It’s Capitalism’s Fault

- It’s Capitalism’s Fault

- A Must-See FREE Webinar TONIGHT!

- ETF Talk: Robotics Fund Grows in Emerging Sector

- Bernie Sanders Is A Capitalist Poster Boy

- Sontag’s Song

**************************************************************

It’s Capitalism’s Fault

What’s to blame for today’s economic ills? Ask that question of both the left and right, rich and poor, and you’re liable to get a similar answer.

That answer is: It’s capitalism’s fault.

On the left, you have the extreme Marxist-types who argue that capitalism is the final stages of a decayed society. Yet now there also is a phalanx of mainstream 2020 Democratic presidential candidates who all are racing to blame the nation’s income inequality, racism, culture clash, crime, opioid addiction, climate change and every other possible unsavory aspect of human life on capitalism.

On the right, you also have critics of capitalism, including our current president. Indeed, it was President Donald Trump’s critique of free trade, free markets and his willingness to take on a protectionist posture complete with threats of tariffs and other punitive measures on foreign competition and on companies here at home that helped get him elected in the blue-collar swing states.

Now, you might expect that individuals at the lower end of the economic spectrum may be hostile to capitalism because it hasn’t benefited them as much as the so-called rich. Yet these days the loudest cries of, “It’s capitalism’s fault” can be heard by some of the wealthiest, most-successful capitalists among us.

The latest sonorous screed against capitalism comes from Ray Dalio, who has gotten a lot of press of late with his series of LinkedIn posts on “Why and How Capitalism Needs to Be Reformed.”

Dalio, who is the founder of hedge-fund manager Bridgewater Associates, was recently profiled on “60 Minutes.” Now, given that Mr. Dalio is worth an estimated $18 billion and is one of the best investors in the world, I had hoped I would find out more about his keys to success. Yet what I found out more about is why the system that allowed him, and millions of other Americans throughout history to become so successful, i.e. capitalism, is now cause for a “national emergency.”

According to Dalio, the American dream is lost because it’s not adequately “redistributing opportunity,” and that this “wealth gap” as he puts it, is a huge problem. “I think that if I was the president of the United States… what I would do is recognize that this is a national emergency.”

So, what is Dalio’s key prescription for fixing this wealth gap?

Sadly, his fix includes a bromidic mix of tired ideas, including: “Bipartisan and skilled shapers of policy working together to redesign the system so it works better,” and “Redistribution of resources that will improve both the well-beings and the productivities of the vast majority of people.” Of course, Dalio also advocates every authoritarian’s favorite solution to any problem, increased taxation on wealth and government redistribution of that wealth.

But Dalio isn’t the only member of the rich elite that’s recently criticized capitalism. Jamie Dimon, CEO of JPMorgan Chase & Co. and one of the best bankers in the world, also has piled on with his own critique in his latest annual letter to shareholders. Although Mr. Dimon doesn’t get as philosophical as Mr. Dalio in his assessment, he does think that corporate America has ignored and avoided some of society’s biggest problems.

Now, regular readers of this column likely will have figured out that I disagree with both the left and much of the right on this issue. I also disagree with Mr. Dalio and Mr. Dimon.

It’s not that I don’t recognize that some people have much, much more wealth than others. That’s just a fact. Yet it’s not capitalism’s fault that wealth is concentrated.

Wealth concentration is simply a matter of the reality that some people are more productive economically than others, and some people operate in areas that generate more capital than others. Hence you find much greater compensation and wealth creation. Is this unfair? Well, yes, it is.

Yet what is even more unfair, what is dangerously unfair, is to try and strip success from those who have achieved via government fiat (i.e. taxation and redistribution) in the name of “equality.”

I think that if we want to fix the income gap, increase the pie for everyone and make America a more prosperous place, what we need to do is stop blaming capitalism and start extolling capitalism.

And, the greatest way to do that is to recognize that capitalism could use some reform, but that reform is a move toward more liberty and less government involvement in the economy — not greater central planning and less freedom.

**************************************************************

A Must-See FREE Webinar TONIGHT!

Are you ready for the biggest FREE webinar event of the year?

If not, then get ready, because it’s taking place TONIGHT, Wednesday, April 24, 8:00 p.m. EDT.

This webinar features yours truly, as I will be a guest of the ON THE MOVE Webinar, a live series hosted by my friend and precious metals expert Rich Checkan of Asset Strategies International, and market analyst extraordinaire Chris Blasi of Neptune Global Holdings.

During this webinar, the three of us will identify the key market trends that every investor should take into consideration. We’ll also do a recap of the first quarter, and we’ll be taking a deeper dive into the issue of capitalism vs. socialism. Most importantly, we’ll be taking your questions live.

To sign up for this FREE webinar, taking place TONIGHT, Wednesday, April 24, 8:00 p.m. EDT, all you have to do is click here!

I hope to see you all there.

**************************************************************

ETF Talk: Robotics Fund Grows in Emerging Sector

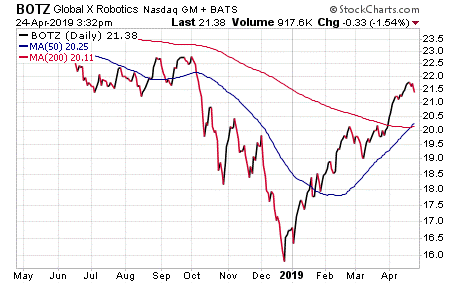

The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI).

Specifically, industrial robotics and automation, non-industrial robots and autonomous vehicles are among the products and applications the companies targeted by BOTZ are pursuing. This exchange-traded fund (ETF) gives investors market-cap selected, cross-sector and weighted exposure to companies involved in the production of robots and the development of AI.

Eligible companies are listed using the Indxx Global Robotics & Artificial Thematic Index and must earn a significant portion of their revenue from or have a stated business purpose in robotics or AI. This field includes varied applications from the development of drones to health care robots and predictive analytics software. Viewed through traditional sector classification systems, BOTZ leans heavily towards industrials and technology.

The fund’s top holdings include Keyence Corp. (OTCMKTS:KYCCF), Mitsubishi Electric Corp. (OTCMKTS:MSBHY), Intuitive Surgical, Inc. (NASDAQ:ISRG), Fanuc Corp. (OTCMKTS:FANUY) and ABB Ltd. (NYSE:ABB). Although BOTZ is heavily weighted in technology and industrials, its other top sectors are health care, energy and basic materials.

Chart courtesy of StockCharts.com

The ETF has $1.75 billion assets under management, an average spread of 0.05 percent and 34 holdings. With an expense ratio of 0.68 percent, it is relatively expensive to hold in comparison to other funds.

To sum up, BOTZ enables investors to access high-growth potential through companies involved in the design, creation and application of programmable automated devices. The fund’s composition transcends sector, industry and geographic classifications by tracking an emerging theme, although the ETF also is heavily weighted toward certain segments.

As a reminder, investors should conduct their own due diligence to decide whether this ETF is suitable for their portfolio. Investors also should ensure the ETF’s potential volatility fits within their level of risk tolerance.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**************************************************************

In case you missed it…

Bernie Sanders Is a Capitalist Poster Boy

You know who my favorite capitalist poster boy is these days?

No, it’s not Amazon’s (NASDAQ:AMZN) Jeff Bezos or Facebook’s (NASDAQ:FB) Mark Zuckerberg or former Cypress Semiconductor (NASDAQ:CY) CEO T.J. Rogers. (Okay, T.J. is actually my favorite, but please suspend that thought for just a moment for the purposes of this article.)

My favorite example of a true capitalist poster boy these days is Bernie Sanders.

Yes, I realize that the Vermont Senator and 2020 Democratic presidential frontrunner made his bones with a large segment of American voters by constantly fulminating about the unfairness of capitalism and why it should be replaced by what he calls “democratic socialism.” I also realize that Sen. Sanders did something quintessentially capitalist — which vaulted him firmly into “millionaire” status.

“If I had a dollar for every time Bernie Sanders has inveighed against ‘millionaires and billionaires,’ I’d be… well, still probably not as rich as Bernie Sanders…”

That was the leadoff paragraph from a story by Peter Suderman at Reason.com titled, “Bernie Sanders Is a Millionaire. That’s Great!” I highly recommend this article, as it nearly perfectly mirrors my thoughts on why Bernie Sanders is a quintessential example of how one gets rich in America.

As Suderman explains, much of Sanders’ newfound wealth comes from sales of his best-selling book, “Our Revolution,” a tome about his experiences during the 2016 presidential campaign. The book’s royalties earned Sanders some $885,000 in 2017, according to Sanders’ own 2017 Senate financial disclosure forms.

In an interview with The New York Times, Sanders explained his latest financial windfall by saying, “I wrote a best-selling book… If you write a best-selling book, you can be a millionaire, too.”

To that comment I say, “Bravo!”

You see, unknowingly, the democratic socialist revealed what capitalism is all about, i.e. the producing of a good or service at a cost below what consumers are willing to pay for it, and that results in a hefty profit for its creators.

Here’s how Suderman expertly frames it:

“Sanders spent years building himself and his name into a successful national brand by identifying and filling a relatively unique niche in the market for national politics. Based on the success of that brand, he then negotiated a deal with a publisher to bring a product — his book — to market. The product sold well, and Sanders, who had invested a significant amount of personal time in conceiving and producing the product, reaped the financial rewards. Now he’s better off, and I suspect that he, at least, would argue that the people who bought his book are better off too. Everyone wins.”

The concept that “everyone wins” here is spot on, although philosophically the adoption of the ideas inside the Sanders book are not, in my opinion, a winning prescription for America. Yet the content of what Bernie is saying isn’t relevant to my point, or to Suderman’s point.

It is the principle of entrepreneurship, the creation of a product, the putting of that product out there for consumption and the adoption of that product by a significant customer base that is the essence of capitalism.

As Suderman puts it, “Sanders, in other words, was acting as an entrepreneur, a person who made something new in the world, something for which there turned out to be considerable market demand. And Sanders clearly feels no shame about earning a large return on his labor as a result.”

Nor should Sanders feel shame. In fact, he should feel proud of what he’s achieved, as becoming a best-selling author is no easy task.

Of course, what this should teach Sanders is that those dastardly “millionaires and billionaires” in America he loves to rail against are, as a general rule, just people who have figured out how to make something new in the world that people are willing to buy. Yes, there are many crony capitalist exceptions to this general rule, but their existence doesn’t invalidate the general rule.

Suderman closes his piece with this brilliant observation:

“…I think it’s genuinely great that Bernie Sanders is a millionaire, and that in becoming a millionaire, our nation’s most well-known democratic socialist politician has, however inadvertently, started defending one of the core tenets of capitalism — that if you come up with an idea for a product, make that product a reality in the world, and sell it to lots of willing buyers, it’s perfectly just and reasonable for you to earn a lot of money as a result.”

Now, in a just and reasonable world, Bernie Sanders would see the irony in what’s taken place, and perhaps become a bit more sympathetic to capitalism and its bountiful consequences — but don’t count on it.

After all, hatred of the rich and successful is just too effective a marketing tool to abandon now, especially with a presidential election coming up.

*********************************************************************

Sontag’s Song

“The ideology of capitalism makes us all into connoisseurs of liberty — of the indefinite expansion of possibility.”

— Susan Sontag

The writer, filmmaker and social critic wrote a lot about a lot of subjects. One of her areas of interest was socialism and leftist ideology. Here, she comments on the connection between capitalism and liberty, a connection that not only leads to the indefinite expansion of possibility, but that also is commensurate with human flourishing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods