Loving Capitalism’s New Embrace

- Loving Capitalism’s New Embrace

- ETF Talk: Embracing Your Inner NERD

- Smoking Cigars with Saddam Hussein

- A Plane Ride with the President-Elect

- The Eternity of Time

***********************************************************

If you are acquainted with me, either “in person” or through the digital pages of this column, then you probably know that I love capitalism.

And I don’t just love capitalism because it provides the greatest good for the greatest number. Yes, it does deliver in that utilitarian sense. But the reason why I love capitalism is because it’s the most moral form of human interaction.

You see, capitalism is based on the principle of free exchange, with humans trading goods and services for money and for profit, of their own volition, and in the service of their own happiness.

This concept of capitalism’s virtue plays out every day in our equity markets, with investors looking to own shares of companies whose goods and services will provide profits for shareholders, and that will thus make their share prices move higher.

Indeed, devoting much of my professional life to understanding, explaining and, yes, singing capitalism’s praises to my readers, is one of the most gratifying aspects of what I do. And because I rejoice in the spread of capitalism and the embrace of markets, there is one trend that’s taken place in this COVID-19-compacted year that has been extremely gratifying to me, and that trend is the flood of new individual investors jumping into the capitalist waters.

To get a sense of the scope of this capitalist embrace, all one needs to do is look at some statistics directly from the major brokerage firms regarding the number of new accounts opened this year.

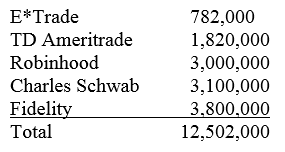

Here are the number of new individual trading accounts opened in 2020, as reported by each of these major brokerage firms:

That’s a huge number of newly minted investors, and the growth in the number of people taking control of their lives and participating directly in capitalism is beautiful.

Now, I have heard some of my Wall Street colleagues lament this development, claiming that the flood of new individual investors is skewing market volume, driving up options premiums on the hottest tech stocks and creating a form of “unnatural” market distortion. While some of this may be true, I say this is just a new element in our decision making that we need to account for as investors.

And rather than lament the need to adjust, I rejoice in this new embrace of capitalism and markets. In fact, I would love it if millions more Americans opened brokerage accounts and decided to dive headlong into markets and participate in one of the greatest forums for wealth creation the world has ever known.

The reason why is because the more people who have “skin in the game,” and the more people who own these companies, the more people will be able to benefit from the phenomenon that is capitalism. And the more people who benefit from capitalism, the more people will realize that beauty, efficacy and morality of this magnificent aspect of our society.

The way I see it, a growing democratization of investors in the market could lead to a greater appreciation of capitalism and the integral role it plays in enhancing our lives.

This is particularly true today, when so many people feel like the rich are sticking it to the poor, not paying their “fair share” of taxes and that somehow corporations exist to exploit others for their own “selfish” gains.

Well, capitalism doesn’t work like that.

Exploitation for gain is the province of government, not business. Business exists to provide a good or service to consumers. Consumers are free to choose that business by buying that good or service, or by choosing another company’s competing good or service.

For a company to make profits, it has to provide something that individuals or groups of individuals are willing to pay for (and it has to do so at a cost that is lower than the cost to produce that good or service). Another term for this is freedom of choice, and another term for that is liberty.

So, by opening up a brokerage account and buying shares of a company, you become part of this milieu of liberty that creates wealth. And once you are a participant in the game, you understand that your success is directly tied to the success of the companies you own. That means you are going to root for the success of your company, and for its ability to make a profit.

Once you realize that’s the name of the game, then you have just become an advocate of capitalism — and the more advocates of capitalism there are, the better off society will be.

So, as my Parisian grandfather might say, “Vive le Capitalisme!”

***************************************************************

ETF Talk: Embracing Your Inner NERD

Who knew that being a NERD had become so cool?

One of the most recent technological revolutions that has affected the way that humans spend their leisure time has been the development of video games.

Indeed, the gaming industry is a multi-billion dollar sector of the international economy, with its respective titans — Sony (NYSE:SNE), Nintendo Co., Ltd. (OTC:NTDOY) and Microsoft (NASDAQ:MSFT) — competing to produce the next big hit.

Gaming has even intersected with the world of competitive sports through the development of esports, which is a form of competition with multiple players participating in video games for an audience. Given the coronavirus epidemic, which is still raging around the globe, it’s no surprise esports shows no signs of abating (as we can witness through the new round of lockdowns in California and Europe). And, it is clear that the popularity of esports and gaming in general will only continue to grow.

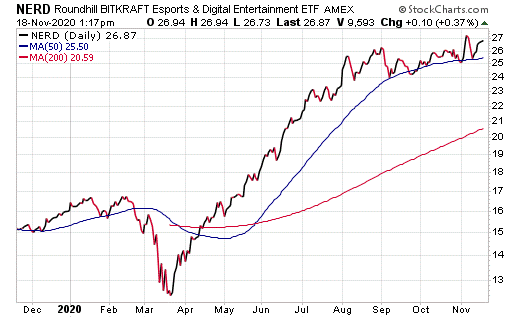

An exchange-traded fund (ETF) called the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSE:NERD) was specifically constructed to enable investors to play this growing sector of the market. Thus, NERD tracks a tier-weighted list of global companies that are connected to esports and other digital gaming industries. The ETF is designed to provide investment results that closely correspond to the performance of the Roundhill BITKRAFT Esports Index.

Companies that appear in NERD’s portfolio include firms that are involved with video game publishing, development or streaming, the organization of video game tournaments, leagues or competitive teams or technology. The holdings are weighted by the degree to which the company in question is dedicated to gaming and sorted into categories like “Pure Play,” “Core” and “Non-Core.”

Some of this fund’s top holdings include Corsair Gaming, Inc. (NASDAQ:CRSR), Tencent Holdings Ltd. (OTCMKTS:TCTZF), Modern Times Group (STO:MTG-B), Activision Blizzard, Inc. (NASDAQ:ATVI), DouYu International (NASDAQ:DOYU), Razer, Inc. (OTCMKTS:RZZRY), Sea Ltd. (NYSE:SE) and HUYA, Inc. Class A (NYSE: HUYA).

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Nov. 17, NERD has been up 4.69% over the past month and up 8.16% for the past three months. It is currently up 66.67% year to date. The fund has amassed $48.25 million in assets under management and has an expense ratio of 0.25%.

Chart courtesy of www.stockcharts.com

While NERD does provide an investor with a chance to tap into the world of gaming and esports, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Smoking Cigars with Saddam Hussein

Last week was Veterans Day, so let me first start by giving all of my fellow veterans a big, belated shout out. For most of us, it was a job we did that we both loved and hated (veterans will know exactly what I mean).

It’s also a job that we took immense pride in, because we swore an oath to protect and defend the Constitution of the United States, and I can’t think of a better set of principles to preserve than those enumerated in that brilliant document.

Now, given that it is Veterans Day, the timing couldn’t be more perfect for the debut of the newest episode of the Way of the Renaissance Man podcast.

Ask yourself this: What was it like to be responsible for guarding the highest-profile prisoner of the Iraq War? That’s a fascinating question, and the answer is equally fascinating, equally complex and equally spellbinding.

In this episode, I speak with Kelly Hillyer, the U.S. Army officer in charge of Saddam Hussein’s security detail.

And while you might initially think guarding a tyrant would be an austere detail, what you’ll discover is that the job was much more nuanced, and much more human, than you can imagine. From smoking cigars together to reading poetry, the two men developed a relationship that is guaranteed to surprise you.

Very few people have the opportunity to do something as unique and with as much historical significance as Kelly Hillyer. And in this episode, you’ll find out just how this exemplary soldier handled the difficult duty with class, skill and with true American virtue.

So, get ready to be riveted by my conversation with Kelly Hillyer.

*************************************************************

In case you missed it…

A Plane Ride with the President-Elect

It has been just over two weeks since America voted, and though the results aren’t yet officially certified, it’s a near certainty that former Vice President Joe Biden will be the next president of the United States. Now, while about half of us may not like this development, we need to accept that reality is reality. Or, as Aristotle might put it, that “A is A.”

Yes, President Trump has challenged the results in key battleground states, but the way it looks now, it’s hard to see a path for the president to somehow win in the courts and be reelected. Now, that’s not just my opinion, it’s also the opinion of John Fund of National Review, who is probably the very best political analyst out there.

I spoke with John about this during our Post-Election Investment Summit in Las Vegas. And in the spirit of Las Vegas, John told me that, at this point, “Donald Trump would have to draw an inside straight in order to win.” And while Trump did just that in 2016, the way it looks now, the president is likely to come up with snake eyes.

So, now that we have a President-elect Biden, I thought it timely to share with you my six-hour long interaction with the man from about 12 years ago. I have written on this before, but now it seems more important than ever to get a sense of who Biden is when the public isn’t looking. And when you have a chance to exchange thoughts on a long cross-country flight, well, you can get to know someone in interesting ways.

The following is from my original article titled, “We All Scream for Ice Scream: A Joe Biden Tale.”

***********

You can tell a lot about a man by the way he eats.

Some men like to sit down to a meal, take their time and savor each and every morsel of food and drink. People like this tend to be thoughtful, meticulous, confident and in many cases, hedonistic. How do I know this? Well, I’ve been known to spend more time than most getting through a multi-course, wine-paired meal.

Still, other men like to dig right into their prize, attacking the meal with fervor and a literal hunger for life that reveals their carpe-diem approach to the world. This type of person tends to be decisive, purposeful, driven and a born leader. My favorite example of this type of eater is my good friend and fellow investment guru Doug Fabian.

But what do you say about a man who eats his meal in reverse order?

That thought has plagued me ever since I sat next to Sen. Joe Biden on a flight from Washington, D.C. to my hometown of Los Angeles, California. Sen. Biden was on his way to L.A. for an appearance on HBO’s “Real Time with Bill Maher,” while I was returning home from my annual pilgrimage to the nation’s capital for a meeting with friends, publishers and people from some of my favorite think tanks.

After exchanging pleasantries with the senior senator from Delaware, Biden wasted no time in digging right into his criticisms of the war in Iraq, and what he perceived to be the folly of the Bush administration. I expected nothing less from the senator, as he’s known for his outspoken critiques and his shoot-from-the-hip commentary.

What I didn’t expect was a lesson in how to eat a meal backwards.

Now, since I had the benefit of first-class seating accommodations during this journey, the flight attendants were very conscientious when it came to serving what was a surprisingly tasty meal.

The first course was a salad with Italian dressing, which was followed by a main course of a plump, well-seasoned chicken breast and a side of rice. The best part of the meal for me was the dessert, which was a generous scoop of gourmet chocolate ice cream.

I ate my meal with my usual casualness, and in the aforementioned order. Sen. Biden, however, took a different path. Biden accepted the salad, but he put it aside and saved it for later. When the main course came, he politely rejected it. But when the ice cream came, Biden’s fervent personality really came out. He emphatically asked for a serving, although he had not yet eaten any food.

Biden ate his ice cream while we discussed Kevin Phillips’ book “American Theocracy,” the then-latest critique of the Bush administration’s religious overtones. After eating the ice cream, Biden pulled out a hefty ham sandwich from his briefcase and consumed it in a deliberate and determined fashion. Once the sandwich disappeared, the senator turned to the only remaining bit of food left on his tray table, the salad.

As I watched this reverse-order meal consumption, a thought occurred to me: Is this why the federal government is so screwed up? Is Sen. Biden’s backwards approach to a meal indicative of what’s wrong with Washington? Does this backwards eating pattern explain why the government does everything less efficiently and less effectively than the private sector?

Given my theories on discerning knowledge of a person based on how they eat, what was I to make of Sen. Biden’s meal habits? The only logical conclusion is that Biden looks at the world — shall we say — differently from the rest of us. And while there is nothing wrong with a little different perspective on things, I don’t think I want someone a heartbeat away from the presidency who eats his ice cream first.

The next thing you know is that person will advocate raising taxes to stimulate the economy, negotiating with our ideological enemies as a means of portraying strength and railing against judges who think interpreting the Constitution is the only proper function of the courts.

Wait a second… that’s what Biden wants?

I knew there was a reason why he ate the ice cream first.

*******************************************************************

The Eternity of Time

“Time is too slow for those who wait, too swift for those who fear, too long for those who grieve, too short for those who rejoice, but for those who love, time is eternity.”

–Henry van Dyke

Leave it to a poet to make sense of the many faces of time. And in these stressful pandemic days, time can be distorted by a sense of loneliness, isolation and fear. Yet despite these natural feelings during this difficult period, what we must remember to do is make time to celebrate and to love. Because as van Dyke reminds us, time is short for those who rejoice, and eternal for those who really love. So, right now, go tell the special people in your life that you love them. And when they smile in surprise and thank you for that unexpected gesture, just tell them it was Jim’s idea.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods