It’s Just a Cleveland Indians Stock Market

If you’re into baseball, you almost certainly know about the remarkable run of consecutive wins that the Cleveland Indians just mounted. An incredible 22 straight victories; just four games shy of the century-long record of 26 consecutive wins held by the 1916 New York Giants.

Now, I must admit I’m not a huge baseball fan, but you don’t have to be to know what’s going on with this story. The reason why is because big winning streaks — whether they be in the world of sports, or in financial markets — tend to attract a lot of attention.

In fact, big winning streaks tend to bring into focus a diverse set of responses that can tell us a lot about ourselves as people and as investors.

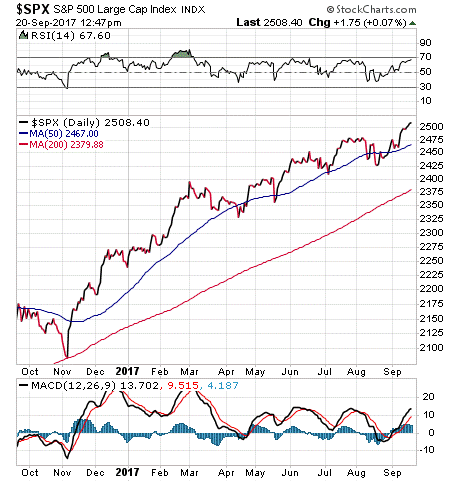

As we all know, the stock market has been on a rocket ship ride higher since that little electoral event we had back on November 8, 2016.

The chart here of the S&P 500 Index makes it perfectly clear that stocks have been on a Cleveland Indians-like winning streak since Donald Trump was elected the 45th president.

And what’s been driving this winning streak?

In one word… hope.

The hope that the president’s pro-growth campaign agenda would translate into real-world economic and market stimulus. And while much of that hope has been dashed on many fronts (health care reform, infrastructure spending, and even immigration reform) the one remaining, as well as the most important hope, is tax reform.

Specifically, corporate tax reform, i.e., a material cut in the corporate tax rate down to 15% or 20%. That kind of reduction in the corporate tax rate would almost certainly add to the bottom line of corporate results, and if the tax cut is big enough those beefed-up earnings will go a long way toward justifying a market that’s currently trading at about 18X 2018 EPS estimates.

If, however, we fail to get tax reform. then I suspect the market will begin to look more like football’s perennial losers the Cleveland Browns than baseball’s red-hot Cleveland Indians.

According to the latest news reports, we will get much more detail from Republican congressional leaders on Sept. 25 regarding a tax plan. That’s just over a week from now, so until then, expect this market to keep grinding higher the way it’s done all year long.

Interestingly, when a market winning streak is in place, there tends to be one of three possible reactions. We saw this during the Indians’ winning streak among the various factions that followed that circumstance.

First, there are those who rooted for the Indians to keep winning. Second, there are those who are rooted for the team to lose. And third, there are those who attempted to maintain complete and total impartiality.

It’s the same for markets.

There are the “perma-bulls” in markets who always tell you that things are great, and who tell you that you should never flinch when it comes to putting all your money in stocks.

Then there are the “perma-bears” in markets who are constantly warning of impending doom and gloom, and who want you to hunker down in hard assets.

Here I am, seated between two of the world’s most-famous market Cassandra’s, Jim Rogers (left) and Peter Schiff (right), during a debate at this year’s FreedomFest conference in Las Vegas.

While both these gentlemen have interesting thoughts on the markets, the Fed, and the future of the global economy, both are bearish on U.S. equities and on the U.S. economy. Both also warn of a coming debt-fueled collapse somewhere down the road.

Now, I do admire both men’s always-strident opinions, and I think much of what they say is interesting theoretically. The issue I have with their ideas is that I think by constantly sounding the gloom-and-doom alarm, they’re missing out on the current opportunities open to all of us to own great companies in a bull market.

Finally, there are those who try to remain objective about markets, and who try to be impartial about what the market is telling us.

I try to be this way when it comes to markets, but when you put your money at risk it’s often very difficult to remain a stoic observer.

Still, a good investor will always attempt to remain objective, and to let the price action in markets dictate the best decisions for his/her money. Indeed, it is only via a respect for objective reality that humans can make progress.

Wishing doesn’t make things so, as any rational adult will tell you. Yet when it comes to markets, sometimes even the most rational adults will turn into irrational children.

So, let’s not let that happen to us. Instead, let’s respect the trends, ride the continued winning streak when our money is long… but let’s always be mindful that stocks can and ultimately will experience pullbacks, corrections and even bear markets.

Hey, that’s just the nature of the game, and the nature of objective reality.

Sometimes we’re Indians, and sometimes we’re Browns. It’s knowing how to handle each circumstance that makes one a perennial winner.

Upcoming Appearances

Dallas MoneyShow, Oct. 4-6: If you’re in the “Big D” in early October, then come by the Hyatt Regency Dallas and see me, as well as many other great industry speakers, at the Dallas MoneyShow. I will be giving a presentation on Friday, Oct. 6, 8:00 – 8:45 a.m., titled, “5 ETFs to Fight the Fake News.” For your complimentary tickets, go to Woods.DallasMoneyShow.com.

*************************************************************

ETF Talk: This Fund Provides Consistent Income

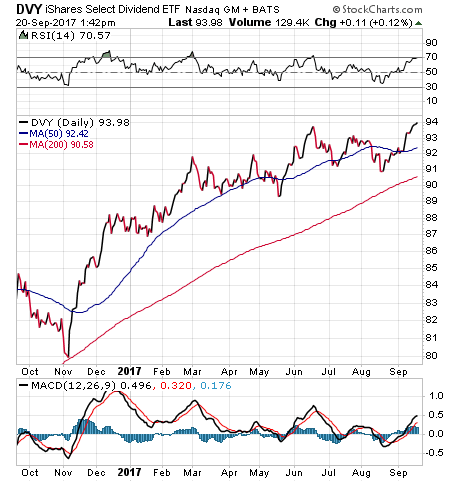

The exchange-traded fund iShares Select Dividend ETF (DVY) focuses on holding equities with a history of consistent income instead of equities with potential future dividend increases.

All DVY’s holdings have at least a five-year record of paying dividends. DVY invests its $17.5 billion in total assets in roughly 100 stocks based on dividend yield from a broad market-cap universe.

Unlike many other funds that weigh their holdings according to market cap, DVY weighs its holdings by dividend per share. This results in a skew toward smaller firms that pay consistent dividends.

With its high asset base and great liquidity of $46.15 million in daily trading volume, DVY is one of the most accessible funds on the market for reliable dividend income. Around 30% of the fund’s portfolio is in utilities, which is one of the sectors with the highest yields, although utilities also tend to be interest rate sensitive and relatively slow-growing.

Year to date, DVY has returned 7.64%, versus the S&P 500’s 11.91%. While the fund’s gain may not seem impressive, it is worth noting that by holding only dividend payers with a consistent track record, DVY sacrifices some of its gains in a bull market but lowers its risk in a bear market. DVY’s strategy has garnered it a 14.2% return during the last five years while the S&P 500 returned 13.6%.

DVY has an expense ratio of 0.39%. The distribution yield is 3.17%. This is a fund that is suitable for passive long-term investors who want to reduce the risk of their portfolio.

The fund’s top five holdings are Lockheed Martin (LMT), 4.16%; CME Group (CME), 3.16%; McDonald’s (MCD), 2.32%; Chevron (CVX), 2.29%; and NextEra Energy (NEE), 2.27%.

For those seeking consistent dividend income for the long term, I encourage you to look at the iShares Select Dividend ETF (DVY).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

Don’t Call the Government When the Levee Breaks

Natural disasters just plain suck.

Mother Nature is as cruel matriarch, and she doesn’t much care about you, me, or any of the human structures we’ve erected to help combat her occasional wrath.

Indeed, Mother Nature’s caprice and cruelty were on full display over the past couple of weeks, and watching the scenes of the aftermath in Houston, Florida and the Caribbean over the past several days made me sad, mad… and uplifted, all at the same time.

The destruction also reminded me of one of my favorite rock/blues songs, Led Zeppelin’s classic, “When the Levee Breaks.” Here’s the lyric that came to mind:

Mean old levee, taught me to weep and moan;

Mean old levee, taught me to weep and moan.

It’s got what it takes to make a mountain man leave his home.

As we all know, many disaster zone residents were forced to leave their homes. Yet we also know that despite the damage and destruction suffered, many are resolute, strong of mind, and already on their way back to clean up, rebuild and return to normalcy.

And, they are doing so with the help of their fellow citizens, many of whom have donated to the charities of their choice (my preferred charity is Upbring.org, and I encourage you to help through this fine organization, if you are able).

In fact, the recent storms have really revealed the true character of America; a rich country that is both generous and compassionate, and one replete with humans reaching out to help other humans in countless ways, including via monetary donation, manpower, equipment, food, shelter… and just simple love and affection for those who are hurting.

Unfortunately, when disasters like Harvey and Irma strike, many peoples first reaction is to turn to political leadership and government for a clue as to what to do, or how to respond, or what kind of help they are likely to get.

But I say that when the levee breaks, don’t call the government… count on yourself first, and second, your fellow man.

Yes, by all accounts, the response to Harvey and Irma by federal agencies such as FEMA, and by state and local government agencies has been pretty good. But what’s been even better is the effort of individual citizens acting out of a sense of what’s right.

Investor’s Business Daily, a news source I highly recommend (full disclosure, I worked there for many years in the 1990s), has done a great job in its editorial page detailing the heroes of both Harvey and Irma. And wouldn’t you know it, none of them worked for Big Brother.

Most were just your average, good-hearted Americans stepping up to do their part to assist other Americans.

For example, in an Aug. 29 piece, “If You’re Focused On The Government’s Response To Harvey, You’re Looking In The Wrong Direction,” the op-ed told about the great work done by the so-called “Cajun Navy”:

Over the weekend, dozens of people from Louisiana showed up in Houston as part of what’s become known as the Cajun Navy. This is an all-volunteer group formed during Hurricane Katrina that has grown in size since.

The Cajun Navy was part of what’s been described as an “armada of private boats” that came to Houston to help rescue thousands of people stranded in their homes by Harvey’s relentless deluge.

Nobody ordered it, or organized it, or coordinated it, or directed it. Nobody’s getting paid. But their efforts are a big reason why the death rate from Harvey has been so low.

It’s the same with Irma.

In a Sept. 11 editorial titled, “With Hurricane Irma, Private Volunteers — Not Gov’t — Again Lead Way In Relief,” the newspaper detailed some of the contributions by private companies to the relief effort:

Discount giant Wal-Mart, a frequent and favorite target of the elitist pro-union left for daring to sell things cheaply to low- and middle-income Americans, has pledged $30 million for Irma relief efforts. Other major corporations have kicked in an estimated $160 million, and that amount is growing by the minute.

Home Depot actually runs a staffed Hurricane Command Center in Atlanta, from which it makes sure its stores are stocked with vital goods — including portable generators — needed to survive a major storm and rebuild after it’s over.

Meanwhile, at least 30 utilities across America and from Canada have sent some 16,000 technicians to Florida to help get power there up and running again after the storm has passed. No one ordered them to do it. No one forced them to. Private groups and businesses such as these did it out of basic decency, the kind that Americans once were known for — and may someday be known for again.

Ah, yes, the key concept here is that no one (especially not government) ordered them to do it, and no one forced them to do it. These people, and these companies, did it because they wanted to make a bad situation better for their fellow man.

It is my view that left unmolested by the shackles of over-taxation, over-regulation and the encroachment of government into areas where it has no business being, Americans would not only do just fine, we would thrive even more than we already do.

That’s true during times of economic, social and cultural prosperity… and it’s especially true when the levees break.

***************************************************************

The Genius of Simple

“Any fool can make something complicated. It takes a genius to make it simple.”

— Woody Guthrie

The great folk singer made his mark with simple, yet extremely powerful lyrics married to catchy melodies. In this quote, Guthrie reminds us that real genius involves making the complex simple, and not vice versa. This quote speaks to me, not just because I am a Guthrie fan, but also because I take pride in making the complex world of investing simple. Yes, I could use all the lingo and industry jargon if I wanted to, but most of the time that just serves to befuddle the reader. I prefer to make the complicated simple, or in other words, I prefer to pursue genius.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.