Make the Coronavirus Kindness Choice

The world is a different place than it was last week.

Sure, markets were extremely volatile leading up to last Wednesday’s issue of The Deep Woods, but that’s nothing compared to the near-16% drop in the S&P 500 we’ve seen since last Wednesday’s close. Yet, financial markets are not the biggest difference in the world since last week.

The biggest difference is that the coronavirus has prompted an unsettling mixture of fear, uncertainty, angst, anxiety and a very real sense of impending doom in the minds of billions around the globe.

All over the planet, people are being quarantined, or are self-isolating, or practicing social distancing or whatever the proper term might be for any particular situation. In the United States, many store shelves are bare of essentials such as toilet paper, paper towels and cleaning products. More importantly, many stores have experienced shortages of meat, milk, eggs and other vital foodstuffs.

Today’s coronavirus milieu reminds me of the words of the great Thomas Paine, who famously wrote, “These are the times that try men’s souls.”

Now, in an effort to mitigate the fear we’re all legitimately feeling from the potentially disastrous health effects of the coronavirus, federal, state and local governments have stepped in big time. And though I am no fan of government as the solution to societal problems, government does have a role to play here.

That role should be limited to the protection of individual rights, but protecting rights also means protecting Americans during times of national crisis. And while one can debate the efficacy of the government’s actions so far in this crisis, I do think that leaders are doing what they think is proper to help.

Those government actions also include monetary and fiscal stimulus by the Federal Reserve and the Treasury Department. And while I can criticize Fed policy, bailouts and direct payments to individuals ad infinitum, I will reserve that criticism for another week and another column. Don’t worry, I won’t forget.

What I would rather do today, and what I think is the better use of this column, is to focus on what’s being called “coronavirus kindness.”

All over the world, individuals have stepped up their game to help others through this crisis. In fact, I personally know many people taking action to help those who need help most. For example, my friends who run a catering and meal preparation company are ordering extra meat, eggs and other foods to make sure their clients have the basics they need to survive.

I also know someone in my local area who has offered to go shopping for the elderly citizens in our community, citizens who are most susceptible to the devastating effects of the coronavirus.

In my own case, last weekend I took my SUV to the pet store to help my elderly neighbors stock up on food for their pets. This took up about two hours of my time, but after I did it, I felt like I had experienced two of the most uplifting hours of my life.

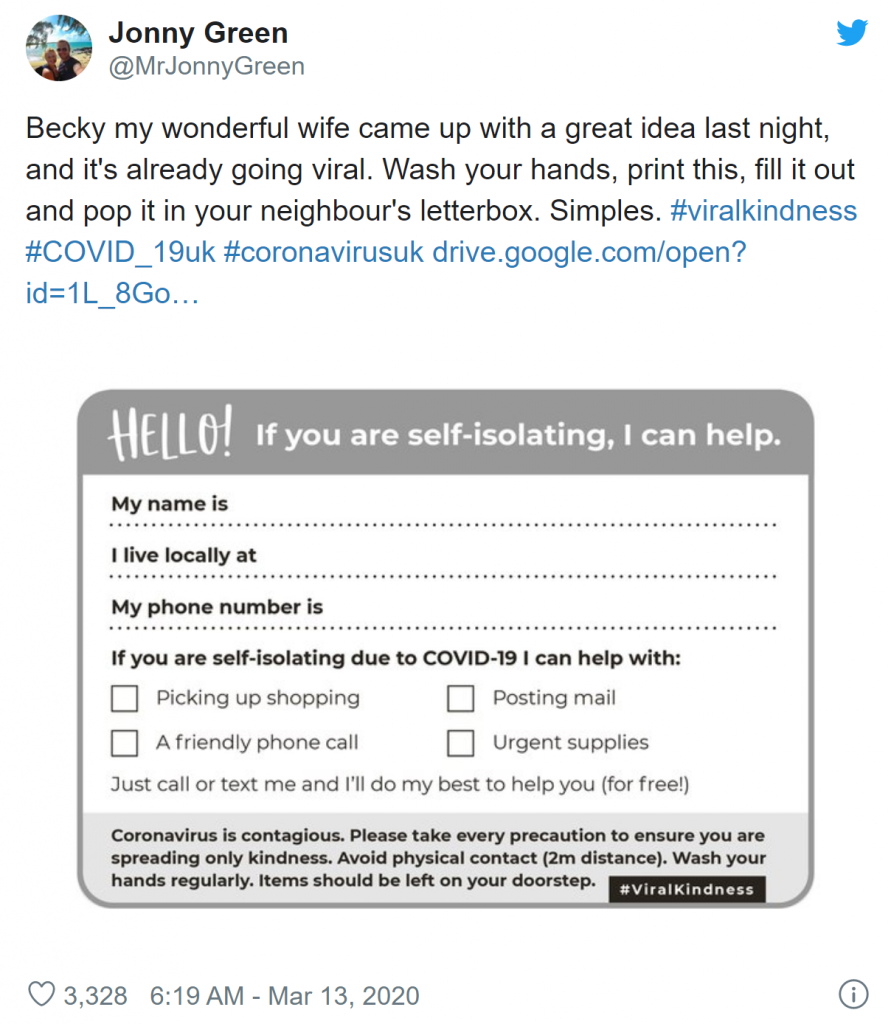

Indeed, coronavirus kindness is all around us. A recent CNBC article featured the work of Becky Wass, from the county of Cornwall in the U.K. She created a postcard that said: “Hello! If you are self-isolating, I can help.”

Wass then left space for people to fill out their contact details and whether they would like help with shopping, posting mail or simply a phone call. Wass’s husband then posted an image of the card on Twitter, urging people to wash their hands and print it out. The card quickly went viral on social media with the hashtag #viralkindness.

This beautiful act of coronavirus kindness is just one of many I’ve heard about in the media, which is actually refreshing, as the media likes to be the source of hyper-fear, hyper-criticism, hyper-reaction and hyper-danger signaling. “If it bleeds, it leads.” I get it.

But in The Deep Woods, on this day, kindness and love for yourself and your fellow humans leads, and the only thing that bleeds is the common blood of humanity coursing through all our veins.

So today, I recommend you make the coronavirus kindness choice.

Call your friends, acquaintances, reach out to those in your community and offer up a friendly voice or just ask them if there is any way you can help them through this crisis.

The answer might be “no,” and there may not be a way to directly help. But simply knowing you have your fellow man’s back will not only make them happy, it also will make you happy.

The way I see it, it’s a value-for-value exchange worthy of any rational man. So, go do your part to help.

I guarantee you, the person you see in the mirror will be proud.

P.S. Do you know precisely when to sell your stocks? We do, because we have a plan in place to tell us when to buy and — more importantly — when to sell our positions. That plan is the proven, four-decade-plus trend-following plan at the core of my Successful Investing advisory service.

If you want to make sure you have our proprietary “Safety Switch” in place that tells you when this market should be sold, and when it’s safe to get back into the market after you sell, then you simply must check out my Successful Investing advisory service, today.

**************************************************************

ETF Talk: Shorting the Russell 2000 to Profit from the Drop

With the markets suffering from seemingly daily meltdowns due to COVID-19, now is a great time to consider whether your portfolio might benefit from inverse exchange-traded funds (ETFs).

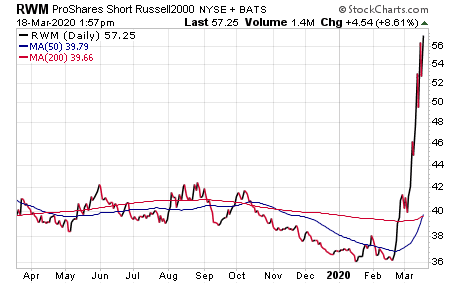

One fund that seems set up to outperform given current trends is ProShares Short Russell 2000 ETF (RWM). As you may know, the Russell 2000 is an index of small-cap stocks, and these naturally more volatile companies have tended to be hit extra hard by this crisis, which smaller companies may have more trouble weathering.

In the last month, while the S&P 500 is down about 25%, the Russell 2000 is doing even worse by dropping nearly 40%. The question now is when its slide will end and its recovery begin.

RWM seeks daily investment results that correspond to the inverse (-1x) of the daily performance of the Russell 2000. Recently, its performance has been better than this goal would suggest, as it is up more than 50%. These instruments are rarely perfect, but that has been a good thing lately with RWM.

The fund is not designed for long-term holding, and to that end, its expense ratio of 0.95% is on the high side. Net assets are $297 million. The fund pays a small yield of 1.38%. Unsurprisingly, RWM has spiked upward in the last few weeks.

This fund does not hold any stocks. Rather, it invests strategically in financial instruments designed to increase in value as the Russell 2000 Index goes down. With the current daily dose of news around the world about the deadly coronavirus spreading near and far, the Russell 2000 faces strong headwinds that could keep it trending downward for a while.

If you are seeking ways to profit in this extreme volatility, ProShares Short Russell 2000 ETF (RWM) may be a valuable fund to investigate.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Why Most Businesses Fail in the First Five Minutes

It’s often said that more than half of new businesses fail during the first year, but that’s actually a bit too optimistic. The fact is most businesses fail in the first five minutes.

That’s the premise, and the title, of the new book by two of the nation’s leading business consultants, my friends John Paul Mendocha and Gabe Bautista.

In the new episode of the Way of the Renaissance Man podcast, John Paul and Gabe join me direct from the W Ranch for an intimate dining room conversation about why most businesses are doomed to fail from the start, why it usually takes several years to realize it and why correct positioning is essential for anyone who wants to create a successful enterprise.

Gabe, Jim, Paratrooper the Quarter Horse and John Paul at the W Ranch

More importantly, you’ll find out how and why John Paul and Gabe are both Renaissance Men, and why I am so excited to share their eclectic backgrounds, experience, and their years of hard-earned knowledge and wisdom about how to properly position your business, and your life.

If you’ve ever wanted to learn why some businesses succeed while others fail miserably, then this episode is positioned to win just for you.

*********************************************************************

One More Note on Kindness

History’s been leaning on me lately

I can feel the future breathing down my neck

And all the things I thought were true

When I was young, and you were too

Turned out to be broken

And I don’t know what comes next

In a world that has decided

That it’s going to lose its mind

Be more kind, my friends, try to be more kind…

— Frank Turner, “Be More Kind”

In this time of social, economic and health tumult, there is one prevailing sentiment you can adopt to help not just for your fellow human, but also yourself. That sentiment is to try to be more kind.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.