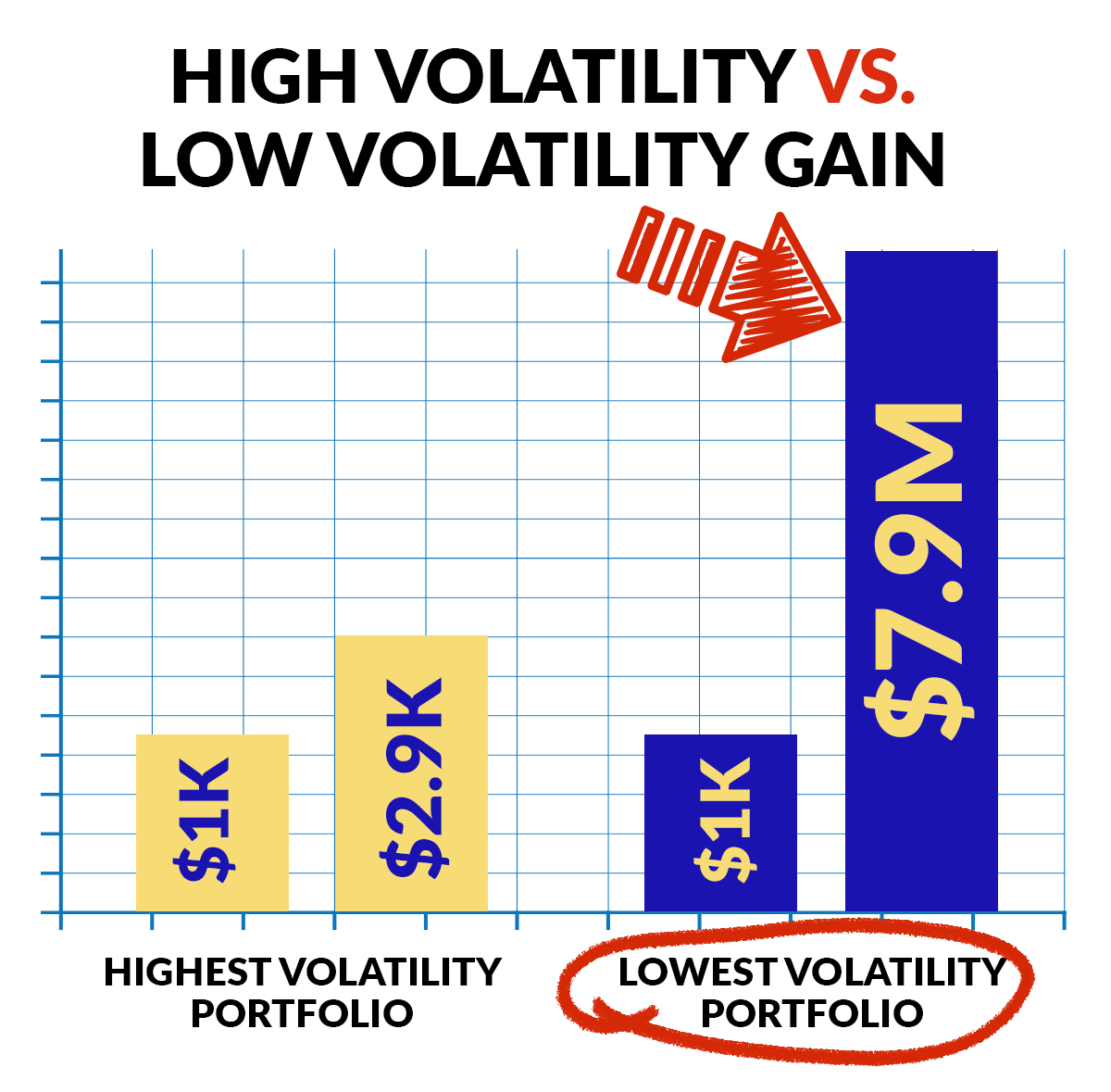

To put that performance in context…

An initial $1,000 stake in the highest-volatility portfolio would be worth roughly $290,000 today.

But that same $1,000 stake in the lowest-volatility portfolio would be worth a whopping $7.9 million today.

That’s an extra $7.6 million produced by the low-volatility portfolio.

Look, I know “less risk, more reward” goes against everything you’ve been taught about finance…

But literally dozens of studies prove that this anomaly works…

Like this one from the Journal of Portfolio Management…

And this one from the Journal of Empirical Finance…

Here’s one from Harvard Business School…

Here’s another from the Journal of Asset Management…

And another from the CFA Society…

Analysts at BMO Global Asset Management summed up this mountain of research best by saying:

With all this evidence, you’re probably wondering why you haven’t heard about this low-volatility anomaly before…

Well, Wall Street advisors and CNBC talking heads have zero interest in sharing it with you… because it would bankrupt them.

Think about it….

If you learned a strategy that’s been immune to market crashes while also crushing the returns of the stock market over time… just by holding three stocks…

You’d never pay money to a financial advisor or tune in to the CNBC hype ever again.

That probably sounds like heaven to you.

Now, can I guarantee that these three stocks will repeat the world-beating results I just showed you?

Of course not.

No one has a crystal ball.

And losses can and do happen.

But what I can tell you is — as you’ve just seen — the strategy behind The Perfect Portfolio is empirically proven to have delivered higher returns than other stocks for at least 90 years.

That’s an astounding track record.

More important…

If you owned the three stocks in The Perfect Portfolio, you were able to crush the market while avoiding any painful losses… through four market crashes over the past two decades.

That peace of mind is what millions of folks like you are looking for right now.

And that’s the sense of security and prosperity that I want to give to you today.

Look, many of my new subscribers are folks who’ve been burned by the bad mainstream investing advice they’ve received in the past.

Some were told to pile into high-risk growth stocks to try and strike it rich by getting in early on the next Amazon… Apple… or Google…

But that strategy has the same odds of winning as playing the lottery, with the growth-heavy NASDAQ down a hefty 31% in 2022…

Others were told to buy a supposedly “safe” 60/40 mix of stocks and bonds and hold on tight.

But CNBC reported that a typical 60/40 portfolio was having its worst year ever, down nearly 20% last year…

Other folks relied on advisors to “actively” manage their portfolios… trying to magically time the market just right.

But as the American Enterprise Institute reports, when it comes to beating the market, “95% of Finance Professionals Can’t Do It”…

That means investors often cash out too late in a crash, which leads to crushing losses that set them back years.

That’s why I’m so eager to share this research with you today…

Because the spectacular performance of The Perfect Portfolio proves there’s a far superior way for you to invest.

Look, by now you’re probably dying to know how the low-volatility anomaly behind The Perfect Portfolio works…

Well, I wish I could tell you it’s because of some sexy-sounding “secret” formula…

But it’s actually incredibly simple.

As researchers at S&P Dow Jonesput it plainly…

And here’s how they do it…

First, low-volatility portfolios WIN by NOT LOSING.

Low-volatility stocks have stable prices, which means less downside risk.

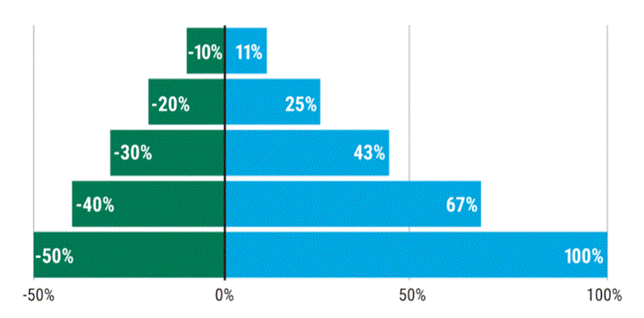

See, most investors don’t pay enough attention to the crushing math of losses.

A 30% portfolio hit like the one many folks experienced just this year requires a 43% gain just to get back to break-even.

That could take years just to get back to where you started.

If you can avoid devastating losses during market crashes, you’re WAY ahead of most investors…

Second, investing in low-volatility stocks of strong, profitable companies allows you to participate in long bull market runs.

Investors are willing to pay a premium for strong, profitable companies.

That helps you collect outsize returns and outperform the market over time.

The simple fact is…

Low-volatility companies that are highly profitable deliver both lower risk and excess returns.

Financial theorists say this shouldn’t be possible.

But it happens all the time.

And these kinds of stocks don’t just beat the market by a little.

They demolish it…

Just by relying on this simple formula…

Low Volatility + Strong Profitability = Perfect Performance

And when markets started collapsing last year, I decided to put this formula to the test…

I took a deep dive into the entire universe of stocks to find the best -performing “Perfect” stocks since the beginning of the century…

And I uncovered a unique combination of three that delivered returns that, frankly, I didn’t think were possible…

Have a look for yourself…

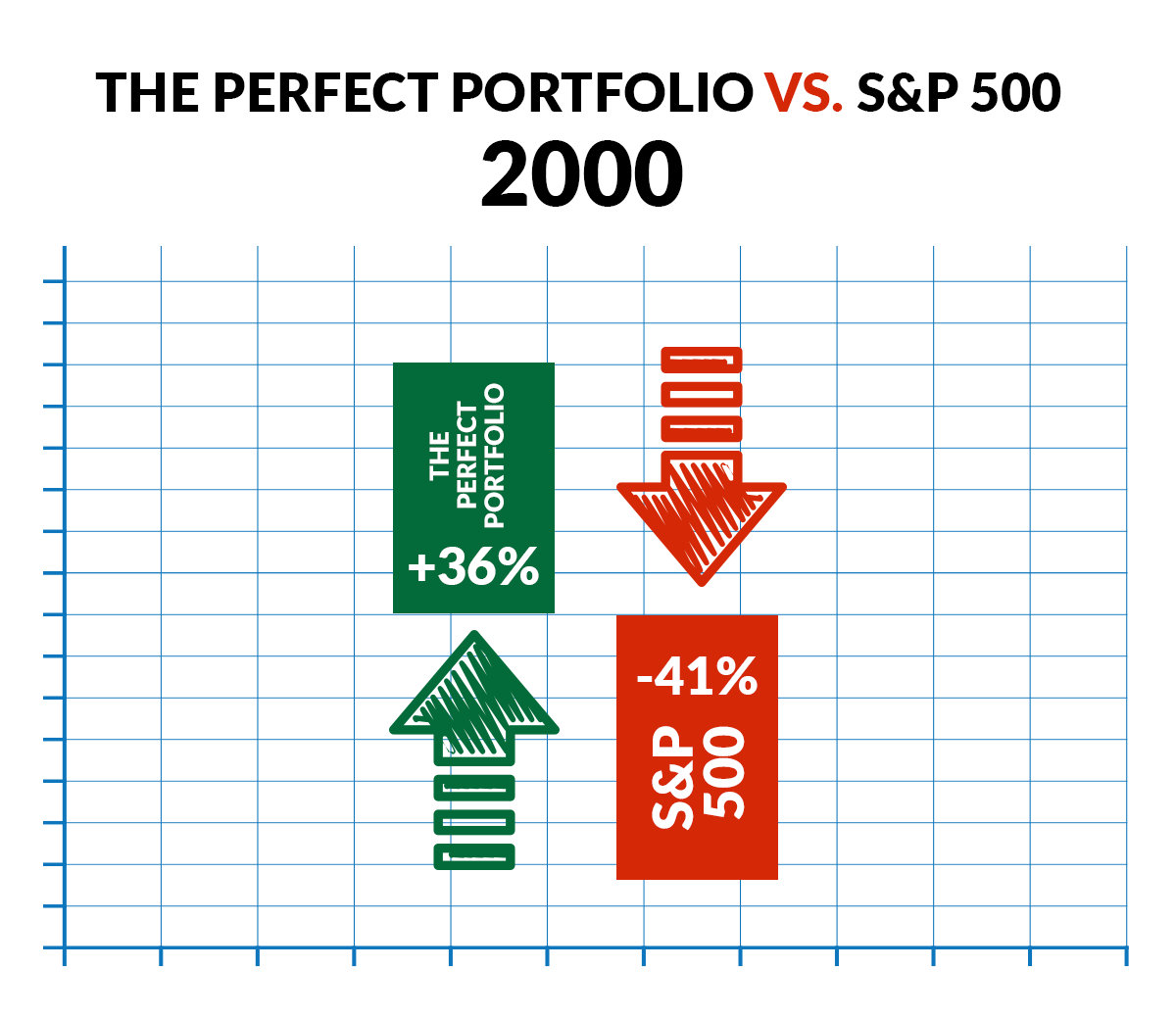

When the dotcom crash sent the S&P 500 plunging -41% in 2000…

The Perfect Portfolio actually gained 36%…

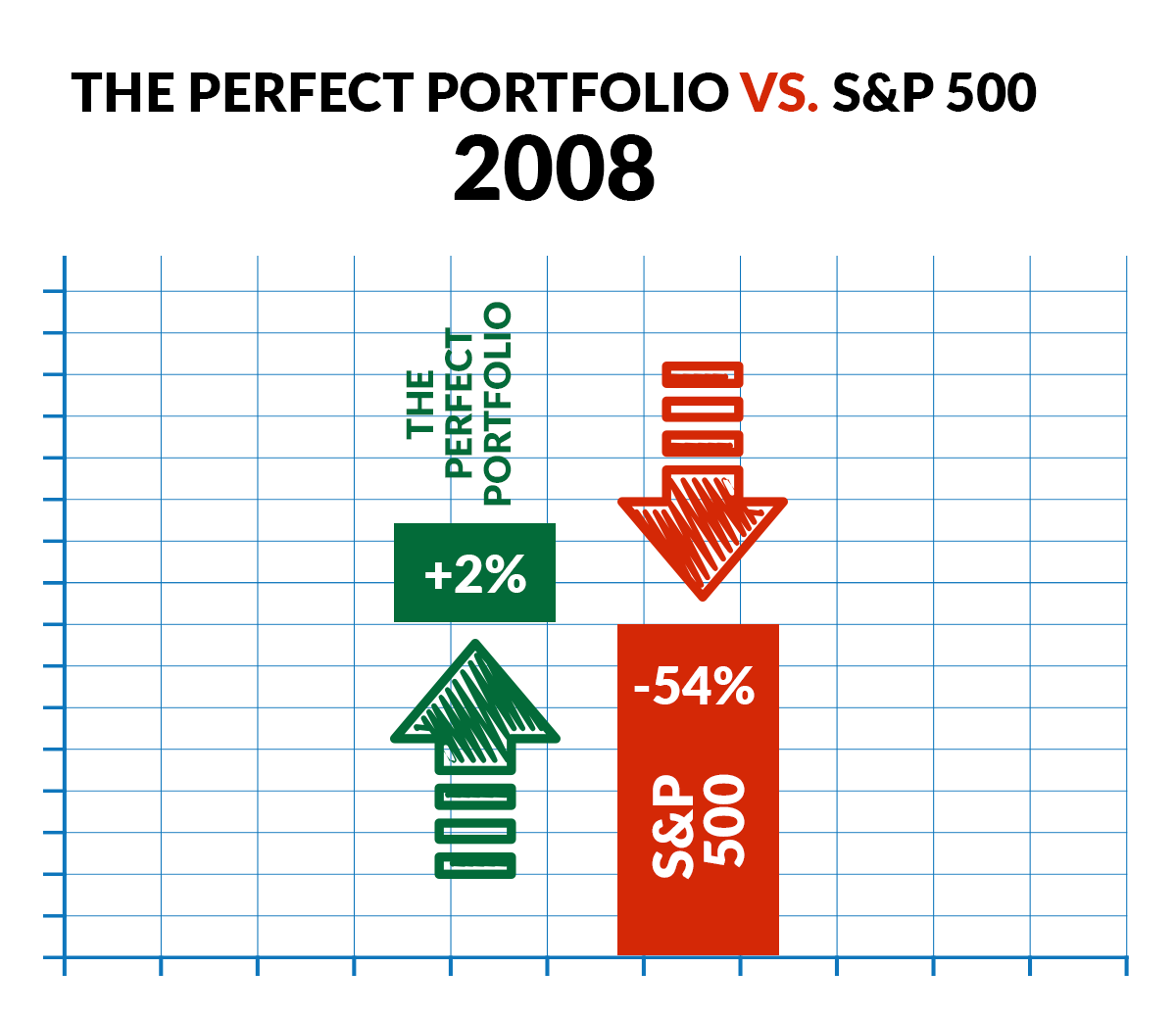

When the financial crisis of 2008 sent the S&P into a -54% tailspin…

The Perfect Portfolio stood strong with a 2% gain…

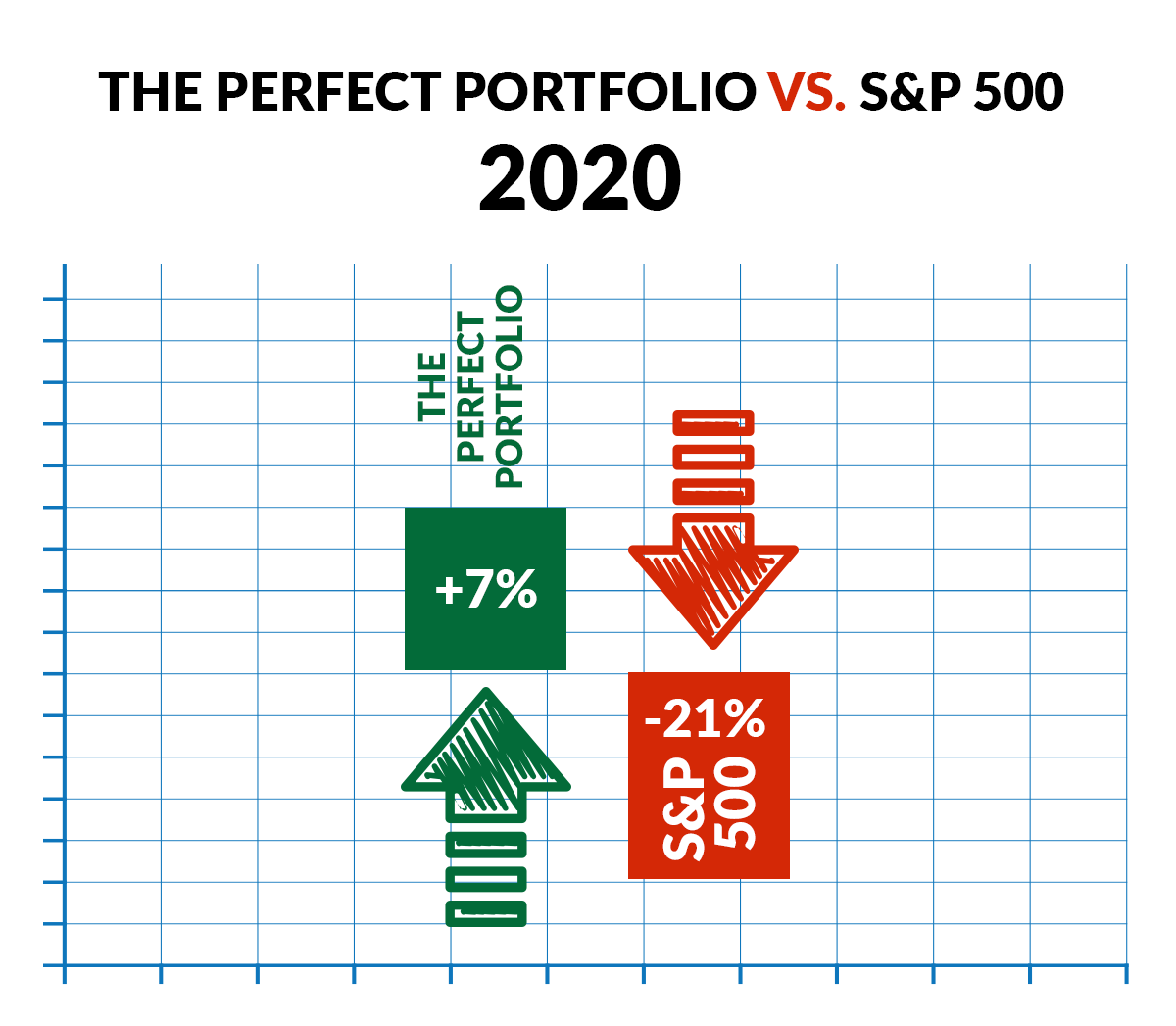

When the Covid panic hit in 2020 and markets took a -21% swan dive…

The Perfect Portfolio remained steady, with a 7% gain…

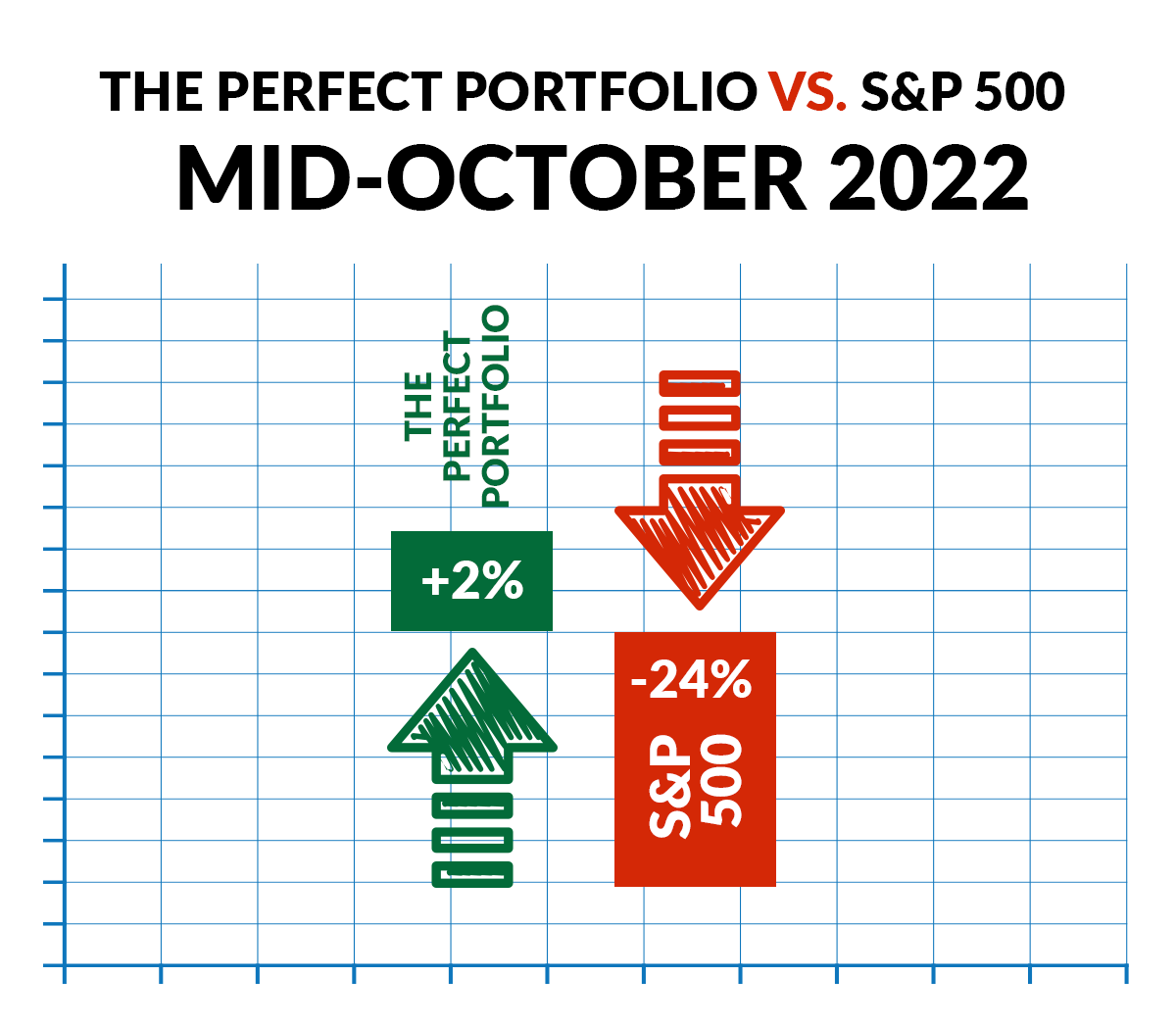

And during the -24% market meltdown through mid-October 2022…

The Perfect Portfolio didn’t lose a penny, managing a 2% gain.

All in all…

The Perfect Portfolio averaged an 11% gain through every kind of crash the market has thrown at it for the past two decades…

And over the full 21-year time period, including lengthy bull markets, The Perfect Portfolio collectively gained an astonishing 1,744%…

Outperforming the S&P 500 ETF by a massive 1,461%…

Let’s be real…

What other strategy do you know that offers this kind of unparalleled protection combined with HUGE profit potential?

And what’s great is…

Using The Perfect Portfolio is about as simple as it gets…

Simply buy three stocks… and you’re done.

With The Perfect Portfolio… you’ve got the ultimate peace of mind.

So, while your friends and neighbors are stressing about earnings, inflation and recessions…

You’ll be safe in the knowledge that you’ve got a portfolio designed to thrive in ALL market conditions.

And that highlights an important point…

NOW Is the Time to Protect Your Wealth

Look, if you want to protect your portfolio, you’ve got to act now.

I know the talking heads on CNBC are telling us everything will go back to normal…

That the worst of last year’s market correction is over…

But I’m here to tell you that’s dead wrong…

Much of the effects of the central bank rate hikes have not yet been felt in the economy.

Rate hikes take months or quarters to meaningfully impact growth, much less show up in the mostly lagging economic data the same policy makers are focusing on for signs of easing inflation.

This will lead to that so-called “hard landing” that everyone fears.

When that happens, it means the Fed and other central banks overshot on rate hikes, and then there is nothing they will be able to do to stave off a deep recession and a deleveraging of the massive credit bubble.

How bad could it get?

Well, famed investor Jeremy Grantham says we’re in an economic “super bubble” and markets could see a decline of over 50% before all is said and done.

And he warned, “We’re in a dangerous mix of overvalued stocks, bonds, and real estate.”

Michael Burry of “Big Short” fame predicts something far worse…

He says we’re in the mother of all bubbles and sees a correction of over 61% before the carnage is over.

In other words — if you have $1 million in your retirement account, you could lose over $610,000!

And considering that Burry also predicted the 2008 subprime mortgage meltdown, the current stock market correction AND the most recent crypto crash…

We could be in for some scary times…

That’s why I’m so excited to show you The Perfect Portfolio today.

It has not only offered perfect protection during all major market meltdowns this century… but also produced extraordinary returns when stocks were booming… with just three stocks!

Imagine having access to a time-tested portfolio that has gained money through every recession and bear market of the last two decades.

Imagine never missing a night of sleep worrying about your portfolio…

And feeling confident your nest egg is going to steadily rise even if markets around the world crash.

Now, I know this might sound too good to be true… but consider…

The research I’m sharing with you is backed by some of the most renowned research institutions in the world, including Harvard Business School, the Journal of Empirical Finance and the CFA Society…

And as we go forward, I’m going to show you why strategies like The Perfect Portfolio are going to become more and more important…

Because the reality is… for roughly the past 15 years, we’ve lived in a fantasyland where people could borrow money for ZERO percent thanks to Federal Reserve policy.

In fact, many of Wall Street’s top traders have never worked in an environment where money had any cost…

But as we’ve seen, with sky-high inflation, that’s all changing…

The Fed has been raising rates aggressively to combat it…

That means they’ve turned off the spigot of easy money that’s been pushing stock prices higher for the past 15 years…

And those who aren’t prepared — they’re about to get crushed.

But luckily for you, there’s another way…

A portfolio that can give you access to massive gains while still protecting you from any downside market chaos.

I’ll show you how to get access to those stocks in just a minute…

But first I want to expose the biggest myth in modern finance…

A story that’s been pushed by mainstream outlets for years…

“Just Buy the DIP”

Now, if you follow the legacy media…

No doubt you’ve heard markets always go up over the long term…

And that anytime markets drop, you should take that as a buying opportunity to add more shares to your portfolio.

Here’s the problem with that…

Although markets have gone up over the long term in nominal terms…

The trouble is…

If your timing is bad, that time horizon can be years or even decades before you get all your money back.

For example, if you had money invested in the stock market during the crash in September 1929 — it would’ve taken you until 1954 to get your money back!

Think about that…

Imagine owning stocks and 25 years later still being down on your money?

That would be like making an investment today and not breaking even until 2048!

Sure, you might say…

That was the Great Depression…

That’s not likely to happen today.

A quick look at history reveals “lost decades” like these have happened numerous times…

If you’d bought in the market downturn in 1965, you’d have waited 14 years before you got back to zero…

If you’d bought in the tech crash of 2000… you’d have been underwater until 2012!

Talk about frustrating…

It’s sad to see… but so many people have been crushed by simply buying stocks at the wrong time…

If you are anywhere near retirement or don’t want to watch your portfolio collapse…

The Perfect Portfolio offers you the best of both worlds.

It almost doesn’t seem fair…

How could one portfolio offer such high gains while at the same time cutting risk?

Well, that’s why I’ve been devoting my research to this…

And in the next few minutes I want to give you an unfair advantage.

I want to give you access to a portfolio that can build substantial amounts of wealth without risking the farm.

How much are we talking about?

Life-Changing Wealth

Let’s play around with some numbers to show you what kind of impact this technique can really make…

As I showed you earlier — historically speaking —

By avoiding the devastating power of losses, The Perfect Portfolio would have turned $100,000 into a nice $1.7 million nest egg (without having a single down year).

That’s incredible…

But that’s with a one-time investment…

What if you continued to invest money in this portfolio on a yearly basis?

Well, here’s where the numbers get fun…

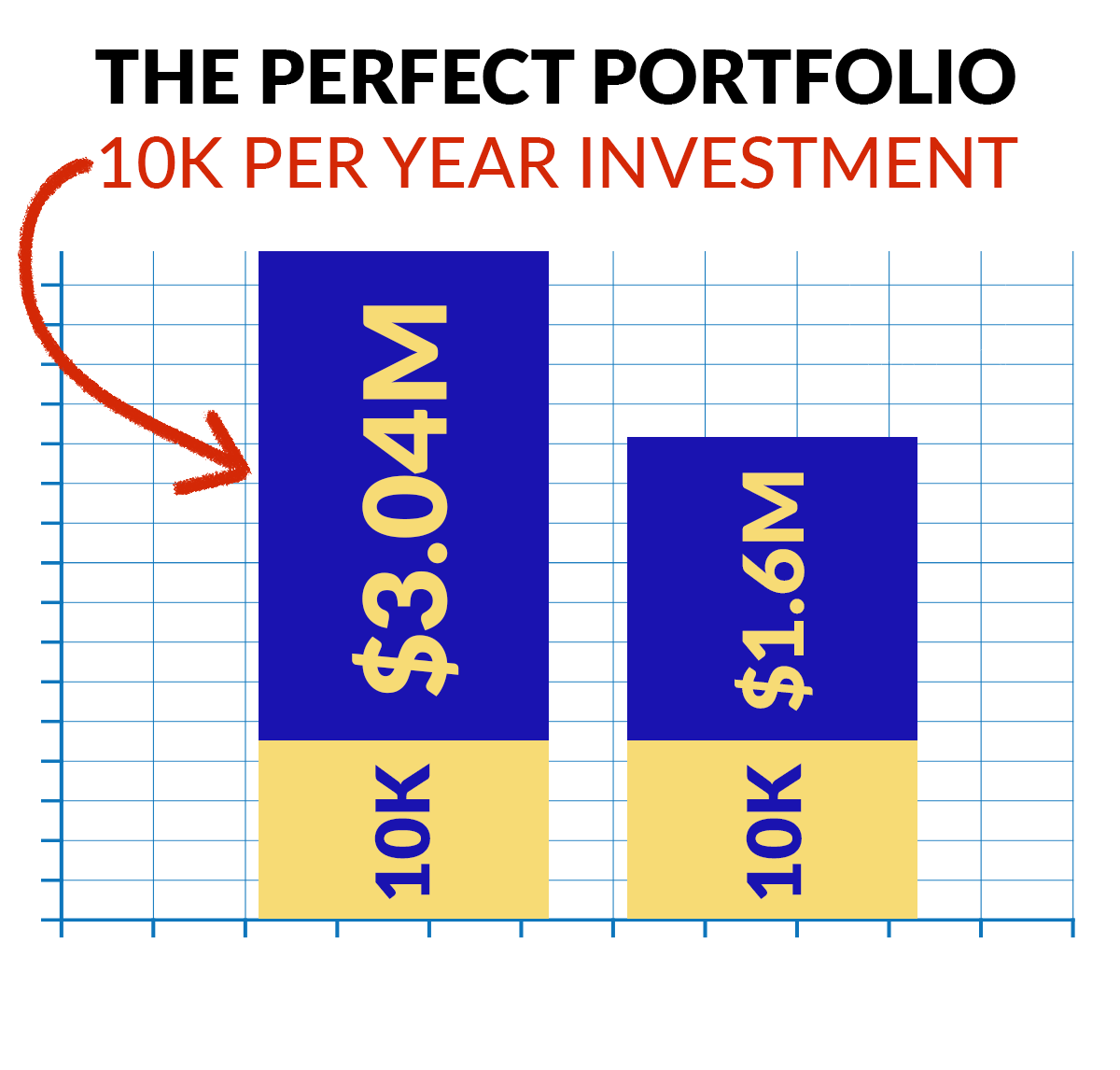

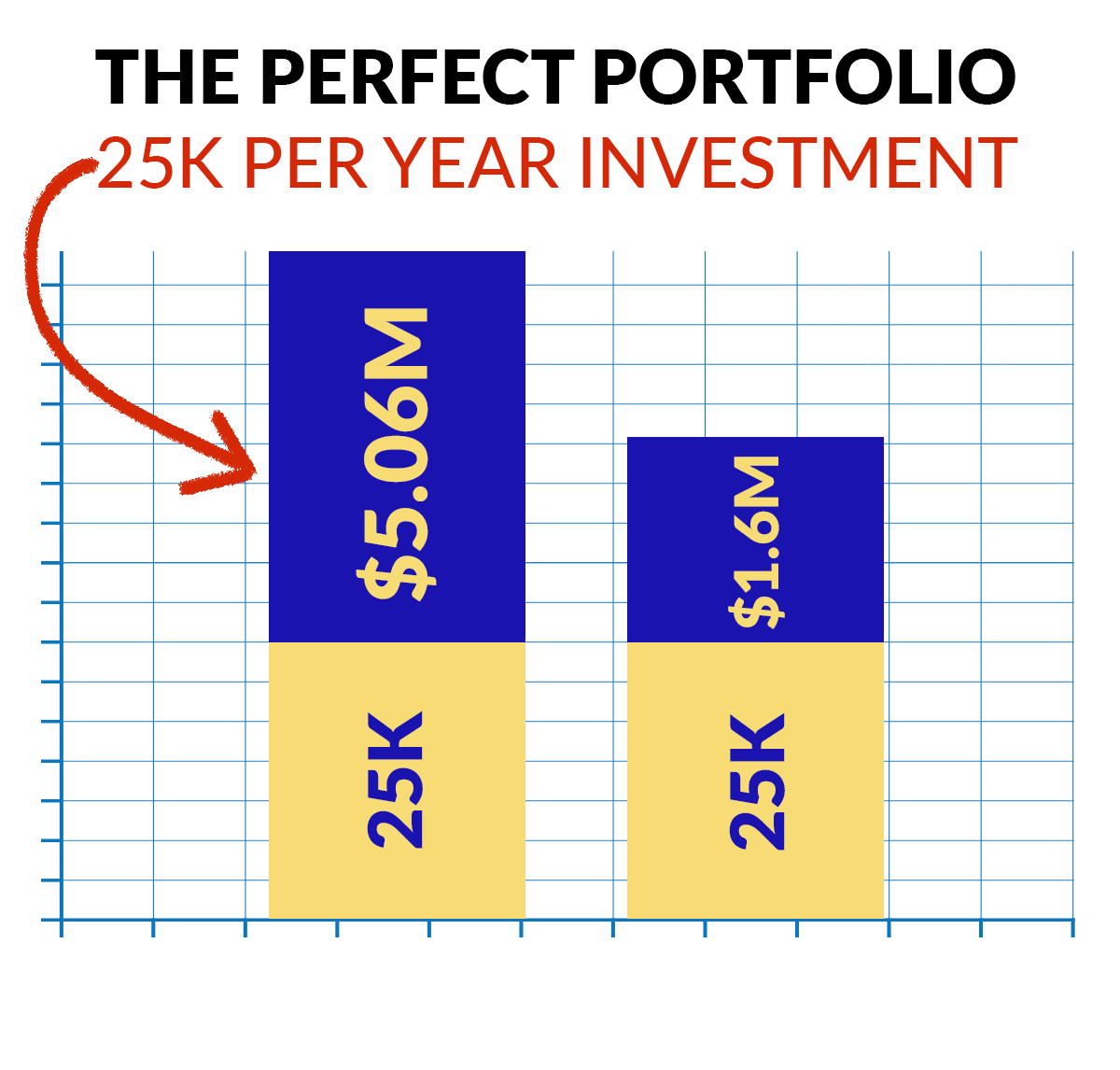

What if after your initial $100,000 you continued to pump in $10,000 a year?

What about $25,000 a year?

I want you to imagine what having that kind of money would do for your lifestyle.

How different would you feel knowing you’ve got access to a portfolio proven to outlast some of the worst bear markets ever?

To put it bluntly…

The way I see it, there’s not much of a choice…

You can either buy traditional stocks and hope for the best… or take a different approach and earn far more profits from a seldom-used strategy.

This “Perfect Portfolio” strategy gives you a fantastic combination of high returns and unparalleled safety.

If you are as excited about this strategy as I am and you want to learn more…

Here’s how to get started.

As I explained earlier… I’ve spent most of my adult life studying finance and how to make money.

And when I began my career decades ago as a financial journalist…

One thing I quickly discovered was that most of the best opportunities to make money are hidden…

Strategies like The Perfect Portfolio…

Ones that allow you to vastly increase returns while cutting risk were not covered in the mainstream media… and financial planners hardly ever recommended them.

This lack of real information is what set me on a quest to take what I’ve learned behind the scenes in the finance world and bring it to everyday readers.

And this journey allowed me to write several best-selling books, like:

Billion Dollar Green: Profit from the Eco Revolution and The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.

Not to mention the numerous interviews with national radio talk shows and newspapers.

But for all the appearances I’ve done and books I’ve written…

By far the most gratifying part of my job is showing everyday people how to take the same techniques the Wall Street pros use and apply them to their own finances.

Here’s what a few people who’ve followed my work have said:

— Ken M.

— Tom Z.

— Ed C.

— James C.

— Tim J.

Are you next?

I firmly believe that while no investment is 100% foolproof, The Perfect Portfolio offers you the highest returns possible… while at the same time drastically reducing your risk.

You can’t beat that…

That’s why I put together a special report called:

The Perfect Portfolio: Discover a Simple Strategy to Outperform the S&P 500 by 1,461% (Even If Stocks Crash!)

This brand-new report details everything you need to know to get started.

I’d like to send this to you absolutely FREE!

In it, I share all the details you need, including the ticker symbols of the three “Perfect Portfolio” stocks.

And with your permission, I’ll gladly rush a copy directly to your email… at no charge.

But you need to act now.

The sooner you get in, the more money you stand to make.

And remember, we’re not timing the market with any speculative algorithms or complicated options strategies…

This portfolio is based on large-cap, blue-chip, household-name companies.

Very big…

Very safe…

This level of safety gives you peace of mind.

It allows you to sleep soundly at night, knowing you are using one of the most robust portfolios ever designed.

The bottom line is…

The Perfect Portfolio gives you the best chance to protect yourself in today’s hyper-volatile market.

But you see, up until this point, I’ve mainly focused on The Perfect Portfolio and the incredible kick-start these stocks could give your portfolio.

But what I haven’t told you yet is that “The Perfect Portfolio” is just one of the weapons I recommend to increase gains while slashing risk.

As I mentioned earlier, I’ve spent 30 years in this game, and in that time, I’ve developed an entire newsletter dedicated to revealing hidden situations that present phenomenal profit opportunities like these.

I call it the Intelligence Report.

This monthly letter specializes in finding undervalued, incredibly safe investments… far from the beaten path of Wall Street.

This work is my passion, and it has taken me all over the world in search of the perfect long-term investments…

In fact, in the last year alone, I’ve sifted through thousands of annual reports, pored over countless balance sheets and had boots on the ground all over the world.

Grueling?

Sometimes, yeah.

But that’s the kind of work and diligence it takes to locate exceptional opportunities like The Perfect Portfolio I’ve been telling you about.

As I said, I’ve just created a report that gives you full details on this opportunity that I’d love to send to you FREE.

But before I do, let me tell you about another opportunity I recently discovered:

Top 5 ETFs for Lifetime Income

If I could give away one tip to anyone looking to have a happy retirement or who wants financial freedom…

The biggest thing to focus on would be income investments… period!

Now, I know income investments have been a dirty word for the last few years, with the crypto and tech bubbles booming.

But one thing I can tell you is… if you can focus on building up your monthly cash flow… all your money problems can quickly disappear.

It’s hard to run out of money when you’ve got passive checks hitting your account every month.

And in this report I want to give you five of the top income ETFs on Earth…

And when I say the best ETFs on Earth, I mean it…

While most financial advisors are telling you to settle for 2% from typical dividend stocks…

You’re about to discover five ETFs that can outperform this by up to 500%.

We’re talking ETFs that can pay up to 12% a year …

And before you start guessing, these aren’t covered call ETFs… where all they’re looking for is yield and they will eventually start losing money.

No, I’m talking about ETFs that invest in real businesses making real cash flows…

We’re not messing around with speculative tech, crypto or anything like that…

These income ETFs are based on rock-solid businesses with proven track records to pay out in a wide variety of markets.

We’re talking closed-end funds, infrastructure MLPs and funds of funds…

In other words, the type of opportunities typically only available to the rich…

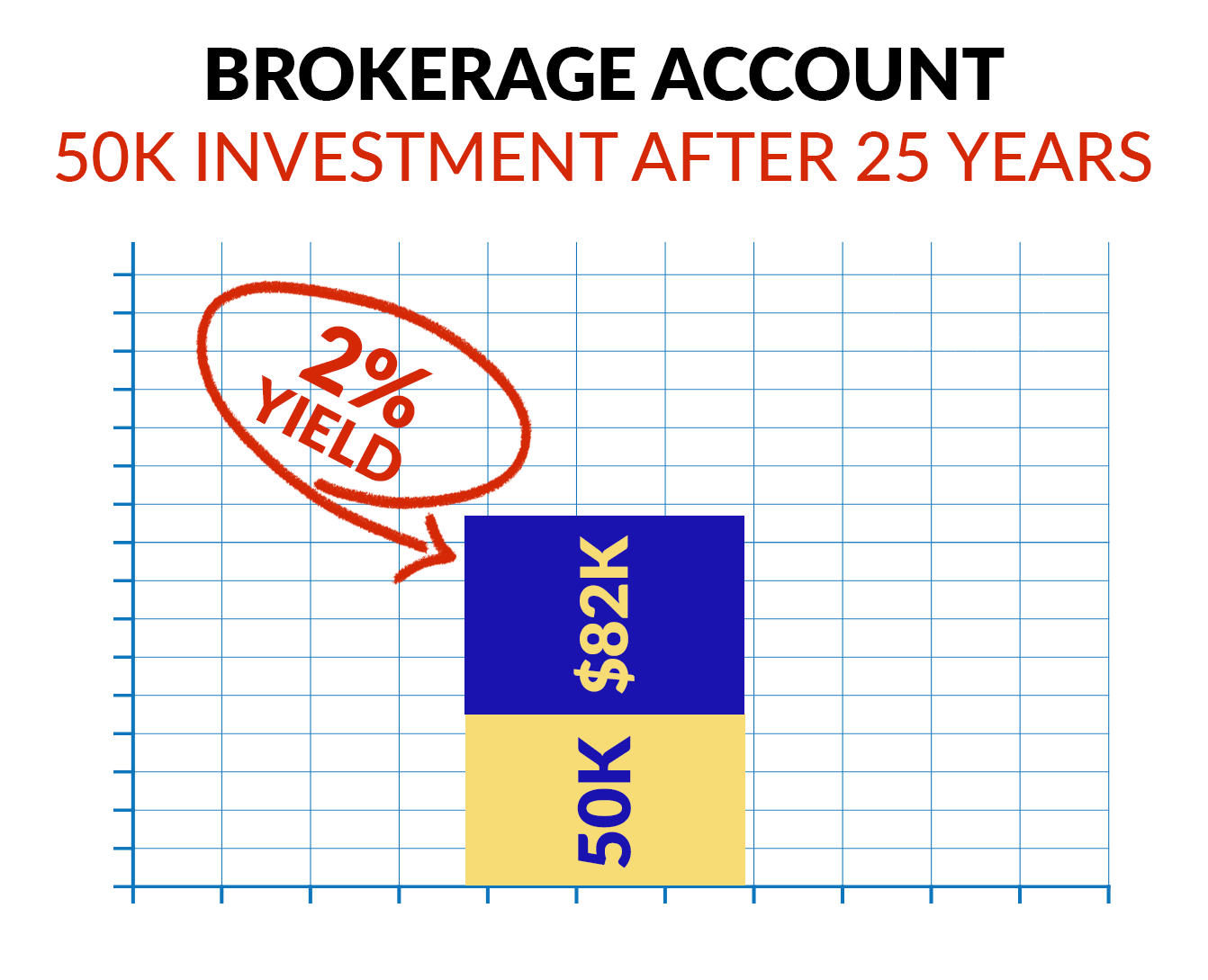

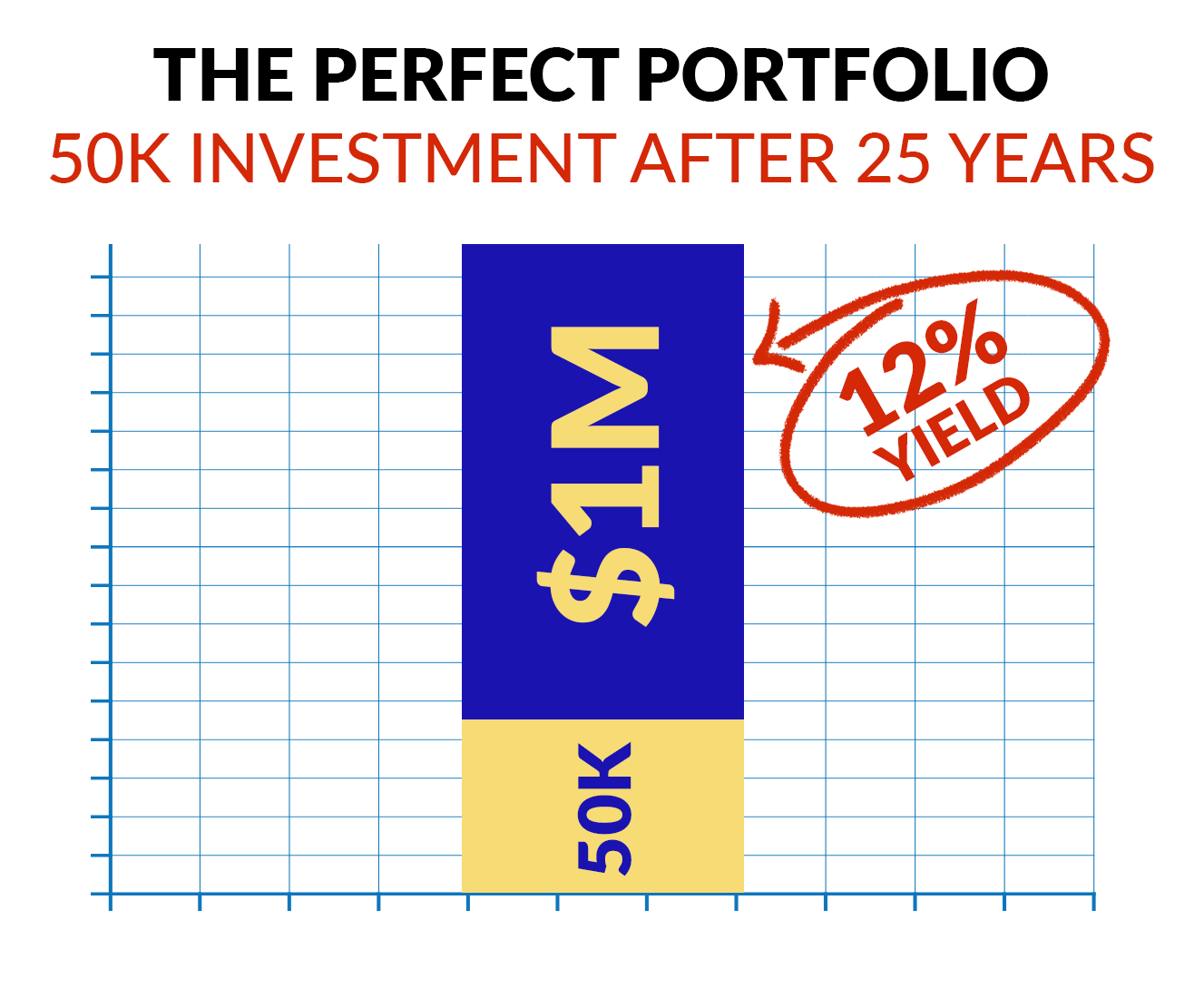

To put these yields into perspective —

Right now the so-called Dividend Aristocrats like McDonald’s and Coca-Cola yield anywhere from 2% to 3%…

But the yields I’m going to show you pay as high as 12%…

Take a look at what this means over a longer time horizon…

If you’d put $50,000 into a brokerage account yielding 2%… after 25 years, you’d be sitting on roughly $82,000.

Not bad…

But take a look at what happens when your yield goes up to 12%…

Instead of settling for $82,000, you’re now looking at close to a million-dollar nest egg.

The potential here is phenomenal…

If you ever wanted a predictable income source but didn’t want to rely on one company, you’ve got to check this out.

If you want to know more and get full details on these income investments, check out the recent report I wrote called Top 5 ETFs for Lifetime Income.

Look, we’ve covered a lot of ground so far… and by now you’re probably wondering…

Is my research right for you?

Well, only you can decide after seeing my work firsthand.

But there is a dead-certain way to tell if it’s definitely NOT right for you…

Conventional Thinkers Not Welcome

If you’re the type of person who thinks our government has your best interest at heart…

Or if you’re someone who actually likes paying overpriced commissions to financial advisors for conflicted advice…

Or the type of person who’s willing to settle for table scraps, just because you don’t want to take a little effort to uncover “under the radar” profit opportunities…

Then I can say that Intelligence Report is DEFINITELY NOT right for you…

See, I’m looking for a group of folks brave enough to tap into the same investment research the world’s richest and most famous investors use to grow their wealth.

The assets we examine aren’t typical.

They require a special type of person — an unconventional thinker — to see them work.

They’re more fun.

They’re easy (if you play them the way I’ll show you).

And most of all…

They have the potential to substantially boost your nest egg… while limiting your risk.

If that sounds good to you, here’s what I’ve arranged for you today…

Try out Intelligence Report… completely RISK-FREE!

Here’s what I mean…

Enroll today for a trial subscription to Intelligence Report and I’ll automatically send you, with no obligation:

Research Report #1: The Perfect Portfolio

Research Report #2: Top 5 ETFs for Lifetime Income

And that’s not all…

When you join us today, you’ll also get these exclusive benefits:

- Access to my Monthly Issues — Each issue will be delivered to your email inbox. In it, you’ll find my latest market analysis, updates on recommended investments, and information designed to make you a more successful and profitable investor.

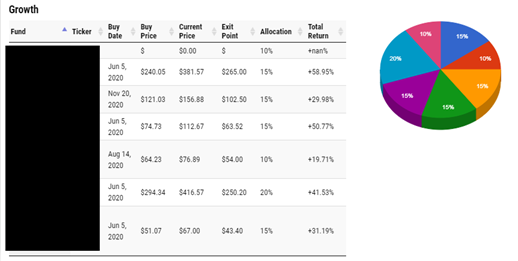

- Two Model Portfolios — Whether you’re looking for growth or aggressive growth in the markets, I’ve uncovered some of the fastest-growing investments in the world. Whether you’re looking for a homerun-type investment or you’re a little less aggressive and just want to safely keep the ball in play… I’ve put together a portfolio to suit every investor’s needs.

- Weekly Dispatches — Delivered every Friday (or as needed), these dispatches will give important updates on the markets including “buy” and “sell” signals. You’ll get behind-the-scenes access to my analysis, commentary and advice on current positions, plus new opportunities on the horizon.

- Access to my Quarterly Calls — Each quarter, I’ll send out a private link to subscribers to attend a virtual closed-door meeting. These calls will reveal my thoughts on the markets as well as my personal analysis of current market conditions.

- 24/7 Website Access — You’ll have instant, password-protected access to all of my current advice and Special Reports, plus archives of back issues, recent articles and more.

- VIP Concierge Customer Service — You’ll have your own concierge customer service team on standby waiting to answer any questions you may have. Whether you have questions about how to log in to the website or questions about my analysis, your customer service team will be waiting to answer them.

In other words, by enrolling today, you’ll have complete access to our entire library for one full year (new issues included) before deciding if Intelligence Report is right for you.

And if for any reason over the next 30 days you’re not satisfied, simply let us know and we’ll send you a full refund, no questions asked!

As an added bonus, you can keep everything we’ve sent you up until that point as a thank-you for giving our service a try.

Fair enough?

But frankly, I don’t think that’s going to happen…

Because once you get a taste of how quickly and radically your financial situation can be changed with the right information… I think you are going to be hooked!

I want you to see what it feels like to consistently close gains… all the while sleeping soundly knowing you’re using the same strategies as world-class investors.

But how much does Intelligence Report cost?

I’ll tell you… but before we get to that, there’s one more opportunity I think you should know about…

My Income Multipliers Portfolio

As I’ve mentioned, for the past 30 years I’ve developed an obsession with safe, income-producing investments…

These investments have come from businesses, real estate, side hustles, etc….

But if I’m honest — my favorite source for passive income is without a doubt — dividends…

Probably why John D. Rockefeller said:

For me, I can never have too many income streams…

And for taking us up on our offer today, I want to give you a glimpse of my Income Multipliers Portfolio system…

As the name suggests, this is a list of the absolute best income opportunities out there right now…

We’re talking the crème de la crème of income-producing opportunities that’ll give you the highest-yielding returns with the LEAST amount of risk possible.

Take a look at this portfolio…

It spat out dividends every month…

Some ranging as high as $625…

Now imagine this was your portfolio…

Picture what it would feel like to have these checks coming in every month.

But what if you don’t have a large portfolio yet?

Well, here’s why dividends are so great…

The power of reinvesting can allow you to hit your financial goals way faster than just typical investing…

Think of it like double compounding.

Let me show you…

Most investors just look at the price appreciation…

With a company like McDonald’s, price appreciation has been great…

In fact, if you’d put $10,000 into it in 1997, today you’d be sitting on over $120,000!

That’s pretty good…

But if you reinvested the dividend…

Instead of settling for $120,000, over that same period you’d be sitting on a 20X gain with over $213,000.

When you reinvest your dividends, it takes the compounding process and puts it on steroids…

And you can do this with every stock in the Ultimate Income Multipliers Portfolio…

This portfolio gives you all the details you need to locate some of the top income opportunities on the market.

Access to this portfolio is yours FREE when you take a trial subscription to my monthly research service, Intelligence Report…

How to Get Started

The retail price for Intelligence Report is $249 for a 12-month subscription.

But for a limited time, my publisher has arranged for you to get the entire year for 80% off, or for as little as $49.95.

Why are we giving away so much for so little money?

It’s simple — we are hoping this is going to be a long-term relationship… and trying it out for yourself is the best way for you to see just how powerful this research is.

That’s why I’d encourage you to take us up on the best deal for Intelligence Report we’ve ever offered.

And remember — there’s no obligation. Take your time. You have 30 days to make sure this is right for you.

If for any reason you want to leave us, no problem — just let us know before the end of the 30th day, and we’ll send you a full 100% refund — no questions asked.

And to top it off, you can keep everything we’ve sent you as our thank-you for giving my research a try.

So click the link below and claim all of the exclusive benefits of membership I told you about today…

Including your brand-new copy of…

The Perfect Portfolio.

Click the button below to get started right away.

Sincerely,

Jim Woods

Editor, Intelligence Report