Kevin O’Leary Enters My Shark Tank

- Kevin O’Leary Enters My Shark Tank

- ETF Talk: Finding Solace in a Bond ETF Without Surrendering

- Time to Kill All Tariffs

- ‘Stay’ Wisdom

***********************************************************

Kevin O’Leary Enters My Shark Tank

Cryptocurrencies are getting crushed.

Consider that Bitcoin, the largest and most heavily traded cryptocurrency, has plummeted 26% over the past five trading sessions. That is an astounding decline in such a short period, and it illustrates not only the inherent volatility of this asset class, but also the precarious nature of putting money to work in this still-nascent market segment.

Yet despite the decline in cryptocurrencies of late, the sector remains populated with high-profile investors who see huge opportunity in the space going forward. One such investor is “Mr. Wonderful” himself, Kevin O’Leary.

I suspect you know Kevin O’Leary from his starring role in the CNBC show “Shark Tank,” a favorite TV program of mine, and of just about every entrepreneurial type that I know. Yet O’Leary is far more than just a TV “shark.” He’s also the creator of the O’Shares family of exchange-traded funds (ETFs), several of which I have recommended in my newsletter advisory services.

One of O’Leary’s newest ventures is a company called WonderFi, a cryptocurrency trading platform that Mr. Wonderful says will provide a compliant and transparent place for institutional and individual investors to trade cryptocurrencies.

According to O’Leary, what Bitcoin and other cryptocurrencies really need to flourish is, ironically, real industry regulation. And as he puts it, “that’s when the real money is going to come into it.”

O’Leary explained all of this to me in the latest episode of the Way of the Renaissance Man podcast.

In this interview, Mr. Wonderful enters the Renaissance Man shark tank, as I let him “pitch me” on the reasons why investors should consider WonderFi.

Along with WonderFi CEO Ben Samaroo, O’Leary explained that despite the hype of cryptocurrencies, the big money players such as pension funds and sovereign wealth funds have yet to embrace the asset class. He also attributes cryptocurrency volatility to the relatively small amount of money invested in the asset class relative to stocks, bonds, commodities, and other currencies.

This interview took place on the cusp of an interesting time for cryptocurrency, as the huge June 2022 swoon in the price of Bitcoin and other cryptos has rattled investors, along with many companies in the industry.

So, is there a future for Bitcoin and cryptocurrencies? Is there likely to be a rebound in the segment? If so, could the catalyst be what O’Leary thinks it will be?

To find out the answers, and to decide for yourself, I invite you to watch/listen to the new episode, “Investor Kevin O’Leary Enters the Renaissance Man’s Shark Tank,” today.

***************************************************************

ETF Talk: Finding Solace in a Bond ETF Without Surrendering

Amid the wave of selling caused by war in Ukraine and the continued effects of supply chain disruptions amid the COVID-19 pandemic, some investors are turning to bonds and bond-related exchange-traded funds (ETFs) as sources of solace in an increasingly turbulent and unstable world.

That, of course, is easier said than done. Not only are there many different types of bonds, including Treasury, savings, agency, municipal and corporate, each sector of the bond market attracts different buyers and sellers.

Their respective bonds also contain different levels of duration, as well as levels of risk and reward. Indeed, the level of complexity in the bond market might cause more than a few aspiring bond traders to raise their hands skyward, as if to surrender, and exit.

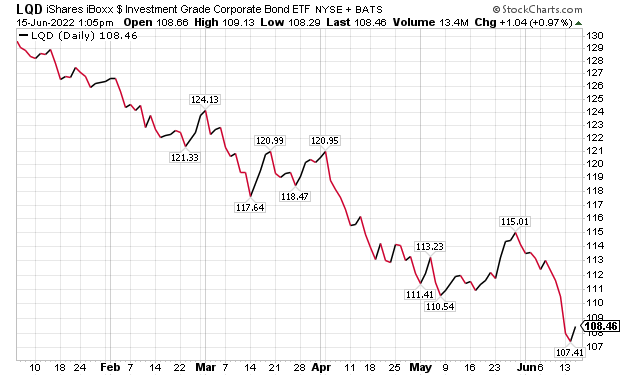

However, there are more than a few bond-related ETFs that aim to demystify this process. One of these has appeared in my Successful Investing trading service: iShares iBoxx USD Investment Grade Corporate Bond ETF (NYSEARCA: LQD).

This ETF draws on bonds from the Markit iBoxx USD Liquid Investment Grade Index. Since this index only contains bonds that are three years to maturity, this exposes LQD to a higher-level of interest-rate-related risk than other bond ETFs. While the lion’s share (85.87%) of LQD’s bond portfolio is comprised of U.S. bonds, LQD’s portfolio also contains bonds from the United Kingdom (4.47%), Canada (2.41%), Japan (2.24%) and beyond.

The top four holdings in the portfolio are BlackRock Cash Funds Treasury SL Agency Shares, Anheuser-Busch Cos. LLC 4.9% 01-FEB-2046, CVS Health Corporation 5.05% 25-MAR-2048 and T-Mobile USA, Inc. 3.875% 15-APR-2030.

As of June 14, LQD has been down 3.57% over the past month and down 8.70% for the past three months. It is currently down 18.08% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $31.43 billion in assets under management and has an expense ratio of 0.14%.

In short, while LQD does provide investors with an access point into the bond market, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Time to Kill All Tariffs

It’s not often you get politicians to admit they might be wrong on an issue, but that’s actually what happened recently, and of all things, it happened on the subject of tariffs.

Now, I have long been an opponent of tariffs, as they are essentially a tool used by government that punishes its citizens by making them pay more for goods. Moreover, they are a violation of the free-market principles by which I think economies should be structured around.

I was an ardent opponent of the tariffs former President Donald Trump imposed on steel and aluminum, and I am equally opposed to those same tariffs that President Joe Biden has left in place.

The fact is that tariffs of all kinds, in addition to being immoral tools of control used by government, also raise prices on goods. And given the current, multi-decade high in inflation, it’s time for tariffs to disappear.

Incredibly, one Biden administration official at least partially agrees with me. Her name is Gina Raimondo, and she also happens to be the Secretary of Commerce.

Now, hat tip to my friends at Reason.com for alerting me to this issue, and particularly writer Eric Boehm. In his article “Tariffs Are Adding to Inflation. Biden’s Commerce Secretary Says Repealing Some ‘May Make Sense’”, Boehm points out that when asked during a CNN interview whether the administration would consider rolling back some tariffs to fight inflation, Raimondo admitted that it “may make sense” to do that.

Of course, this small nod to reality also came along with additional bad ideas from Raimondo, who in virtually the same breath suggested that the Trump-imposed tariffs on steel and aluminum would remain in place, “because we need to protect American workers and we need to protect our steel industry; it’s a matter of national security.”

One thing to note here is that whenever a government wants to impose controls on its citizens, it will do so either A) in the name of national security or B) in the name of protecting children. And as a general rule, most policies designed to control the populace neither add to national security nor protect children.

There is, however, a silver lining in this cloudy thinking by Raimondo. In that same interview, she admitted that aside from aluminum and steel, there are other products where it might make sense to remove tariffs, items such as household goods, bicycles and other goods. Raimondo said, “I know the president is looking at that.”

Well, it’s a good thing the president is looking at that, because his earlier proposals to tackle inflation, which he released in a speech on May 10, will do nothing to combat inflation. Bromide notions of taxing the most successful in our society to bring down the deficit by making them “pay their fair share” and “investing” in alternative energy with taxpayer money are both pro-inflationary, not to mention a further immoral imposition on citizens.

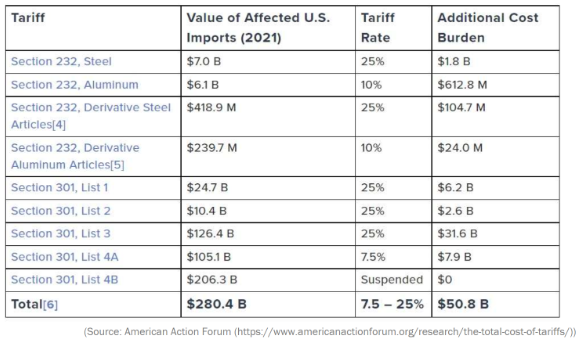

But just how much are those tariffs costing Americans? As Boehm points out, “The set of tariffs imposed by Trump and maintained by Biden — including those on steel and aluminum, along with a host of imports from China — is applied to approximately $280 billion of imports every year. Those import taxes add about $51 billion annually to Americans’ consumer costs, according to an analysis by the American Action Forum, a pro-market think tank.”

Boehm included the chart here in the American Action Forum analysis that breaks down that nearly $51 billion of additional cost burden created by these tariffs.

Of course, the solution to inflation isn’t just to eliminate tariffs. The problem is a whole lot bigger than that, and even beginning to tackle the issue in earnest would require a new paradigm regarding how we look at both monetary and fiscal policy.

Yet one thing is certainly true here, and that is tariffs are a penalty on taxpayers — a penalty that raises prices, because that’s precisely what tariffs are designed to do.

So, if you want to combat inflation, start with an easy, baby step that is both rational and moral — kill all tariffs!

***************************************************************

‘Stay’ Wisdom

And you say

I only hear what I want to

I don’t listen hard

I don’t pay attention

To the distance

That you’re running or to

Anyone anywhere…

–Lisa Loeb, “Stay (I Missed You)”

I’ve always been an advocate of listening to your inner voice when it comes to making life decisions, because your life belongs to you and no one else. Yet part of feeding your life with healthy intellectual nutrition is to listen carefully to others, and especially to opinions that you might not agree with.

If you want to be the best human you can be (and I assume that you do if you are reading The Deep Woods), then don’t be like the lamenting self in the Lisa Loeb classic, “Stay.” That means don’t only hear what you want to, listen hard, and pay attention. Doing so will not only help you be better, but it might also help you avoid some of life’s heartbreak.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods