Let the Freedom Party Begin

If you know me, you know I’m always up for a good party. And while my wild, all-night music business soirees of the 1990s now have given way to more substantive intellectual gatherings, a great party is still a great party — especially if that party is in the service of liberty.

Today, I am honored to invite you to what I suspect will be one of the very best parties of the year, and it’s all going down in the land of the Delta blues!

Yes, I’m talking about FreedomFest, the world’s largest gathering of free minds. This year’s event theme is “The Soul of Liberty,” a theme that I really love. The reason why is that my conception of “soul” is one that exists free of coercion, free of servitude and one imbued with libertarian freewill.

As the brilliant novelist/philosopher Ayn Rand wrote in “Atlas Shrugged,” “As man is a being of self-made wealth, so he is a being of self-made soul.” Indeed, I think we are beings of self-made soul, but in order for that soul to prosper, we require the freedom to choose. Yet as Ronald Reagan once warned, “Freedom is a fragile thing and is never more than one generation away from extinction.”

Now, while freedom is a beautiful concept, it’s also one under constant assault.

Anti-freedom, authoritarian forces on both extremes of the political and philosophic spectrum actually abhor the notion of liberty, as free minds thinking for themselves are viewed as a threat to their ability to impose control. And guess what, they are right.

Free-thinking humans are always a threat to wannabe demagogues, would-be dictators, authoritarians, nationalist movements or any other stripe of collectivism intent on telling you that they know what’s in your best interest and how you should live better than you do.

Well, I reject this concept, and I do so by assuming the responsibility of thinking for myself. And, knowing that I have the responsibility of thinking for myself is why I love FreedomFest.

You see, in order to come to rational decisions about the world, one must be exposed to the best ideas. Moreover, one must also be exposed to ideas that one may disagree with, because it is only through carefully weighing opposing views that you can truly understand and properly defend your own views. And at FreedomFest, there are many opposing views presented, which is one of the reasons why I love it.

For example, one of the featured speakers last year was businessman and former Democratic presidential candidate Andrew Yang. Now, I wouldn’t vote for Andrew Yang, as we have very different views on politics and the role government should play in our lives.

Your editor exchanges ideas over libations with Andrew Yang at FreedomFest 2022.

Yang wants to provide everyone with a “universal basic income,” and I want to provide everyone with “universal basic reason.” Still, Yang was offered a platform at FreedomFest to talk about his new project, the Forward Party. Here is an area of agreement I do share with Yang, as the new party’s motto is “Not Left. Not Right. Forward.”

Now, this week, it was announced that the keynote speaker at this year’s FreedomFest is who my friend, colleague and FreedomFest founder Mark Skousen calls, “the man who has restored his faith in America.”

That man is Mike Rowe, executive producer of such TV series as “Dirty Jobs,” “Somebody’s Gotta Do It,” “How America Works” and “The Story Behind the Story.” Mike also is the author of the New York Times bestseller, “The Way I Heard It,” and he’s also a podcaster extraordinaire.

One reason why both Mark and I really like Mike Rowe is that he brings Americans together. Here’s a man who can comfortably talk with Chris Cuomo on NewsNation (and CNN before that) and Tucker Carlson on Fox News. Now how rare is that!

I’m really looking forward to hearing Mike’s message about how he is making a difference in reinvigorating America’s work ethic through his mikeroweWORKS Foundation. I’m also looking forward to sampling some of Mike’s Knobel Tennessee Whiskey, as his sample offerings will no-doubt result in one of the most popular booths at the Memphis bash.

Of course, Mike Rowe is only one of the many fantastic speakers already inked for FreedomFest. The line-up also includes Steve Forbes, John Fund (National Review), Steve Moore (Heritage Foundation), Tulsi Gabbard (a former Democratic congresswoman), Michael Shermer (Skeptic magazine), Enes “Freedom” Kanter (a former NBA basketball player), David Boaz (Cato Institute), Bryan Kaplan (GMU), Douglas Brinkley (“America’s Historian”), Grover Norquist (Americans for Tax Reform), Art Laffer (famed economist), Richard Epstein (New York University law professor), Amity Shlaes (historian), Magette Wade, Barbara Kolm (VP of the Austrian central bank) and many more. Go here for the full lineup.

Returning as master of ceremonies is Lisa Kennedy, host of Fox Business, along with my most excellent friend and cohost, the sublime Heather Wagenhals. There’s the Anthem film festival, a libertarian comedy festival and a full three-day investment conference, including such financial gurus as Alexander Green (Oxford Club), Louis Navellier and David Bahnsen. Plus, there will be a special interview with Jeremy Siegel, the “Wizard of Wharton,” and Burt Malkiel (Princeton).

And last but definitely not least, my fellow financial editors at Eagle Publishing will be at FreedomFest — including Bryan Perry, George Gilder, Roger Michalski, Paul Dykewicz — and of course, Mark Skousen and yours truly.

Finally, we are expecting a full house in July, but we have saved room for The Deep Woods reader, and at a special $77 discount off the registration fee. Use the code EAGLE77 to save $77 off the registration fee by going to www.freedomfest.com. Or call Hayley at 1-855-850-3733, ext. 202.

The $77 discount will end in just seven days (on May 31). No exceptions. So, sign up now and the join me, Mark, Mike Rowe and everyone else at “the world’s largest gathering of free minds.” I guarantee you the joint will be jumpin’.

***************************************************************

ETF Talk: Playing the Field with This Fund

Dating is usually the first thing that comes to mind when hearing the phrase “playing the field,” but today, we are playing the field with this uncorrelated exchange-traded fund (ETF).

The expression often refers to dating multiple people at once, to see what works and what doesn’t work. The goal is to minimize risk and maximize reward — essentially, it boils down to not putting all your eggs in one basket.

Not putting all of its eggs in one basket is exactly what Core Alternative ETF (NYSE: CCOR) seeks to do. The fund utilizes a combination of several strategies with the purpose of producing capital appreciation, while reducing risk exposure across market conditions.

CCOR invests primarily in U.S. equities, specifically focusing on high-quality companies across all industries and sectors that have the potential for long-term total returns stemming from their ability to grow earnings and willingness to increase dividends over time.

In normal market conditions, at least 80% of the value of the fund’s net assets will be invested in equity securities. The fund’s goal is to then invest the remaining value of its net assets into options where the pricing provides favorable risk versus reward models and where gains can be attained independent of the direction, or volatility, of the broader U.S. equity market.

Using proprietary models and portfolio analysis of historical funds, CCOR is then able to identify appealing option-trading opportunities, including favorable call and put option spreads.

However, it is true that this option strategy may cause the fund to sacrifice some upside, but in return, it also shields the fund from excessive downside risk exposure… a bit like playing the field.

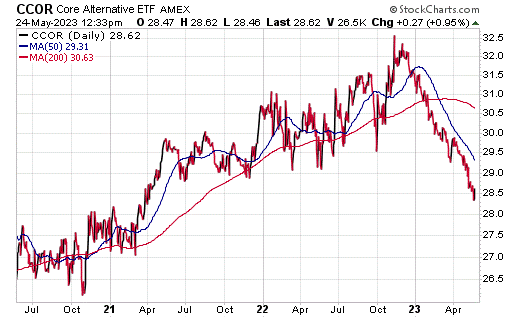

CCOR has $496.53 million in net assets and a weighted average market cap of $309.15 billion. Now, while I agree that the fund has taken a plunge, that’s not too unbelievable given the current market conditions, and uncertain Fed and varying U.S. debt-ceiling chatter. However, if you look at the beginning of November, it’s clear that this fund can reach new highs and hold its strength.

Chart courtesy of StockCharts.com.

CCOR’s top 10 holdings include JPMorgan Chase & Co. (JPM), 3.02%; PepsiCo, Inc. (PEP), 2.95%; Johnson & Johnson (JNJ), 2.83%; Walmart, Inc. (WMT), 2.82%; Eli Lilly and Co. (LLY), 2.80%; Fiserv Inc. (FISV), 2.28%; Morgan Stanley (MS), 2.76%; Microsoft Corp. (MSFT), 2.76%; Merck & Co. Inc. (MRK), 2.73% and Genuine Parts Co. (GPC), 2.70%.

Ultimately, CCOR is playing the field, which is a game full of risk and reward. But unlike in the dating world, there is a precision to it. The fund’s option strategy allows it to navigate the choppy market waters and remain a bit further away from the hazards of a volatile market.

No one wants to have their heart broken or their gains lost, so maybe playing the field isn’t such a bad idea after all. However, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Refreshing Scent of Musk

“I’ll say what I want, and if the consequence of that is losing money, so be it.”

This is one of many refreshingly honest, bold and yes, eccentric quotes by the inimitable Elon Musk during his much-talked-about interview a week ago with CNBC’s David Faber.

Musk offered this thought in response to Faber’s question about the Twitter CEO’s sometime caustic, inflammatory and darkly conspiratorial tweets, and whether he was concerned that his tweets could scare off potential Tesla Inc. (NASDAQ: TSLA) buyers or Twitter advertisers.

What I found eminently fascinating and most important about the Musk interview, which I strongly recommend you watch in its entirety, is that Musk is one of the few public figures, and certainly one of the few public company CEOs, that has enough courage to actually speak his mind.

Now, you may love what Elon Musk is saying, or you may hate it. Either way, as an informed citizen and as an investor in the equity markets, you had better listen, as Musk’s opinions matter to society more than nearly everyone else’s.

I say that because Elon Musk is not just a normal CEO. He’s a polymath of the highest order, and a man who has done more with his 51 years on earth than just about anyone who has ever lived. So, when he speaks, it behooves us all to pay close attention.

Another important observation I had in watching the CNBC interview was just how thoughtful Musk is when answering questions. In response to many of Faber’s tough and provocative inquiries, Musk’s immediate response was a pregnant pause that revealed a man who actually thinks deeply about issues. Indeed, when you watch the interview, you can see a man whose “gears are turning” and who actually is calculating not just what he “should” say about an issue, but what he “thinks” about an issue. That kind of honesty is rare, regardless of whether you think his honest opinions are right.

What I also find interesting is that Musk’s thoughtfully blunt responses were reminiscent of the time I met with, and interviewed, him. I was at an alternative energy investing conference in 2008, where Musk was a speaker/panelist. He also gave select investors demo rides in what was then the first Tesla Roadster. I was fortunate enough to be given one of these demo rides, and to ask Musk a few questions about what was then a relatively new (and not-yet-publicly traded) electric car company.

Well, what I saw Tuesday on CNBC was similar to what I saw up close and personal. That is to say, a man who actually thinks deeply, and who gives clear and well-thought-out answers to questions of importance to us all.

Now, there were many other newsworthy thoughts offered in the CNBC interview, particularly on controversial and critically important subjects that affect the future of humanity. One area of inquiry important here, particularly to investors, is the subject of artificial intelligence, or A.I.

Here, I thought Musk was a bit more optimistic about A.I. and the role it could play in humanity’s future than he has been in past interviews, when he warned that A.I. could lead to “civilization destruction.” Now, Musk reiterated that the chance of A.I. going very wrong is still present, but he made sure that he said he thought the chances of that outcome are small. What he also said was that Tesla is on the forefront of A.I., and that at some point soon, he expects Tesla will have a “ChatGPT moment” with full self-driving cars. Musk has been promising fully autonomous, or “self-driving,” cars for some time now, but the company isn’t there yet.

Another example of just how refreshing the scent of Musk’s responses were to Faber’s questions is when he discussed politics. Musk admitted that he voted for President Biden, and that he believes Biden won the 2020 election and that it wasn’t “stolen.” However, Musk also said that he did think there was at least some voter fraud.

Yet, the most refreshing part of Musk’s response here was what he said about the nature of the people who have recently occupied the Oval Office: “I wish we could have just a normal human being as president.”

Here, the refreshing scent of Musk is a fragrance we all should fancy.

*****************************************************************

Head Full of Doubt

When nothing is owed or deserved or expected

And your life doesn’t change by the man that’s elected

If you’re loved by someone, you’re never rejected

Decide what to be and go be it…

–The Avett Brothers, “Head Full of Doubt/Road Full of Promise”

The 2024 presidential election season has just gotten real, and though you may be excited about it (I know I am), one thing to always keep in mind no matter what happens is the sage lyrics from The Avett Brothers. You see, your life isn’t going to change by the man that’s elected. Change, either for better or worse, is always up to you. So, decide what to be — and go be it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods

P.S. Come join me, some of my Eagle colleagues and more than 30 other speakers at the Annual Summer Market Summit. This virtual event is from June 5 through June 8. Click here now to sign up for this free, virtual event! See you there!

P.P.S. Come join me and my Eagle colleagues on an incredible cruise of our own! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.