Laughing at a Stock Market Crash

A stock market crash is no laughing matter. So, what’s with today’s seemingly irreverent headline? Well, because a stock market crash is eminently survivable if you are following the proper investment plan.

As you likely know, Q4 2018 was a horrible one for stocks. On a total return basis, the S&P 500 plunged 13.52% in the quarter. That was the worst quarterly decline since Q3 2011. We also saw the broad-based measure of domestic equities dip into official bear market territory in Q4. A bear market is defined as 20% off the most-recent highs.

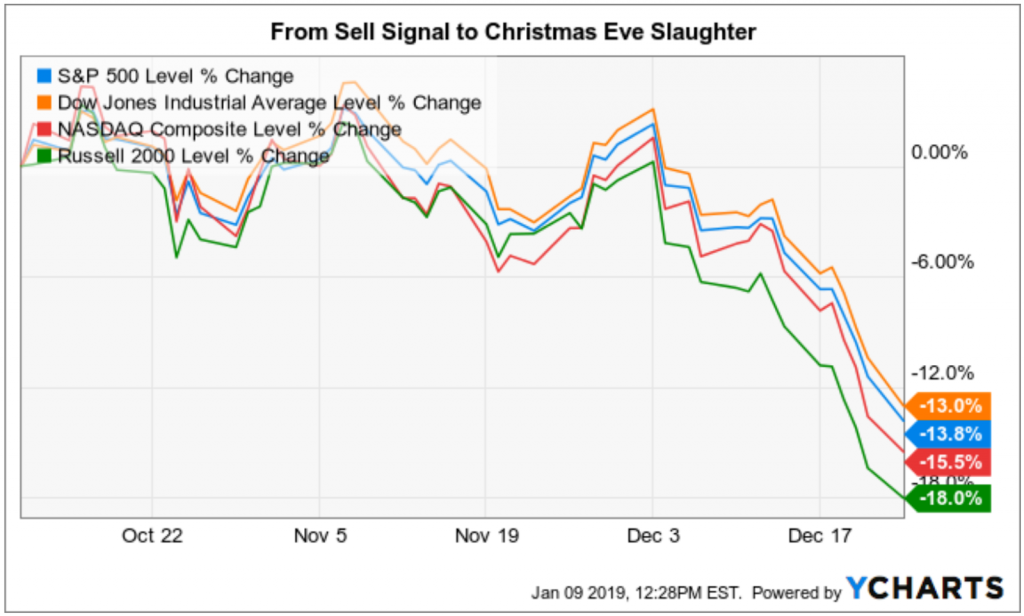

The worst of the damage in stocks occurred from early October through late December, and specifically that Christmas Eve slaughter in stocks that took the major average down nearly 3% across the board.

Take a look at the chart here of the Dow Industrials, S&P 500, NASDAQ Composite and Russell 2000 from Oct. 11 to Dec. 24.

As you can see, markets took a huge dive over this condensed, roughly 10-week time frame. So, if you were in stocks during this most bearish of periods, you’ve likely felt the pain and sorrow that comes with loss (at least, paper losses).

Yet what’s so special about Oct. 11? Why did I choose to highlight this particular day to make my point?

The reason why is because that was a pivotal day for subscribers to my Successful Investing advisory service.

You see, that was the day that our investment plan that tracks domestic equities flashed a “sell” signal. So, the following day, Friday, Oct. 12, I issued a sell signal to subscribers instructing them to exit their broad-based equity allocations and move to the safe harbor that is cash.

How did I know that, beginning Oct. 12, the market would continue its double-digit-percentage slide through Dec. 24? I didn’t.

Yet what I did know is that by adhering to an investment plan that serves as a de facto “safety switch” on the next stock market crash, I was able to help my subscribers move out of harm’s way and, thereby, avoid taking a big portfolio hit.

Now, in the final week of 2018, as well as in the first week or so of 2019, stocks have come roaring back. The S&P 500 now is up some 10% from that Christmas Eve low. That’s good news for investors, but it’s by no means enough to signal an “all clear” in markets.

Sure, Federal Reserve Chairman Jerome Powell appears to have softened his stand on interest rate hikes and balance sheet unwinding. And, the December jobs report helped buttress one of the two pillars holding the bull market up in 2018, i.e. strong economic growth. These two developments helped the bull case for equities.

Yet for us to be able to declare an all clear, we need to see Q4 earnings come in strong. Fortunately, we won’t have to wait much longer to find out, as the first round of significant earnings results will begin next week.

If things come in strong, we could see the early 2019 gains continue. If, however, the data is worse than anticipated and/or if companies significantly lower their respective 2019 forecasts, then this year’s nascent rally may fall to earth before it achieves escape velocity.

If that happens, there will be a segment of investors out there staying calm and steady in the face of adversity, and those will be the investors following the right investment plan that allows them to laugh at a stock market crash.

Another name for those investors is subscribers to Successful Investing.

**************************************************************

ETF Talk: High-Yield ETF’s Recent Loss Provides Opportunity

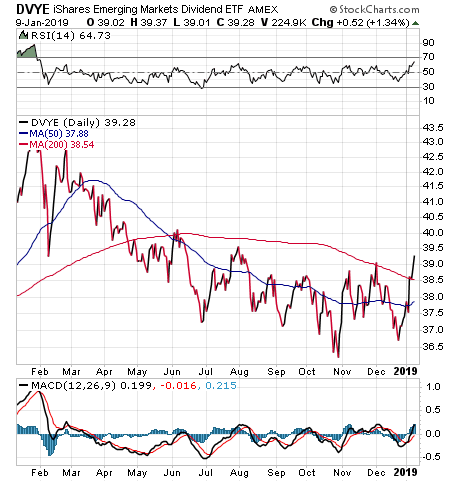

Although emerging markets do not get much press these days, thanks in part to bad returns in 2018, they’re off to a great start this year.

So perhaps it is not surprising that iShares Emerging Markets Dividend ETF (DVYE) is a top performer among the dozens of income-generating strategies I track. It is up over 3% so far in 2019.

One of the larger funds among the broad emerging market ETFs, DVYE has $530 million in assets that are managed by BlackRock. The iShares Emerging Markets Dividend ETF is down since the beginning of 2018 by almost 6%, but it’s still up over 30% since 2016.

Launched in 2012, DVYE is a smart-beta ETF, which by definition considers factors such as size, value and volatility instead of the typical cap-weighted index strategy, making it an ideal ETF for investors to maximize return and minimize risk.

This fund tracks the Dow Jones Emerging Markets Select Dividend Index — a dividend-weighted index of high-dividend-paying emerging markets companies, according to StockInvestor.com.

A recent Zacks article listed DVYE as a good high-yield ETF to own, since it paid a total of $2.13 a share in dividends in 2018 on a quarterly basis to produce a yield of more than 5.50%.

The focus of the iShares Emerging Markets Dividend ETF is much narrower compared to other emerging markets ETFs that track large-cap companies in market-cap-weighted indices by holding 100 of the highest-yielding stocks from emerging markets.

This fund’s top holdings, comprising 19.21% of its total assets, are Farglory Land Development Co. Ltd. (5522.TW), Seaspan Corp. (SSW), Severstal PAO (CHMF), Highwealth Construction Corp. (N/A), ALROSA PJSC (ALRS), Arcadyan Technology Corp. (3596.TW), Barwa Real Estate Co. QSC (BRES), Energy Company of Minas Gerais Participating Preferred (CMIG4.SA), Tatneft PJSC (TATN) and Novolipetsk Steel PJSC GDR (NLMK).

Chart courtesy of Stockcharts.com

Long-term investors who are looking for exposure to emerging markets should consider this fund, which also is a good way to add international diversity to a portfolio. As always, investors should exercise their due diligence in deciding whether DVYE is a worthwhile investment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Renaissance Man 2019: An Antidote to Chaos

One of the biggest breakout best-sellers of 2018 was the intellectual self-help work, “12 Rules for Life” by Dr. Jordan Peterson.

The subtitle of this excellent and highly recommended book is “An Antidote to Chaos.” As Peterson explains throughout the work, life, by its very nature, is fraught with chaos that constantly must be put into order. This order is hierarchical, philosophical, political, social and, most importantly, personal.

I agree with much of what Peterson writes in “12 Rules for Life,” although I disagree with a lot of his overall work. I’ll save our points of disagreement for another time, as I want to focus on the key takeaway here, which for me is that the chaos of life — as well as the chaos in financial markets that we all painfully lived through in the fourth quarter of 2018 — does demand an antidote.

For subscribers to my newsletter advisory services, we take on this chaos by employing sound investing principles, proven tactics and strategies, focused fundamental and technical analysis, a psychological understanding of market behavior and an awareness of the current zeitgeist in markets (something I call “NewsQ”) to help us navigate.

We also need tools to help us navigate accurately in life. In the year ahead, perhaps more than ever, it’s important to put as many tools in our kit to deal with what appears to be some truly overwhelming societal, political, financial and even personal chaos.

Last year, my team and I launched a tool to help with that personal chaos, and it is the Way of the Renaissance Man website and podcast. From fighter pilots to West Point grads, from samurai to psychologists, from anarchists to anti-tax warriors, and from radio hosts to FBI agents to war heroes, the inaugural season of the Way of the Renaissance Man podcast had a little something for every curiosity seeker.

We kicked off the season with Grover Norquist, president of Americans for Tax Reform. Grover is a man on a mission to help you keep more of your money. More importantly, we discussed what it really takes to be truly committed to an idea.

In my discussion with Rich Checkan, West Point graduate and businessman, we talked about the military ethos and how it can help define one’s focus and help integrate concepts and ideas into real-world action.

West Point grad, former U.S. Army officer and businessman Rich Checkan of Asset Strategies International dons his very own Way of the Renaissance Man t-shirt.

I found a similarly invigorating discussion with former Marine Corps fighter pilot Ed Rush, who shared some success-enabling habits he learned during his military service. Ed also let me in on some of his fascinating “21-day adventures” in self-improvement.

With psychologist Dr. Joel Wade, author of the fantastic book “The Virtue of Happiness,” we discussed the nature of happiness, what it is to be happy and what the “success of being human” really means.

Life is never dull when you’re speaking with the always-entertaining creator of the Financial Survival Network, Kerry Lutz. Here we riffed on Facebook, the value of skepticism and even Yossarian, the unforgettable protagonist from Joseph Heller’s masterpiece, “Catch-22.”

In season one, I also spoke with the eminently interesting anarchist and “dollar vigilante” Jeff Berwick, an extremely passionate man who takes life seriously, and who also has a lot of fun doing so. The inaugural season also brought us two major figures in the war on terror, retired FBI Special Agent and counterterrorism expert John Iannarelli and Afghanistan subject matter expert and Coalition Forces interpreter Saber Rock, who survived near-fatal wounds inflicted by the Taliban.

Both John and Saber are fighting the same battle, namely the forces of theocratic tyranny. And, both of these men helped us understand how to be your best self in the face of incredible adversity.

Finally, I got a chance to connect again with my longtime friend, fellow market analyst, motorcycle enthusiast and real-life samurai Keith Fitz-Gerald. If you want wisdom from one of the smartest men on planet Earth, this episode is a must listen.

Now, in addition to the amazing guests I had the privilege of interviewing, I also was able to share some interesting views via my articles, speeches, media appearances and quotes in the areas of ideas, high-intensity pursuits, human relationships, health and fitness and finance and money. We also featured some great guest contributions this year.

Some of my favorite articles include:

How You Park Your Car is How You Approach Life

3 Renaissance Man Rules of Wealth Building

5 Favorite Renaissance Man Quotes to Live By

8 Keys to Cultivating a Renaissance Man Mindset

In the spirit of the aforementioned antidote to chaos, I started this project as a free adjunct to my work here at The Deep Woods, and as a supplement to my newsletter advisory services Successful Investing, Intelligence Report, Bullseye Stock Trader and Fast Money Alert, which all can be accessed simply by going to JimWoodsInvesting.com.

I did so because, in an era of chaos characterized by a frequent lack of intellectual curiosity, mental laziness, destructive “conventional wisdom” that is anything but wise and even the willful evasion by good people of facing evil, it’s important to put as much ammunition in your arsenal as you can to win the battle for your values.

The Way of the Renaissance Man website and podcast is there to help us all focus on what matters, and to integrate that knowledge and meaning into our lives so that we can rationally celebrate our victories and continue battling our dragons. Anything short of that is just letting yourself down in the most important pursuit you’ll ever engage in… the pursuit of your own values.

In 2019, the Way of the Renaissance Man will continue this pursuit with a vengeance, and together, we help each other discover the tools needed to better focus our minds, integrate our thoughts with actions and live the way we really want.

May the new year bring you continued focus, integration, celebration… and a true antidote to chaos of all stripes.

*********************************************************************

A Deeper Burn

“If you be pungent, be brief; for it is with words as with sunbeams – the more they are condensed the deeper they burn.”

— John Dryden

The poet reminds us that the power of words, and indeed ideas, often is in the way they pierce and burn into the mind. Remember that the next time you hear a politician or pundit saying a lot of words that amount to virtually nothing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods